Single Parent Benefits in Nova Scotia

Nova Scotia is one of the provinces with the highest rates of single parent families in Canada. There are many who struggle every day to make ends meet and provide for their children’s needs, such as food and clothing. Many of these families rely on social assistance from government agencies or charities to survive.

While all parents must handle a variety of expenses to keep their kids healthy and safe. It's even more challenging to do so with only one income.

Like in other Canadian provinces, the government of Nova Scotia offers assistance for those struggling with money for different reasons. If you're raising your child alone, it's essential to know all about the programs you could be eligible for so you can benefit from all the available funds.

If you’re on government benefits but still need some extra money, iCash instant loans provides quick access to the funds that you need with simple application process, even with a low or bad credit score, when you are looking for a short-term solution until your next paycheque arrives.

To help you navigate through the single parent benefits in NS, here are the programs designed to make your life easier:

• Affordable Living and Poverty Reduction Tax Credit

• Nova Scotia's Child Care Subsidy

• Direct Family Support for Children

• Early Intervention Program

• Employment Support and Income Assistance (ESIA)

Affordable Living and Poverty Reduction Tax Credit

The Canadian government implemented The Affordable Living and Poverty Reduction Tax Credit Program to help low-income persons and families make life more affordable, and it has been available to Nova Scotians since July 1, 2010.

This tax credit program includes two different available benefits.

The Nova Scotia Affordable Living Tax Credit (ALTC)

If you are a permanent resident in NS, and you file your tax return with the CRA yearly, then you are eligible for the program. You can receive tax-free quarterly payments to help you afford the basics.

With this ALTC program, expect the following amounts each year:

• $255.00 - base amount for couples or individuals, plus

• $60.00 for every child.

If your yearly family income exceeds $30,000, your credit will be reduced by $0.05 for every dollar over that amount.

As for the payments, the Canada Revenue Agency makes them along with the Federal GST/HST credit payments.

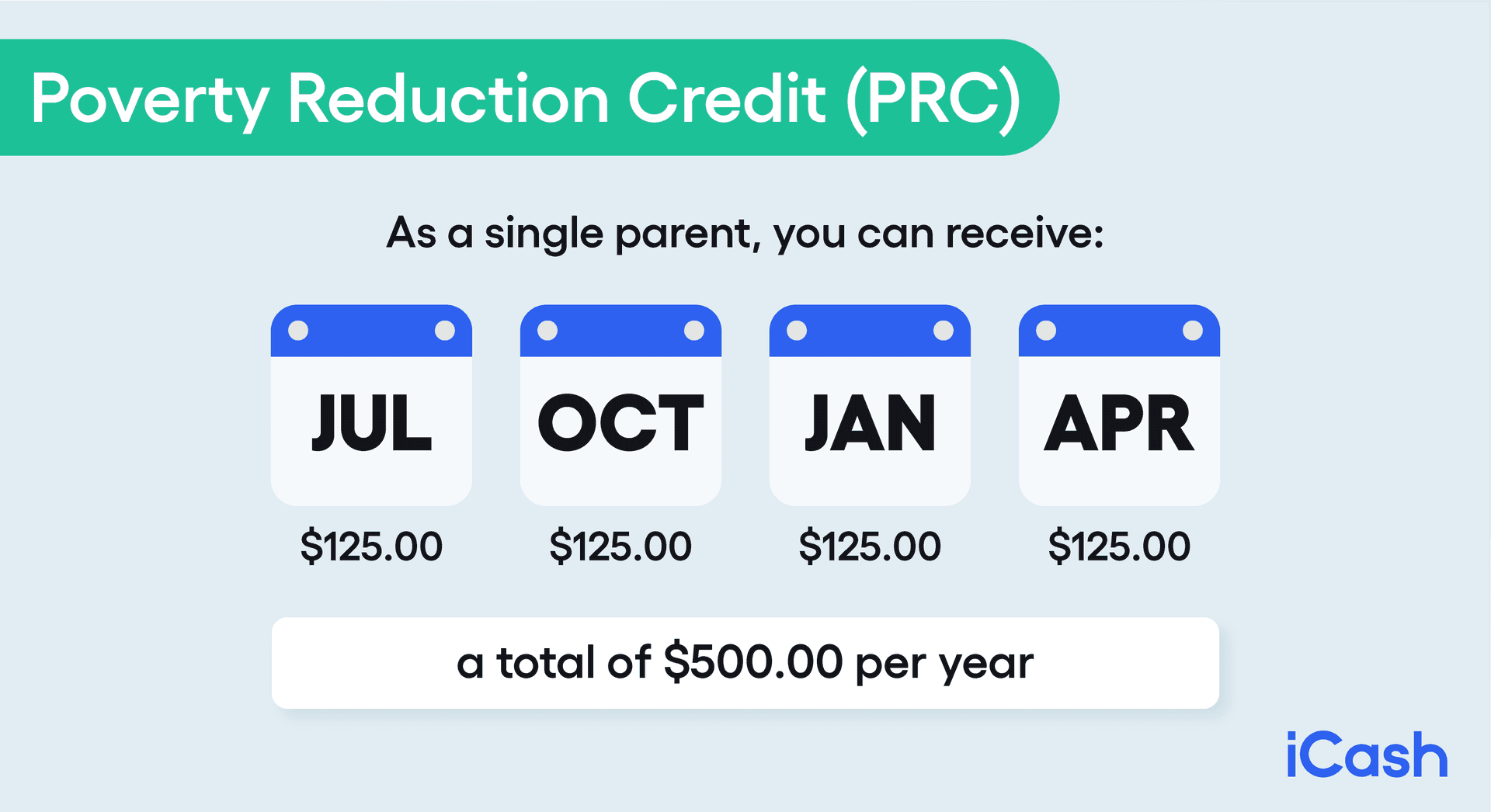

The Poverty Reduction Credit (PRC)

The Department of Community Services administers the PRC, a program that provides tax-free quarterly payments. You don't have to apply for the Poverty Reduction Credit; the Department will check if you are eligible and start making the payments if you meet the criteria.

They decide whether you qualify based on whether you have received payments the previous year and whether you have filed your taxes.

As of July 2021, the adjusted annual income limit was raised from $12,000 to $16,000 allowing more residents the chance to benefit from the program. If you do qualify, but still aren’t able to cover your monthly expenses, consider applying for a payday loan.

As a single parent, you can receive $125.00 every July, October, January, and April for a total of $500.00 per year.

Keep in mind that you can only receive these payments if you don't have a child when the Department checks your eligibility. You can be pregnant, but as soon as the child is born, you will have to turn to other available benefits.

Nova Scotia's Child Care Subsidy

Paying for child care is a struggle for single parents everywhere, but if you live in Nova Scotia, you can count on the Child Care Subsidy, as long as you qualify. Your income and your finances are used to determine eligibility.

Your income is taken from line 236 of your CRA Income Tax Notice of Assessment or your current paystubs. It's calculated by taking the deductions out of your gross income. It's also important to know that all your income sources will be considered, so you must report them. As for your finances, your savings or liquid assets cannot exceed $50,000 to qualify for the subsidy.

The childcare assistance rates vary according to the family income and number of members in your household. You will need to stay in touch with a caseworker and find a suitable daycare centre, as well.

Applying for the subsidy is simple and can be done online or on paper and mailed in with the appropriate documentation.

Upon approval, the childcare subsidy will remain valid even if you move your child to a different care facility – provided it’s licensed. Make sure you notify your caseworker of any and all changes.

Single-parent households in Nova Scotia can also access loans on child tax credit, in addition to government benefits.

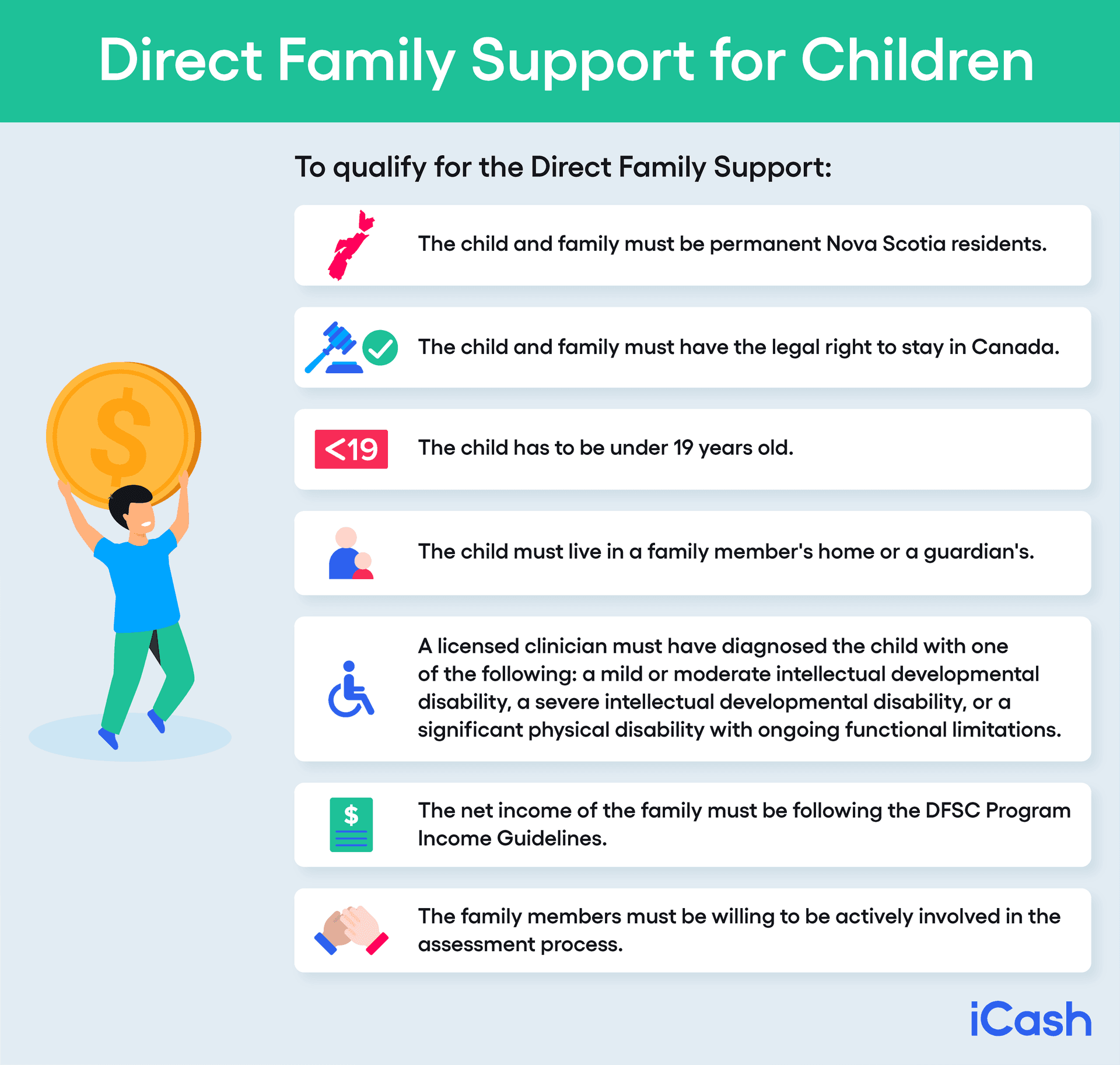

Direct Family Support for Children

The Direct Family Support for Children(DFSC) was created to help parents with special needs children in their household. The goal is to offer the necessary support so that the child can continue living in their home and for the family to receive support from the community.

Indeed, in some cases, it may be necessary to opt for an out-of-home placement, but with the help of DFSC, the moment can be delayed or even prevented.

To qualify for the Direct Family Support, the child and their family must meet specific requirements:

• The child and family must be permanent Nova Scotia residents.

• The child and family must have the legal right to stay in Canada.

• The child has to be under 19 years old.

• The child must live in a family member's home or a guardian's.

• A licensed clinician must diagnose the child with one of the following: a mild or moderate intellectual developmental disability, a severe intellectual developmental disability, or a significant physical disability with ongoing functional limitations; it can also be any combination of these disabilities.

• The net income of the family must follow the DFSC Program Income Guidelines.

• The family members must be willing to be actively involved in the assessment process.

Parents need to contact the Nova Scotia Department of Community Service's local office to apply for this program.

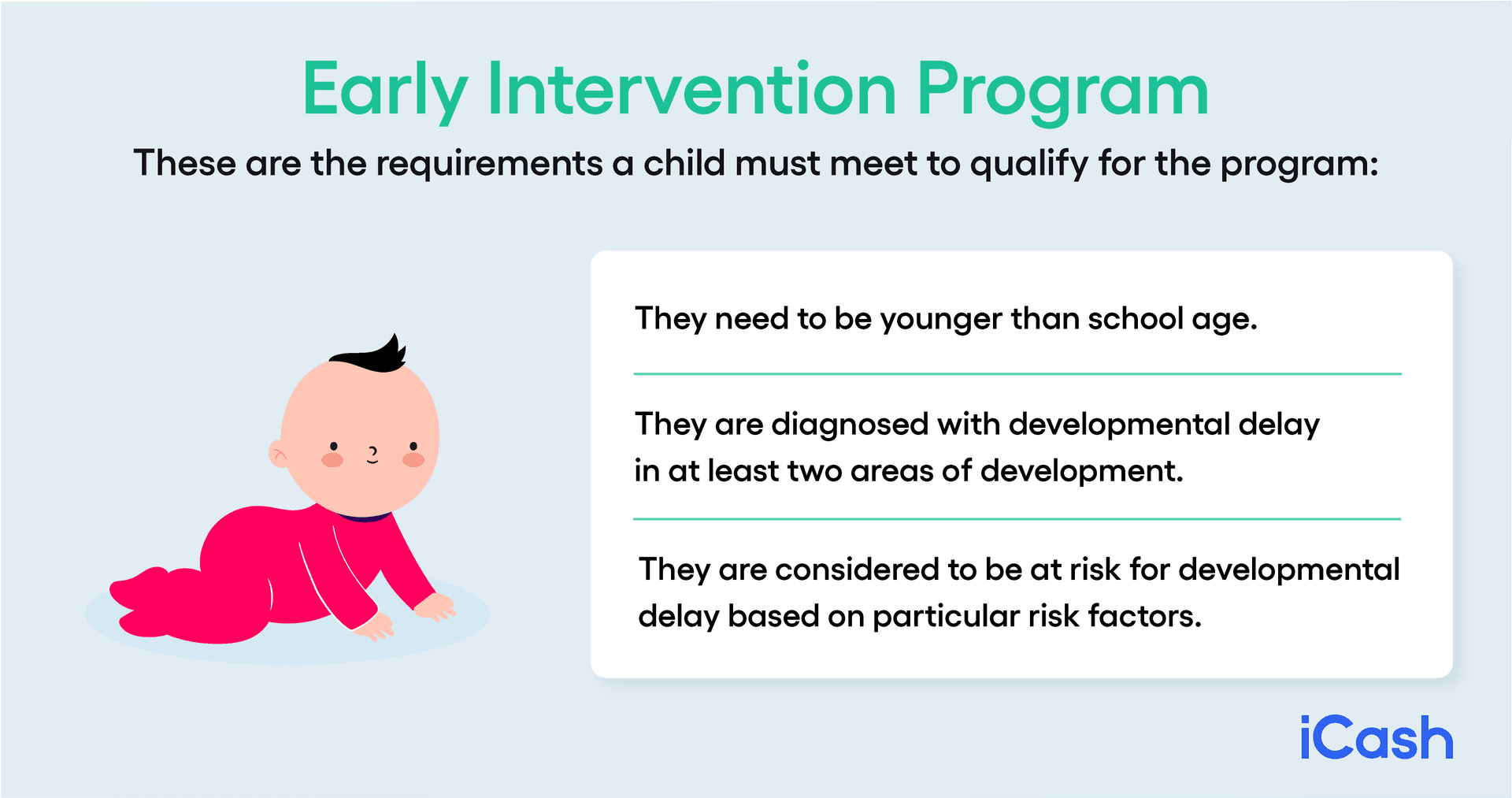

Early Intervention Program

The Early Intervention Program's goal is to create an improved environment for children to grow from the early stages. Consultations and services are offered to families in need of support. All the information and assistance provided aim at the healthy development of every child, based on their situation.

Identifying the risk of developmental delay as early as possible is vital, and the family alone may not have the necessary information and resources to accomplish that. In Nova Scotia, the Early Intervention Program can provide essential support to single parents.

These are the requirements a child must meet to qualify for the program:

• Younger than school age;

• Diagnosed with developmental delay in at least two areas of development;

• Considered at risk for developmental delay based on particular risk factors.

The Nova Scotia Early Childhood Development Intervention Services are available to families through an open referral system. The family can make the referral, or it can be handled by a physician, language specialist or an early childhood educator with the family's consent.

A home visit and an initial screening process will take place to establish if the child is eligible. If they are, the family will have access to toy libraries, discussion groups, playgroups, and various events.

They will receive the information they need to ensure their child's best development and then be connected to community services and programs. The child can also benefit from home visiting services and support in the transition to school.

Employment Support and Income Assistance (ESIA)

The Employment Support and Income Assistance program (ESIA) provides financial support for people and families who cannot handle basic living costs. It's a sort of last resort when no other option is available. ESIA consists of two programs:

Income Assistance

This program helps single parents struggling financially cover costs for basic needs such as food, shelter, basic utilities, and clothing. On top of that, it can help with expenses related to childcare, transport, prescription drugs, eyeglasses, and emergency dental care.

To be eligible for the program, you must live in Nova Scotia, be at least 19 years old, and be in severe financial need.

To apply, you need to make an appointment at the Community Services office in your area. You will then meet with a caseworker, and you will have to provide them with the necessary information that can help them understand your situation.

Your caseworker will fill in the application form, and you will find out if you qualify in three to seven days; that's also when you will find out the amount you will receive.

Employment Support Services

You can qualify for this particular benefit if you already receive Income Assistance. The goal is to help residents become self-sufficient.

A caseworker will meet with you and go over your background. They will suggest the programs and services that will benefit you. It can be about education, finding a job, or other services that can help you be more independent.

You’re Not Alone as a Single Parent in NS

Single parent benefits come in many forms in Nova Scotia. There’s help available out there to keep your youngster in a childcare facility while you work or train for a job to cover medical costs, and even to afford the basic needs when finances are dire.

It's also good to know that you can turn to a short-term loan when, despite the benefits you receive, the money is still insufficient for those unexpected costs. You can solve your urgent financial problems with a loan from a trusted direct lender online.

About the author