Menu

Table of contents :

Unexpected car repairs. A medical bill that can't wait. Groceries needed before payday. Life doesn't always sync with your bank account, and when urgent expenses hit, you need a solution that's just as fast.

E-Transfer payday loans offer Canadians instant access to cash when they need it most. These are short-term loans deposited directly into your bank account via e-Transfer, often within minutes of approval. No waiting for business hours, no trips to physical locations, and no lengthy bank processes.

At iCash, we understand financial emergencies don't follow a schedule. That's why we offer e-Transfer payday loans 24/7/365. Whether it's 3 AM on Sunday or New year eve, our platform is ready to help. Borrow up to $1,500 with approval in minutes. Bad credit? We consider all applications. Returning customers enjoy streamlined processing with no credit check required.

We're here to help you bridge the gap with speed, transparency, and respect. You're in control, apply when you need us, borrow only what you need, and get back on track.

Key Takeaways

e-Transfer payday loans are regulated financial products available across Canada

Funds received via e-Transfer in minutes, 24/7, including weekends and holidays

Bad credit considered – approval focuses on current income, not just credit score

Borrow only what you need and understand repayment obligations before applying

Payday loans are widely available throughout Canada and fully regulated under provincial legislation.

Each province has specific regulations governing payday lending, including maximum loan amounts, fees, interest rates, and repayment terms designed to protect borrowers.

What sets modern e-Transfer payday loans apart from the rest is 24/7 availability. Instant e-Transfer loans in Canada can be accessed anytime through secure online applications.

Provincial regulations are in place for protection across all lending activities. For instance, Ontario's Payday Loans Act sets maximum costs at $14 per $100 borrowed, while other provinces have similar frameworks that regulate the cost of borrowing and interest charges.

Always verify that lenders are properly licensed in your province. As a responsible payday lender, we're members of the Canadian Consumer Finance Association, demonstrating our commitment to responsible lending and consumer protection.

At iCash, we understand that every Canadian's financial situation is unique. That's why we offer payday loan options designed to meet different needs and income sources. Below are some of the most common types of e-Transfer loans available:

Loan Type | Description |

e-Transfer Payday Loans on Social Assistance | Designed for Canadians receiving social assistance. These loans provide quick access to funds without the hassle of traditional credit checks, focusing on your current income. |

e-Transfer Payday Loans for Disability Assistance | Provide financial help for individuals on disability benefits, covering extra costs with fast approval and funds sent directly to your email. |

e-Transfer Payday Loans with Minimal Documentation | Our streamlined online application requires minimal information. No need to scan or upload documents, visit a branch, or provide extensive paperwork. Simply provide basic personal and income details to apply. |

True 24/7/365 Operations: Unlike other payday lenders who claim 24/7 service but process only during business hours, we provide genuine round-the-clock funding. We know that financial emergencies don’t have a schedule and can happen on weekends and holidays. Our platform operates around the clock, every single day of the year.

All Credit Types Welcome: With a 93% approval rate, we consider poor credit, no credit, or past denials. Our evaluation process focuses on income stability and bank account patterns, not just credit scores or credit checks. Returning customers don't need credit checks either, offering a fast alternative to traditional lenders.

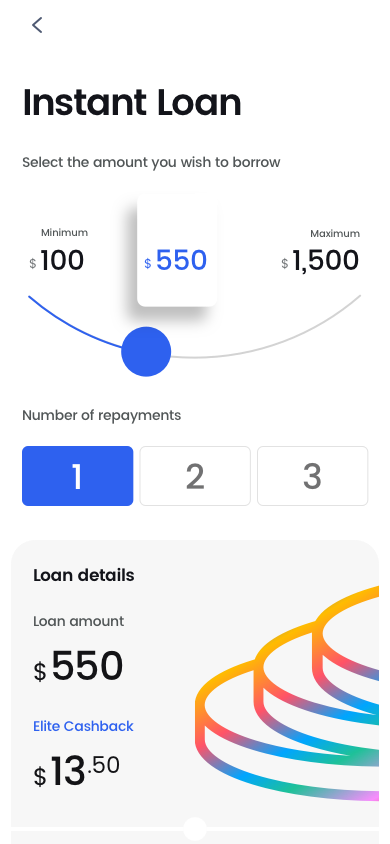

Lower Costs with Cashback: We offer competitive rates at $14 per $100 borrowed, and you can earn up to 12% cashback on the cost of borrowing when you repay on time. This money gets credited to your account for future use, helping lower your overall borrowing costs.

Mobile App Advantage: Rated 4.8/5 with 56,000+ reviews across app stores. Our apps make it easy for returning members to secure payday loans in under 60 seconds with instant access to loan details, repayment schedules, and account management.

Proven Track Record: Over 1.6 million Canadians helped. Rated 4.7/5 on Trustpilot (2,900+ reviews), 4.5/5 on Google (6,000+ reviews), and 4.4/5 on Birdeye (12,000+ reviews).

Get an easy e-Transfer loan with us anytime! Simply choose your desired loan amount, repayment plan* and provide some personal details.

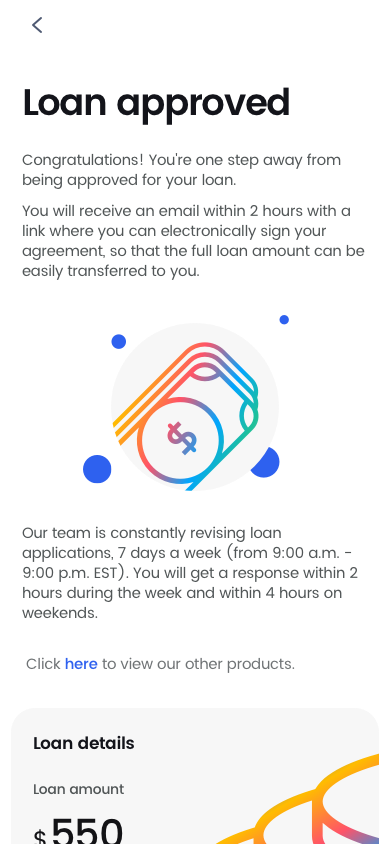

Our e-Transfer loan application will instantly tell you if you’re approved. Once you are, all you need to do is electronically sign your contract!

Once you e-sign your agreement, your loan will be sent by e-Transfer within 2 minutes. Funds are sent 24/7!

Be at least 18 years old (19 years old for applicants in British Columbia, New Brunswick, Nova Scotia)

Be a resident of any of the provinces in which we operate (AB, ON, BC, MB, NB, NS, PEI)

Show that you have been receiving the same source of income for the past three months

Have a total net income of at least $800/month (monthly income requirements may vary by province)

Have access to an online bank account, in which pre-authorized debits can be performed*

Have a valid Canadian mobile phone number, address, and email address (VoIP numbers are not accepted)

*Please note that KOHO accounts do not qualify as they do not support pre-authorized debits.

Employment isn't always required when you apply. We accept various forms of income, including government benefits (CPP, ODSP, AISH, EI), disability income, and self-employment. According to Statistics Canada, approximately 22% of Canadian households rely on government transfers as their primary income source, and we're committed to serving these communities with fair access to emergency cash advances.

Borrow only what you need. Calculate your exact expense and stick to that amount. Extra money adds unnecessary costs to your short-term loan.

Understand borrowing costs. We charge $14 per $100 borrowed. That means, for example, that a $500 loan costs $70 in fees (plus the initial loan amount to be repaid).

Plan your repayment. Ensure you can repay the loan plus cover other monthly expenses within the repayment period. We offer flexible repayment options in some provinces.

Avoid repeat borrowing. As much as possible, payday loans should be for one-time emergencies. Repeated borrowing may signal that you need different financial solutions.

Explore alternatives. Consider payment plans with creditors, paycheck advances from your employer, or borrowing from family as an alternative before applying for a payday loan online.

Some financial apps and services advertise "no-fee" cash advances or "interest-free" access to your money. Sounds perfect, right? Look closer.

Subscription-based cash advance apps charge monthly membership fees ranging from $5-$20. Access your own paycheck early for "free,” after paying $120-$240 per year in subscriptions. They may also request "voluntary" tips of 10-20% per transaction, which aren't mandatory but are heavily suggested through app design.

Digital wallet cash advances from popular fintech platforms often come with these hidden costs:

Mandatory premium account upgrades ($10-$15/month)

Limited advance amounts (often $100-$250 maximum)

"Express" delivery fees to get your money instantly ($3-$10 per transaction)

Restrictions on how quickly you can request another advance

Subscription tiers that lock features behind paywalls

Real-World Example: A $200 "no-fee" advance with a $10 monthly subscription, $5 express fee, and suggested $30 tip costs you $45. That's 22.5% of the amount borrowed. Compare that to iCash's transparent rate of $14 per $100 borrowed ($28 for $200), and you're actually paying more with the "free" alternative.

Why transparency matters: e-Transfer payday loans at iCash show you the total cost upfront. No subscriptions. No tip pressure. No hidden express fees. You pay one clear fee ($14 per $100 borrowed), receive your money in minutes 24/7, and that's it.

We don't disguise costs behind memberships or call fees "optional tips." You deserve honest lending, especially when you're facing a financial emergency. While some fintech apps market themselves as alternatives to payday loans, their complex fee structures and monthly subscriptions can actually cost you more over time.

When financial emergencies strike, waiting isn't an option. With iCash, you don't have to.

Join over 1 million Canadians who have trusted iCash for fast, reliable financial assistance. With our 93% approval rate, funding available 24/7, and industry-leading customer reviews, we're here to help you bridge the gap until your next payday.

Check your eligibility today. Apply online now for your cash advance and receive funds via e-Transfer within minutes!

Since 2016, we've helped over 1.6 millions Canadians get instant loans online.

Since 2016, we've helped over 1.6 millions Canadians get instant loans online.

Read more reviews.

Have more questions? Check out our full FAQ.

e-transfer payday loans are a great way to get money fast for any financial emergency that may come up.... Read more