Single Parent Benefits in Alberta

The province of Alberta is known as one of the most affordable places to live in Canada. With a medium income higher than the national average for individuals (currently sitting at $35,800 - over $5,000 more than the rest of the country). Despite that, single parents still struggle.

If you're raising a child alone, receiving a helping hand could mean the difference between putting food on the table or not. That’s precisely why the federal and provincial governments created specific single parent benefits to assist in these situations.

Being a single mother or father means juggling a wide array of expenses, not just regular monthly costs. Apart from housing, utilities, food, clothing and transport, having children means covering potential medical issues, paying for education, and keeping them entertained. Let's not forget the need for daycare while you are at work, too.

Despite the extra aid, unexpected costs may still appear. These circumstances don't distinguish between people living on a salary and those living on support program funds.

If for whatever reason, you need a quick cash advance to get back on your feet until the next benefit cheque comes along, you can turn to iCash. We are a Canadian lender that provides quick and easy lending options to Alberta residents even if their income comes from government benefits.

Below, we’ve put together a list of every kind of assistance you can receive in Alberta. The provincial government created these programs to cover the essential aspects of providing for a child. They offer financial aid that you can rely on every year.

• Alberta Child Health Benefit

• Alberta Child and Family Benefit

• Child and Youth Support Program

• Child Care Subsidy Program

• Family Support for Children with Disabilities (FSCD)

• Alberta's Income Support program

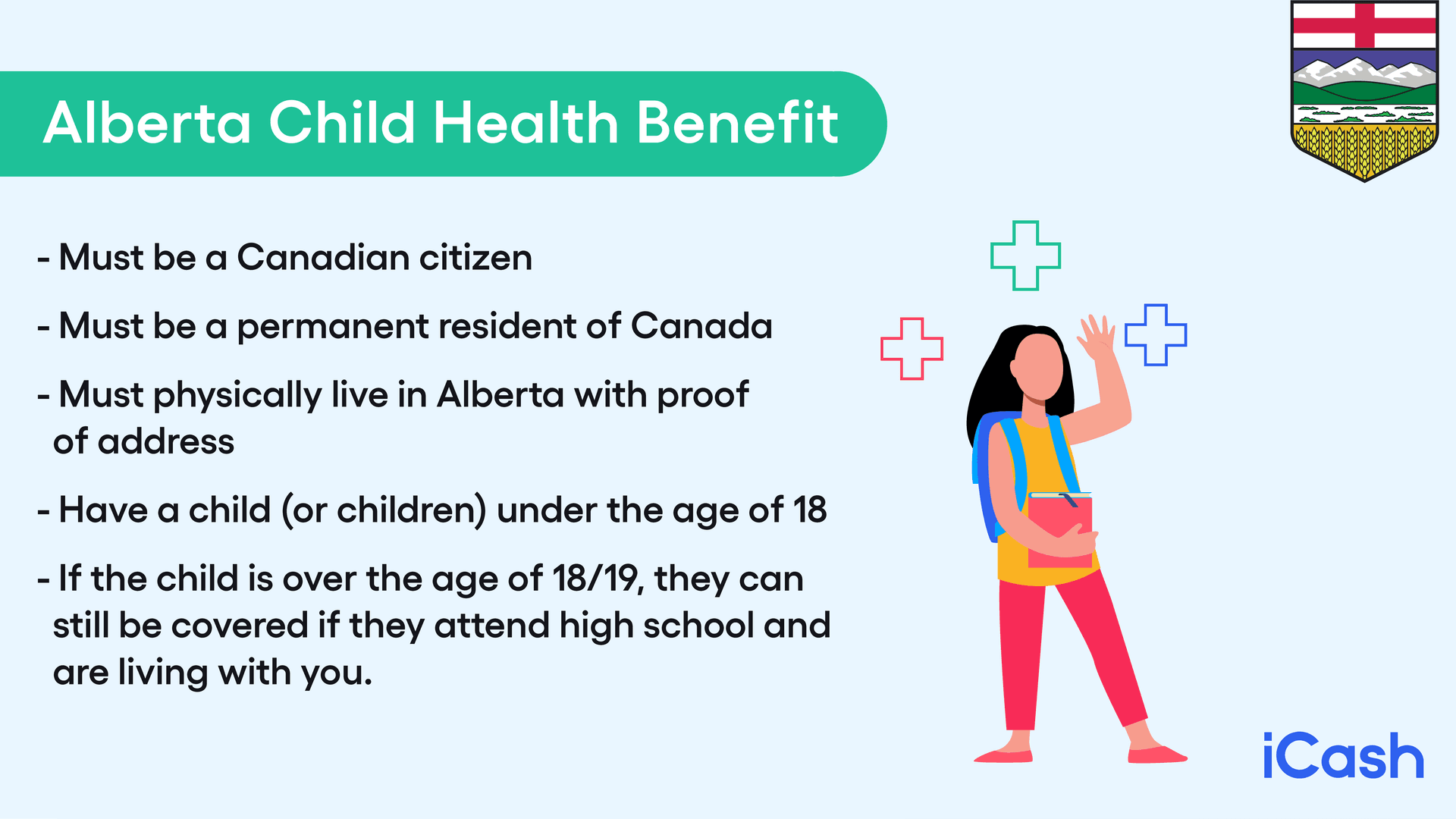

Alberta Child Health Benefit

The Alberta Child Health Benefit program is designed for primary and frequent medical problems that single parents and families with children encounter at every age. It covers unavoidable health expenses that aren’t everyday procedures and considered above the norm.

Dental and eyecare are two of the most critical issues children face while growing up, and they tend to get expensive. If you receive child health benefits, you will have access to coverage for dental exams, X-rays, fillings, extractions, as well as teeth cleaning. Yearly eye exams and new eyeglasses -- when necessary -- are also covered.

Prescription drugs can be another recurring expense if you're a single parent. However, this health plan covers a wide variety of medication, a few vitamins and other over the counter supplements children usually need.

The list of drugs covered is available online or at your doctor's office. It's a good idea to check the list when your child has a health problem because you may have to pay for part of the treatment yourself.

If your child needs an ambulance or is diabetic and needs supplies every month, these are both covered.

In order to qualify for this health benefit plan in Alberta you must meet the following criteria:

• Must be a Canadian citizen;

• Must be a permanent resident of Canada;

• Must physically live in Alberta - with proof of address;

• Have a child (or children) under the age of 18;

• If the child is over the age of 18/19, they can still be covered if they attend high school and are living with you.

The Alberta Child Health Benefit cannot be combined with the following government programs: Income Support, Child and Youth Support Program, AISH. Make sure you check the eligibility section on the provincial government site.

You also have to make sure you meet the net household income guidelines presented below.

Family | Maximum income |

Single adult | $16,580 |

1 adult + 1 child | $26,023 |

1 adult + 2 children | $31,010 |

1 adult + 3 children | $36,325 |

1 adult + 4 children* | $41,957 |

Couple, no children | $23,212 |

Couple + 1 child | $31,237 |

Couple + 2 children | $36,634 |

Couple + 3 children | $41,594 |

Couple + 4 children* | $46,932 |

*For each additional child, add $4,973

If you want to apply for this program and have already checked to see if you are eligible, the next step is to fill out the Alberta Child Health Benefit application form.

There are two sections you need to make sure you sign and date: My Declaration and Consent for Canada Revenue Agency. Once you have correctly filled out the form submit it, either by fax (the number is 780 415 8386) or mail, to the Health Benefits Contact Centre.

If everything is in order and your application is approved, you will receive a health benefits card that will clearly show the name and identification number of each of your children.

This card is essential. You will have to show it every time you use a service covered by the program. When you take your children to the doctor, dentist, optician, pharmacist, or if you need to use an ambulance, you must present the card.

It's also essential to know that your family income will be reviewed once a month with the Canada Revenue Agency. If nothing changes, your enrolment will automatically renew.

Alberta Child and Family Benefit

The Alberta Child and Family Benefit (ACFB) provides financial assistance to families and single parents living on low- to middle-range income with children under 18. For solo parents that work and have a steady income, it offers a tax-free sum to provide financial assistance to ensure these households can provide adequate living conditions.

The ACFB was created in July 2020 by consolidating the Alberta Child Benefit (ACB) and the Alberta Family Employment Tax Credit (AFETC) into a single program funded by the government.

One of the main advantages of this particular financial aid is: no application process. The amount received depends on your income level, as well as how many children under the age of 18 are under your care.

The ACFB is granted automatically, as long as the requirements are met:

• You must have one or more children under the age of 18;

• Be an Alberta resident;

• Filing a tax return is mandatory;

• You must also meet the income requirements.

There are two components to the Alberta Child and Family Benefit: base and working. You can qualify for one or both, depending on your income.

The base component is received even if you are unemployed. It's the part of the subsidy designed to help low-income families. The other part of the program, the working component, is only accessible to those who receive employment income.

Number of children | Base component (max.) | Working component (max.) |

|---|---|---|

1 child | $1,330 | $681 |

2 children | $1,995 | $1,301 |

3 children | $2,660 | $1,672 |

4 or more children | $3,325 | $1,795 |

The ACFB is paid in 4 instalments throughout the year via the CRA and is either mailed or directly deposited in August, November, February and May.

When you file your annual tax return, you will automatically considered for the Alberta Child and Family Benefit based on that submitted information, as long as you also qualify for the Canada Child Benefit federal program which you can apply for online.

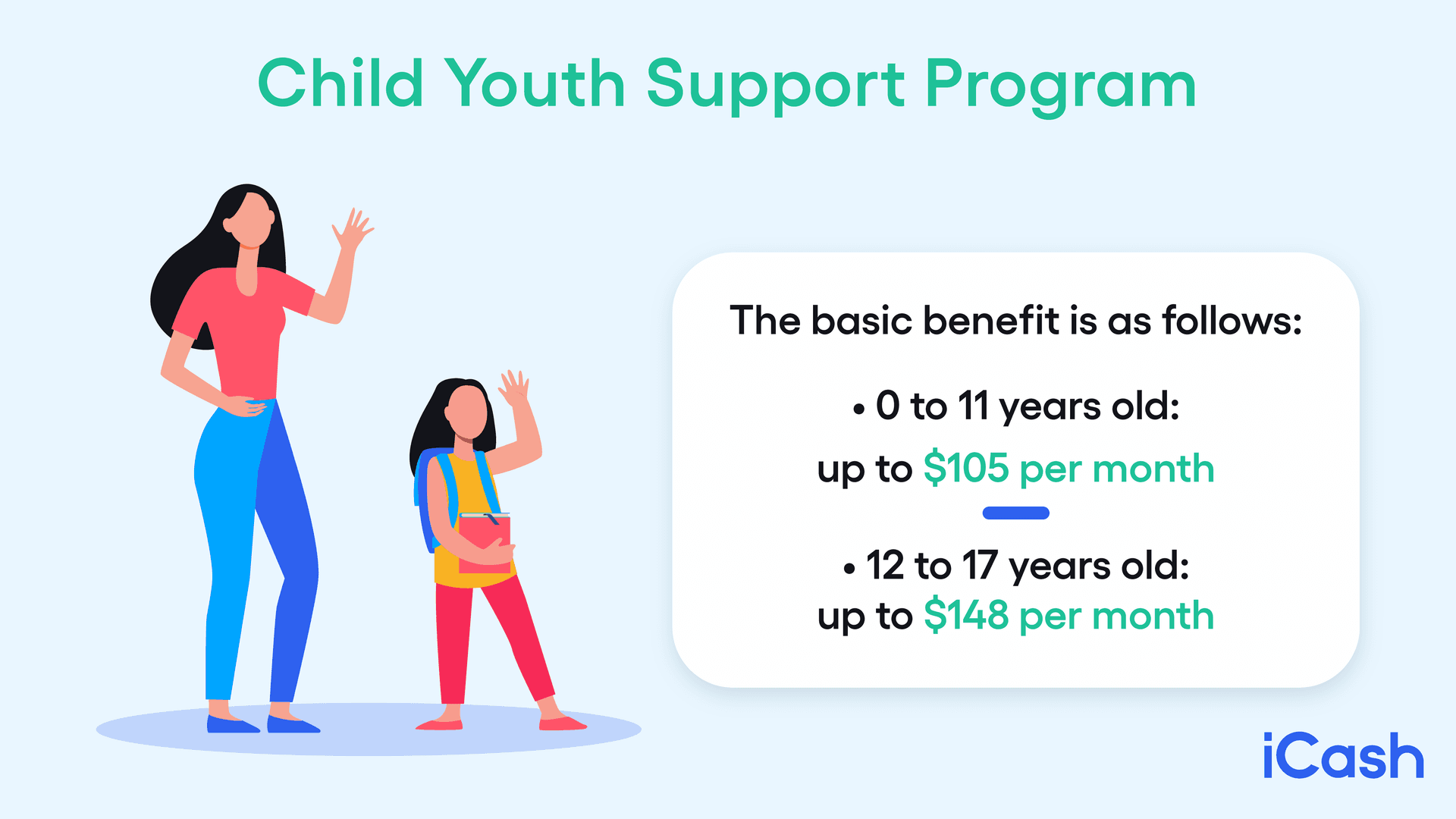

Child and Youth Support Program

To be efficient, support programs need to consider all the situations a family can face, as circumstances can differ massively. The Child and Youth Support Program was created to provide for children who, for different reasons, cannot live with their parents and are in the full-time care of an appointed guardian.

Single parents looking for support for their own kids, cannot apply for this program.

When the child lives in the caregiver's home, the program covers the adolescent's financial and medical costs. This aid is strictly provided as an alternative when the biological or adoptive parents cannot (or refuse to) take care of their children.

If you are a legal caregiver, you can benefit from this financial aid to ensure decent conditions for the child in your care. Of course, there are some initial requirements you have to meet: you must have private guardianship, the child must attend school, and their parent(s) cannot live in the same house as you.

To be eligible for this assistance, the child and the caregiver need to also meet the following conditions:

• Present a letter of consent written by the child's parents or guardians, agreeing that the caregiver will be responsible for the minor.

• Without a letter, the caregiver must prove private guardianship.

• The child must be younger than 18 when the application is submitted.

• The minor's income must be within limits imposed by the financial guidelines of the program.

• The youth must either be attending school, attending a full-time training program, or working full-time.

• The adolescent needs to live with the caregiver seven days a week.

• The parent or guardian who either declared themselves unable or refused to care for the minor must not reside in the same home as the caregiver.

• As for the caregiver, they cannot live on-reserve (if they do, they need to turn to the Child Out of Parental Home Program).

The amount you should expect to receive will be calculated according to the child's age and on the income received on their behalf.

The basic benefit is as follows:

• 0 to 11 years old: up to $105 per month

• 12 to 17 years old: up to $148 per month

If after applying for this specific program, you still find yourself in need of extra cash to cover those emergency costs that always seem to arise with children, applying for a secure online loan from a direct lender like iCash is a great option to consider.

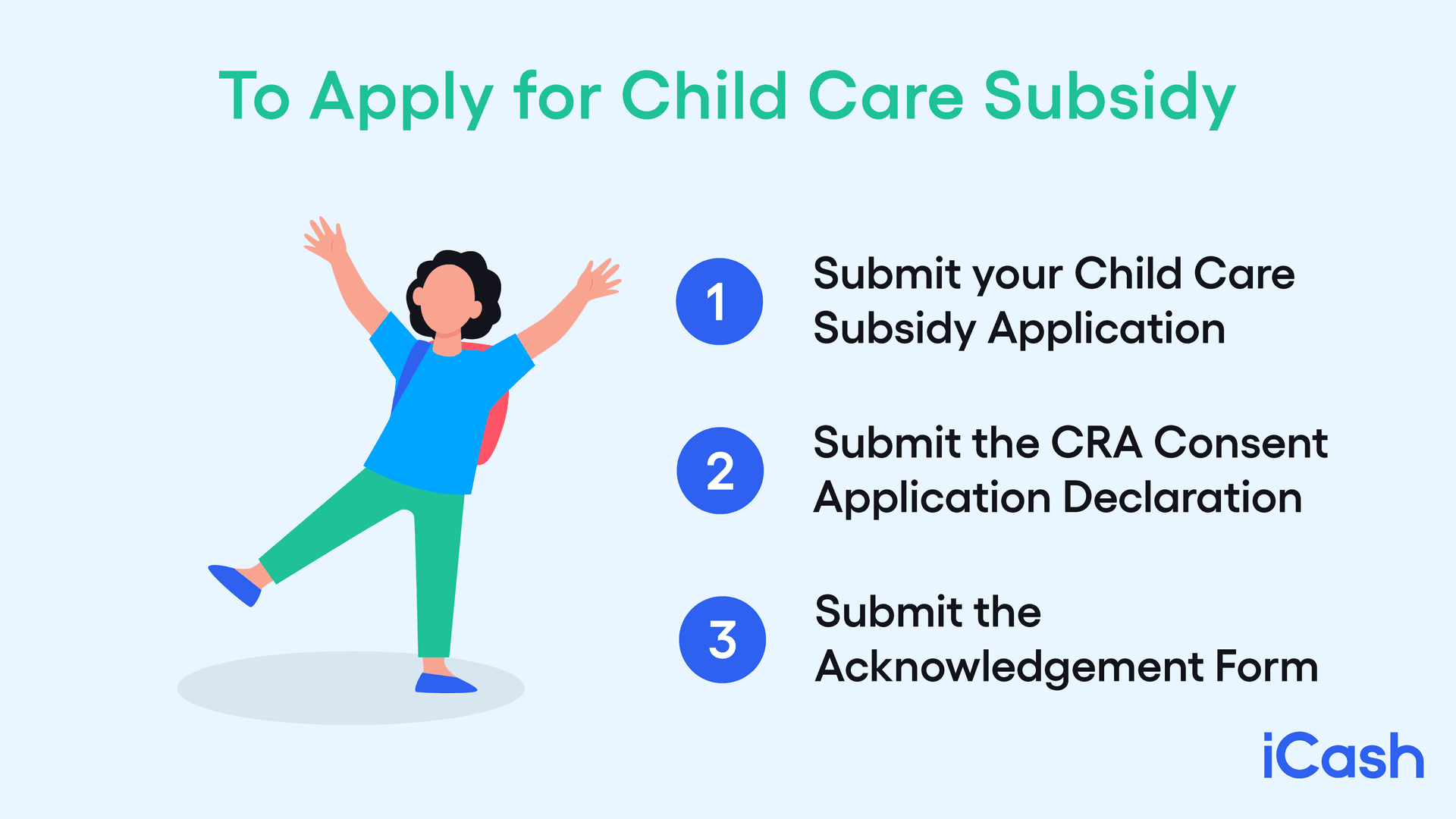

Child Care Subsidy Program

The Child Care Subsidy Program offers financial help in the form of grants for families and single parents with low and middle income to help cover their children's enrollment in authorized care centres.

If you are a single mother or father and need to leave your infant at a daycare or other childcare facility while working, this program will help cover that expense. The facility must be a licensed centre, a group family child care, an approved family day home or an out-of-school care centre.

The exact amount given depends on a few aspects, such as your child's age (must be 12 years or under), your income, and the type of facility you choose to use. There are also adjustments made for summer months while school is out.

As of September 2021, the subsidy program will include three new income brackets, stretching past $74,999 all the way to $89,999.

Here are the amounts you should expect to receive with the Child Care Subsidy Program if you are eligible:

Maximum Daycare and Out of School Care Rates | |||

|---|---|---|---|

Income | Infant (under 18 months) | Preschooler (19 months to 1st grade) | School-age (grade 1 to 6) |

$0 to $49,999 | $741 | $644 | $366 |

$50,000 to $54,999 | $704 | $612 | $348 |

$55,000 to $59,999 | $630 | $547 | $311 |

$60,000 to $64,999 | $556 | $483 | $275 |

$65,000 to $69,999 | $482 | $419 | $238 |

$70,000 to $74,999 | $408 | $354 | $201 |

$75,000 to $79,999 | $333 | $290 | $165 |

$80,000 to $84,999 | $259 | $225 | $128 |

$85,000 to $89,999 | $185 | $161 | $92 |

Flat rate $125/mth (all income brackets) |

Maximum Family Day Homes and Group Family Care Centers Rates | |||

|---|---|---|---|

Income | Infant (under 18 months) | Preschooler (19 months to 1st grade) | School age (grade 1 to 6) |

$0 to $49,999 | $614 | $516 | $366 |

$50,000 to $54,999 | $583 | $490 | $348 |

$55,000 to $59,999 | $522 | $439 | $311 |

$60,000 to $64,999 | $461 | $387 | $275 |

$65,000 to $69,999 | $399 | $335 | $238 |

$70,000 to $74,999 | $338 | $284 | $201 |

$75,000 to $79,999 | $276 | $232 | $165 |

$80,000 to $84,999 | $215 | $181 | $128 |

$85,000 to $89,999 | $154 | $129 | $92 |

Source: Alberta Child Care Subsidy Rates Table. 3 and Table.4

The extended-hour subsidy was created for families and single parents with well-founded reasons for needing to use childcare outside the usual working hours (6 AM to 6 PM) or on the weekend. Along with the subsidy, these families can get an extra $100/month for every child.

Two requirements must be met for the extended-hour support to be granted: they must use a licensed program that has to be approved to provide extra hours of care. The minor must stay in the care facility for at least four extended hours.

To be eligible for a the regular childcare subsidy program, you must meet the following conditions:

• You or the child who is benefiting from the care facilities must be a Canadian citizen and live in Canada.

• You have to be a resident of Alberta.

• You must be: working, attending school, trying to find employment, or you or your child have special needs.

• Your children must be younger than 12 years of age and must attend school (only up to grade 7).

• There must be a secured spot for your child(ren) in a licensed daycare, out-of-school facility, an approved family day home, or group family child care program.

• Your family's income must not be over $89,999 per year.*

*As of September 2021.

An essential part of qualifying for this program is finding eligible care services. You will want one that is licensed, but most importantly it needs to provide a healthy, stimulating and safe environment for your child.

To find a suitable childcare facility, you can start by asking your friends for references. If that doesn't work, you can turn to the local Children's Services office and get the list of childcare programs available.

To determine your childcare subsidy amount, use the online estimator. This can help determine if you qualify, as well as your assistance value. The evaluation requires your marital status, how many children you have and their ages, your regional child and family services authority, and whether you also need the extended-hour subsidy.

You can apply for the care program online by submitting the Child Care Subsidy Application. Once you send your application, you also need to submit the CRA Consent Applicant Declaration and Acknowledgement form.

You can receive a conditional subsidy for two months, if you meet certain conditions, while your application is being processed and approved. Once accepted, a letter will inform you of the subsidy start and end date and the amount you will receive.

Family Support for Children with Disabilities (FSCD)

The Family Support for Children with Disabilities program offers eligible families and single parents support and services to cover their child's particular needs and those of their family.

If you qualify for the FSCD, the support offered is quite comprehensive; you will receive useful information, counseling, specialized services, and help with every stage your special needs child goes through.

The financial help covers specific clothes or shoes your child may need, medication, supplies, and medical costs. It also pays for expenses related to appointments and moments when you and your child must be away from home for reasons connected to their health.

A meeting with an FSCD worker will assess you and your youth’s specific needs.

You will get support from people who understand the challenges of a family or single parent dealing with a disability. Your plan will be customized to your specific situation after an initial assessment.

To qualify for the FSCD program, you must meet the following conditions:

• You must have a child younger than 18 living with a disability;

• Your child has to be a Canadian citizen or at least a permanent resident;

• The child must live in Alberta;

• Only the child's parent or guardian can apply for the program.

Apart from the above conditions, you must also provide documentation proving that your child has a diagnosed disability, due to a developmental, physical, sensory, mental or neurological issue, and/or a health problem that prevents them from completing daily activities like eating, walking, dressing and cleaning themselves, as well as socializing/playing with others.

To apply for the FSCD program, you must fill out an online application using myAlbertaSupports.ca. Make sure you prepare the medical documentation related to your child's disability. You can either print and bring your application to the nearest FSCD office in person, by mail, or via email.

After you apply, an FSCD worker will contact you promptly to let you know if your minor is eligible and if you need to provide any extra information.

Alberta's Income Support Program

The Alberta's Income Support program is designed to help residents, including single parents, who cannot cover their basic monthly food, shelter, and clothing needs due to a lack of or inability to work, or time off for training purposes.

The amount given depends on the individual’s particular situation, but it's meant to help those who cannot work temporarily or permanently for various reasons. You may request this support while you look for work or even while you work, but your income is insufficient to cover basic needs.

Residents who cannot work for a short period due to an accident, for example, or those who cannot work at all because of chronic health problems or other severe issues can also apply. It can also provide help to someone while they complete work training.

While this is a comprehensive program, those needing to cover last-minute costs can also apply for a payday loan online from a licensed Canadian direct lender until the income support comes in.

Income support can also be requested after a significant adverse event or unforeseen emergency, like a fire or being forced to vacate your residence. If the low- or no-income situation is temporary or out of your hands due to a chronic illness or external factors preventing you from earning a living, you will receive assistance.

To be eligible for the income support program, you must meet these conditions:

• You must either be a Canadian citizen, a permanent resident, or a refugee

• You must live in Alberta

• You must be over 18 years old

• You must be financially unable to provide your basic needs

• Your income and assets cannot be over $5,000 in RRSPs per adult and $10,000 equity in vehicles

• You cannot have any income higher than what you receive from income support benefits

• Your cash or savings cannot be over the liquid asset limit (which is usually three times the value of the income support benefit)

• You must accept to apply for other programs you may qualify for (like Employer Insurance)

• You must accept to offer financial information for all the members of your household

• You must work with an income support worker on a plan to improve your situation

The amount you can qualify for is dependent on your situation, your needs, whether you can work, and how many members are in your family. But to get an idea, these are the available benefits:

• Basic costs like food, shelter, and clothes

• Childcare / access to child support

• Special dietary needs

• Utility connection fees

• Expenses related to work

• Unanticipated emergencies

• Costs connected to getting away from domestic violence

• School expenses for your children

• Health benefits

• Employment services

To apply for the Income Support program, you must fill out the application. You can do that online or get a paper form from the nearest Alberta Supports or Alberta Works Centre.

After, you will then have a meeting with an Income Support worker to analyze your additional documents. After that, the application will take up to two weeks to be processed.

Summary

The provincial benefits available for single parents in Alberta are quite diverse. The goal is to cover the major issues a solo mother or father with low-to-moderate income would usually face.

Raising children on a single income is difficult; that's why we compiled this list of programs that can truly improve your financial situation. The amount for each benefit may not be huge, but many of them can be combined, and the result is a significant financial load taken off your shoulders.

Government and provincial benefits can help you have a better living situation so that you can focus on enjoying your little one's childhood. Make sure to stay informed. Apply for every eligible program. The struggles of bringing up children as a single parent remain but lowering your financial stress can make a huge difference.

Despite the extra help, unexpected costs may still appear. These situations don't distinguish between people living on a salary and those living on government benefits. That’s when applying for a short-term emergency loan from iCash, available 24 hours a day seven days a week, can help and let you focus on cherishing those childhood moments instead of stressing about finances.

About the author