Menu

Table of contents :

We've all been there. Your car decides to break down on a Tuesday afternoon, or an unexpected bill shows up right before payday. Picture this instead: You're sitting on your couch at 11 PM, apply for a loan, get approved by 11:05 PM, and have money via e-Transfer before midnight. When you need cash quickly, waiting days for a traditional bank loan just doesn't cut it.

That's where mobile loan apps come in. They put the power to borrow up to $1,500 directly in your pocket, with approvals happening in minutes instead of days.

You don't need to visit a branch, fill out mountains of paperwork, or wait nervously for a callback. Canadian loan apps let you handle everything on your smartphone. For over 1 million Canadians dealing with financial gaps, these apps have become absolute lifesavers.

Key Takeaway

Mobile loan apps deliver emergency funds in minutes via e-Transfer, 24/7, without branch visits or lengthy bank approvals.

Four main types exist: payday apps ($100-$1,500), advance apps ($10-$250), installment apps ($500-$5,000+), and credit lines ($500-$10,000).

Top loan apps approve over 90% of applicants by evaluating income stability rather than credit scores alone.

Government benefits like ODSP, AISH, CPP, and EI qualify as income. Legitimate apps are provincially licensed and use bank-level encryption.

Think of a mobile loan app as having a lender right in your pocket. It's a smartphone app that lets you apply for and receive short-term loans entirely through your phone, which gives you a tremendous amount of convenience since you never need to leave your home to apply.

They use digital systems to give you instant decisions within minutes of hitting submit on the online application. Once you're approved, the money gets sent straight to your bank account via e-Transfer. We're talking minutes here, not the days you'd wait with traditional banks.

What really makes these apps stand out is how they look at your application. Instead of obsessing over your credit score like banks do, many payday loan apps check out your income stability, how you manage your bank account, and your employment history.

Remember when getting a loan meant waiting in a long bank line for over an hour? Those days are over. Download the iCash app from the Apple App Store or Google Play, then fill out the digital application. It only takes about 3-5 minutes.

You'll get an approval decision immediately. No waiting around for days or weeks. Once approved, review exactly how much you're approved for, what it costs, and when you'll pay it back. Then just sign electronically!

Money hits your bank account within 2 minutes via e-Transfer after you’ve been approved and have signed your digital agreement. Fast, convenient and hassle-free. Funds are sent 24/7, no matter what, even on weekends and holidays.

Not all loan apps are created equal, and that's actually a good thing. Different apps are designed for different situations. Let's break down what's out there:

Loan App Type | Typical Use Case | Loan Size Range | Best Used For |

Payday Loan Apps | Emergency cash between paychecks | $100 - $1,500 | Fast funding (minutes), accepts all credit, short repayment |

Advance Apps | Small immediate expenses | $10 - $250 | Very small amounts, ultra-fast access, often low-cost |

Installment Loan Apps | Larger expenses with flexible repayment | $500 - $5,000+ | Longer terms (months), lower monthly payments |

Line of Credit Apps | Ongoing access to funds | $500 - $10,000 | Reusable credit, pay interest only on what you use |

Here's how to figure out which one you need:

Need $100-$300 right now for an immediate bill? Go with advance apps or small payday loans

Need $500-$1,500 to fix your car or cover a medical expense? Payday loan apps like iCash are perfect for same-day funding

Need $2,000+ and you're okay with paying it back over several months? Installment loan apps give you more breathing room

Need flexible access to emergency funds on an ongoing basis? Line of credit apps are your best bet

We've helped over 1 million Canadians since we started, and we're pretty proud of that. Here's what makes us different from other loan apps out there:

We're seriously fast: With a 93% approval rate (one of the highest in Canada), we approve most people who apply.

Your credit score isn't everything to us: We get it, not everyone has perfect credit. That's why we don't just look at your credit score. We want to understand your whole financial picture. So even if you have bad credit, you can get approved.

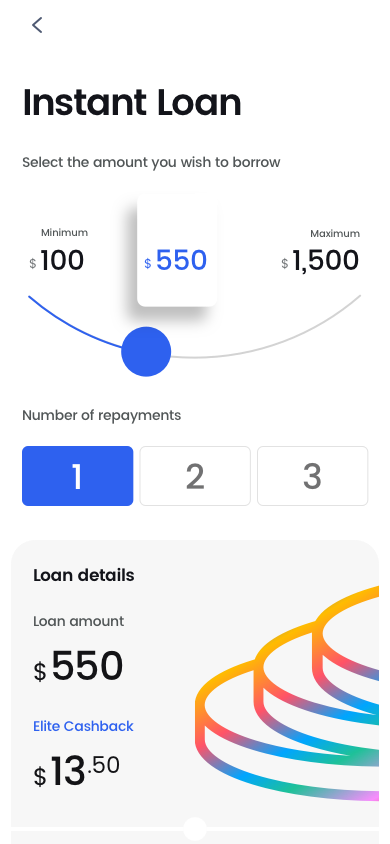

No surprises, ever: We charge $14 per $100 borrowed for instant loans, and we tell you that upfront before you sign anything.

Bank-level security: Every transaction gets protected with 256-bit SSL encryption, the exact same security your bank uses for online banking.

Earn Cashback on every loan: Our Cashback program lets you earn up to 12% back on your borrowing costs. That means you’re saving on fee costs in the long run, thanks to the Cashback you’ll accumulate.

Real reviews from real people:

4.7/5 on Trustpilot (2,900+ reviews)

4.8/5 on Apple App Store (22,000+ reviews)

4.8/5 on Google Play Store (34,000+ reviews)

Our app works on both iPhone and Android, so you can apply literally anytime, from anywhere in Canada. Borrow anywhere from $100 to $1,500 with pricing that's crystal clear before you commit to anything. We use the same security your bank does, and our support team is available 24/7 if you have questions.

If you're new to iCash, you'll typically qualify for $100 to $500 on your first loan. Once you've borrowed and paid us back successfully, you can access up to $1,500 on future loans. How much you get approved for depends on your income, how you manage your bank account, and the lending rules in your province.

Our fee structure is super straightforward: $14 per $100 borrowed for instant loans. So if you borrow $500, you pay $70 in fees and repay $570 total. When it comes to paying it back, some provinces may let you split it into up to 3 installments. Conditions apply.

Everything gets spelled out before you sign. No hidden fees, no surprise charges showing up later, no "gotcha" moments. That's not how we do business.

Good news: most Canadian adults can qualify for apps like iCash. The requirements are pretty straightforward.

Here's what you need:

Be at least 18 years old (19 years old for applicants in British Columbia, New Brunswick, Nova Scotia)

Be a resident of any of the provinces in which we operate (AB, ON, BC, MB, NB, NS, PEI).

Show that you have been receiving the same source of income for the past three months.

Have a total net income of at least $800/month.

Have access to an online bank account, in which pre-authorized debits can be performed.*

Have a valid Canadian mobile phone number, address, and email address (VoIP numbers are not accepted)

*Please note that KOHO accounts do not qualify as they do not support pre-authorized debits.

Income we accept:

Regular job income (full-time, part-time, contract, etc)

Government benefits: ODSP, AISH, CPP, OAS, disability payments

Employment Insurance and Workers' Compensation

Child Tax Credit and Canada Child Benefit

Self-employment and gig work income

It's totally fair to wonder if loan apps are legit. You're trusting them with your money and personal info, after all. So let's clear this up.

Every legitimate loan app in Canada must be licensed by provincial financial regulators. W’ere fully licensed in all seven provinces where we work: AB, BC, MB, NB, NS, ON, and PEI. You can actually verify our licensing yourself by checking provincial regulatory websites. It's all public information.

Security-wise, reputable apps use 256-bit SSL encryption for all your data. That's literally the same protection major Canadian banks use for their online banking. Your info is locked down tight.

Watch out for these red flags that scream "scam":

Anyone asking for upfront fees before approving you

Apps that aren't licensed in your province

Promises of "100% guaranteed approval for absolutely everyone"

Requests to send gift cards or wire transfers (huge red flag)

Pressure tactics, threats, or sketchy communication

Real, licensed loan apps from legitimate lenders are completely safe and legal. We’ve been helping Canadians since 2016, with over 1 million customers and thousands of verified positive reviews from real people. So if you’re ready to join the millions that have found solace in our services, then apply with iCash today!

Since 2016, we've helped over 1.6 millions Canadians get instant loans online.

Since 2016, we've helped over 1.6 millions Canadians get instant loans online.

Read more reviews.

Have more questions? Check out our full FAQ.