When you’re shopping around for a payday loan, or even weighing the options between a short term loan vs a long term loan, one of the most important things to figure out first is how you’re going to manage it and ensure you don't end up with too much debt.

Payday loans are designed to be small, rapid loans that provide immediate financial relief, typically until the person borrowing the money receives their next paycheck. They’re usually easy to obtain, requiring minimal (or no) credit checks, which makes them a popular choice for those in urgent need of cash.

Payday loans are usually used to cover unexpected expenses like emergency repairs, expensive grocery bills, or urgent utility payments that need to be dealt with ASAP. They can be applied for very quickly, and often fund disbursements can happen as quickly as 2 minutes, especially if you’re dealing with a reptuable lender such as iCash.

However, as you would with any payday loans, it’s important to approach payday loans with a plan. Effective management of payday loans involves understanding when it's wise to use these loans and having a clear plan for repayment. This blog will help you gain some knowledge of the best strategies for managing a payday loan (or any other type of loan) and getting yourself financially healthy.

Budgeting for Urgent Loan Repayments

When you take out short-term, high-interest loans like payday loans, adjusting your budget to manage the repayments effectively is important. Here are some tips to help you plan so that you don't end up with too much payday loan debt:

Prioritize Your Expenses: Look at your monthly expenses and prioritize them. Essential costs like rent, food, and repayments for payday loans should come first. It’s definitely worthwhile thinking about creating a budget for yourself to avoid too much payday loan debt.

Have Your Funds for Repayment: As soon as you get your paycheck, set aside the amount you need for the loan repayment. iCash makes repayment of your loan easy by automatically withdrawing the funds from your account when the loan is due, but it’s crucial you have the money ready and in your account. If you don’t think that you can, it’s always best to contact us (or any other lender you may go with) as quickly as possible.

Create a Repayment Plan: While payday loans are usually due in full on your next paycheck, some payday lenders will allow you to pay them back in repayments (depending on provincial regulations). Break down the total amount you owe into manageable parts. If your full loan repayment is due in a month, figure out how much you need to save each week and stick to this plan.

Adjust as Needed: If you find that you’re struggling to set aside enough for your payday loan repayment, look for areas in your budget where you can cut further.

Accelerating Debt Clearance

If you can, paying off high-interest payday loans quickly is a smart financial move. Whether it’s a smaller amount from a payday loan of $1,500, or something bigger like a personal loan worth $50,000, these strategies may help you clear your debt faster:

Make Extra Payments: If you’re even in a position where you have some extra money, consider using it to pay down your loan. This could be money from a tax refund, a bonus from work, or any gift in the form of cash. Even the smallest extra payments can reduce the total interest you pay and shorten your payday loan cycle term.

Round Up Your Payments: If your monthly payment is $245, consider rounding it up to $300. This small increase can make a big difference over time, helping you pay off your loan faster without feeling such a huge financial pinch.

Use Windfalls Wisely: If you happen to receive a large sum of money, like a bonus or inheritance, resist the temptation to spend it all. Consider allocating a portion (or all of it, if you can) to your loan. This can significantly decrease your balance and interest cost.

Cut Unnecessary Spending: Review your monthly expenses and cut down on non-essential items. Use the saved money to increase your loan payments. Even the smallest amounts from things like streaming subscriptions or dining out can help speed up your debt clearance.

By adopting these strategies for payday loans or any other kind of loan, you can take control of your debt and reduce the burden of high-interest loans more quickly.

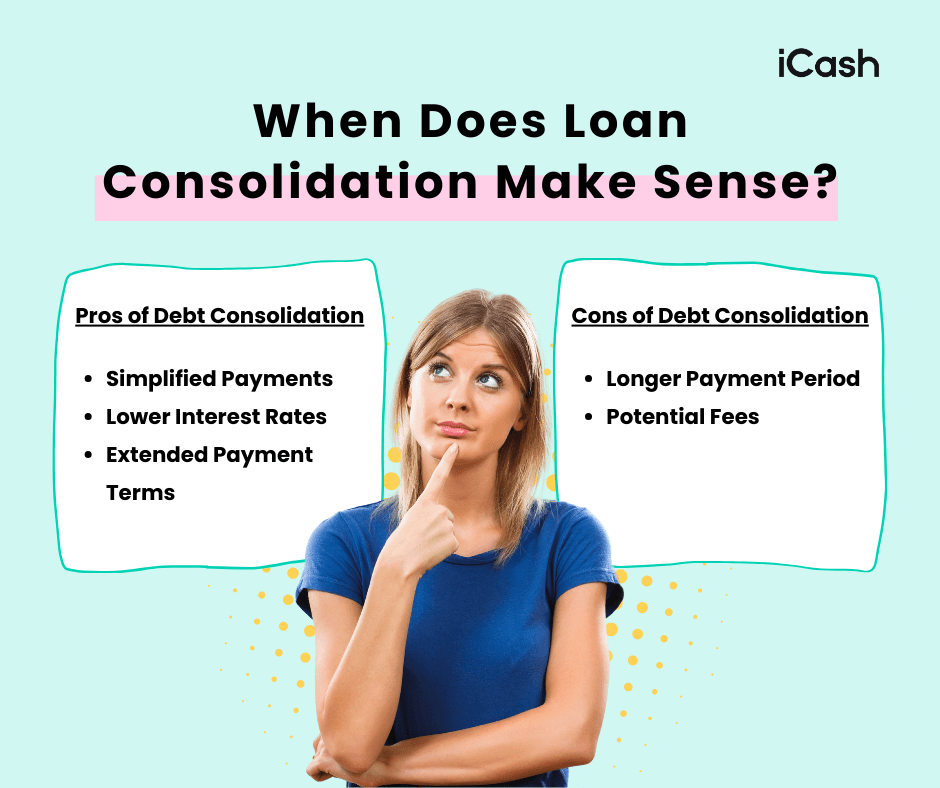

When Does Loan Consolidation Make Sense?

A debt consolidation loan is when you combine multiple high-interest loans into one single loan with a lower interest rate. For many, it’s a great way to manage their loan. Here are some pros and cons to consider:

Pros of Debt Consolidation:

Simplified Payments: Instead of juggling several payments with different due dates, you'll have just one payment to deal with, making it easier to manage.

Lower Interest Rates: Consolidation can often secure a lower interest rate, reducing the amount you pay over time.

Extended Payment Terms: With consolidation, you might extend the payment period, which can lower your monthly payments and free up some of your budget.

Cons of Debt Consolidation:

Longer Payment Period: Extending the loan term might mean paying more interest over the full life of the loan.

Potential Fees: A consolidation loan might come with so many fees or penalties that a lower interest rate would make almost no difference and save you no additional cash.

Tips for Reducing Monthly Payments

Reducing your monthly loan payments can make managing your finances easier. Depending on the circumstances and loan provider, this may not always be possible, but here are some helpful tips to help you negotiate better terms and explore loan modification options

Start by talking to your lender ASAP and explain your financial situation. Ask if they can lower your interest rate or extend your repayment period. Both options can reduce your monthly payments.

Ask any payday lenders about a possible loan modification. It might be possible to adjust the terms of your original loan to make the payments more manageable. This could potentially include reducing the interest rate, extending the loan term, or even forgiving a portion of the loan principal. It can never hurt to simply contact your payday lender and ask.

There is also the possibility that some government programs may help you manage your payday loan debt repayments. Check for any programs available that could help reduce your monthly payments to help you with your payday loan debt.

These strategies can help you ease your financial burden and maintain a stable financial situation by making your loan payments a bit more manageable, whether it's a smaller payday loan or a bigger personal loan. Either way, do your research and make sure you find a lender you trust.

Snowball vs Avalanche Method

Managing loans effectively can be easier with strategies like the debt snowball and avalanche methods. In a nutshell, the debt snowball method involves paying off your smallest debt first while making minimum payments on others. Once the smallest debt is cleared, you move to the next smallest and repeat the process.

The avalanche method, on the other hand, focuses on paying debts with the highest interest rates first, saving you money on interest over time. Both strategies can be helpful depending on the amount of loans you have, and the cost of each. For the record, it's never a good idea to have multiple payday loans, as it can lead to excessive payday loan debt. Reputable payday loan lenders like iCash will not allow you to take out multiple payday loans.

Get an Easy Payday Loan with iCash

Ultimately, payday loans can be a great tool for managing your finances and staying on top of your finances, provided you manage your payday loan effectively and avoid getting into a payday loan debt cycle. With a payday lender like iCash, you can trust that you’re in good hands. All the terms are spelled out clearly, with the application process taking only a few minutes. And once approved, you’ll get an e-Transfer in 2 minutes with your cash. So if you’re ready to explore payday loans from iCash as a financial solution, apply today!