Single Parent Benefits in Ontario

Ontario is one of the most expensive provinces to live in Canada. Indeed, the difference in living costs between some cities can be significant. Toronto has one of the highest costs of living, while Ottawa, for instance, is surprisingly affordable.

For single parents, the situation may be even more complicated, and even with a competitive salary, it can sometimes be insufficient. It can be tough to pay for expenses such as utilities, groceries and other bills, even with the money that you get from government assistance programs like OW and ODSP.

With iCash, there’s no longer any reason to delay paying bills or buying things for yourself and your family because of bad credit or lack of funds at hand -- we offer online loans for Ontarians with bad credit, as well as those without jobs or on social assistance.

If you're one of those struggling parents living in Ontario, you know how financially demanding raising a family can be. Costs for keeping your kids healthy and safe add up! Usually to a concerning level by the end of the month.

The good news is that the government takes serious measures to aid low-income families and single parents struggling, even with basic expenses.

Below, you’ll find each official program and precisely what you can expect to receive, whether you qualify, and the steps needed to apply.

• Assistance for Severe Disabilities

• Autism Program

• Blindness and Low Vision Program

• Developmental Disabilities Program

• Healthy Babies, Healthy Children Program

• Healthy Smiles Ontario

• Infant Hearing Program

• Ontario Child Care Tax Credit

• Ontario Disability Support Program: Income Support

• Ontario Low-Income Individuals and Families Tax (LIFT) Credit

• Ontario Works

• Key Takeaways: Single Parent Benefits in Ontario

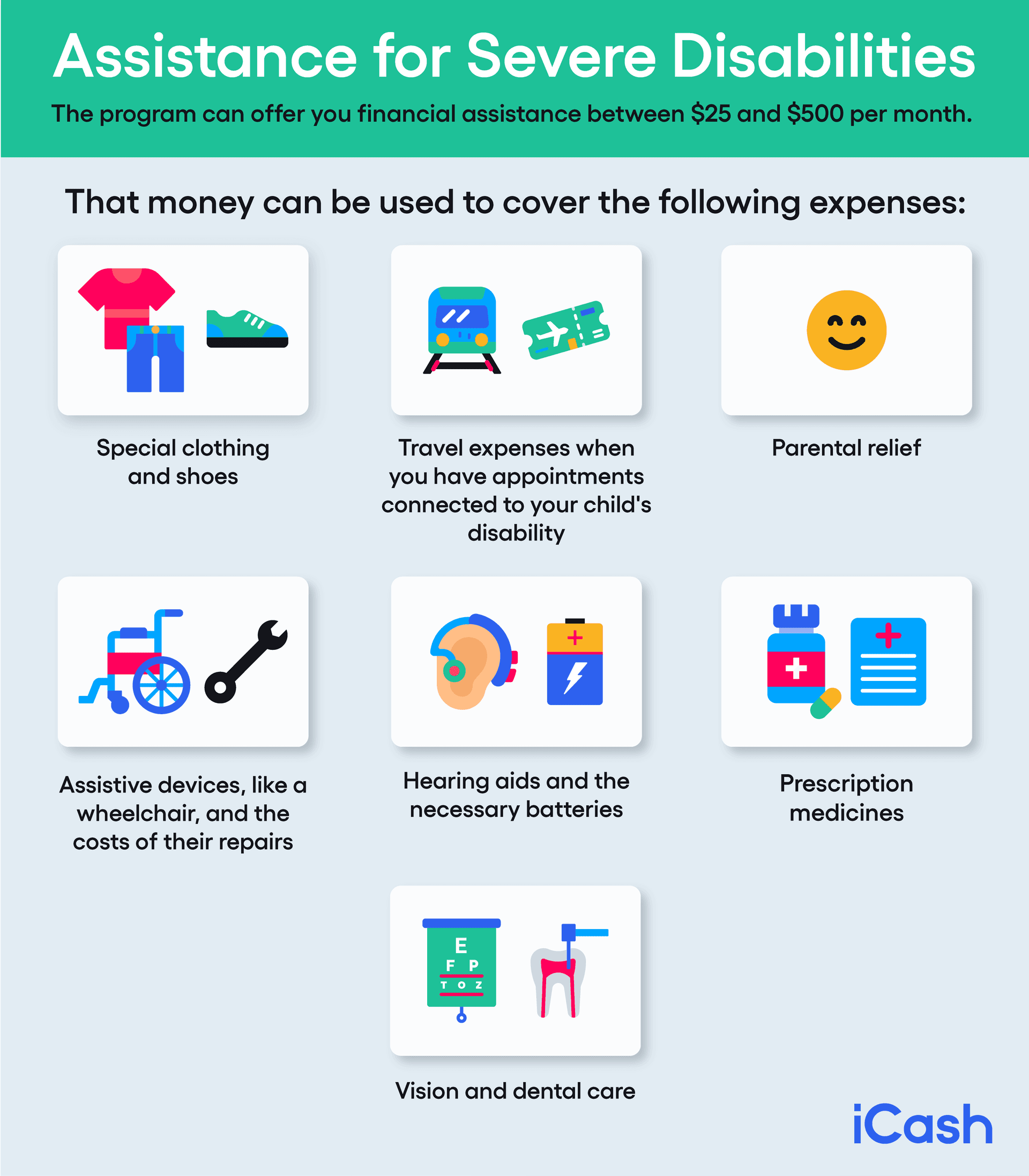

Assistance for Severe Disabilities

The Assistance for Children with Severe Disabilities program was created to help families living on low- or moderate-income pay for all the additional expenses associated with their child's disability.

To qualify for the program, you must be a parent or legal guardian of a child younger than 18 who lives in your home and has a severe disability.

The amount you can receive depends on some factors, like your family's size and net income, the level of severity of your child's disability, and the additional costs mandatory for ensuring they are well cared for.

After considering all these factors, the program can offer you financial assistance between $25 and $500 per month. That money can be used to cover the following expenses:

• Special clothing and shoes

• Travel expenses when you have appointments connected to your child's disability

• Parental relief

• Assistive devices, like a wheelchair, and the costs of their repairs

• Hearing aids and the necessary batteries

• Prescription medicines

• Vision and dental care

To apply for this program, you need to get a form. Once filled in, you can send it back together with any additional documentation they may demand.

You will be assigned a Special Agreements Officer who will review your application. After it’s processed, you will be informed whether or not you are eligible for a grant and how much you will receive.

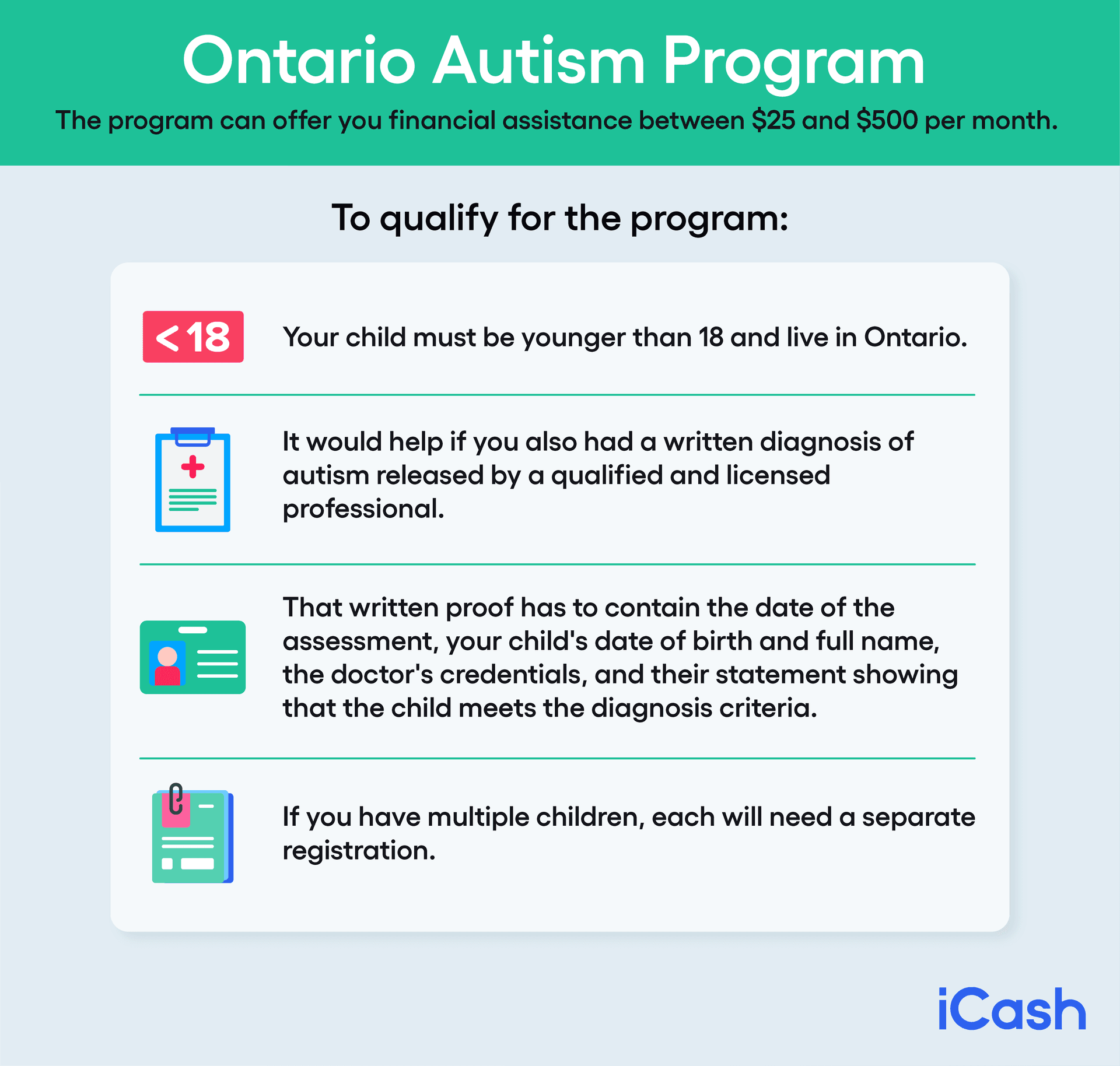

Autism Program

The Ontario Autism Program provides support and financial assistance for children suffering from autism spectrum disorders. To qualify for the program, your child must be younger than 18 and live in Ontario. It would help if you also had a written diagnosis of autism released by a qualified and licensed professional.

That written proof has to contain the date of the assessment, your child's date of birth and full name, the doctor's credentials, and their statement showing that the child meets the diagnosis criteria.

If you meet all these requirements, the next step is to register your child to the program by submitting the registration form along with the specified documents.

If you have multiple children, each will need a separate registration, but you won't have to renew your application in the future once you send it.

The Autism Program will create a budget that you can use to pay for the necessary services and particular types of support your child needs. You can expect to receive $20,000 for every child 0-5 years old, and $5,000 per child if they are over six years old.

The services mentioned above can include:

• Behavioral assessments

• Speech-language pathology

• Physiotherapy and occupational therapy

• Training for the person who takes care of the child

• Respite services

• Travel costs

• Special aids

It's important to know that while you are on a waitlist for certain services, you can qualify for one-time interim funding to cover eligible services. If that’s still not enough, a pay day loan can help make ends meet.

Blindness and Low Vision Program

The Blindness and Low Vision Program offers support for children born blind or living with low vision. The program provides specialized services for kids until they enter grade 1. Eligible families will be assigned a trained support worker who will help minimize the impact the vision impairment can have on the child's progress.

Intervention services are also available, handled by trained professionals, who will help the child develop their other senses as much as possible. They will also show parents how to do their part and efficiently support the youth's development.

Here are the areas the program’s professionals will cover:

• Movement issues, like orientation

• Motor skills development

• Skills necessary in everyday activities

• Concept development

• Developing social and emotional skills

• Language and communication developing

• Maximizing residual vision

• Using all senses for development

On top of that, when your child begins attending childcare or a learning centre, the program will assist the staff, showing them the best ways to engage with your child and teach them.

Developmental Disabilities Program

Children with developmental disabilities or those at risk for developmental delays need special care and intervention from their first years. These are disabilities that they will have to handle their entire lives, so guidance and specialized assistance are crucial.

The Developmental Disabilities Program provides the following services:

• Respite

• Specialized support inside the community to help with integration

• Residential provisions

As for eligibility, all children who suffer from an impairment in cognitive function, along with their families, can apply. Simply contact the regional office in your area to fill out an application.

The Behavioral Management Program helps children with developmental disabilities if they also manifest behavioral issues. The Infant Development Programs focus on children under five years of age who either have a developmental disability or are at risk of a delay.

Healthy Babies, Healthy Children Program

The Healthy Babies, Healthy Children Program offers the necessary assistance to ensure babies and children up to six years have the right environment and the conditions they need to be healthy and develop correctly.

The services single parents can access through this program are:

• Assessments and screenings meant to discover any risks your child may be facing

• Support for new parents

• The inclusion of parents into community programs that can help them raise a healthy child, such as parenting programs, breastfeeding support groups, and other health-connected programs

The program is entirely free and available for pregnant women and families with small children younger than six. Your doctor can give you the necessary information, you can contact the local public health unit or an Ontario Early Years Centre.

Healthy Smiles Ontario

Low-income families that cannot cover dental care costs for their children can benefit from the Healthy Smiles Ontario program. Free dental care is available for children up to 17 years old if they are eligible.

The Healthy Smiles program covers the costs for routine check-ups and cleanings, cavity fillings, x-rays, scaling, extractions, and emergency treatments.

Your children will be automatically enrolled in the program if they already benefit from Temporary Care assistance or Assistance for Children with Severe Disabilities, or if your family benefits from Ontario Works or Ontario Disability Support.

Along with being residents of Ontario, your family must meet the income requirements from the table below in order to qualify for the benefit:

Number of dependent children in the household | Family's net income |

|---|---|

1 child | Under $24,347 |

2 children | Under $26,189 |

3 children | Under $28,032 |

4 children | Under $29,874 |

5 children | Under $31,717 |

6 children | Under $33,559 |

7 children | Under $35,402 |

8 children | Under $37,244 |

9 children | Under $39,087 |

10 children or more | Under $40,929 (Add $1,843 for each additional dependent child to calculate the income level) |

To apply for the program, you need to enroll by mail or online. When you start filling in the application, you will need to provide the child’s date of birth, a current Ontario address, your Social Insurance Number, and your taxes filed for the previous year.

You must also print and sign a consent form to send to Healthy Smiles Ontario within 30 days. After the enrolment, your child's dental card will come in the mail.

Infant Hearing Program

If your child has hearing issues, it's crucial to find out as early as possible. The Infant Hearing Program helps through screenings and support services. With this program, all newborns will be assessed to check for permanent hearing loss, and those who are at risk will be monitored. If necessary, the program also provides language development assistance.

For most babies, the screening test shows there is nothing wrong with their hearing. However, if the doctor considers that more tests are necessary, or if the screening was not completed, they will go through a full hearing assessment.

If the results show that your baby has permanent hearing loss; you will receive support in understanding this condition and be given access to available services. You also will be referred to local hearing programs.

Ontario Child Care Tax Credit

The Ontario Child Care Tax Credit is provided to help parents cover the cost of childcare and support families living on a low income.

The CARE (Childcare Access and Relief from Expenses) tax credit is calculated according to the following factors:

• Your family income, based on the numbers used for the Child Care Expense Deduction

• Your eligible childcare costs

The amount a family can receive is calculated by assessing your eligible childcare costs multiplied by the credit rate. In the table below, you will see an example of how the credit rate is estimated:

Family Income | Rate Calculation | Examples – Family Income | Examples – CARE Tax Credit Rate (percent) |

|---|---|---|---|

Under $20,000 | 75% | $10,000 | 75 |

Between $20,000 and $40,000 | 75% minus 2p.p.* for every $2,500 over $20,000 | $25,500 | 69 |

Between $40,000 and $60,000 | 59% minus 2p.p. for every $5,000 over $40,000 | $45,500 | 55 |

Between $60,000 and $150,000 | 51% minus 2p.p. for every $3,600 over $60,000 | $95,000 | 31 |

Over $150,000 | 0% | $150,000 | 0 |

*p.p. meaning percentage points

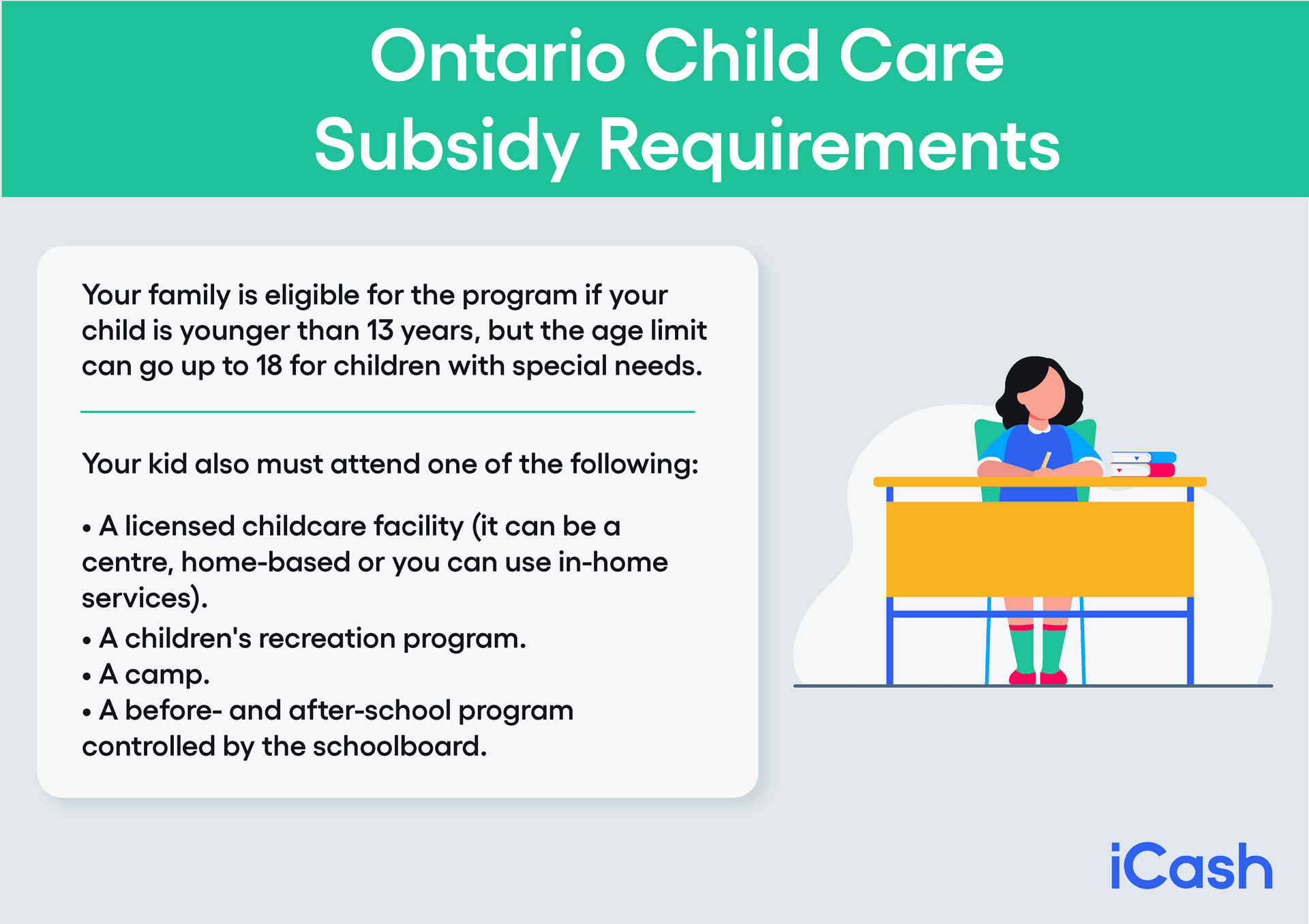

Ontario Child Care Subsidy

The Ontario Child Care Subsidy receives combined funding from the Ontario government, municipal governments, and First Nations communities. The goal of the program is to help families with low-income pay for qualified childcare.

Your family is eligible for the program if your child is younger than 13 years, but the age limit can go up to 18 for children with special needs. Apart from the age requirement, your kid must attend one of the following:

• A licensed childcare facility (it can be a centre, home-based or you can use in-home services)

• A children's recreation program

• A camp

• A before- and after-school program controlled by the schoolboard

The amount you can receive is calculated according to your family's adjusted net income. You can determine this amount by looking at line 236 of the Canada Revenue Agency personal income tax form and subtracting the Universal Child Care Benefit payments, which aren't relevant to the support program.

The funds for these free subsidies come. To apply, you need to contact the local Consolidated Municipal Service Managers (CMSMs)/District Social Services Administration Boards (DSSABs), or the local band office administrator, for First Nations.

If even with the Child Care Subsidy you still find yourself struggling to pay bills at the end of each month as a single parent in Ontario, consider applying for an instant e-transfer loan with a direct lender. Applications are easy and can be done via an app on your phone. It’s a great solution when you need funds quickly and don’t want to wait on government benefit approval

Ontario Disability Support Program: Income Support

People living with a disability can benefit from the Ontario Disability Support Program, which can provide them with financial assistance. The funds they offer can be used for basic expenses, like food and shelter.

To be eligible for the program, you must meet the following conditions:

• You must be over 18 years old

• You must be an Ontario resident

• Be struggling with finances

• Have a disability that matches this program's definition or be part of a Prescribed Class

The definition of a person with a disability, according to the ODSP Act, is:

• Someone who has a substantial mental or physical impairment, either continuous or recurrent, which the doctor expects to last more than a year.

• Someone whose impairment causes severe restrictions in terms of ability to work, self-caring, and participating in community life.

• Someone who has had an approved health care professional establish the impairment, how long it's expected to last, and the restrictions that it causes.

Financial need, in general, can be a bit relative, but as far as eligibility for this program is concerned, it requires the costs of your family's basic expenses to be greater than your income and assets.

An ODSP caseworker will review your situation and determine the correct amounts. To do that, they will ask you to show documents that illustrate the essential costs of your household, as well as any money entering your home and assets family members own.

To establish your exact financial situation, the caseworker may need to contact third parties. For that reason, you will also have to give them your written consent to disclose and verify your information.

You won't know with certainty if you are eligible until your caseworker tells you so. But you can get a general idea of your chances by using the online application for social assistance. Even if you have applied for the benefit program and are approved, don’t forget you can still apply for odsp payday loans online for those immediate cash needs and unforeseen expenses.

Once your financial need has been established, you can apply in a few different ways: by contacting the local ODSP office in person or by phone, or via an online application. You will then have a personal meeting with your caseworker, so you can read and sign a few extra documents

If you qualify, you will receive:

• Health benefits

• Disability-related benefits

• Employment incentives and benefits

The last part is applicable when you become able and want to work. The program can cover costs for training, childcare, extended health coverage, and the transition from the program to being employed.

Ontario Low-Income Individuals and Families Tax (LIFT) Credit

The Low-income Individuals and Families Tax Credit provides families living on a low income with a non-refundable tax credit of up to $850. The credit came into effect in January 2019, and you can claim it when filing your tax return.

If you want to determine your LIFT credit, you must take the following two steps:

1. Determine the maximum amount, which can be either $850 or 5.05% of employment income, whichever is lower

2. Bring down the amount calculated above by 10% of the adjusted income. Keep in mind that the income you consider must be the greater of the following: adjusted individual income over $30,000, or adjusted family income over $60,000

The amount after the second step will be limited to the taxpayer's Ontario Personal Income Tax otherwise payable.

As for eligibility, you need to be a Canadian resident and live in Ontario with the ability to file a tax return.

You cannot qualify for this tax credit if you are in one of the following situations:

• You don’t have Ontario Personal Income Tax payable.

• You don't receive any employment income.

• Your adjusted individual net income is over $38,500.

• Your adjusted family net income is over $68,500.

• You were imprisoned for more than six months during that year.

Ontario Works

The Ontario Works program can help you when you are unemployed and trying to find a job. Despite your best efforts, employment can be difficult to find before your financial reserves run out. So, this program will help you with your essential expenses while you continue to look for a job.

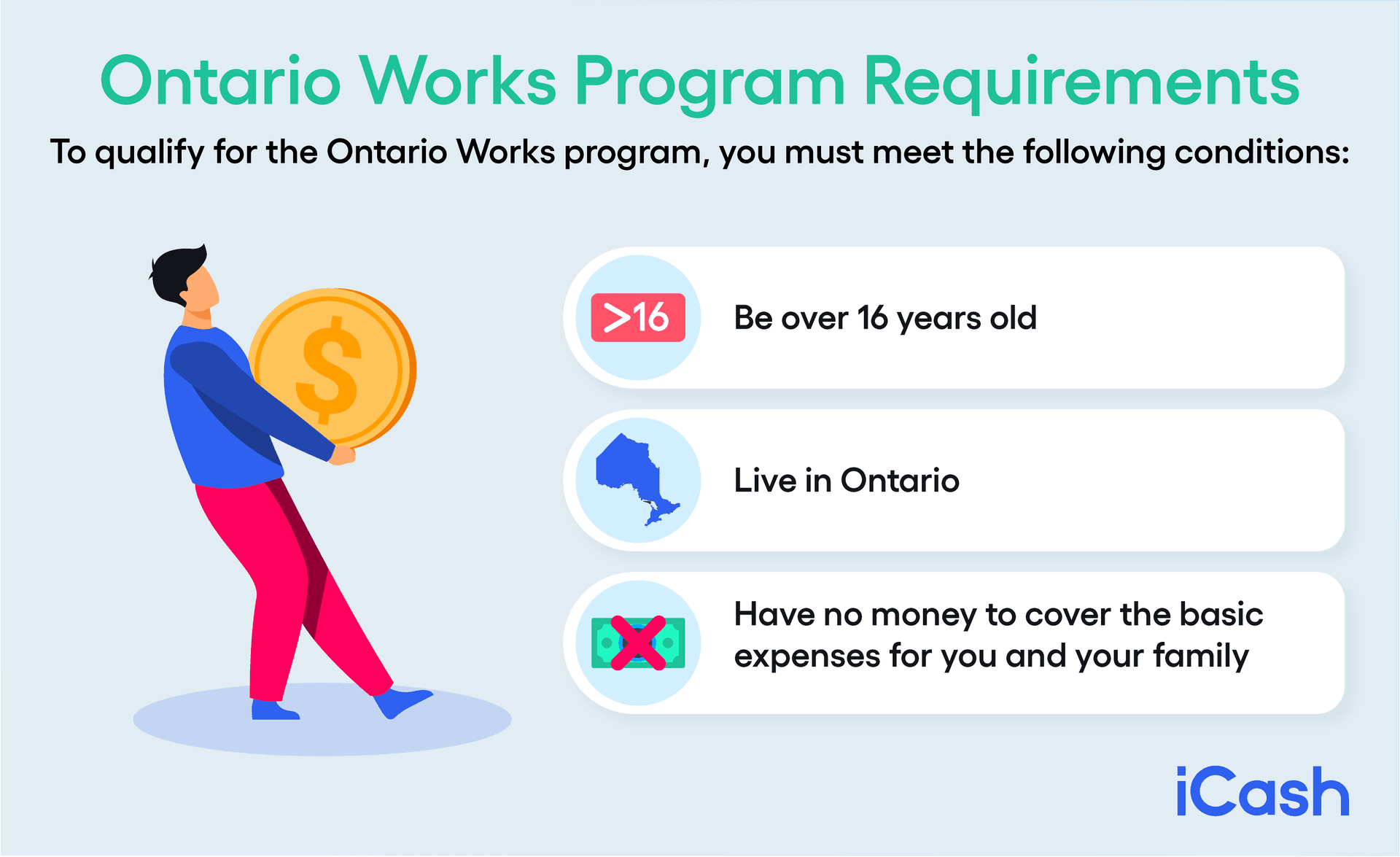

To qualify for the Ontario Works program, you must meet the following conditions:

• Be over 16 years old.

• Live in Ontario (not just visiting).

• Have no money to cover the basic expenses for you and your family.

Ontario Works offers two types of support. You can receive financial aid to pay for food, clothes, shelter, and basic medical expenses for you and your family. You will also receive help to find the job you need so much.

That means that you will take part in workshops to develop your abilities and learn how to draft an efficient resume; you will go through job training and counseling to help you find the type of work you can perform well.

The amount you receive depends on the applicant’s exact situation. However, you could get $733 per month and possibly more benefits for you and your family members.

You can apply for Ontario Works online. You only have to submit one application for you and your family members. This is the information you will have to provide.

This is the information you will have to provide on you and your family:

• Names, dates of birth, and status in Canada

• Social Insurance Numbers

• OHIP Card number

• Birth certificate

• Your address

• Tax returns

• The minimum costs for your household

• E-mail addresses of all family members older than 18 years

• The total monthly income and your family's assets

• Additional expenses (childcare, for instance)

• Your bank account information for direct deposit

A verification meeting with a caseworker will follow. Within four business days from the meeting, they will inform you whether you were approved and how much you can receive, and when to expect the first payment.

You will also have another meeting to help create an efficient strategy to find a job and participate in activities that can help you reach your goal.

Key Takeaways: Single Parent Benefits in Ontario

As a single parent, you are aware of the difficulties in raising children with limited funds. But, as you can see, the Ontario government funds available are quite varied, and the amounts available can make a difference.

If one of your children has a disability or special health requirements, additional funds are available to help you cover those expenses. If you go through a truly challenging period, you know you can rely on assistance, at least as far as basic living costs are concerned.

Despite all the help these programs offer, the challenges you face can sometimes be too hard to handle. So, when unexpected costs appear, and it's crucial to cover them immediately, you need an alternative source of money.

In such cases, when it's imperative to get the money you need, loans in Ontario are a valid option. Private lenders like iCash will offer a different borrowing experience from the traditional loans you may have used before. You can get up to $1,500 to use for your urgent expenses.

Online lenders are a great option because they make the entire process straightforward and comfortable. You will know immediately if you qualify, and once you sign the contract, the money will be available that same day. Since these loans are designed to help as many people as possible, there is no minimum credit score or collateral requirement. It's merely a back-up plan you can turn to when the situation is too complicated, and even the benefits prove to be insufficient.

About the author