Menu

Table of contents :

Employment Insurance is a type of temporary financial support for Canadians who are between jobs. It’s meant to help cover the costs of things like groceries and rent while you search for another job. The issue, however, is that it doesn’t account for unexpected expenses that might pop up during unemployment.

That’s where EI payday loans can come in handy. As a type of short-term lending option, these types of loans can give you the quick cash you need to handle urgent bills, car repairs, or any other unexpected financial emergencies that can’t wait until your next benefit payment.

Job loss creates enough stress as it is. The last thing you want to worry about is how to handle financial emergencies on top of that. The reality is that being unemployed often means facing the same expenses on a reduced income, and sometimes you need immediate help.

So, if you’re wondering, “Can you get a payday loan while on EI?” Yes, you can, and we’ll explain exactly how it works, what you need to qualify, and what to consider before applying.

If you’re a recipient of EI, here’s how getting a payday loan works (spoiler alert: it’s super easy!):

EI is considered valid income by most payday lenders in Canada. Here's what you need if you apply with iCash:

Be at least 18 years old (19 years old for applicants in British Columbia, New Brunswick, Nova Scotia)

Be a resident of any of the provinces in which we operate (AB, ON, BC, MB, NB, NS, PEI).

Show that you have been receiving the same source of income for the past three months.

Have a total net income of at least $800/month.

Have access to an online bank account, in which pre-authorized debits can be performed.*

Have a valid Canadian mobile phone number, address, and email address (VoIP numbers are not accepted)

*Please note that KOHO accounts do not qualify as they do not support pre-authorized debits.

Unlike traditional loans, you don't need employment verification or pay stubs. Your consistent EI payments serve as proof of reliable income, often making the approval process faster than for irregular employment income.

And if we do need any additional information, we’ll make sure to tell you exactly what we need to make the process as easy as possible.

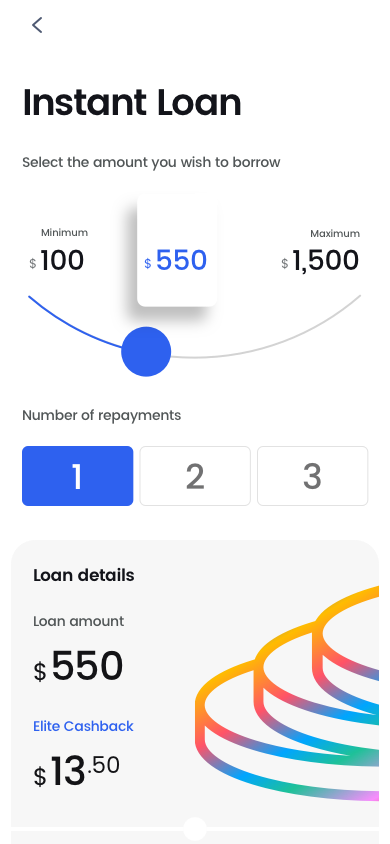

Getting an online loan with us is fast and easy. Simply select your loan amount, repayment plan* and provide some personal details.

Our online loan application will tell you if you’re approved instantly. Once approved, all you have to do is electronically sign your contract. It’s that easy!

Once you sign your digital agreement, your cash advance will be sent by e-Transfer within 2 minutes. Fast, convenient and hassle-free. Funds are sent 24/7, no matter what.

Employment insurance payday loans can really provide financial and mental stress relief if you need them. But remember that they should always be used responsibly. It’s important to understand the full terms and conditions before you agree to sign any digital agreement.

EI recipients should also carefully consider whether the urgent expense truly can't wait until the next benefit payment. If you do proceed, ensure you can comfortably repay the loan without jeopardizing essential living expenses covered by your EI benefits.

Unemployment brings enough challenges without financial emergencies adding extra stress. If you're receiving EI benefits and need quick access to cash for urgent expenses, unemployment loans through iCash can help you out of a bind.

Our online application process is designed with EI recipients in mind, offering respectful service without judgment about your employment situation. So, if you need some assistance, we’re here for you. Click below to apply with iCash today!

For more information about payday loans with different government benefits, visit our page on payday loans with government benefits. You can also learn about our general payday loans process.

Payday loans are high cost products. iCash loans comply with Payday Loans Act (2008), Ontario. For more information about your borrower rights, visit the Ontario borrower rights page.

Licensed in AB, BC, NB, ON, MB, NS, PEI. License numbers and addresses available upon request.

Since 2016, we've helped over 1.6 millions Canadians get instant loans online.

Since 2016, we've helped over 1.6 millions Canadians get instant loans online.

Read more reviews.

Have more questions? Check out our full FAQ.