How many payday loans can I get? It’s a common question for many people. If you’re facing financial challenges and need quick cash, understanding the rules around these loans will help you weigh your options wisely.

In Canada, you can only take out one payday loan at a time. This prevents consumers from falling into a cycle of unmanageable debt. Each province has specific rules, so understand the regulations in your area to ensure compliance.

If you need financial assistance right now, iCash offers fast and secure payday loans in Canada. With flexible repayment options and clear terms, you’ll navigate financial difficulties with ease. Apply for funding now and get up to $1,500 for whatever your immediate needs may be.

Below, we’ll continue exploring how short-term loans work. We’ll also uncover provincial regulations, the potential risks of taking on multiple loans, and how to navigate the process responsibly. Whether you're considering your first small loan or wondering about the limits for additional financing, we've got the information you need.

What Are Payday Loans?

Payday loans, often referred to as advanced cash or short-term loans, are financial services designed to meet urgent monetary needs. They provide a quick infusion of funds, usually repayable by the borrower's next paycheck. They cater to individuals who face unexpected expenses or budget constraints.

If you're short on cash for groceries, utilities, emergency repairs, or medical bills, they offer quick financial relief. They are also accessible to a wider range of individuals, including those with poor credit or no credit at all.

The process for obtaining a cash advance is straightforward. Applicants should provide proof of income and banking details. The minimal eligibility requirements make them a popular choice among borrowers of all financial backgrounds.

For an even faster funding process, explore online financing options. Virtual loans for payday provide a quick and easy way to access funds from anywhere. All you need is an internet connection and a few minutes to complete the digital application.

These online loans offer the convenience of applying directly from your home or while on the go, eliminating the need for in-person visits to a lender's office. With instant processing and decisions, receive the funds via e-Transfer, often within minutes.

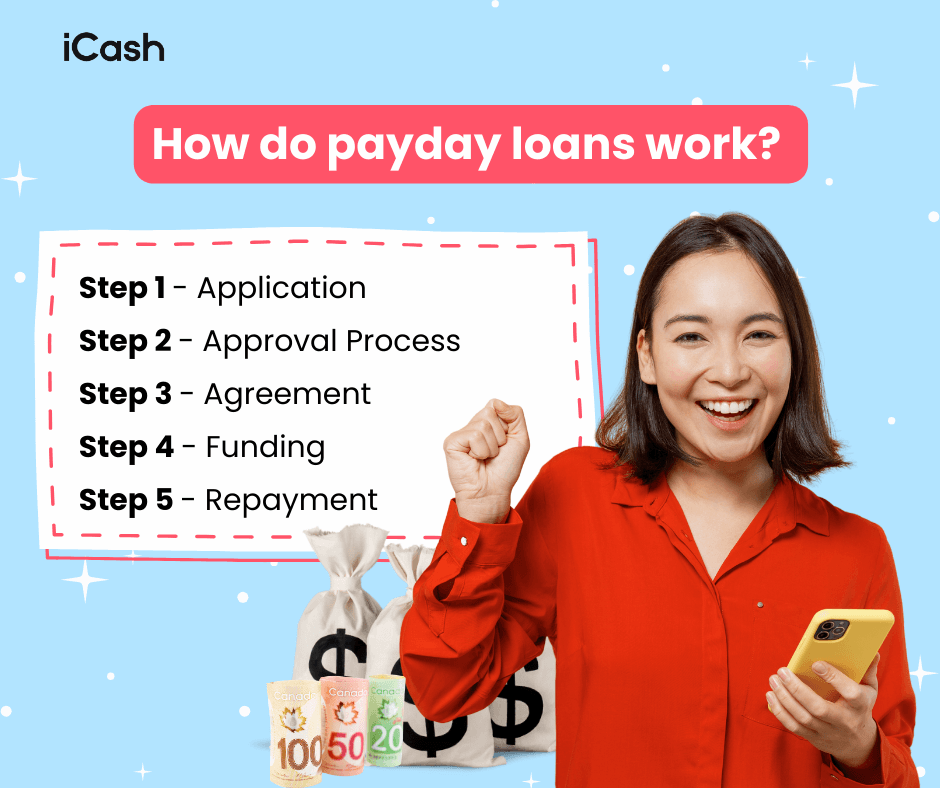

How do payday loans work?

Understanding how payday loans work is important if you’re considering financial assistance. Familiarize yourself with each step of the process to ensure you’ve made the best decision.

Here’s a step-by-step guide to the process of obtaining a small loan online:

Step 1 - Application: Begin by completing the digital loans application through the lender’s website or mobile app. You'll need to provide proof of income, such as a pay stub or proof of benefit payments (for borrowers collecting government benefits), your banking details, and contact information.

Step 2 - Approval Process: The lender reviews your application. Approval is usually quick, with decisions often made right away.

Step 3 - Agreement: Agree to the loan terms upon approval. This includes the loan amount, interest rate, fees, and repayment schedule.

Step 4 - Funding: Get your e-Transfer loan 24/7 in minutes and use the funds however you see fit.

Step 5 - Repayment: Repay the loan on your next payday or up to a maximum 62-day term. Repay through a pre-authorized debit from your bank account or by email transfer.

How Many Payday Loans Can I Get?

Searching “how many payday loans can I get” is normal if you’ve faced sudden expenses or financial gaps. You may be wondering if one loan is enough to cover your needs or if it’s possible to take out more than one at a time.

Provincial regulations determine payday advance limits in Canada. This means the number of loans you can have at any one time can vary depending on where you reside. Most provinces have rules in place to prevent consumers from taking out multiple loans simultaneously.

A reputable lending company will only allow you to take out one payday loan at a time. This rule encourages responsible borrowing and ensures that you’re not overburdened with debt.

Before applying for financial assistance, you should understand the specific regulations in your province regarding the number of loans you're allowed to have. These limits protect consumers and promote financial stability.

Following these guidelines will help you avoid the risks associated with multiple cash advances. Taking multiple loans often leads to compounding interest rates and fees, making repayment more challenging and stressful. This can escalate into financial instability and affect your credit score negatively.

Do payday loans affect your credit score?

A common concern among borrowers is whether payday loans affect your credit score. The impact on your credit score can vary depending on several factors, including the lender's policies and how you manage the loan.

Short-term funding solutions do not directly affect your credit score if repaid on time. Timely repayment demonstrates your ability to manage debt, which reflects positively in your credit history.

Failure to repay, however, can have the opposite effect. If a loan goes unpaid, the lender may report the delinquency to the credit bureaus. This leads to a negative mark on your credit report.

Payday Loan Regulations in Canada

Knowing the payday loan regulations in Canada is important for both borrowers and lenders. These laws are in place to protect consumers from unfair lending practices, while also ensuring that loan providers operate within ethical boundaries.

In Canada, each province and territory has its own rules regarding small loans. The following breakdown is an example of payday loan regulations in the provinces we serve:

Province | Maximum Borrowing Cost | Maximum Loan Amount | Cooling-off Period | Additional Notes |

British Columbia | $14 per $100 borrowed | $1,500 | 2 business days | Maximum 62-day loan term |

Alberta | $14 per $100 borrowed | $1,500 | 2 business days | Maximum 62-day loan term |

Manitoba | $14 per $100 borrowed | $1,500 | Within 48 hours | Maximum 62-day loan term |

Ontario | $14 per $100 borrowed | $1,500 | 2 business days | Maximum 62-day loan term |

Nova Scotia | $14 per $100 borrowed | $1,500 | 1 day | Maximum 62-day loan term |

New Brunswick | $14 per $100 borrowed | $1,500 | 48 hours, excluding Sundays and holidays | Maximum 62-day loan term |

PEI | $14 per $100 borrowed | $1,500 | 2 business days | Maximum 62-day loan term |

Knowing the payday loan laws in Canada helps you navigate the funding process easier. These regulations ensure that lenders are fair and equitable. Always familiarize yourself with the specific laws in your province or territory to understand your rights as a borrower.

Alternatives to Multiple Payday Loans

Exploring alternatives to multiple payday loans will help you manage your finances better. One approach is seeking financial support from friends and family. This can offer a flexible, interest-free solution to your immediate financial needs.

You can also search for government grants and funding programs designed to assist individuals and families. These initiatives may provide significant financial relief during times of financial strain.

For example, the Canada Child Benefit (CCB) is a tax-free monthly payment made to eligible families to help with the cost of raising children under 18 years of age. This grant is a lifeline for many families; it helps them cover essential expenses such as food, housing, and clothing.

You may also be able to take advantage of the HST/GST credit in Canada. This credit is a tax-free quarterly payment that helps individuals and families with low and modest incomes offset all or part of the GST or HST that they pay. Qualifying for the HST/GST credit depends on your annual income and family situation, but it can provide additional financial support throughout the year.

More recently, the Canadian government introduced the Grocery Rebate Canada program, aimed at assisting with the rising cost of living. This initiative provides financial support directly to lower and middle-income families and individuals to help cover the increasing prices of groceries.

Community organizations and non-profit groups also contribute valuable financial support. Some local programs offer financial counseling programs, budgeting assistance, and in some cases, direct monetary aid or grants. These resources are important if you’re looking to navigate through temporary hardships without taking out multiple loans.

Of course, there are instances where these alternatives may not cover an urgent expense. In this case, payday advances offer a practical solution. They provide rapid monetary relief, so you’re not stranded without funds. A straightforward application process, minimal eligibility criteria, and instant funding offer a lifeline when time is of the essence.

How to Manage Payday Loan Repayment

Knowing how to manage your payday loan repayments is essential for reaching financial freedom. Effective management of repayment begins with planning and strategic thinking.

Here are several key strategies to ensure you stay on top of your payment responsibilities:

Prioritize your spending: Analyze your spending and categorize your expenses before your repayment is due. Aim to repay the full loan amount to shorten the loan term and interest rates.

Cut unnecessary expenses: Evaluate your monthly subscriptions and memberships. Cancel what you don’t need to free up any extra cash. Use the extra cash to help repay your loan.

Set up a repayment plan: If repayment plans are available in your province, ask the lender to break down your repayment into smaller, more manageable segments.

Avoid taking on new debt: Never take any new debt until you have paid your loan in full. Additional loans can lead to a debt spiral that’s difficult to escape.

Seek financial advice: If you find yourself relying on short-term funding solutions or are struggling with excessive debt, seek professional advice. A counsellor can help you create a budget, manage your debts, and develop a plan for improving your financial situation.

Following these tips will help you manage your finances and ensure that they remain in good standing.

Get Quick & Easy Payday Loans with iCash

Get quick and easy payday loans with iCash on your side. Our commitment to transparency, speed, and customer service ensures a seamless borrowing experience.

As a reliable partner, you never have to worry about regulations and compliance. Adhering to provincial guidelines is a top priority; we provide safe access to alternative financial support for anyone who needs it.

Experience a straightforward application process that you can apply from anywhere, anytime. This accessibility ensures you can access the funds you need without unnecessary delays.

Don’t wait! Start your iCash loan application today using our reliable mobile lending app or web-based platform.