Menu

Customize your instant loan

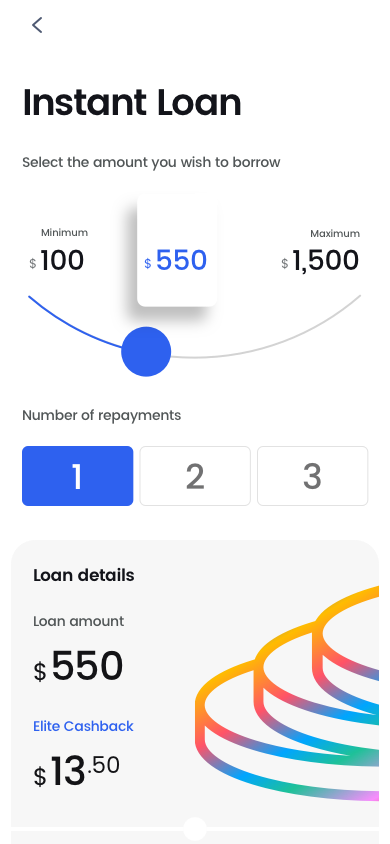

Receive your money by 3:57 pmMinimum

$100

$750

Maximum

$1,500

1

2

3

Elite

New customer

Prestige

VIP

Cost summary

Apply now and receive your money by e-Transfer at no extra cost.

Table of contents :

Payday loans are often only thought of as short-term loans designed to help you cover expenses between paycheques. However, while this is true, it doesn’t highlight the value payday loan companies provide to Canadians.

They’re short-term cash advances that bridge the gap between your immediate financial needs and your next paycheck. They play a crucial role in offering fast cash for unexpected costs. Take care of medical bills, car repairs, or other urgent expenses.

Getting one is simple. Choose your desired amount, ranging between $100 - $1,500, and you can receive easy approval. Then, use your funds for any expense and repay it with your next paycheck.

People of all credit types successfully use urgent loans to manage financial emergencies. More recently, Canadians have been using them for groceries, rent, and other day-to-day essentials.

Many Canadians experience financial hardships, resulting in poor credit scores, which limit their ability to access credit and cash from traditional lenders when they need it. What should they do in these situations? They still need to pay their bills, such as rent and utilities, or cover an emergency car repair so they can get to work while they wait for their next paycheque.

Lenders fill this gap by providing loans to Canadians with poor credit so they have the cash they need when they need it.

We understand how important it is to get you your cash as fast as possible, and iCash loans are designed for speed. Once approved, your funds will be sent within 2 minutes! Contact iCash today to get the cash you need. Digital signatures are used for contract acceptance after loan approval.

Never taken out a payday loan before? The process is simple. It starts with finding a lending company you can trust. It’s important for ensuring a safe, transparent, and fair borrowing experience. The average application takes less than 5 minutes to complete.

Look for a licensed payday lender with positive reviews, clear terms and conditions, and a strong commitment to customer service. They should guide you through the application process, clearly explain the repayment terms, and provide support for any questions you might have. All costs associated are clearly outlined in the agreement, ensuring there are no hidden fees.

Online lending platforms, such as iCash, are gaining trust among Canadians. They provide a more flexible and user-friendly approach, allowing for quick applications, fast approvals, and 2-minute funding. That’s less time than it takes to make a cup of coffee!

Application: You apply online or at an in-store provider. You commonly need proof of income, a bank account, and identification.

Decision: Application decisions are often quick, sometimes within minutes, and may include a soft credit check (which doesn’t impact your credit score).

Getting your cash: When you get a payday loan, funds will be deposited directly into your account.

Repayment: You will need to pay back the full amount, plus interest and fees, by the agreed due date. It’s common to repay with automatic withdrawals from your account, but paying in cash and with post-dated cheques are also options with some online payday lenders.

Renewal: If you can’t pay your balance by the agreed due date, your lender may offer to renew your loan with a new agreed payment date, with additional fees and interest.

Ready to get started? Apply using the application on the web or the mobile loan app. Provide some personal and financial information, including your income. Most online payday lenders require a minimum net income of $800 per month.

Don’t make a traditional salary? Income from self-employment, government benefits, and pension payments is also acceptable. Plus, with 24/7 access, you can get a payday loan whenever you need it - including weekends and holidays!

Don’t wait! Rapid financial assistance is a click away. Secure your loan in minutes with the mobile app or online form.

Unlike the traditional method of visiting a retail store, e-transfer payday loans allow you to apply and receive funds online, emphasizing speed and efficiency.

They are simply payday loans where you get your cash through e-transfer rather than in cash. The advantages are significant. Your application is nearly instantly approved, and your cash is transferred literally within minutes.

Let’s say your car breaks down on the road, and you don’t have the funds to call a tow truck; what then? No problem! You can apply and be approved in minutes, with your cash sent to you before your tow truck arrives!

e-Transfer payday loans Canada 24/7 are digital and available at all hours of the day. Many lenders now offer this option, providing you with the convenience of being able to apply and receive funds whenever you want. It’s helpful if you have an urgent expense to cover outside of regular business hours.

Use the funds for a variety of purposes, including handling bills, covering unexpected expenses, or making a special purchase. Even if you need a small amount of cash to avoid a costly overdraft fee or late payment charge, email loans are a useful solution.

Online payday loans allow you to apply and receive your cash using any electronic device from the comfort of your home. You’re no longer limited to the payday lenders located in your town or city.

iCash currently operates in seven provinces: Alberta, British Columbia, Manitoba, New Brunswick, Nova Scotia, Ontario, and Prince Edward Island. The company has issued online loans since 2011.

An online payday loan provides short-term funds for individuals of all credit types. You may borrow up to $1,500 and use the funds for various expenses, ranging from emergencies to day-to-day essentials. Pay back with your next payday or up to the maximum 62-day period.

Small amounts are beneficial if you only need a small sum of cash to ease temporary financial difficulties. You’ll also avoid the hassle and cost of having to borrow large amounts.

A perfect example would be if an accidental dental bill arises. You could use this small-sized cash advance to cover the cost until your next paycheck arrives. This can help you avoid expensive late fees or overdraft charges from your bank.

Payday loans in Canada serve as a reliable resource for individuals needing quick cash. Legislated under provincial regulations, they offer a fast and efficient way to manage any type of small expense.

With transparent fees and capped rates, feel confident choosing this option. Provinces across the country adopt measures to protect you from unfair lending practices. This framework not only enhances your borrowing experience but also gives you more confidence in choosing a lending institution to do business with.

You may also have the option of installment plan loans. Available in some provinces, they allow you to divide payments over a set period. This makes it easier to manage your budget alongside your repayments.

Below is the breakdown of iCash Canada repayment terms by province:

Province | Repayment Options |

British Columbia | 2 or 3 repayments, no additional fees, up to 62 days. |

Alberta | 2 to 7 repayments according to the pay schedule at zero extra cost; ranges between 42 to 62 days. |

Ontario | One repayment only. |

New Brunswick | Possibility of 2 or 3 repayments. No extra costs, maximum of 62 days. |

Nova Scotia | One repayment only. |

Manitoba | Allows 2 or 3 repayments. No additional fees, up to 62 days. |

Prince Edward Island | 2 or 3 repayments based on pay frequency. No additional fees, up to 62 days. |

Once you receive your next paycheck, you can repay in full and move on without carrying the burden of a larger debt. Of course, failure to pay on time can result in additional fees. Always consider your ability to pay things back before borrowing.

Let’s quickly review the three areas you’ll want to focus on to ensure a speedy approval process:

Be accurate: double-check all the information you provide on your application is accurate.

Gather your required information: have your necessary information ready before you start the application. While you can apply and be approved for an iCash payday loan without documentation, you will need to know important information such as your monthly income, its source, how long you’ve received it, and your banking information.

Bank account: Make sure your bank account is in good standing and you have access to its online features.

Costs will vary by province. These are higher-cost loans, with rates at $14 for every $100 borrowed. Our application process is secured by industry leaders, ensuring your data is protected with top-level encryption.

Below is a breakdown of regulations and payday loan costs by province. It includes the maximum cost of borrowing, the cooling-off period cancellations, and the maximum penalty for a returned pre-authorized debit payment.

Province | Max. Charge per $100 Borrowed | Cooling-Off Period | Max. Penalty for Returned Payment |

Alberta | $14 | 2 business days | $20 |

British Columbia | $14 | 2 business days | $20 |

Manitoba | $14 | 48 hours, not including Sundays/holidays | $5 |

New Brunswick | $14 | 48 hours, not including Sundays/holidays | $20 |

Newfoundland and Labrador | $14 | 2 business days | $20 |

Nova Scotia | $14 | Next business day | $20 |

Ontario | $14 | 2 business days | $20 |

Prince Edward Island | $14 | 2 business days | $20 |

Staying informed gives you an advantage when managing your finances. Always understand the rules and regulations that lenders must follow, as well as your rights and responsibilities.

Remember, you should only use these loans as a temporary solution. Never rely on them for long-term financial stability. If you find yourself repeatedly needing monetary support, it may be time to seek financial counselling, explore credit union loans, or create a budget to address underlying issues.

If you’re looking for loan places near me, you’ve probably discovered both in-store and online lenders. Both are viable options and provide you with the financial assistance you need.

In-store providers allow for face-to-face interactions and offer quick access to cash, provided you have proof of being regularly paid and steady local employment. This option is helpful for those who prefer a personal touch.

Keep in mind that most lending offices operate within traditional business hours. This means they may not be available outside of regular business hours or on weekends. If you need emergency funding in the middle of the night or on a weekend, consider online lenders who offer round-the-clock services.

Online funding has become the most convenient option available. Apply from the comfort of your own home or anywhere you are. 24/7 accessibility means you can get cash at any time, day or night.

With this option, you have a range of lenders to choose from. Compare rates, repayment terms, and customer reviews to ensure the best borrowing experience.

With online payday loans, you can apply from the comfort of your home using any smart device with an internet connection. No more traveling to and from a physical lender’s location and waiting in line.

No refusal payday loans in Canada come with low refusal rates. If you've faced credit rejection in the past, don't stress! Your approval chances may still be high.

Keep in mind the term “no refusal” doesn't mean 100% approval. The truth is, no reputable lender can guarantee funding. They can, however, offer options with high approval rates and minimal eligibility criteria.

As long as you provide proof of steady income and residency, and are the legal age of majority, you have an excellent chance of getting the cash you need. This makes a no-refusal loan ideal for Canadians with poor credit or no credit at all.

Interested in no refusal payday loans 24/7? Always consider working with a reputable provider. It starts with ensuring the lender holds valid licenses in the province and that they operate within the rules and regulations of the industry.

You should also check that the lender works alongside the Canadian Consumer Finance Association. This association sets standards and rules that members must adhere to. It gives you an extra layer of protection and the peace of mind of knowing you're dealing with a responsible company.

When considering these loans, remember that your financial well-being is a priority. Working with a trustworthy company will give you the best opportunity for a positive borrowing experience. Address your immediate financial needs without compromising your long-term financial health.

Payday loans with no credit check are accessible to people of all credit types. They allow for easier access to funds for those who have a poor credit score or no credit at all. You can get up to $1,500 in instant cash, regardless of your financial background.

Second chance lenders understand that your financial past doesn't always reflect your current ability to pay things back. They also understand that people who haven't established credit sometimes struggle to find traditional funding options.

You shouldn't confuse loans without credit evaluations with no requirements at all. Alternative credit providers have certain criteria you must meet. This includes having a steady source of income, a valid bank account, proof of residency, and being the legal age of majority in your province.

Lenders may also conduct a credit check to verify your identity, but this won't affect your approval chances. This is different from a hard credit check, which can impact your credit and be visible to other lenders. Above all else, understanding how they work helps you navigate the process with more confidence.

Payday advance loans with no credit check give you advanced cash without stringent credit requirements. Much like other forms of short-duration credit, they offer a convenient way for individuals to access emergency funds. This is especially important if you cannot secure traditional forms of credit.

Advance loans with low requirements are ideal for individuals with varying income sources, low credit scores, or no credit history. Traditionally, lenders base their approval decisions on credit history, employment status, and other financial factors. This makes it difficult for those with unstable credit or unconventional sources of money to secure funding.

Alternative lenders accept all credit types and income sources, including self-employment income, government benefit payments, and even unemployment (EI) benefits. It's an inclusive option for those who may not qualify for traditional forms of credit.

If you collect disability benefits and need fast access to cash, advance loans with no credit check can be the perfect solution. If you're a young adult who hasn't established a solid credit history, this type can help you build your financial profile. Whatever your situation, there are financing options available.

Instant payday loans stand out for their speed and immediacy. They provide a rapid solution to urgent financial needs.

There are no documents, paperwork, bank statements, or in-person visits needed. Complete the entire process online - and within minutes! It's the most realistic option if you need cash and don't have the time or means to go through the traditional application steps.

Immediate funding loans also cater to individual needs. They offer personalized dollar amounts based on income and financial situation.

If you need $100 to cover your next grocery bill or $1,500 to purchase a new laptop, you'll find customized options that fit your needs. Simply choose your provider, request your desired amount, and receive funds via in minutes. Online cash lenders send cash 24/7, giving you the best access to cash when you need it most.

Payday loans for bad credit borrowers are available 24/7. They offer you a second chance at getting cash, regardless of your credit rating. Your credit background won't be a factor in the approval process, as long as you demonstrate your ability to repay.

In Canada, a poor credit score is anything below 650. Many traditional lenders will not consider giving money to people with this score. This makes it difficult for them to access emergency funds.

Being in a difficult credit situation isn't always a result of financial irresponsibility. Life happens, and unexpected expenses arise at any time. A medical emergency, car repair, or job loss can lead to missed payments and a lower credit rating.

Remember, always check your credit score and take steps to improve it. This can include paying off outstanding debt, making all payments on time, and keeping your credit utilization ratio low. Both Equifax and TransUnion provide free credit reports that you can access online.

If you suspect an error on your records, you have the right to dispute and correct it. This can help improve your credit score and make it easier to obtain funding, other than low credit loans, in the future.

Knowing the payday loan requirements can help you decide if it's right for you. While each lender may have different criteria, you'll need to meet the following criteria when applying with iCash:

You must be 18 years of age or older (19 years of age or older in British Columbia, New Brunswick, and Nova Scotia).

Be a resident of any of the provinces we operate in.

Have a steady net income of $800 or more per month. We accept income from various sources, including employment income, self-employment income, government benefit payments, pensions, etc.

Prove you have received the same source of income for the past 3 months.

Have access to a bank account with online banking capabilities.

Have a valid home address, email, and mobile phone number (we do not accept VoIP numbers).

These easy-to-meet iCash requirements make them accessible to a wide range of Canadians. You don't need collateral or perfect credit, and there's no long wait for approval. Get your money and get back to what you enjoy most.

There are various types of payday loans available. Alternative lenders understand that no two financial situations are the same. That's why they offer a variety of options to cater to different needs.

Some common small loan options that are available to you include:

Type of Loan | What's It All About? |

Receive funds on the same day of approval. They provide a quick iCash payment of up to $1,500 for emergencies or urgent expenses. | |

They come with a very high approval rate. People who apply have an excellent chance of receiving funds, despite their credit history or income level. | |

Allows for a complete online experience. There's no need for faxing documents or filling out extensive paperwork. Plus, you can apply and receive funds from anywhere! | |

Designed for individuals receiving government benefits, offering them an option to borrow based on their benefit payments. | |

Tailored for financing last-minute travel expenses. They provide immediate funds 24/7. | |

Allows for multiple repayment options for easier management. | |

Funding with competitive rates, transparent terms, and high approval chances. It's highlighted by customer reviews and ratings. |

Knowing how to pay back a loan is important. This ensures that you avoid any unnecessary fees or penalties. If you want to know how to pay back iCash loans, here's a simple three-step process:

Step 1: Choose Repayment Plan

Select a repayment plan that fits your financial needs. Depending on your location, you may have the option of one lump sum payment or multiple installment payments. Consider what works best for your budget to ensure timely payments.

Step 2: Set Up Payment Method

After choosing your payment plan, set up your preferred payment method. You can choose repayments through pre-authorized debit transactions directly from your bank account or via e-Transfer. Decide on the method that offers the most convenience and reliability.

Step 3: Communicate With Us

Open communication is key. If you encounter any financial challenges during the repayment period or have any questions about your agreement, contact us right away. We'll provide proper advice, adjust your payment plan if necessary, and help you navigate through any difficulties to avoid penalties. Plus, if you decide you want to pay back early, let us know. You won't incur any additional fees or prepayment penalties.

Another important aspect is budgeting. Always ensure you have a plan in place for how to pay back what you owe. This could mean cutting back on unnecessary expenses or finding additional sources of income to cover the repayment amount.

It's also important to avoid taking out multiple loans or working with a lender that allows you to. This can lead to a cycle of debt that may be difficult to break. If you find yourself struggling to pay back an advance, look for debt management resources or additional programs to help you get back on track.

Getting easy payback loans ensures a smooth and stress-free borrowing experience. With responsible borrowing, proper budgeting, and timely repayment, you can use them as helpful financial resources when you need extra cash.

Designed with you in mind, we offer a straightforward financial solution in minutes. Take care of your financial obligations without stress or delay.

When you apply online or through the iCash app, you'll find a process that's quick, convenient, and secure. Whether you're in the middle of a busy work day or unable to leave your home, our loans are accessible anytime, anywhere.

We also value your trust and ensure you're always informed about the terms of your loan and repayment options. This includes a clear explanation of fees, rates, and repayment schedules before you commit. Our approach prioritizes transparency and responsibility, helping you to make the most of your funding choices.

We're available to offer any assistance you need. Contact us through the app or via the iCash phone number. If you're ready to start the process, we've got you covered! Begin by installing the mobile loans app on your device. Let iCash pay for your expenses with an easy loan of up to $1,500!

*No credit check is required for any second or subsequent loan application. A credit check is only conducted on your first loan application, which means all future loans are exempt from it.

Since 2016, we've helped over half a million Canadians get instant loans online.

Since 2016 we have happily served over half a million customers.

Read more reviews.

Getting a payday loan online with us is quick and easy! Select your desired loan amount, repayment plan* and provide a few personal details.

Our online payday loan application will tell you if you’re approved instantly. If you are, you just need to electronically sign your agreement. That’s it!

Once you digitally sign your agreement, your payday loan will be sent by e-Transfer within 2 minutes. Funds are sent 24/7, no matter what.

Have more questions? Check out our full FAQ.

Master payday loan management with smart budgeting and debt reduction tips. Learn all the strategies to get ahead financially. Take charge of your money now!... Read more

Find the answer to the question “How Many Payday Loans Can I Get?” Learn about regulations, provincial limits, and get tips for responsible borrowing. ... Read more

Unlock financial freedom with our step-by-step guide on securing a loan using the innovative iCash platform!... Read more