Menu

Date Published: September 27, 2023 (Updated February 25, 2026)

Table of contents :

The payday loans industry has seen a significant amount of growth over the past decade. More and more people are searching for terms like "payday loans near me" and "payday loan locations near me," seeking the closest and most convenient options.

Looking at the population in Canada, of 38 million people around 75% of them are adults. This would mean that Canada has approximately 28.5 million adults. Now let’s presume that 4% of the adult population is looking for “payday loan stores near me,” the potential number of people who are looking for and using same day loans is 1.14 million people.

Obviously, the total market size for these types of loans can fluctuate based on economic changes, the employment rates, or income levels based on where people live throughout Canada.

The availability and popularity of other short-term credit options (like installment loans, credit card cash advance loans online, etc.) have made it easier to access and get approved for these types of loans.

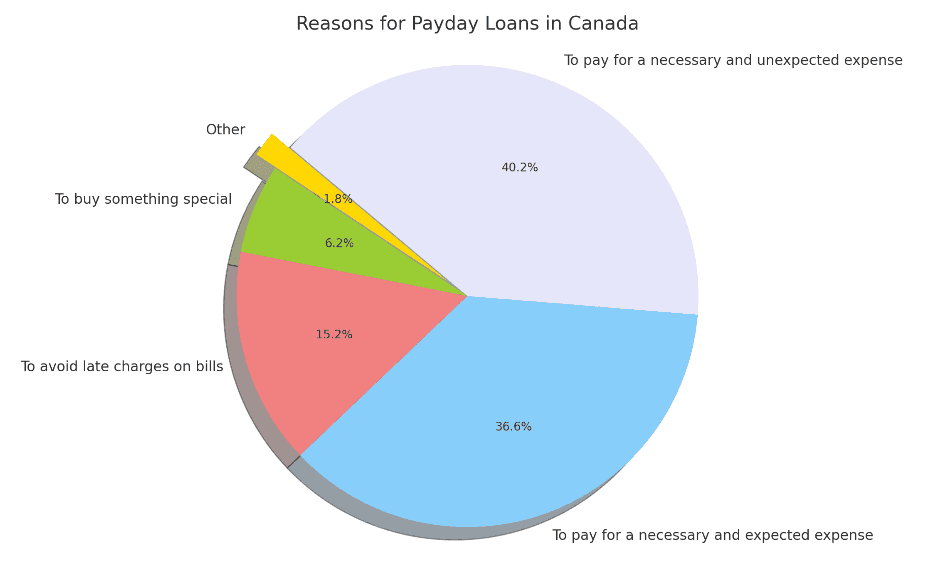

When Canadians were asked why they borrowed money from a payday loans near me location or a payday loan online, they said the following:

To pay for a necessary and unexpected expense: 45% of the respondents used instant payday loans in Canada to cover unexpected but necessary expenses like car repairs or broken appliances, which suggests a lack of emergency savings among these individuals.

To pay for a necessary and expected expense: 41% of the respondents took out a "payday loans near me" for essential and expected expenses, such as rent, heating or electricity bills, or a mortgage, indicating reliance on paycheck loans to cover regular living costs.

To avoid late charges on bills: 17% of the respondents used a salary loan to avoid late fees on their bills, suggesting a short-term cash flow problem where they expect to have the money soon.

To buy something special: 7% of the respondents applied for a payday loan near me to where they live to purchase something special, indicating non-essential spending.

Other: 2% of the respondents took out a payday loan for reasons that are not listed on the chart.

This data clearly shows that the primary reason Canadians apply and get payday loans near them is to cover important and necessary expenses, whether expected or unexpected, with 86% of respondents falling into these two categories combined.

This may reflect a broader issue of financial insecurity facing many Canadians in 2023 and going into 2024.

Payday loan companies near you also play a crucial role in providing financial services to individuals who might not have access to traditional banking or credit solutions. This includes people with poor credit histories or those who are temporarily unemployed and need a loan.

Through these advancements, the industry is not only meeting the immediate financial needs of Canadians who are looking for money loan places, but it is also working towards creating a more responsible lending environment.

The modern financial landscape offers a blend of both "payday loans near me" and applying online, each with its own set of advantages.

Let’s dive in a bit more and learn about the availability of payday loan providers near you and shed light on the conveniences that come with applying for payday loans online.

Having a payday loan nearby can provide a sense of security and immediacy, knowing that help is just around the corner.

For many Canadians, local loan providers are a convenient solution when unexpected expenses arise. These establishments offer the benefit of having payday loan stores near you, which some individuals prefer, especially when dealing with financial matters.

Nearby payday advance providers offer the opportunity to receive immediate cash, which can be a lifesaver for urgent expenses.

However, while payday loans near me locations serve a crucial role, they may have limited operating hours, they may not be open every day or on holidays such as New year’s Day and could require additional paperwork as compared to online alternatives.

In Canada, the rise of online payday loan lenders provides many advantages over traditional payday loans stores. Here are some benefits of applying for a loan online:

Convenience: Online loan applications eliminate the need for travel and waiting in lines at a store location. You can apply from the comfort of your home or office at any time, making it a highly convenient option. Some lenders even provide mobile loan apps, where you can apply for a loan on the go.

Speed and Efficiency: When you apply online, you can get payday loan approval decisions. As soon as you sign your loan agreement, the money can be sent to you within 2 minutes via e-transfer.

Privacy: Applying for a loan online provides a level of privacy that a typical payday loans near me location can not provide. You don’t need to worry about potentially seeing anyone that you may know. Your financial matters remain confidential, and that’s how it should always be.

Wider Choice: Online payday lenders give you access to get the cash you need quickly, anytime, day or night 24/7.

Less Pressure: The process of applying for a short-term loan online can be less intimidating, giving you all the time that you need to thoroughly review the terms and conditions of the loan.

The transition towards easy and quick online payday loan applications reflects a broader shift in consumer behavior, driven by the desire for convenient, fast, and discreet transactions. Online lending companies have also implemented strong security measures to ensure the safety and confidentiality of your information.

According to a survey that was conducted by the government of Canada, 45% of respondents used payday loans to pay for a necessary and unexpected expense (for example, car repairs, broken appliances, etc.).

Part of the reason is because large banks take a long time to approve a loan. They do not provide instant approval decisions* to many Canadians who are not “prime customers.” This leaves many Canadians with no choice but to look for payday loans near their homes when they need short-term credit urgently.

One of the most notable advantages of online loans is the ease of comparing different options and quickly reading reviews. With the growth of online lending, the popularity of websites which are dedicated to comparing new lenders also increased, providing more insights on interest rates, and terms.

Additionally, online reviews and testimonials help guide Canadian borrowers. These websites provide feedback on user experiences when dealing with a lender, helping individuals make better and smarter decisions on the service of different lenders.

Online short-term loan companies are reshaping how Canadians borrow money online. As technology and demand from customers grow, we will see more innovations and improvements in the online short-term loan industry.

If you are wondering how you can apply for a payday loans near me, simply follow these steps:

Apply for a Loan Online - When you apply for a loan, all you need to do is follow the simple step-by-step instructions. You’ll select your loan amount, repayment plan* and provide some personal details. No documentation is required.

Get an Instant Decision - Get instant approval once you’re finished filling it out.

Sign your loan agreement.

Receive Your Funds via e-Transfer - Once your contract is signed, your funds will be sent by e-transfer in the next 2 minutes! Fast, convenient and hassle-free. Funds are sent 24/7, even on weekends and holidays.

By understanding the difference between applying for a loan at nearby loan store or online, you can make a more informed decision that aligns with your financial needs and the urgency of getting the funds.

As the payday loan industry continues to evolve, having these different options will empower you and all Canadians to make better decisions with a greater level of confidence.

For Canadians who need emergency loans, having a payday loan location near me can provide quick access to cash for up to $1,500.

The presence of loan stores in various places across Canada provides people access to quick cash solutions. Let’s look at the availability and convenience of nearby payday loan options, and how searching for "payday loans near me" or similar phrases can lead you to a variety of lending facilities.

Canada has payday loans store locations spread across different provinces and territories. According to the Canadian Consumer Finance Association, their members have over 1,200 licensed stores and online. These storefronts are often situated in accessible areas, like shopping centers or along main roads, making them easy to find and reach.

Having these easy to find places can provide a cash advance loan in Canada when financial emergencies arise. The convenience of walking into a nearby location, discussing your needs with someone, and walking out with cash-in-hand can be comforting.

A quick search online on Google is often the first step in trying to find nearby payday loan locations. Canadians looking for quick loan options may use a variety of search terms like "payday loans near me," "payday loan lenders near me", "payday loan stores," "payday loan stores near me," or even "cash advance places near me."

These searches demonstrate the demand from people to find loan places near them to get unsecured loans in Canada. Searching online for these loan places helps people find what others are saying about these money borrowing places before visiting and applying in person.

Using search engines to find payday loan places close to where you live, not only provides a list of potential lenders but may also offer insights into the experiences of previous borrowers. This added layer of information can be invaluable in making an informed decision on which cash loan provider to choose.

Payday loans near me locations provide many advantages to Canadians, one of which is the opportunity to have face-to-face talks at the place where they borrow money.

This personal touch allows customers to engage directly with loan officers, leading to more personalized service. This can help those who never took out a loan in the past and now need help to go through the loan application.

Money loan places near me may also be helpful to people who prefer doing paperwork in person when applying for a loan, can help reassure some people who are not comfortable with digital documents or online loan applications.

This aspect is especially important for those less inclined towards technology or who appreciate the “perceived security” of paper documents. Although in today’s world, a lending company that operates online provides very strong encryption which is then audited by third party vendors for additional security.

There are some Canadians who prefer payday loans store nearby because of the local presence. Seeing the same people all the time in your community can provide a sense of community trust.

The drawbacks of payday loan stores near are long waiting times. Customers may find themselves queuing to speak with a representative, particularly during busy periods like the days leading up to a paycheque.

Another significant limitation is their fixed operating hours. Unlike online services available around the clock, physical stores are bound by specific opening and closing times. This can be a major inconvenience for individuals needing financial assistance outside of these hours or during weekends.

The requirement to travel to a payday loans store locations can also be inconvenient, especially for those without easy access to transportation or with mobility issues. The effort and time involved in visiting a store might deter busy individuals or those living far from a cash store.

Privacy is another concern. Applying for a loan in a payday loan store might not provide the same level of privacy as an online application. This lack of privacy can be uncomfortable for customers who prefer to keep their financial matters confidential.

Finding safe and reliable online alternatives to traditional payday loan locations and payday loan stores near you is essential in an emergency when all these places are closed.

Check for Proper Licensing and Regulation: It's vital to ensure that online lenders are properly licensed and adheres to Canadian lending laws.

Online lenders must be registered to operate in province that you live in, and they must comply with all regulations.

Evaluate Their Online Presence: A legitimate and trustworthy lender will be transparent regarding information about the terms of the loan like any fees, interest rates, and how to contact them.

Read Customer Reviews and Testimonials: Customer reviews and testimonials are also important when you’re considering borrowing money from an online lender.

Review feedback on independent platforms such as Trustpilot.

Real customer reviews can provide you with valuable insights into the reputation of the lender and what actual customers experienced in working with them.

Ensure Data Security Measures: When completing a loan application, security is paramount.

Check that the lender's website is secure (look for HTTPS in the URL) and that they have proper data encryption and security certifications.

Some payday loans near me locations also have websites, do it might be easier to apply online.

Be Wary of High-Pressure Tactics: Reputable lenders do not resort to high-pressure sales tactics. This is about helping your financial situation. You should not feel pressured in any way.

All online short-term lenders should give you adequate time to review loan terms and make an informed decision.

Some provinces like Alberta have what is called a “cooling off period” which allows you to cancel the loan with no penalty and without any reason.

Canada has a regulatory framework in place to protect consumers who apply for a loan with a payday lender.

It’s important to familiarize yourself with these regulations to get an additional layer of security when considering online payday loan options.

Opting to apply for a payday loan with a reputable online lender is not only about ensuring a safe borrowing experience but also about protecting your financial well-being.

When facing short-term financial challenges, many people’s first reaction would be to go to Google and search for “payday loans near me” or “payday loan locations near me", and some people look for “payday loan stores,” but sometimes it’s worth trying something different, depending on your situation.

One viable alternative to payday loan stores near you are credit unions. These member-owned financial cooperatives can provide lower interest rates for short-term loans. It’s important to keep in mind that with credit unions, have tighter restrictions on who they lend money to. People with bad credit scores may have a harder time getting a loan.

In a survey, Canadians stated that there were several factors for not seeking loans from banks or credit unions. Notably, 27% believed these institutions would not approve their loan requests. Time constraints were a concern for 15% who felt they couldn't spare the time to secure a loan from these traditional sources.

A preference for alternative methods was evident, as 13% preferred not to borrow from banks or credit unions. Interestingly, 55% perceived payday lenders as providing superior customer service. The speed and convenience of payday lending were key attractions for 90% of respondents, while 74% considered it their best available lending option.

Personal loans from online lenders are another option. These loans usually come with lower interest rates than payday loans and offer a fixed repayment schedule. However, there are some disadvantages to taking out a personal loan, such as restrictions on how you can use the funds and when you apply for a loan. It can also lead to a hard inquiry on your credit report, which may temporarily lower your score.

Another alternative to payday loan places is a credit card cash advance. This is offered by most credit card companies. This can be another option to get quick access to cash, especially in urgent financial situations.

Keep in mind that the interest on cash advances starts accruing immediately. Therefore, it's important to remember that this option should only be used when necessary.

Borrowing money from friends or family can be one additional alternative to payday loans. The advantage of this is that it usually comes with little to no interest on the loan amount. Family and friends will also be more flexible on the repayment terms.

However, it's very important, if you do end up going this route, to approach it with caution and have a 3rd party review the terms of the loan including the repayment schedule. You should also document the agreement in writing to avoid any misunderstandings.

As we move through the economic challenges of 2023 and 2024, payday loans remain a significant source of help for many Canadians, with around 2 million Canadians relying on them yearly.

This growing reliance is a response to the increasing cost of living and unforeseen financial burdens. In this scenario, Canadians face a crucial choice: opting and searching for traditional "payday loans near me" or applying for a instant payday loans online.

Since 2016, we've helped over 1.6 millions Canadians get instant loans online.

Since 2016, we've helped over 1.6 millions Canadians get instant loans online.

Read more reviews.

Getting an online loan with us is fast and easy. Simply select your loan amount, repayment plan* and provide some personal details.

Our online loan application will tell you if you’re approved instantly. Once approved, all you have to do is electronically sign your contract. It’s that easy!

Once you sign your digital agreement, your cash advance will be sent by e-Transfer within 2 minutes. Fast, convenient and hassle-free. Funds are sent 24/7, no matter what.

Have more questions? Check out our full FAQ.