Menu

Date Published: March 30, 2023 (Updated December 12, 2025)

Table of contents :

An installment loan is a type of borrowing option where you receive a lump sum (usually up to $1,500) upfront and repay it through scheduled payments over a set period. Unlike other lending options where repayment terms can vary, these are clear and easy to qualify for, which is why they’re often referred to as no refusal installment loans.*

Depending on specific provincial regulations, repayment periods stretch from weeks to months. It’s a great option for many, because the fixed schedule means no surprises. Just consistent payments until the loan is fully repaid.

For Canadians managing tight budgets, this predictability can be invaluable. You know your obligation upfront, allowing you to plan other expenses without worrying about fluctuating payment amounts.

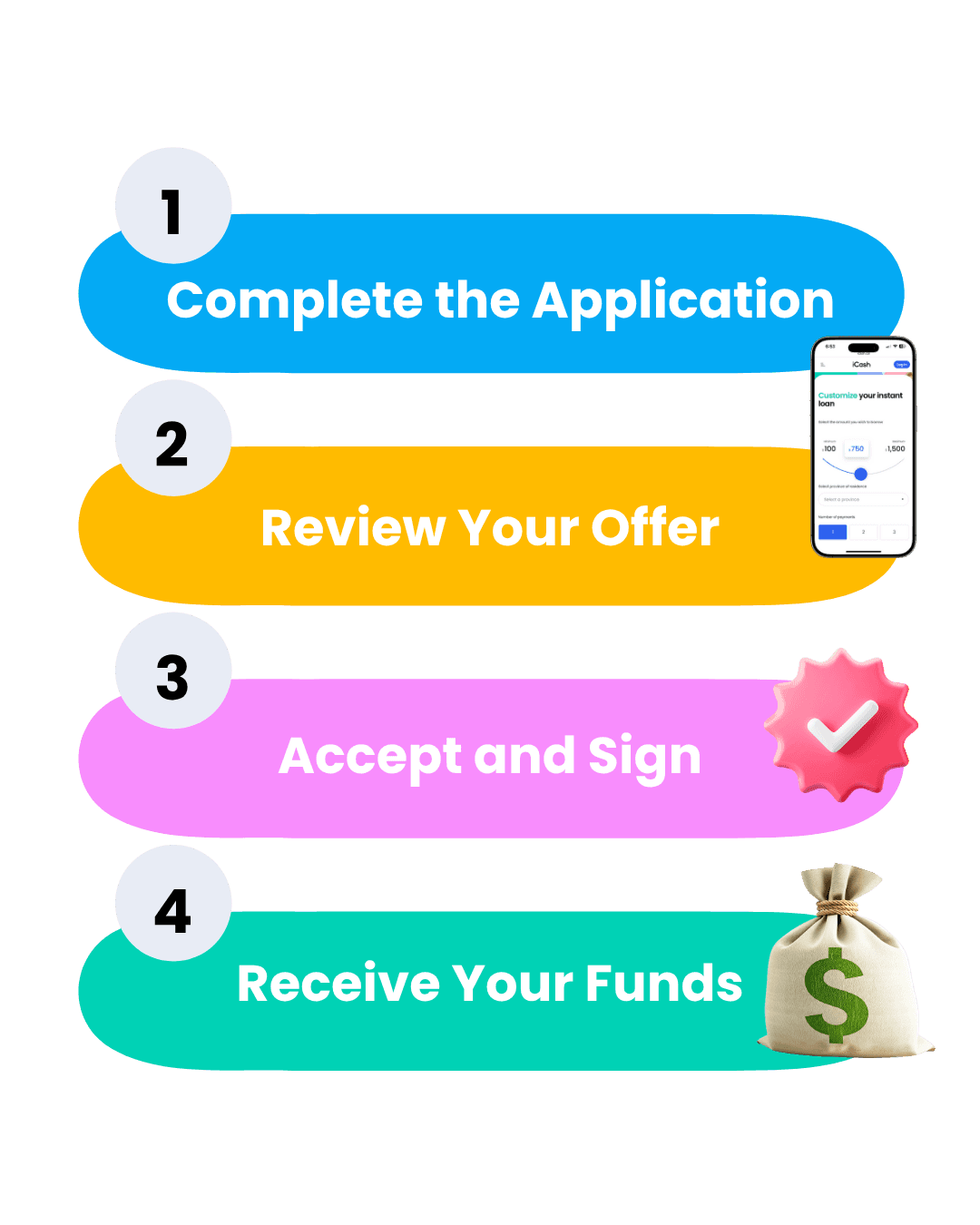

Applying for online installment loans is easy, because the entire process happens digitally, which means no paperwork and no in-person visits. Let’s take a look at what the process is:

Step 1: Complete the Application: Visit our website or download our mobile app to fill out a brief digital application form. You'll provide some basic information and will only need about 10 minutes to complete the actual form.

Step 2: Review Your Offer: Once submitted, we will instantly assess your eligibility. If approved, you'll see the loan terms including the amount, interest rate, repayment schedule, and total cost. Review these details carefully. Either way, you’ll see all the information you need before you agree to anything.

Step 3: Accept and Sign: If the terms work for you, electronically sign the agreement.

Step 4: Receive Your Funds After signing, funds will be transferred directly to you by e-Transfer. Most recipients will receive the e-Transfer within 2 minutes.

The entire process operates with bank-level security, protecting your sensitive information throughout. No hidden steps, no unexpected delays, just an easy path from application to funding.

There are both big and subtle differences between installment loans and other types of loans. Let’s take a brief look at what those differences are:

Feature / Loan Type | Installment Loan | Payday Loan | Revolving Credit | Personal Loan | Cash Advance |

Repayment Method | Scheduled installments | Usually single payment. Sometimes installments. | Minimum payments | Fixed installments | Single payment |

Interest Rate (Apr) | Mid to high range, clearly disclosed | Mid to high range, clearly disclosed | Fluctuates | Mid to high range | High range |

Credit Check Required? | Sometimes, but not for lending decisions | Sometimes, but not for lending decisions | Typically required | Typically required | Varies depending on lender |

Best For | Structured repayment needs | Immediate cash emergencies | Flexible spending | Significant purchases | Urgent small expenses |

Approval Speed | Instant decision | Instant decision | Depends | Days to weeks | Immediate |

Is It Bad Credit Friendly? | ✅ | ✅ | ❌ | ❌ | ✅ |

Installment loans work well for planned expenses with predictable repayment, but they aren't the only solution. Depending on your situation, other options might better match your needs.

If you’re experiencing a financial emergency that simply can’t wait to be dealt with, payday loans are generally a reliable, fast and safe alternative. They’re meant to be used for anything like unexpected car repairs, urgent medical costs, or other situations where waiting isn't an option.

Payday loans typically provide:

Instant approval decisions with no documentation

Same-day funding through a 2-minute e-Transfer, once approved

Simple online applications that take less time than a coffee break

Accessibility for all credit types, including those with past credit challenges

iCash focuses on current income rather than credit history, making approval possible even when traditional lenders say no. If you're employed or receiving regular government benefits, you likely qualify.

Payday loans work best when you need a smaller amount quickly and can repay it with your next paycheck. Rather than committing to multiple scheduled payments, you address the immediate crisis and move forward.

Before deciding if an instant online loan is right for you, here are some key factors that are worth considering:

The Annual Percentage Rate (APR) represents your total borrowing cost, including interest and fees. Online loans can carry higher APRs than traditional bank products, particularly for borrowers with limited credit history. Compare rates across lenders to find competitive options.

Look beyond interest rates to identify all associated costs. There may be late payment penalties, NSF fees or early repayment fees. If you’re unsure, don’t be afraid to request a complete breakdown of costs from your lender before signing. On our side, we’ll happily provide you with any information you want or need, before you even apply.

How long will you be repaying? If you have the option, choose a term that balances affordability with efficiency. Can you comfortably manage the payments? Will completing repayment sooner save significant interest? These are good questions to ask yourself before applying.

Some lenders report payment activity to credit bureaus. Consistent on-time payments can gradually improve your credit profile, while missed payments damage it further.

Some bad credit installment loans don't require credit checks for approval, but may still report payment behavior. Understand the lender's reporting practices before committing.

Always check your credit score to understand where you stand before applying.

Need quick approval and flexible terms? Start your application today and see how much you qualify for.

Since 2016, we've helped over 1.6 millions Canadians get instant loans online.

Since 2016, we've helped over 1.6 millions Canadians get instant loans online.

Read more reviews.

Getting an online loan with us is fast and easy. Simply select your loan amount, repayment plan* and provide some personal details.

Our online loan application will tell you if you’re approved instantly. Once approved, all you have to do is electronically sign your contract. It’s that easy!

Once you sign your digital agreement, your cash advance will be sent by e-Transfer within 2 minutes. Fast, convenient and hassle-free. Funds are sent 24/7, no matter what.

Have more questions? Check out our full FAQ.

Find out how installment loans work and why they could be a smart financial solution for you. Learn more about the benefits, and apply for one today! ... Read more

Choose the right installment loan by avoiding common mistakes and comparing lenders. Ready to find your ideal loan? Start your search! ... Read more

Understand the difference between a short term loan and an installment loan before taking one out. Learn the pros and cons of each loan type in this article.... Read more