What is Debt?

According to Merriam-Webster, the simple definition for debt is something owed. In the context of this article, we will explore debt in terms of a borrower’s obligation to repay someone (the creditor) an agreed value in a certain amount of time.

A 2019 survey revealed that 73.2% of Canadians had some form of outstanding debt. Of those in debt, 31% believed they possessed more than they could comfortably repay.

There are various types of debts from student loans to credit cards to purchasing a home, collecting liabilities throughout our lives is normal. It can be managed. Knowing which can help and which can harm your financial well-being is essential to keep your credit report and by association your score in good standing.

Let’s have a look at different types of debt, how they can hurt (or help you), the good vs. bad, and what debt-to-income ratio means.

• Different Types of Debt

• How Can Debt Hurt You?

• Good vs. Bad Debt

• What is Debt-to-Income Ratio?

• Control Your Debt

Different Types of Debt

There are four main types of personal debt that everyone will experience at least once in their life: secured, unsecured, revolving and mortgages. It’s important to remember that not all liabilities are created equal. Some can actually be better for you than others.

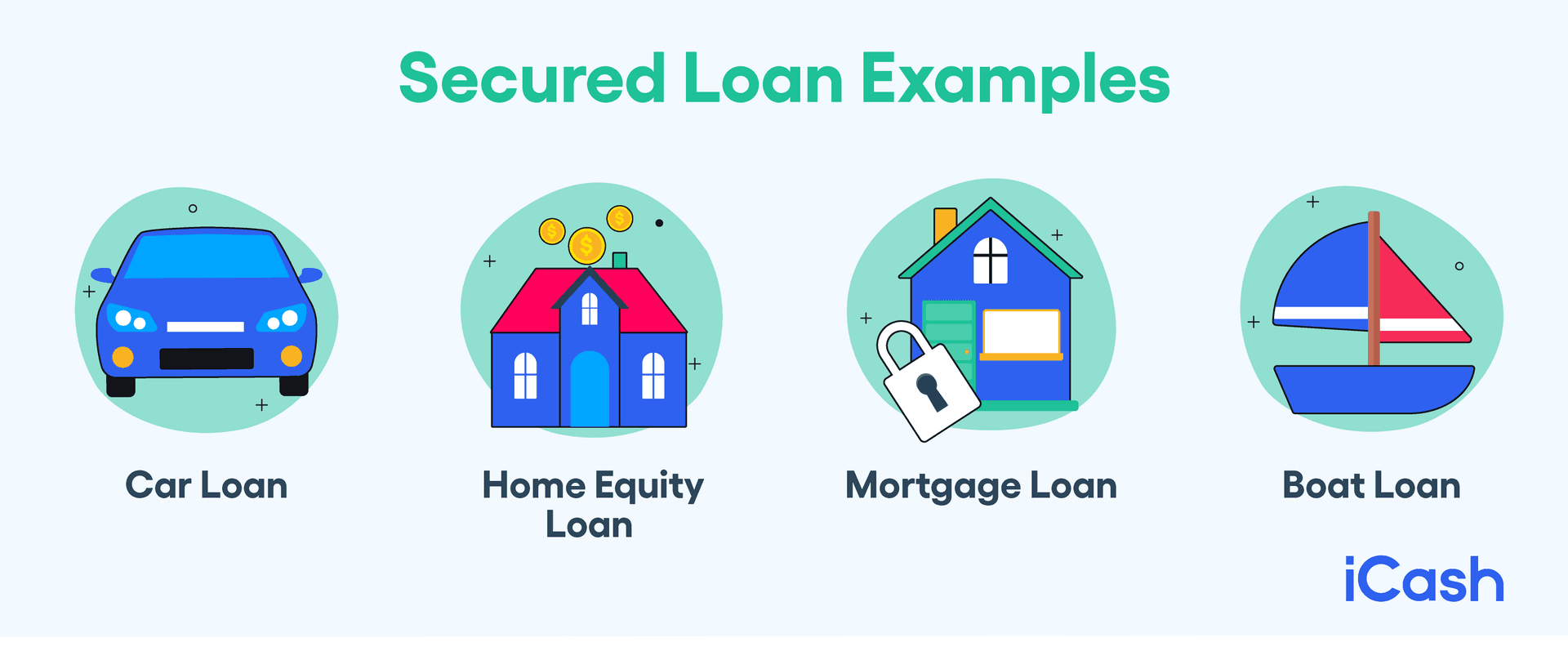

Secured Debt

This type of loan is backed by an asset as collateral. This means that the borrower has something that the lender can seize should the repayment plan not be followed. A credit check is done before the borrower is granted money from the lender in this case.

Rates are generally lower for these types of secured loans and are based more on the borrower’s financial responsibility via the credit report. Examples of secured debt include:

- Car loan

- Mortgage for a property

- Home Equity Line of Credit

In the above examples, the lender has a claim of ownership over the vehicule. If the owner misses a payment, the lender can repossess the car.

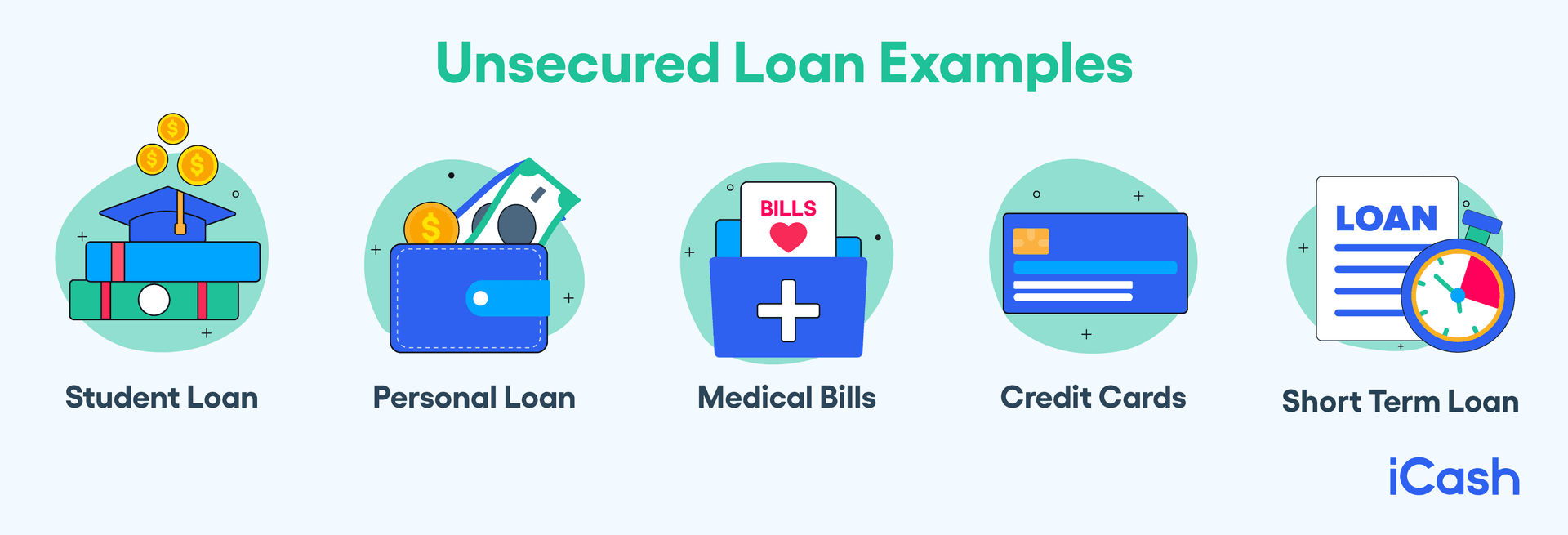

Unsecured Debt

On the other hand, an unsecured loan is all about the borrower’s creditworthiness. There is no collateral, and the interest rates are usually much higher with these types of loans. It’s important to remember that the debtor is bound by the lender’s contractual agreement to repay the amount borrowed in a set period of time.

Credit cards, personal loans, medical bills, and even a gym membership are all examples of unsecured debt.

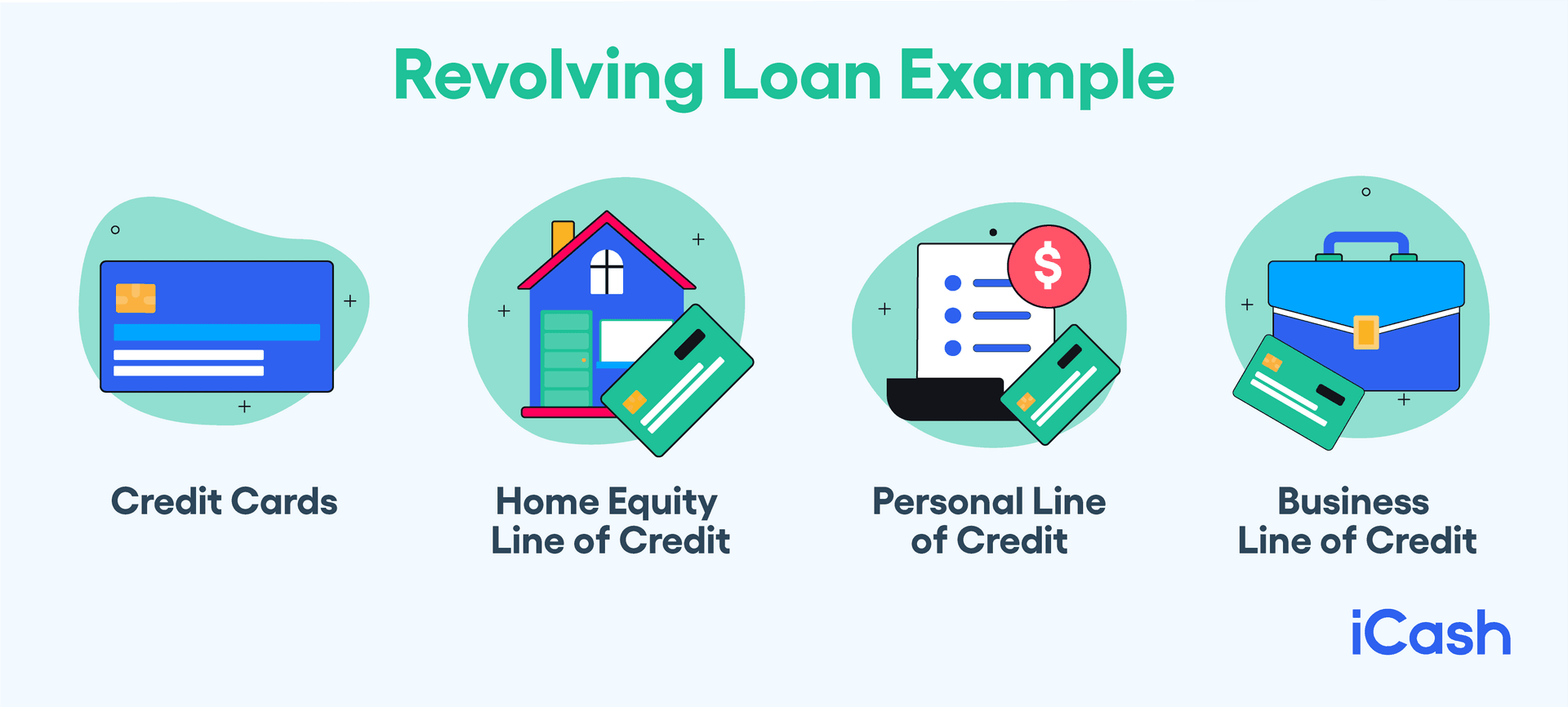

Revolving Debt

A revolving liability can be either secured or unsecured. A lender will agree to loan a certain amount to a borrower (to a maximum limit) on a recurring basis. A credit card is a revolving debt, that’s also unsecured. While a home equity line of credit is also revolving but is secured.

This might be one of the more dangerous types of debt because it is seemingly never-ending. Having an open-ended amount of a recurring loan at your disposal requires a great deal of dedication and discipline to ensure payments are made regularly and on time.

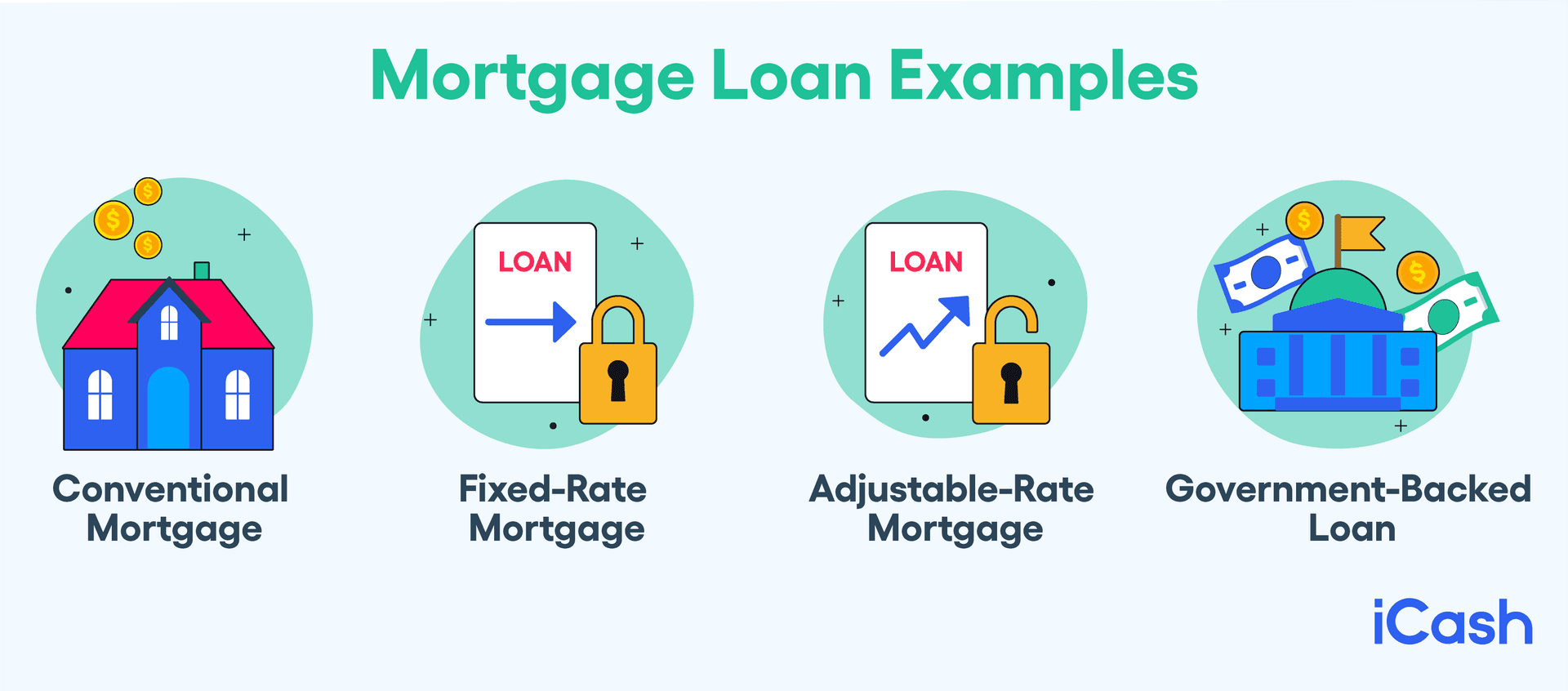

Mortgages

This is the most common and largest debt Canadians possess, and it continues to grow yearly as house prices rise. They also offer the lowest interest rates of any other loan. Mortgages are given in order to purchase a home - and they are secured, with the house itself acting as collateral.

Mortgages are typically 15- to 30-year term loans in order to make the monthly payments manageable for the homeowner.

How Can Debt Hurt You?

Owing money can weigh heavily on some for a multitude of reasons. It can hurt your pride, your financial goals, savings plans, and even your retirement. Being indebted to creditors or lenders doesn’t have to be stressful, but it can be harmful if you don’t stay on top of those monthly payments.

High Debt = Low Credit Score

One of the most detrimental results of high debt is a lowered credit score. The more liability you have, the lower that final number will dip. A bad score can directly affect your ability to apply for large purchase loans for a car or even a mortgage.

It can be a vicious cycle, but there are options when you need funds quickly. Reputable online lenders, like iCash, offer safe and secure cash advance loans even if you have a bad credit score.

Stress

Money worries are one of the main causes for marital breakdowns. With 41% of Canadian marriages ending in divorce, there’s a good chance financial woes and accumulated debt has a great deal to do with that statistic.

Constantly thinking about your financial health can cause high levels of anxiety and even lead to loss of sleep and lack of focus, overall.

You can curb those sleepless nights worrying about the money you owe by taking control of your debt. Consider relief options like consolidation, credit counselling or even filing for bankruptcy.

It might not seem like the best option, but when you’re drowning in payments it is often the only way out. You can also come back from bankruptcy and build your credit score back up, don’t forget that.

Working Multiple Jobs

If you owe money to multiple lenders and the light at the end of the tunnel isn’t at all visible, some will turn to taking on multiple jobs just to cover the payments. This is all part of the stress caused by poor financial standing and a need to claw your way back out.

Working just to pay off debts is no way to live.

Instead, consider creating an effective budget that incorporates a debt-reduction strategy, as well as a savings goal.

Unable to Save for Retirement

If all your available income after paying your set monthly expenses is going towards paying off money owed, then your savings account and retirement plans may be put on hold.

Debt can hurt you the most by preventing you from appropriately planning for the future.

It is so important to set a retirement plan as early on as you can. Contributing to a Registered Retirement Savings Plan (RRSP), opening up tax-free savings accounts or inquiring about RRSP contribution match programs at work are all excellent ways to ensure your financial future is secure.

Good vs. Bad Debt

It might seem a little weird, but there is such a thing as a good liability. Now, it can vary from person to person depending on their life situation and financial history, but in general it’s fairly easy to tell the difference between what’s good and bad.

In essence, good debt can increase your net worth and enhance your life in some way. While bad debt refers borrowing money simply to purchase a depreciating asset (an item that immediately loses its value).

Good Debt

If you take on a loan in order to make more money down the road (i.e., get a higher-paying job), then you are increasing your net worth. This is good debt. If you are enhancing your life, as well as your family’s, by taking on some form of money owed, this can also be seen as a positive.

Here are a few perfect examples of good liability in life:

Education: We often think of student loans as negatives - hanging over the heads of newly graduated students. However, it’s important to remember that some degrees offer high-paying jobs upon graduation, and so taking on that debt is worth the end result.

Buying a Home: This is one of the best debts to acquire. A home is an asset that, over time, can gain in value. The best thing to do when purchasing a home is to commit to living in it for a decade or more to let its price go up, then sell it to make a profit.

Unlike other liabilities, homes can also provide income! Renting out a property you own means you can charge your renters monthly for an amount that covers your mortgage payment, plus a little extra, thus increasing your revenue.

Opening a Business: This one isn’t for everyone, and it does involve a certain amount of risk. However, the benefits of owning your own business can be well worth the initial loan. While the cost of starting your company can be high, if you succeed then it could be financially and even emotionally rewarding to be your own boss and run your own venture.

Bad Debt

These types of loans do absolutely nothing to increase your net worth or help you in any way. Bad debt is when you borrow money to purchase an item that immediately loses its value the moment it’s bought.

Good examples of bad debt are:

Car: The moment a vehicle is driven off the lot, it’s already lost a huge amount of value. New cars depreciate 40%-50% in the first five years of ownership.

Of course, it’s hard to suggest you avoid purchasing a vehicle altogether. However, when you do, make sure you find a low- to zero-interest rate loan. Many manufacturers offer lower rates on previous model-year cars or certified pre-owned units.

Clothes and Other Goods: We all need clothes and furniture to live comfortably. You should avoid purchasing these consumables on credit.

There is no need to borrow money to buy new clothes. If you use a credit card to pay for larger items like a TV or couch, make it a point to stick to the payment plan and don’t let bad debt linger.

When Debt isn’t Good or Bad

Not all debt can be classified as good or bad. There is a grey area when it comes to loans, and it varies from individual to individual. The scale will tip from positive to negative depending on the financial history of the borrower.

Borrowing Money to Pay off Debt

Debt consolidation plans from a bank or reputable lender can be good and help get you out of that liability spiral. These loans usually have low rates and can be paid down with automatic deposits made into the loan account weekly or monthly.

This will ensure you pay down your debt in the prescribed time, and it also helps keep all the money you owe in one place with one large sum amount to paid down instead of having to pay multiple creditors and keep track of those different monthly minimum amounts.

Borrowing Money to Invest

Now, this is pro-level investor territory and is not for everyone. This method of investing could potentially make you money. However, it has the downside of possibly costing you money, and it may end up being more than you can comfortably pay back. This could put you in a worse position than when you started.

What is Debt-to-Income Ratio?

This compares the amount of debt you have to your overall income and is often referred to as DTI. Lenders look at this percentage to assess your reliability when it comes to paying back loans. A low DTI makes it easier to apply for a line of credit or same day loans.

To properly calculate your DTI, you simply divide your combined debts by your gross income to come up with a percentage. For example: If your monthly fixed expenses (mortgage payment/electricity/car payment/debts) add up to $2,000 and your gross income is $6,000, then your debt-to-income ratio is 33%.

Try our debt-to-income ratio calculator and see where you stand.

In the first quarter of 2021, Canadians had an average DTI of 172.3% meaning each owed $1.72 in mortgage loan liabilities for every dollar of disposable household income earned. Now, this is taking into consideration each home’s total amount, not just the monthly payments, to calculate the final percentage.

Banks and lenders look for a DTI under 36% when considering loan applications. They also prefer that no more than 28% of that goes towards paying your mortgage, monthly.

Note that your DTI does not influence or affect your credit score because agencies don’t know your income so they can’t calculate the final percentage.

Control Your Debt

The first step in controlling your debt is understanding it. Knowing the different types, and how they can help or hinder you is a great way to begin paying down any money you may owe. It’s also an excellent way to stop you from accumulating any other negative debts in the future.

Of course, there are always unexpected costs that crop up even when we budget accordingly. For those moments, turning to a trusted online lender like iCash to apply for a quick cash loan in Canada is the best option.

Turn it into a good debt by adhering to the repayment conditions and start your journey towards solid financial footing.

About the author