Menu

Table of contents :

Raising kids is rewarding. But let’s be honest, it’s also expensive. Between school supplies, unexpected medical bills, and everyday essentials, costs add up fast. Sometimes your Canada Child Benefit payments don't stretch far enough to cover everything, especially when emergencies hit.

That's where child tax loans help. If you receive the Canada Child Benefit (CCB), you can access quick cash to bridge financial gaps between payments. We understand family financial challenges and accept your CCB as legitimate income.

What are child tax loans?

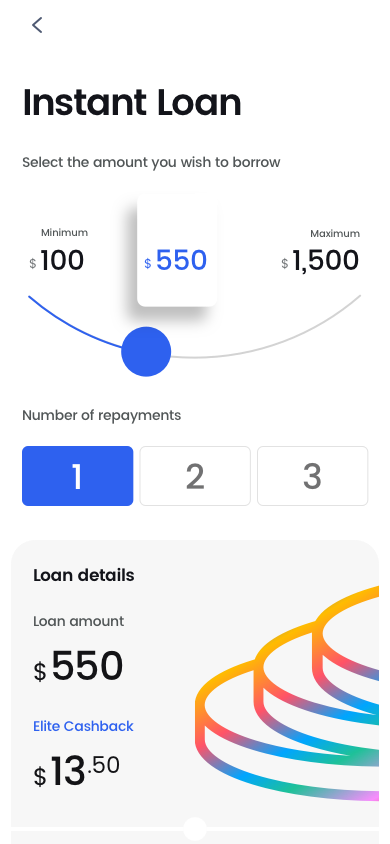

Child tax loans are payday loans that accept your Canada Child Benefit (CCB) as a valid source of income. Canadian families receiving CCB can borrow $100-$1,500 with instant approval decisions, 24/7 e-Transfer funding, and flexible repayment options*.

Child tax loans are short-term loans for Canadian families whose main source of income is the Canada Child Benefit. These loans are meant to help deal with any financial difficulties that might arise while you’re waiting for your next deposit from the government.

Unlike traditional banks that often reject applications based solely on credit scores, child tax loans recognize government benefits as legitimate income. This makes them accessible to parents who might not qualify for conventional financing.

The process is simple: apply online, confirm your CCB income, and receive an instant decision. Funds are transferred directly to your bank account by e-Transfer within minutes. Loan amounts typically range from $100 to $1,500, depending on your income and borrowing history. Repayment aligns with your income schedule, often matching CCB payment dates.

The Canada Child Benefit is a tax-free monthly payment from the federal government for eligible families with children under 18. Administered by the Canada Revenue Agency (CRA), payments are issued around the 20th of each month, depending on the month.

Who qualifies for CCB:

Living with a child under 18 and being primarily responsible for their care

Canadian resident for tax purposes

Canadian citizen, permanent resident, protected person, or qualifying temporary resident

Payment amounts depend on family income, number of children, and their ages. Many lenders accept CCB as valid income when evaluating loan applications.

Qualifying for a child tax loan is straightforward. Here's what you typically need:

Be at least 18 years old (19 years old for applicants in British Columbia, New Brunswick, Nova Scotia)

Be a resident of any of the provinces in which we operate (AB, ON, BC, MB, NB, NS, PEI).

Show that you have been receiving the same source of income for the past three months.

Have a total net income of at least $800/month.

Have access to an online bank account, in which pre-authorized debits can be performed.*

Have a valid Canadian mobile phone number, address, and email address (VoIP numbers are not accepted)

*Please note that KOHO accounts do not qualify as they do not support pre-authorized debits.

Employment is not required. Your CCB can be your only source of income, opening doors for stay-at-home parents or those between jobs. Bad credit doesn't automatically disqualify you.

Getting an online loan with us is fast and easy. Simply select your loan amount, repayment plan* and provide some personal details.

Our online loan application will tell you if you’re approved instantly. Once approved, all you have to do is electronically sign your contract. It’s that easy!

Once you sign your digital agreement, your cash advance will be sent by e-Transfer within 2 minutes. Fast, convenient and hassle-free. Funds are sent 24/7, no matter what.

Getting a child tax loan with iCash takes just three simple steps. Our entire process happens online, with no paperwork, store visits, or lengthy phone calls required.

Select your loan amount and repayment plan (if applicable - conditions apply), then provide basic personal details. Our secure application protects your information with bank-level 256-bit SSL encryption.

Our system reviews your application instantly. Most applicants receive a decision within seconds once they’ve completed the application. You won’t have to wait long to know if you’re approved or not!

Once approved, electronically sign your contract and receive funds by e-Transfer in as little as 2 minutes. We send money 24/7, 365 days a year. Even on weekends and holidays!

Parents use child tax loans to handle real-life situations that can't wait:

Medical and dental emergencies: Your child needs antibiotics or dental work that wasn't budgeted. Child tax loans cover unexpected healthcare costs that insurance doesn't fully address.

Childcare expenses: When regular childcare falls through, or you need to cover a daycare deposit, these loans can help cover those costs.

School-related costs: Field trip fees, school supplies, sports equipment, or uniforms often arrive with short notice. Quick access to funds means your child doesn't miss important activities.

Clothing and essentials: Kids grow fast. When winter coats no longer fit or shoes wear out before your next CCB payment, child tax loans help you provide immediate necessities.

If you need cash to cover daily bills or unexpected expenses, many lenders accept your Canada Child Benefit payments as valid income for child tax loans. Your CCB can strengthen your loan application, especially if you're between jobs or staying home to care for your children.

Unlike traditional lenders who only consider employment income, child tax loan providers recognize government benefits as legitimate monthly income. This opens the door for stay-at-home parents, those on parental leave, or families whose primary income comes from CCB payments.

When you apply, your benefit amount becomes part of your total income calculation, helping you qualify for loan amounts up to $1,500. Once approved, you can use the loan for immediate needs and repay it when your next CCB payment arrives.

Most provinces provide additional child benefits outside the federal Canada Child Benefit. These payments are typically combined with your CCB into a single monthly deposit, increasing your total benefit income and potentially boosting your loan eligibility.

Alberta: The Alberta Child and Family Benefit provides quarterly support payments throughout the year. Families receive deposits in February, May, August, and November, with amounts based on income and family size.

British Columbia: BC's Family Benefit arrives monthly alongside your federal CCB payment. This program targets low- and middle-income families, offering additional non-taxable support to help with raising kids.

Ontario: The Ontario Child Benefit delivers monthly payments to families earning below certain income thresholds. These funds combine with your CCB deposit, creating a larger total benefit amount.

New Brunswick: Families in New Brunswick receive monthly child benefit payments plus seasonal support. The province also offers back-to-school funding each fall to help with education expenses.

Nova Scotia: NS provides monthly child benefit payments that automatically combine with your federal CCB. Eligible families see both provincial and federal amounts in a single deposit.

You can apply for personal loans with traditional banks or credit unions, but you'll need to ask if they accept your Canada Child Benefit as part of your income. Not all financial institutions recognize government benefits as valid income sources.

If approved, banks provide a lump sum that you repay in fixed monthly installments over a predetermined period. However, most banks perform hard credit checks and require a strong credit history to qualify.

The application process is often lengthy, involving paperwork, income verification, and waiting periods of several days to weeks. Even if your bank includes CCB payments in your income calculation, bad credit or insufficient employment history can result in rejection.

For families needing fast access to emergency funds, traditional bank loans may not be practical. That's where specialized child tax lenders like iCash provide faster alternatives with approval decisions in seconds and funds available within minutes, not days.

Many people search for no credit check child tax loans. But here's what you need to know:

For first-time applicants: A credit check is required as part of your initial application. However, this inquiry has minimal impact on your score. Bad credit won't automatically disqualify you because we consider your complete financial picture, not just your score. Thousands of Canadians with poor credit have been approved by us.

For returning customers: No credit check is required for subsequent applications. This protects your score from multiple inquiries and rewards responsible borrowing. Your relationship with us matters more than your credit history.

Credit checks help us verify identity, understand your financial situation, and comply with responsible lending practices.

Be cautious of lenders advertising guaranteed approval with zero credit checks. These often engage in predatory practices with extremely high fees.

Borrow responsibly to protect your family's long-term financial health:

Borrow only what you need. Calculate your actual expense and request only that amount.

Understand the total cost. At iCash, we charge $14 per $100 borrowed for instant loans, which is the amount regulated by the government. Regardless, always read your loan agreement carefully.

Have a solid repayment plan. Confirm you can comfortably repay the loan on your next payday without creating new financial stress.

Explore all options first. Consider borrowing from family, negotiating payment plans, or accessing community assistance programs before taking out a loan.

Since 2016, we've helped over 1.6 millions Canadians get instant loans online.

Since 2016, we've helped over 1.6 millions Canadians get instant loans online.

Read more reviews.

Have more questions? Check out our full FAQ.