Menu

In Canada, your credit report can have a massive impact on your life. If you want to buy a house or a car, or even rent an apartment, you need to know where you stand with your credit. The iCash free credit report service is here to help!

Download the iCash mobile app & check your credit score anywhere, anytime.

Why Check Your Credit Report with iCash

Free and Unlimited Credit Report & Score

We Don’t Sell Your Data to Any 3rd Parties

No Affiliate Ads

Protected by Advanced Security Measures

Accessing Your Report Does Not Affect Your Credit

Private Credit Score, Accessible Only by You

Real-Time Updates

User-Friendly Interface

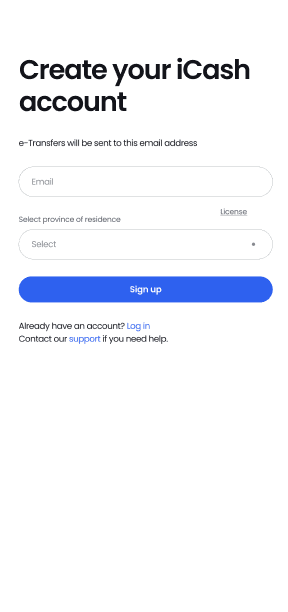

Checking your credit report doesn't have to be complicated! With iCash's credit health service, your credit report is just a click away. Sign up for an iCash account today and start your journey toward financial freedom. It's free and easy!

Table of contents :

A free credit report in Canada outlines your financial history. This includes all your credit accounts, payment history, and any outstanding debts.

Understanding your report is important and your right as a Canadian resident. Think of it as a financial report card of sorts. Depending on how good it is, it can significantly impact your financial decisions.

Are you planning to buy a new car or a home? Or apply for a new credit card? Most lenders will review your report. They assess the risk of lending to you.

A positive report with a history of responsible financial behavior can open doors to favorable interest rates and loan terms. This means paying your bills on time, diversifying your credit, staying below your limits, etc. Banks, and other financial institutions will view this as a positive and will be more likely to approve you for things like loans.

On the flip side, a negative report, with late payments or unpaid debts, can make it challenging to secure loans or credit lines. This is why it’s important to stay informed about the contents of your report and take steps to improve it if needed.

If you want to know how to get a free credit report in Canada, the answer is simple. You can obtain a Canada free credit report with the iCash credit health service.

iCash offers a convenient way to get a free report in Canada with our credit health service, available exclusively to iCash members for free!

With the iCash credit health service, you can check in on your credit any time you want and get a free credit report in Canada online! All you need to do is sign up to be an iCash member and you can use the service any time you’d like. So, if you’re ready to start taking care of your financial health, let iCash get you started today.

If you want to know how to get a credit report in Canada for free with iCash, all you need to do is start by becoming a member*. From there, you’ll be able to check up on your credit regularly and check your credit rating in Canada.

If you’re asking, “Can I get a free credit report in Canada?” the answer is that all citizens have the right to obtain a free report once a year from a credit bureau. There are no specific eligibility criteria to meet; this benefit is available to everyone. If you’re interested in obtaining your free credit bureau report in Canada as often as you want with iCash, here's a quick guide on how to do it:

Start by visiting iCash.ca. If you're a first-time user, you'll need to create an account, which only takes a few minutes. Our platform is 100% secure and your information is completely confidential and safe.

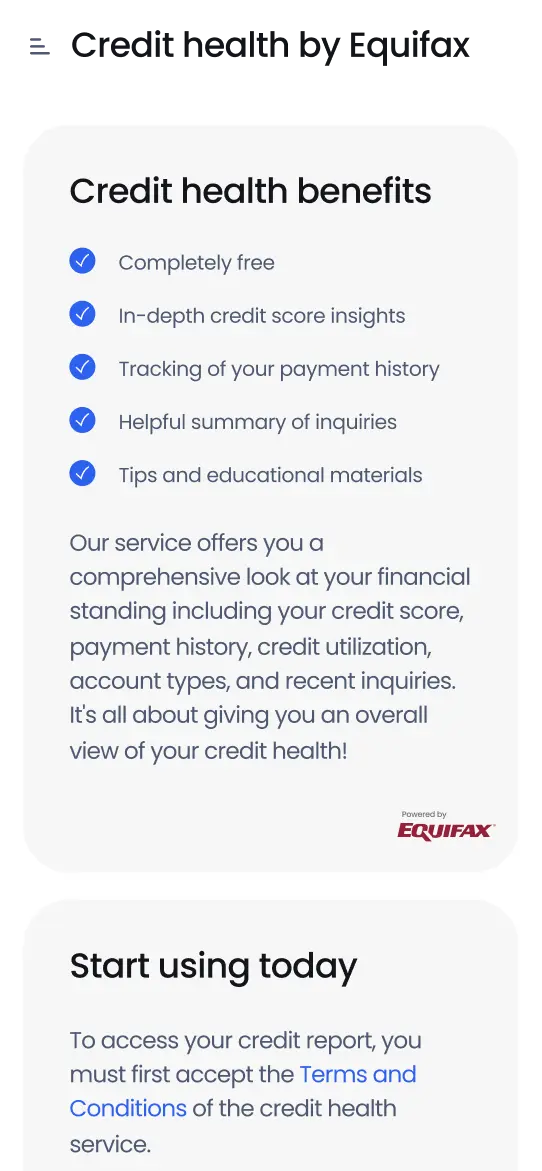

Once your account is set up, you can access your free credit report via the iCash credit health service, powered by Equifax. Simply click on the credit health button from your iCash account dashboard to access it.

Take the time to review your report thoroughly. It contains all the personal credit information about your financial history, including credit accounts, payment history, and inquiries.

iCash encourages you to make credit monitoring a regular practice using our credit health service. Your credit health can change over time, so it's good to stay informed about any developments, both positive and negative.

By monitoring your credit often, you can quickly deal with any errors, disputes, or fraudulent activities that may come up. Plus, staying informed about your credit health empowers you to make better financial decisions in general.

If you have a smartphone or tablet, you can download the iCash app and use it to take advantage of our credit monitoring services. You can access the credit health service from the app anytime and anywhere for added convenience, making it a valuable tool for anyone who prefers to handle all their finances directly on their phone.

By following the steps above, you can take control of your financial well-being, understand your credit, and make better decisions about your finances. Remember that it's your right as a Canadian resident to access your report, and iCash is here to support you.

Credit reports contain information about you, your finances, and your credit history. Generally, they are updated within 30 to 90 days and they may contain:

Name and date of birth

Current and previous addresses

Current and previous telephone numbers

Social insurance number

Driver’s license number

Passport number

Current and previous employers

Current and previous job titles

Financial information in your credit report

Your credit report may also contain:

Non-sufficient funds payments, or bad cheques

Chequing and savings accounts closed “for cause” due to money owing or fraud committed

Credit you use, including credit cards, retail or store cards, lines of credit and loans

Bankruptcy or a court decision against you that relates to credit

Debts sent to collection agencies

Inquiries from lenders and others who have requested your credit report

Registered items, such as a car, that allows the lender to seize it if you don't pay

Fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans

There may also be tons more information, such as when you opened your accounts, how much you owe, if you make your payments on time, if you go over your credit limit and so much more. So, as you can see, these reports have a very detailed history of your finances, which is why so many banks and other institutions rely on them.

At iCash, we want to help you understand your finances. That's why we’ve teamed up with Equifax to offer you a free credit report. When you join iCash, you can get a free credit report easily. This report will show you important details about your financial history, like your credit accounts and payment history.

With this partnership, iCash makes it easy for you to access your Equifax report. By checking your credit report through iCash, you can see if everything is correct and catch any suspicious activity early. This helps you keep your credit in good shape. Using the iCash credit health tool helps you make smarter financial decisions!

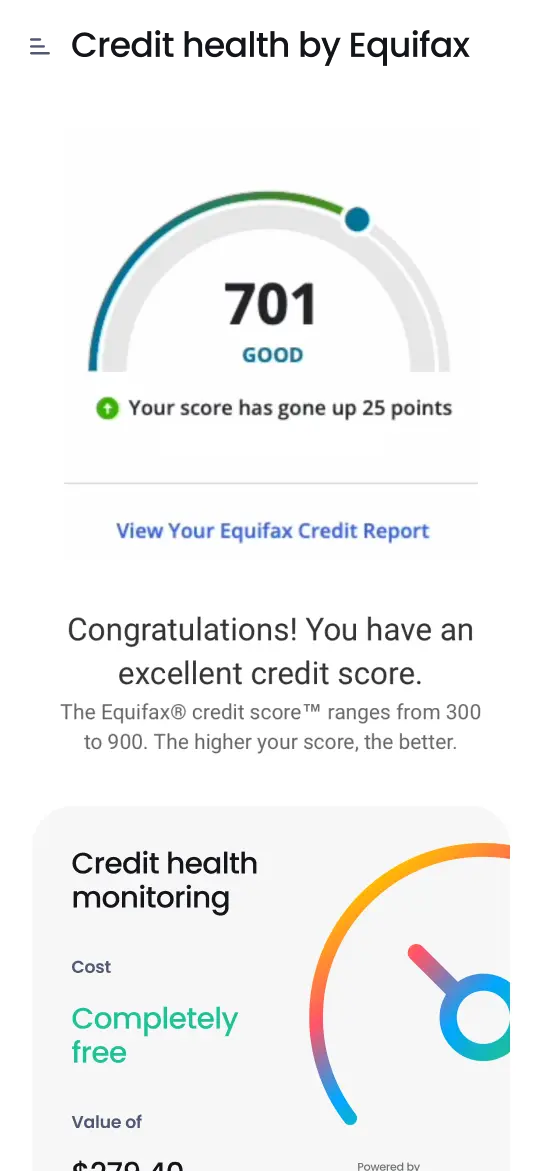

The best way to stay on top of your finances is to monitor your credit health with iCash. By using our credit health service, you’ll be able to regularly check in on your report and see how your financial health is currently looking.

We've explored credit reports, explained the process of obtaining them, and hopefully clarified any confusion you may have had along the way. Now, you’re equipped with the tools provided by iCash and you're well-prepared to take control of your financial well-being.

At iCash, we’re proud to offer a seamless way for Canadians to obtain their free credit report. By making this service accessible to Canadians, it enables you to better monitor and understand your credit history.

By monitoring your credit through iCash, you’re taking charge of your financial future. But iCash is more than just a way to check your report. We're your trusted payday loan partner, here to support you with loans of up to $1,500 when you need them most.

Whether you're looking for a payday loan to handle a financial emergency or simply seeking ways to manage your finances more effectively, iCash is here to help.

Are you ready to get started on your financial journey with iCash? Then visit our website now to access your credit score and apply for payday loans. Take control of your financial well-being with iCash today!

Ready to take charge of your financial destiny? By checking your credit report, you're in control! Effortlessly monitor your credit report, stay ahead of the game, and make informed decisions!

Your credit report is a detailed record of your financial history, crucial for assessing your creditworthiness. A healthy credit report report can unlock lower interest rates and better financial opportunities. Regularly reviewing your report is essential - and with the iCash credit health service, you'll gain valuable insights into your financial standing!

Your credit report is viewed by lenders, landlords, and even employers. They use it to make decisions about loans, rentals, or job opportunities. Maintaining a good report is important for financial success and regular checks are part of the process.

Our loans give you the cash flow you need to tackle bills on time, dodge those pesky late fees, and keep your credit in good shape! They’re designed to support you in keeping your financial history on a positive track!

A

Your grade

Set up your iCash account to access the new credit health service for free*! You can also enjoy our fast and reliable loans whenever you need some extra cash!

Sign up for an iCash account and gain instant access to our credit health service. Download your free credit report, powered by Equifax, and take control of your financial journey today!

With your Equifax credit report ready to go, you can now monitor your credit health and begin walking the path toward better credit and financial opportunities!

Download the free iCash app today find out how easy it is to get your Equifax credit score at no extra cost!

Behind each review is an experience that matters

Since 2016, we've helped over 1.6 millions Canadians get instant loans online.

Since 2016, we've helped over 1.6 millions Canadians get instant loans online.

Read more reviews.

Have more questions? Check out our full FAQ.

Learn the differences between credit scores and reports, their importance, and how monitoring both boosts your financial health. Get tips from iCash now!... Read more