How to Make a Budget (Beginner’s Guide)

This guide for beginners will outline how to make a budget. Remember that the main objective is to reach your financial goals by growing your savings and cutting down on unnecessary expenses.

Even if you’ve never created a budget before, don’t be intimidated! We’ve outlined some easy-to-follow steps for those just starting out to help get you going. If you have a savings target and are determined to reach it, these tips and advice will get there.

• How to Create a Budget in 5 Easy Steps

• Reasons to Make a Budget

• Top 4 Things to Consider Before You Start a Budget

• Things to Remember When Making Your Monthly Budget

• Avoid These Common Budgeting Mistakes

• Make it a Habit

How to Create a Budget in 5 Easy Steps

We’ve put together these 5 easy steps for beginners to create a budget for monthly expenses and spending habits, because we know it can seem overwhelming.

At iCash we understand how important it is to take the time to plan not only for your bills, but those rainy-day unforeseen costs, too. If you're in need of some extra cash, an online short-term loan can be the perfect solution.

Step # 1. Include Your Net Income

The first thing to consider when creating a budget as a beginner is how much you make every month. List your take-home pay, which excludes taxes. This is known as your net income. Knowing this amount guarantees that you don’t have an overestimated understanding of your income.

Do this as soon as the money lands in your bank account. If you list your income before you possess it, you will have an exaggerated sense of how much you can currently spend.

Listing how much you actually make as soon as the money comes in is a great budgeting for beginners’ tip.

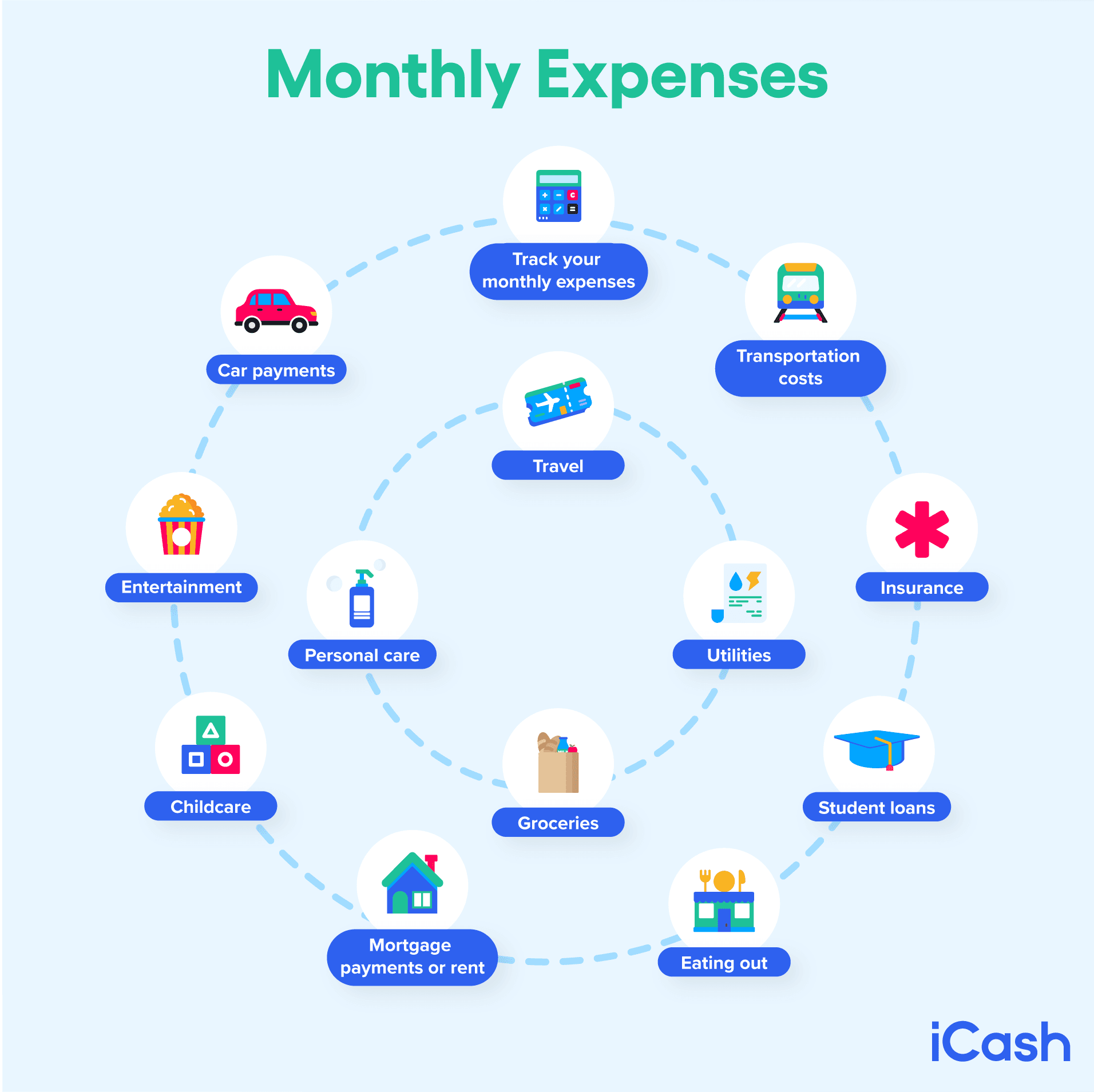

Step #2. Track Your Monthly Expenses

Track your monthly expenses by going through everything you spend and list them routinely. These expenses include everything, both big and small: gas for your car, school expenses, even a candy bar. Everything goes into the list.

Make sure to do this daily or weekly so you don’t forget your spending habits. This way, you will get to evaluate your purchases throughout the monthly budgeting process.

Step #3. Categorize Your Expenses

When creating your budget, even as a beginner, remember that fixed expenses remain constant every month. Variable costs differ based on usage.

Constants:

- Rent

- Insurance

- Subscriptions

- Car payments

Variables:

- Electricity

- Hot water

- Cell phone bill

- Gas

Once you’ve listed your expenses, categorize them accordingly: constant vs. variable.

Classifying your living costs allows you to stop paying attention to fixed payments because you cannot reduce these in any way. You can narrow down on the variables to examine how you can adjust your spending pattern to suit your savings goals.

Step #4. Calculate the Difference

This is an important step when beginning your budget: Add up your incomes and your expenses separately.

Once you have the total for each, subtract the expenses (include your monthly bills as well as anything you spend on entertainment, eating out, etc.) from your income, and see how much you have left.

The remaining amount will represent your monthly savings and money you can put toward paying off debt such as an online installment loan, as well.

Step #5. Review and Evaluate Your Budget

A good way to know if your budget strategy was successful is to look at your savings.

Did you reach the amount you wanted to keep in the bank? If not, this is when you get to trace your spending habits and evaluate how you can do better with your budgeting plan. Are there any expenses you can cut back on?

To understand how well you are budgeting in general, you can compare your spending habits with others across the Canada. This will give you a clue as to how well you’re doing and perhaps provide you with a guideline when setting your budgeting targets.

Reasons to Make a Budget

The budgeting process gives you a better understanding of your spending habits and can help you reach financial goals as an individual or family. Only 47% of Canadians currently use a budget to manage their money.

These are the main reasons why a budget is useful:

Increased Awareness of Your Income

A great reason is to know how much you make every month once you exclude taxes and other payroll deductions. Keeping track of your net income and how you use it shows you exactly how much you spend from that amount.

This is especially helpful if you work multiple jobs or are self-employed, like a freelancer with an unstable income flow.

Keep Track of Your Money

Organizing your money monthly really helps to track your expenses and tabulates your spending so you can easily tell where your money is going. This allows you to gain more control over your finances.

Canadian debts reached 172.5% in 2021, showing just how important it is to keep track of your money and create a list of household expenses. A 2019 survey found that 73.2% of Canadians face outstanding debts.

If you encounter difficulties with disciplining yourself to save, there’s never a better time to start creating a budget, and there are always 24/7 e-Transfer loans to turn to for those unexpected costs if they do come up.

Improves Finances

Another great reason to create a budget it so you know where your money is going so you can improve your finances by understanding what you need to cut. Especially if you have a credit card, living beyond your means can happen subconsciously. Budgeting will stop you from doing this, preventing undue stress.

Improving your finances through a strategic spending and saving routine is ideal when preparing for those unexpected expenses or saving towards a large purchase or vacation. When you make a budget, you can plan around debts and loans by setting spending limits.

Top 4 Things to Consider Before You Start a Budget

Even as a beginner, there are certain things you need to consider before you start a budget. Part of that consideration is determining how you start creating a plan that works for you.

Many people who start budgeting don’t always end up following through. This is because they didn’t personalize their plans for their specific needs or family situations.

To ensure that your household plan is successful, you must evaluate your motivations and your saving abilities. Here are the top four things you need to consider before you embark on creating a solid monthly budget.

1. Decide on Your Financial Goals

Before you start to create a budget you need to ask yourself some question about your financial goals: What are you dreaming about? Do you want to settle all your debts by the end of the year? Or maybe to save up for college or buy a house?

Financial goals help you set targets and provide you with a purpose for budgeting. Before you start the process, create a list.

Divide these into short-term (restricting the use of your credit card) and long-term (getting out of debt or starting a mortgage) aspirations.

Once you have your list, organize it with the most important and pressing objectives first.

2. Choose a Budget Rule

Before you budget, plan how you want to allocate your money. You can do this by choosing some guidelines to follow. A common and simple one is the 50/30/20 budget rule.

This particular strategy means that you should spend 50% of your net income on necessities, 30% on wants, and 20% on savings. Needs include the expenses you can’t go without, such as electricity, food, rent, and gas. Wants may include travelling or entertainment.

The other 20% will go to your savings, which may be allocated for emergency funds, debt repayment, RRSP funds or any other saving plans.

3. Consider Your Previous Expenses

Paying attention to your previous expenses is an excellent opportunity to readjust your spending and saving habits before you start creating your own personal budget.

Before you start, predict your expenses then break them down into categories, such as entertainment, food, and more. You can look at your spending from the previous months to come up with these projections.

Consider monitoring your expenses via a downloadable spreadsheet type: asset-hyperlink id: 1Wj9YkGWbC6KgyMJQE0eVO or or budgeting app to show you when you’re overspending. Using these tools will ease the process and make you more organized.

It’s important to note that even the smallest expenses will build up over a year and cost you. For example, if you buy a chocolate bar every week that costs $10, you will lose $520 in a year.

4. Prioritize Your Spending

Before you start your budget, explore what you usually spend on or are planning to spend on. See whether you can cross anything out that you don’t really need.

Do you really need that new skateboard? Is spending money on a luxury weekend worth sacrificing an end-of-year celebration with your family?

If it is that you really do need to spend your monthly net income on important payments and bills, leaving you with more to cover, remember that private lenders like iCash are here to help you meet those financial needs, quickly and safely online.

Things to Remember When Making Your Monthly Budget

While going through your financial budget, there are some key factors to keep in mind so that the process is effective:

Allocate Money for Savings

When creating a budget, make sure to include a savings goal, and keep this in mind throughout the month. How much do you want to save in the end? Focus on the objective and then work backwards, restricting your spending based on your savings expectation.

Unless it’s an absolute emergency, saving less than that 20% should be a no-go! This will help you become more disciplined in reaching your goal. If you’re getting very close to reaching your spending limit, start to cut back.

Track Your Spending Constantly

It won’t be helpful if you create a budget but only track your spending at the end of the month. When making a monthly budget, only checking in on the 30th or 31st prevents you from seeing whether you are headed towards reaching your savings goal.

Instead, keep an eye on your spending constantly to give you time to reflect daily on your habits.

Allow for Budget Adjustments

Sometimes even the best laid plans don’t work out. That’s OK! Life happens. When it does, you need to be willing to compromise on your budget, occasionally.

This doesn’t mean you splurge for that luxury item you don’t really need, but it does mean that you cover a car repair or a trip to the vet when it wasn’t necessarily planned.

If you don’t allow for some adjustments, you will find yourself getting frustrated at the end of every month – so know that it does and will happen.

At the same time, don’t get too comfortable changing your initial plan. You’ll have to make up for it in the coming months to meet your financial goals!

Save for Seasonal Expenses

The holidays or those annual super-sale events may mean you spend more during those particular months. Take this into account when planning your budget.

Since you know when Christmas and birthdays happen (there is no surprise there!), include these seasonal expenses into your saving considerations. This ensures that your budget accurately reflects your predicted spending patterns.

Avoid These Common Budgeting Mistakes

These are the most common mistakes that people make when they try to create and stick to a budget:

Setting Unrealistic Standards

Setting unrealistic standards like aiming to save almost 50% if your net income off the bat will inevitably stop your plan from succeeding. Instead of amending your budget, you will likely abandon it entirely.

To prevent this from happening, remember to pay attention to financial objectives, as well as evaluate your previous expenses and understand what it takes to makes a realistic saving plan.

Not Keeping Up with Your Budget

If you start a budget, leave it for two months then return to it when you find the time, your plan will not be effective. You’ll start to treat it as a side task instead of an important tool for achieving financial security.

Consider your budget part of your daily routine. Make it what you do at night after dinner or settle in with it as soon as you get home from work so you can look at the day’s spending habits.

It takes 21 days to form a habit. Commit to your new budgeting routine for at least 3 weeks. At that point, you won’t even think about it. The task becomes part of your everyday life, just like brushing your teeth.

Mislabelling Your Spending

A common mistake people make when trying to stick to a budget is to classify their wants as needs, or vice versa.

When you include travelling or going to the cinema in your necessary (needs) spending category, your budget will not be successful. This will prevent you from evaluating those expenses appropriately and finding methods to cut down.

Make it a Habit

A proper budget promises a lot: You will be able to plan for the future and grow more financially secure. If you have debts or loans currently weighing you down, budgeting goes a long way in helping you conquer them.

With this in mind, it shouldn’t be optional. The budgeting process has to become a part of your life to make it work. Incorporate it into your habits by approaching it regularly, and you’ll start to see an improvement in your finances.

At times, you may need help to cover monthly expenses even when you budgeted in advance. When you need short-term help with your bills, get an online loan from iCash, we provide loans for up to $1,500 safely and securely for most Canadians.

About the author