Menu

Did you know that with the iCash credit health service, you can check your credit score for free whenever you want? This is the best way to make sure you’re in good financial standing. Let iCash help you when you need it the most!

Download the iCash mobile app & check your credit score anywhere, anytime.

Why Check Your Credit Score with iCash

Free and Unlimited Credit Report & Score

We Don’t Sell Your Data to Any 3rd Parties

No Affiliate Ads

Protected by Advanced Security Measures

Accessing Your Report Does Not Affect Your Credit

Private Credit Score, Accessible Only by You

Real-Time Updates

User-Friendly Interface

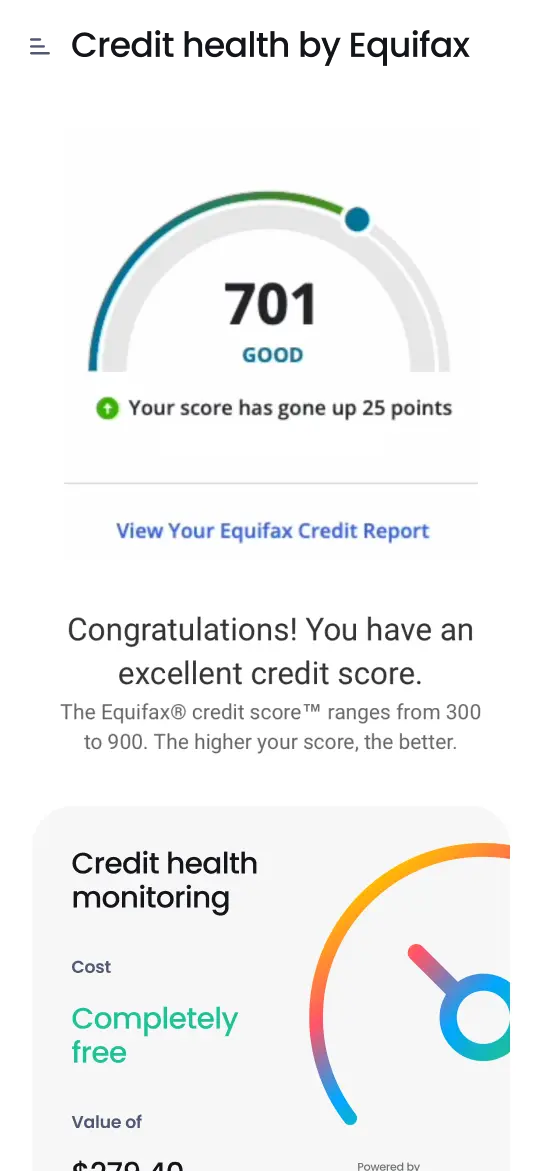

Think of a good credit score as a financial passport to a world of possibilities. It's a three-digit number that tells lenders, landlords, and employers about your financial health. A score above 660 is often considered good, granting you access to lower interest rates and more opportunities. Keep your score healthy, and you'll be on the path to financial success!

Table of contents :

A credit score is like a financial grade that shows how good you are at handling and managing your finances when it comes to things like leasing an apartment, buying a car, getting a smartphone, and many other things. In Canada, the credit score range is from 300 to 900. The higher your score, the better you look to banks and lenders.

Your score is determined by the financial history you have. Paying your bills on time, the amount of debt you owe, and how long you've had credit are all factors. Think of it as a report card that shows how well you're doing financially. Lenders look at this score to decide if they should lend you money or give you a credit card.

A high score can mean better interest rates, which saves you money in the long run. It's important to occasionally do a score check because your score can impact big life decisions. For example, if you want to buy a house or a car, the loan you get and how much it'll cost you largely depends on your credit score.

In Canada, companies like Equifax and TransUnion keep track of your scores. They watch how you use your credit and update your score based on your actions. Knowing where you stand helps you make better decisions, like when to apply for a loan or how to manage your debts.

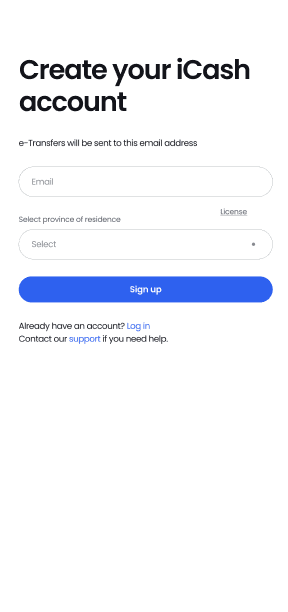

This is where iCash can help you! All you need to do is create an account with us and you’ll get to use our free credit health service powered by Equifax*! You can access your score in real-time, whenever you want. If you’re not a member yet, download our free app or visit our website to create an account.

With iCash, all you need to do is create a free account and the credit health service* is yours to use, as you’d like. It makes credit score checks as easy as possible, providing users with a clear understanding of their financial standing.

Your score is updated regularly, so when you use our credit health services, you’re ensuring you always have the most current information at your fingertips.

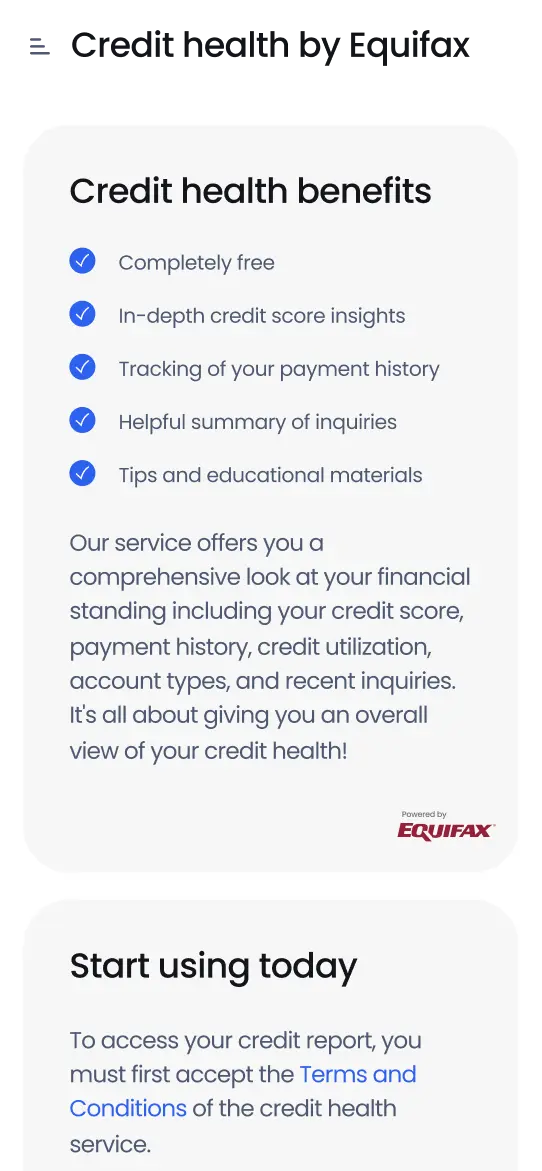

Our credit health service breaks down the different factors affecting your score, such as payment history, credit utilization, and the length of your credit history. Understanding your financial situation and identifying improvement areas is important for a successful financial plan.

Aside from our user-friendly features, we go above and beyond to ensure the security of your personal information. We used advanced security measures to protect your data, giving you peace of mind as you check your credit score.

This focus on security is of huge importance for anyone concerned about the safety of their personal and financial information in the digital age.

Sign up and start monitoring your credit score with iCash today! It's a smart step towards taking control of your financial future, providing you with the necessary tools and information to maintain good credit health.

Getting a free credit score check in Canada is easier than you think. One easy way to do this is through major credit bureaus such as Equifax and TransUnion. However, you’re limited to only one free credit check annually. With iCash, you can regularly monitor it for free! It's a great way to stay updated and catch any errors that might affect your score.

If you’re a member, then the service is yours to use for free and you can check your credit score in Canada free as often as you’d like! You’ll be able to regularly check your free Equifax credit score and monitor your credit health. Inactive users will be unsubscribed after three months - but don't worry! Through the iCash member dashboard, you can easily resubmit your request to use the service.

Either way, it’s clear that many Canadians are starting to care more about their credit health. In 2022, there was a significant year-over-year increase of 20.9% in credit participation among Gen Z, while millennials showed a 3.6% year-over-year increase in credit participation.

When it comes to checking your credit score and handling your financial information, security and privacy are very important. At iCash, we take these issues seriously to make sure your personal data is safe and secure.

We use advanced security measures to protect your information. This means that when you check your credit score or apply for a loan through our service, your data is encrypted and kept safe.

We do not sell or share your data with third parties without your permission. This means you can trust that your information is handled responsibly and with care.

When you use iCash to check your credit score or apply for a loan, you can have peace of mind knowing that your privacy is protected. Our commitment to security and privacy means you can focus on managing your finances without worrying about the safety of your personal information.

To get your Canadian credit score, you can either go through one of the official credit bureaus or do it a little easier with an online service like iCash.

Understanding your credit rating is very important in Canada. This score is like a grade for how you handle your money, and the credit score in Canada ranges from 300 to 900. The average score in Canada is roughly 650.

The higher your score, the better it looks to banks and lenders. It can affect everything from getting a loan for a car to the interest rates you'll get on a credit card.

Knowing your score is important because it influences how much money you can borrow and the terms of the loan that you get from a bank or other traditional lending institutions.

In Canada, your score is calculated based on things like how often you pay your bills on time, how much debt you have, and how long you've been using credit. Keeping an eye on your score can help you spot any mistakes or issues that might hurt your score.

By staying on top of your score, you're taking a big step in managing your money better and our service is here to help you understand your score, so you can make smarter financial decisions in Canada.

If you want to know how to monitor and improve your credit score or how to increase your credit score in Canada, here are a handful of quick tips to use:

Pay Bills on Time: Late payments are the number one thing that can hurt your score. Pay all your bills, like credit cards and loans, on time.

Keep Your Credit Use Low: You should try not to use more than 30% of your credit limit. Using a lot of credit can make it seem like you depend too much on borrowing.

Be Careful with New Credit: Every time you apply for credit, it can potentially lower your score a bit. So, it's best to only apply for new credit when you need it.

Diversify Your Credit: Having different types of credit, like a credit card and a car loan, and using them responsibly can improve your score.

Periodically Check Your Credit Rating: Using things like the iCash credit health service to keep an eye on your score is a great idea. This way, you can see your progress and catch any mistakes or fraud as soon as possible.

Limit any New Credit Applications: Applying for a lot of new credit can drop your score for a short time. If you're working on building or fixing your credit, try to open new accounts only when it’s necessary.

Improving your rating takes time, effort, and patience. If you’re asking, “What is a good credit score in Canada and how do I get it?” these tips should help. As much as we all wish we could improve our score overnight, the reality is that we need to work at it slowly.

So if you want to know how to build your credit score in Canada or how to increase your credit score in Canada, follow these steps, and you can begin the process of increasing your score, which will open up better financial options for you in Canada.

Your credit score plays a big role in your financial life. It’s like a grade that shows how good you are at managing money. In Canada, credit scores range from 300 to 900, and the higher your score, the better it looks to banks and lenders.

A high credit score can help you get loans and credit cards with lower interest rates. This means you pay less money in the long run. For example, if you want to buy a car or a house, a good credit score can make it easier to get a loan.

On the other hand, a low credit score can make it hard to get approved for loans or credit cards. Even if you do get approved, you might have to pay higher interest rates. This can make borrowing money more expensive.

Banks and other lenders use your credit score to decide if they should lend you money and how much interest to charge. That’s why it’s important to check your credit score regularly and make sure it’s accurate. Keeping a good credit score can open up more financial opportunities and help you save money.

Empower your financial journey with iCash credit health! Take control and effortlessly monitor your credit score. Stay ahead of the game, and make informed financial decisions with ease.

A good credit score is 660, while anything above 700 is considered excellent. The better your score, the better your interest rates and terms will be when applying for bank loans, for example. That’s why regularly checking your score is so important, and with iCash's credit health service, powered by Equifax, you'll be able to check it whenever you want, wherever you are!

Lenders, landlords, and even potential employers look at your credit score. They rely on it when considering loans, rentals, or job prospects. That’s why it’s so important to check your score is in good shape, and with iCash, we make it easier than you can imagine!

Our loans give you the cash flow you need to tackle bills on time, dodge those pesky late fees, and keep your credit in good shape! They’re designed to support you in keeping your financial history on a positive track!

A

Your grade

Create your iCash account to enjoy free access to your credit health service*! Plus, if ever you need, you can benefit from quick and easy access to funds up to $1,500!

Access the free credit health service, powered by Equifax! This tool helps you check your credit score and gain financial insights for better decision-making - only for our awesome iCash members!

With your Equifax credit score in hand, it's time to take charge of your credit health. Begin monitoring and pave the way to superior credit and enhanced financial prospects!

Download the free iCash app today find out how easy it is to get your Equifax credit score at no extra cost!

Behind each review is an experience that matters

Since 2016, we've helped over 1.6 millions Canadians get instant loans online.

Since 2016, we've helped over 1.6 millions Canadians get instant loans online.

Read more reviews.

Have more questions? Check out our full FAQ.

Uncover the key factors that affect your credit score and learn practical tips to maintain good credit health. Improve your financial future with these helpful insights.... Read more

Let’s go back to the basics and learn the ways in which your credit score plays a part in the borrowing process and how your credit score can affect your loans.... Read more

Get tips to improve your credit score and secure better loan terms. Learn how to build a solid payment history, reduce debt, and diversify your credit!... Read more