Single Parent Benefits in Canada

Being a single parent is challenging! Parenting is always a demanding balancing act, and it is even more challenging when you're doing it solo. Whether it was planned or the result of life circumstances, parenting alone can be a rollercoaster of emotions and stress.

It can also be gratifying. However, if you talk to most solo mothers and fathers, they would jump at the chance to have a little extra help from time to time.

Single parent homes in Canada have been on the rise in the past 20 years, demonstrating that the typical Canadian household is always evolving. The number of single-parent families in Canada has increased by 160,000 homes from 1.62 million in 2015 to 1.78 million in 2020.

As per the 2016 census, 19.2% of children aged 0-14 in Canada are a part of a lone-parent family, compared to 69.7% of Canadian children who live with their biological parents.

Single moms and dads in Canada cite financial stress as one of the biggest concerns they have and one of the most pressing issues that keep them up at night. Many single parents, especially those who are newly single, may not be aware of the range of benefits available to help make things a little easier.

There are tax incentives, federal government benefits, provincial government benefits, and various programs in place to help balance your financial burdens. There are many existing benefits you can obtain, regardless of parental status (together or apart).

These services have enhanced many single parents' benefits and offered financial help they can trust. It’s important to remember too that if you find yourself in need of funds quickly, you can apply for a child tax cash advance loan to help when needed.

How Do You Qualify for Child Benefits in Canada?

For the government programs, you need to take the initiative to apply, change your status, and submit a form to maximize what you are entitled to as a single parent under the law.

In most cases, the only requirement to be eligible is that you are the child(ren)'s primary caregiver and that they live with you.

In the case of shared custody, you can still apply and obtain most benefits. The amount will be reduced by half as the other parent can also apply for their own financial needs.

Additional requirements (revealing income, employment, etc.) exist for each program. Still, this same standard is pretty much the norm across the board regarding custody and housing.

We've compiled information on the various benefits available to single parents in Canada. We hope that this guide serves as a quick reference for anyone looking to have a little more money in their pocket.

As a single parent, you may qualify for child and family benefits, including:

Canadian Government Benefit Programs

Canadian Child Benefit (CCB)

The Canadian Child Benefit (CCB) is available to parents of one or more children under 18. It provides a tax-free cash benefit based on income, number of children and their ages, and marital status. It can also incorporate other federal benefits, such as the child disability benefit and various provincial program benefits.

The amount is calculated based on your income tax return. When you have a change in your marital status, it is very important to update the Canada Revenue Agency (CRA). Be sure to update the CRA as soon as possible to receive the maximum benefit amount you are entitled to.

In total, you can receive up to $6,833 per year per child under 6 years old and $5,765 per year per child ages six through 17. However, this total changes as your income increases or decreases.

Of the total assistance provided under CCB, a sizeable portion – 1.5 million are families with one child in the household. Furthermore, 1.4 million families with two children's homes received assistance.

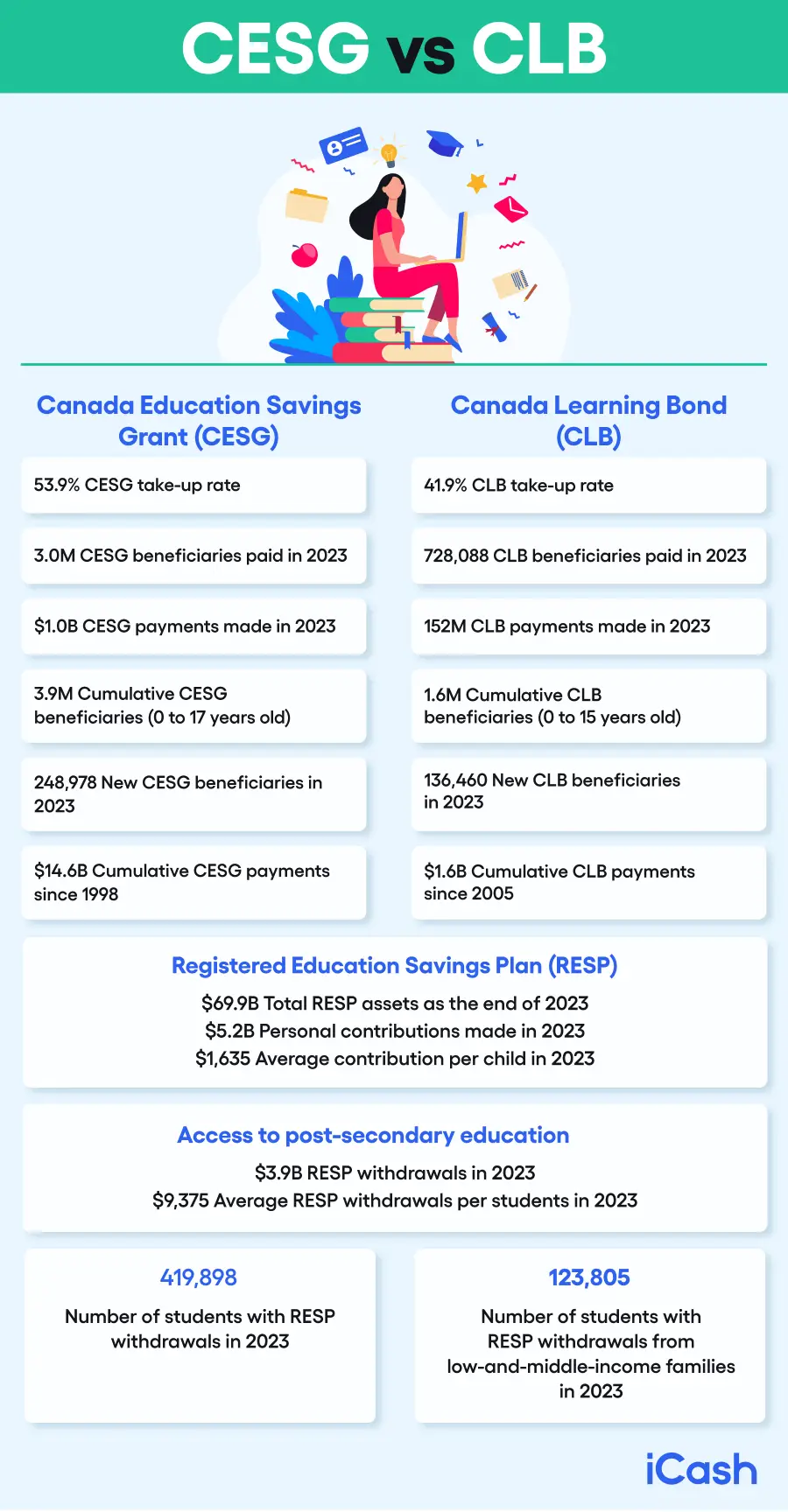

Canadian Education Savings Grant (CESG) for Registered Education Savings Plan (RESP)

The Registered Education Savings Plans (RESP) allows parents and relatives to contribute money towards a child's future educational needs, up to a total of $50,000 per child. The income generated on the savings is tax-free.

It's a great way to set aside money for higher education expenses to ensure that you are not tempted to use it for other financial purposes. Also, having an RESP for your child allows for various federal and provincial grants to be applied.

The Canadian Education Savings Grant offers either a 10% or 20% match to money you contribute up to $500 per child per year. That works out to either $50 or $100 per year per child.

The bracket, based on your income, may very well change or be heavily adjusted when your life circumstances (divorce, separation, or widowing) change.

In 2020 there were almost 250k newly registered Canada Education Savings Grants, and over 134k new Canadian Learning Bond (more on that below) beneficiaries registered. Throughout the last year, $1.0 billion were paid into CESGs, and $152 million into CLBs. It’s clear we take our education seriously here in the Great White North, despite any financial struggles we may be facing.

You should contact your RESP provider when your life circumstances change to ensure your benefit income calculations are accurate. This way, your children or child receive the maximum "free money" match available.

Canada Learning Bond (CLB)

Another great way to build up your child's savings for academics is to take advantage of the Canada Learning Bond (CLB). The Canada Learning Bond deposits $500 into your child's RESP, without any contribution requirements.

Each year after that, it provides an additional $100 deposit, up to age 15. This benefit means you can get $2,000 plus tax-free interest for your child's educational needs, regardless of whether or not you put any money aside into the RESP yourself.

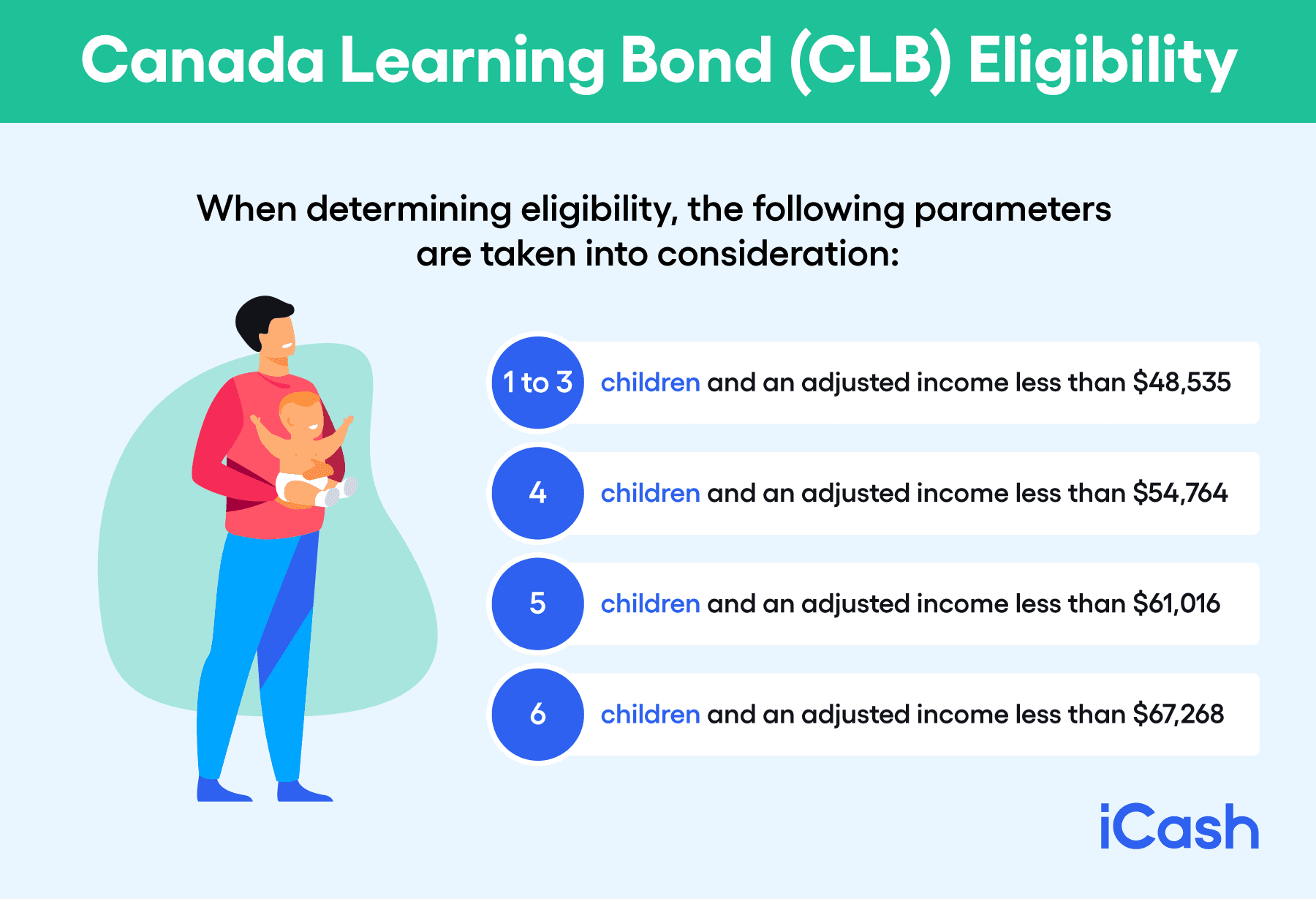

As income plays a large role in defining the amount of aid a family will receive, defining what constitutes as low income is essential. Low yearly earnings are mainly determined by the amount of adjusted annual income and the number of children within a household.

When determining eligibility, the following parameters are taken into consideration:

1 to 3 children and an adjusted income up to $48,535

4 children and an adjusted income less than $54,764

5 children and an adjusted income less than $61,016

6 children and an adjusted income less than $67,268

Contact your RESP servicer to sign up for the Canada Learning Bond. The CLB isn’t always available, so be sure to ask before signing up for an RESP and shop around.

Canada Pension Plan (CPP)

Contributors to the Canada Pension Plan can make some changes when their marital status changes or they have children. This can impact how much you pay into the plan. It's essential to make sure you update your status and file for any exemptions offered.

For example, the Child Reading Drop-Out Provision (CRDP) for the CPP excludes a period when you may have dropped out of the workforce to have and raise a child from your calculated earnings. This ensures your maximum benefits in retirement (or that get passed on to your children).

Likewise, special Children's Benefits for the CPP provide an income if a parent is disabled or dies. There are various restrictions to this particular benefit, such as dependent children need to be under 18, or 18 to 25 and enrolled in a qualified higher education program. And if you ever need extra money to cover unforeseen costs suddenly applying for a CPP short-term loan can be done easily online.

The child of a beneficiary can receive a certain amount, which will be adjusted on an annual basis, and needs to be calculated upon submission of all documents through the CPP application process.

The circumstances under which to apply are when a parent or guardian has applied for disability, when a child comes into the custody of a guardian who already receives disability benefit, or when a parent or guardian dies.

Tax Credits and Adjustment Benefits

Reduce Your Income Tax with Tax Form T1213

There are quite a few not-well-known tax forms and tax laws in Canada. One of these is Tax Form T1213. This form allows you to reduce your income tax deduction from your income source, putting more money in your bank account.

It is designed to reduce your income tax expense when you have considerable ongoing costs in specific categories. This includes childcare or medical expenses, legal and employment expenses, and retirement plan contributions.

Because Tax Form T1213 can be used to deduct childcare expenses, this can be incredibly useful for single-parent households, as childcare can be one of their highest costs throughout the year.

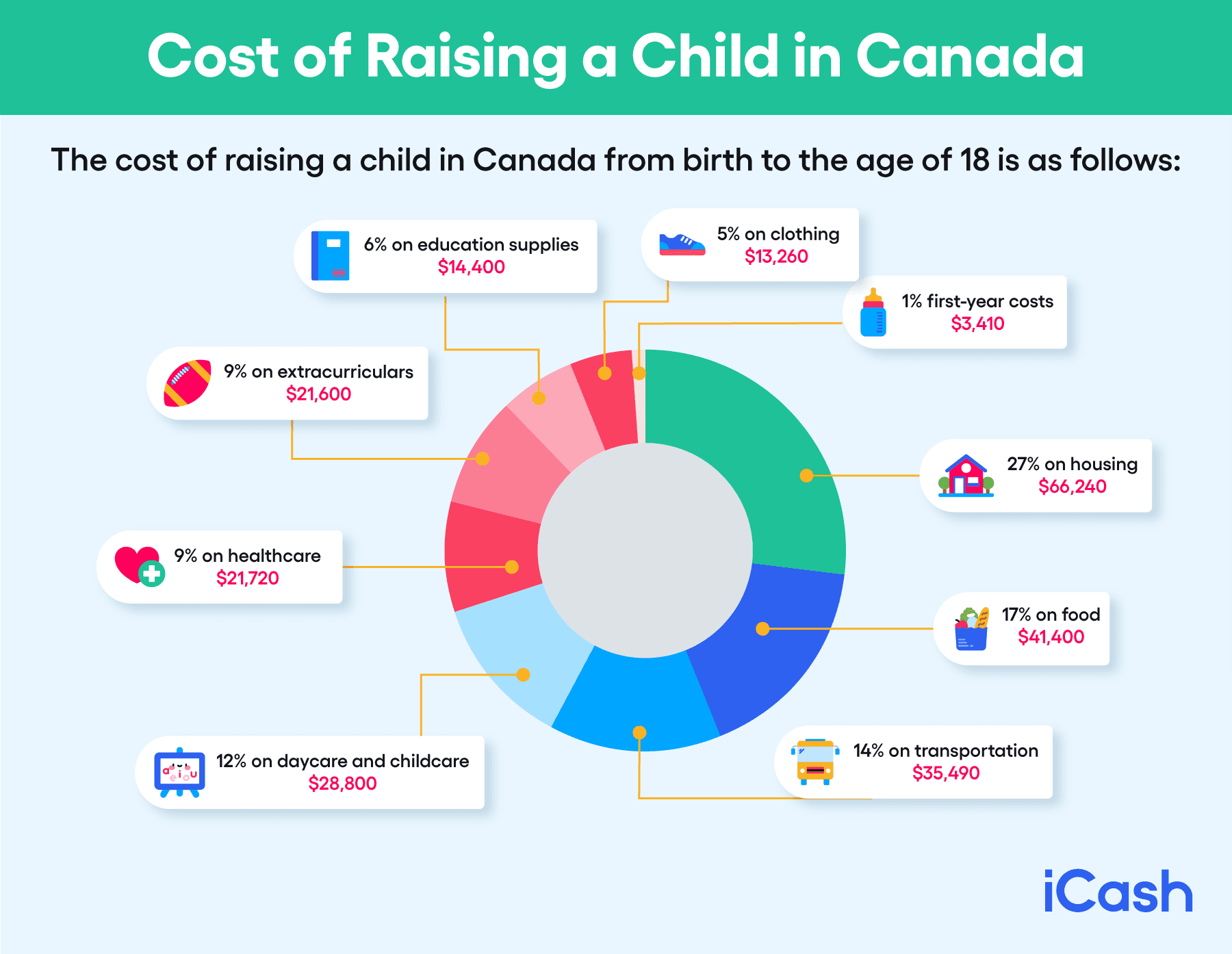

It is important to note that only the parent supporting the eligible child can claim childcare expenses. According to an article in the Financial Post, it's estimated that, on average, the cost of raising a child in Canada costs between $10,000 and $15,000 per year until the child turns a 18. That adds up!.

The costs associated with raising a child tends to be higher during the younger years, and childcare makes up a significant portion of that cost. The associated cost of raising a child from birth to the age of 18 goes as follows:

27% on housing - $66,240

17% on food - $41,400

14% on transportation - $35,490

12% on daycare and childcare - $28,800

9% on healthcare - $21,720

9% on extracurriculars - $21,600

6% on education supplies - $14,400

5% on clothing - $13,260

1% first-year costs - $3,410

You will need to do some guesswork and projections on those expenses in total for over a year. The actual calculation of the reduced tax amount is handled by the Canadian Revenue Agency (CRA).

Disability Tax Credit (DTC)

Tax credits are another great way to reduce the amount of money you must pay for income taxes. Many single parents may be surprised to learn that several conditions qualify for this tax credit and may be able to apply for a disability loan in Canada.

If you qualify, you can receive upwards of $8,000 in tax credits. That can make a substantial dent in the amount of taxes you have to pay each year and help with the financial burdens of being a single parent. Your child may be eligible for the Child Disability Benefit as well.

Family Supplement to Employment Insurance (EI)

Employment Insurance (EI) is designed to provide supplemental income if you lose your job through no fault of your own. Various requirements dictate whether or not you are eligible for EI.

However, if you do qualify for EI and your net income is below a certain threshold for the year, you can be eligible for additional EI amounts through what is known as the Family Supplement. It can increase the amount of your EI payments by as much as 80%. And you’ll also be able to apply for a loan even if you are collecting EI if you need money urgently to cover a sudden payment.

While this option doesn't help if you are actively employed, it can provide a valuable safety net if you lose your job. Especially if you are a single parent with one or more children. Maternity and parental benefits are available under this program for expecting new parents and those adopting or fostering children.

Considering that single parents make up 19.2% of all Canadian families, it is vital to have additional government assistance programs to ensure that all parents and their children maintain a suitable quality of life.

Canada Workers Benefit

The Canada Workers Benefit (CWB) helps families with a low income by providing tax relief. This refundable tax credit is a significant aid for single parents in the workforce who must handle all the expenses connected to their home and children with only one income.

It can also include a disability supplement, depending on the case.

As for how much you will receive, the amount depends on each province. The maximum amounts are generally the same, but there are also a few exceptions: Alberta, Quebec, and Nunavut.

These are the maximum payments you can expect:

The CWB payments can be up to $1,381 for single persons and $2,379 for families. However, it gradually diminishes depending on the income.

The disability supplement can be up to the same level for single persons: $713; it starts to decrease as the income goes over $24,569 and isn't received anymore if the family income goes beyond $30,511.

Provincial and Territorial Programs

Every province also has an array of benefits, credits, and programs that can help single parents with financial assistance, grants, and special programs, services, and more.

Generally speaking, these programs can help with additional childcare, education, housing, food assistance, legal aid, therapy and counseling, and related programs.

We've compiled a list of all single parent benefit programs per province, links to the government websites that allow you to learn more, and a brief description or overview of what is available under each benefit.

The Child and Family Benefits Calculator

If you still aren't sure how much you are entitled to, you can estimate the payments using child and family benefits calculators online, to help you get information on all the benefits you can qualify for.

To get the final amount, you will be required to share some information. If you have children under the age of 19, you will have to enter their names and birth dates. It will then use that information to estimate the benefits you can receive, even if your child's age changes before the end of the year.

It will also need information related to your family's working income. If you're a single parent, the calculations will only be based on the amount you receive from your employment.

There are many types of income that you can enter, like net business or professional income, commission, or farm earnings, and even fishing revenue.

This child and family benefits calculator will offer a fair estimation of the benefits you can expect to receive. However, its accuracy is highly dependent on the exactness of the data you enter. If you decide to use it, make sure to delete your internet browser history when you're done, as a measure of precaution.

Use Available Benefits to Your Advantage

The funds coming from federal and government sources were created and organized in such a manner as to offer consistent help to families living on a low income.

If you feel you need some extra help beyond the benefits the government provides, the good news is there are options available.

Whenever you face unexpected costs that you don't have the funds to cover, you can turn to a short-term loan. Private lenders like iCash offer quick cash advances crafted for such situations. Even if your income comes from social benefits, you can still qualify to receive up to $1,500 sent via e-Transfer.

About the author