Guide To: Free Canadian government grants to pay off debt

Being in debt can be frustrating. It robs you of your joy, peace of mind, and you have to spend the rest of your life wondering how to settle it. So, if you're looking for an easy way out of debt, we get it! The problem is, there are only so many options that you have.

One, you can borrow money from friends and family members to settle the debt. Unfortunately, this sometimes doesn't work! Payday loans with government benefits can also suffice if you make the cut. Another option that works a lot of the time is trying out free government grants.

You've probably come across free government grants and have no idea how they work. The good news is, that's what we're going to cover in this guide. We don't like to see how bad debt can ruin lives.

That's why we're committed to providing reliable solutions to help single parents and anyone who needs help out of debt. So, let's jump right in!

• Canadian Government Debt Relief Programs

• Debt Payoff Programs

Canadian Government Debt Relief Programs

What first comes to your mind when you hear the phrase 'free Canadian government debt relief?' The first things you see are free, Canadian government and grants. But does this mean it's the government issuing free grants to help people get out of debt?

Nothing can be further from the truth! The thought of the government coming to your rescue to help you stay out of debt can be exciting. Unfortunately, the Canadian government doesn't offer debt relief directly.

Instead, the government has established debt relief programs through policies. The companies that advertise free Canadian government loans aren't usually dealing directly with the government.

The government creates standards and regulations to enable these companies to facilitate loans and grants to their customers. So, while all may seem lost, you can rise off the ground, dust yourself and take advantage of these government-facilitated grants.

Let's get started by looking at how to pay off debt through the different programs supported by the Canadian government. This is the governments' way of pushing for a debt-free Canada. However, you can only find the best fitting plan for you after evaluating the pros and cons.

Debt Payoff Programs

That being said, the different debt payoff programs that operate under the Canadian government approved standards and regulations are;

• Debt consolidation

• Credit counselling

• Debt settlement

• Consumer proposal

• Personal bankruptcy

But this is only the scratch on the surface. Below is the comprehensive overview.

Debt Consolidation

Credit card debt is one of the hardest ones to come out of. Debt from credit cards is unsecured and can pile up within a short time. This is especially if the card owner doesn't have a reliable debt management plan. It's recommended to pay a substantial amount of the debt to clear it.

Sadly, life gets in the way and the debt piles over time. Also, credit card debts attract the highest interest rate, making them one of the worst debts one can have. The situation gets more messed up when you have debt from multiple credit cards.

The most reliable way out of this problem is debt consolidation. Consolidating your debts is a great way to stay organized by combining all debts into a single monthly payment. This strategy also helps you get a significantly lower amount of debt burden.

Think about the exorbitantly high credit card interest rates, forcing you to pay unusually more over the lifetime of the debt. Like that's not enough, you're in financial hardship and making the minimum payment is a hassle.

The credit cards debt burden can be overwhelming. The only sustainable way to handle the situation is by consolidating every debt you have from your credit cards. This opens the door for new low-interest rates, helping you get out of debt quickly. You can also consider the option of online loans if you have a bad credit score.

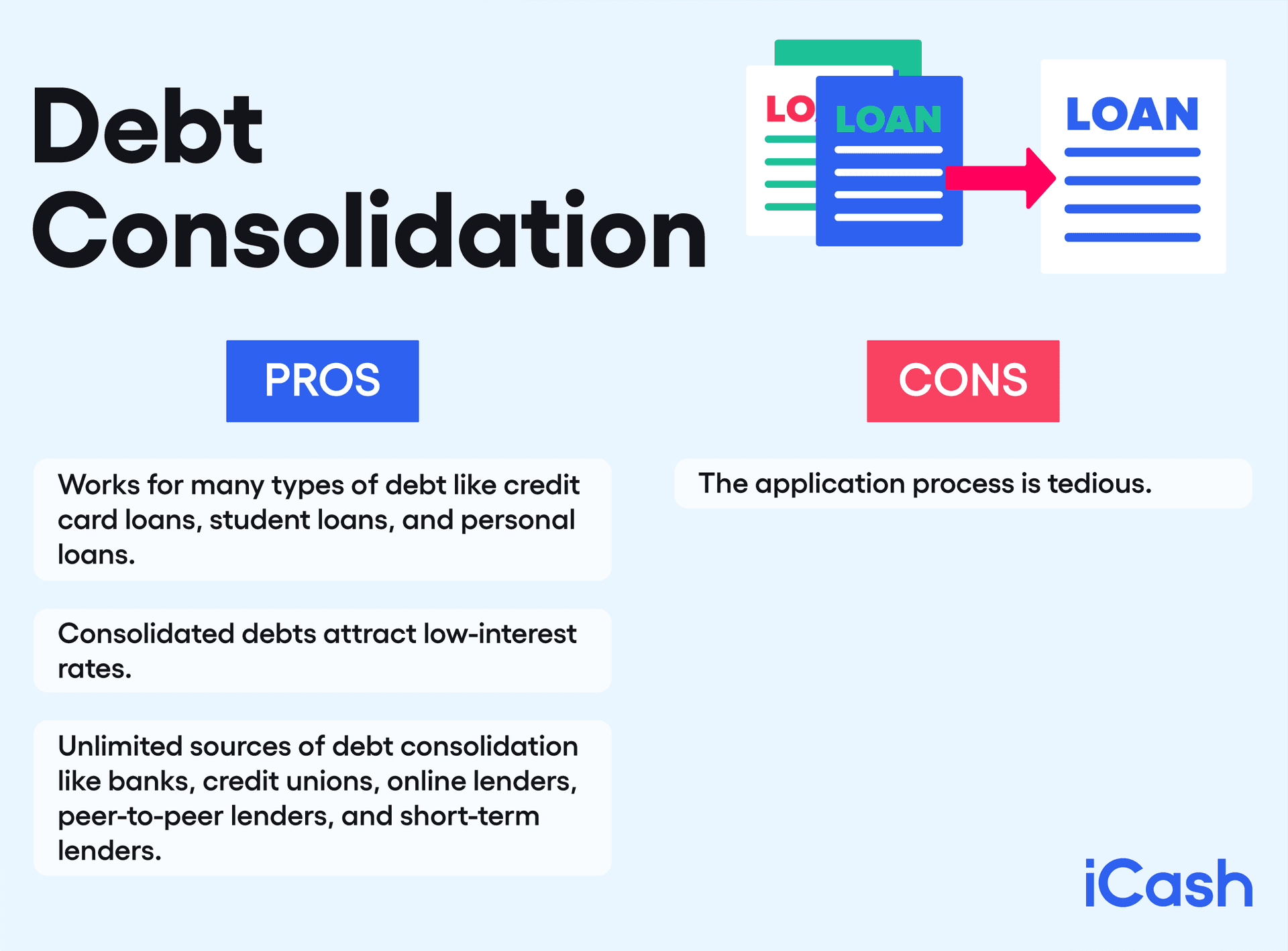

Pros & Cons of Debt Consolidation

• Works for many types of debt like credit card loans, student loans, and personal loans.

• Consolidated debts attract low-interest rates.

• Unlimited sources of debt consolidation like banks, credit unions, online lenders, peer-to-peer lenders, and short-term lenders.

• The application process is rigorous.

Credit Counselling

Sometimes, the reason we get into bad debts is because of inadequate financial literacy. Having the right financial knowledge like proper finance management goes a long way to help stay out of debt.

Crying over spilled milk isn't helpful either. Now that we're in an awful debt situation, it's never too late to seek help from professional loan counsellors.

So, what does a credit counsellor do? You could be asking. Simple! A credit counsellor gives you tips and strategies to pay off your debt in record time. First, they analyze your financial situation, including your assets and liabilities.

Then, they sit you down to discuss the best way to help you manage your income and spending. Overall, they help you watch over your spending habits since this is one area we mostly get wrong. If we can save more, it's possible to have enough to pay the bad debt.

However, if you're looking for a quick fix to your debts, credit counselling may not be a good fit. The loans counsellor's role is to help you manage your finances. So, the sooner you can get your finances up and running, the better for you.

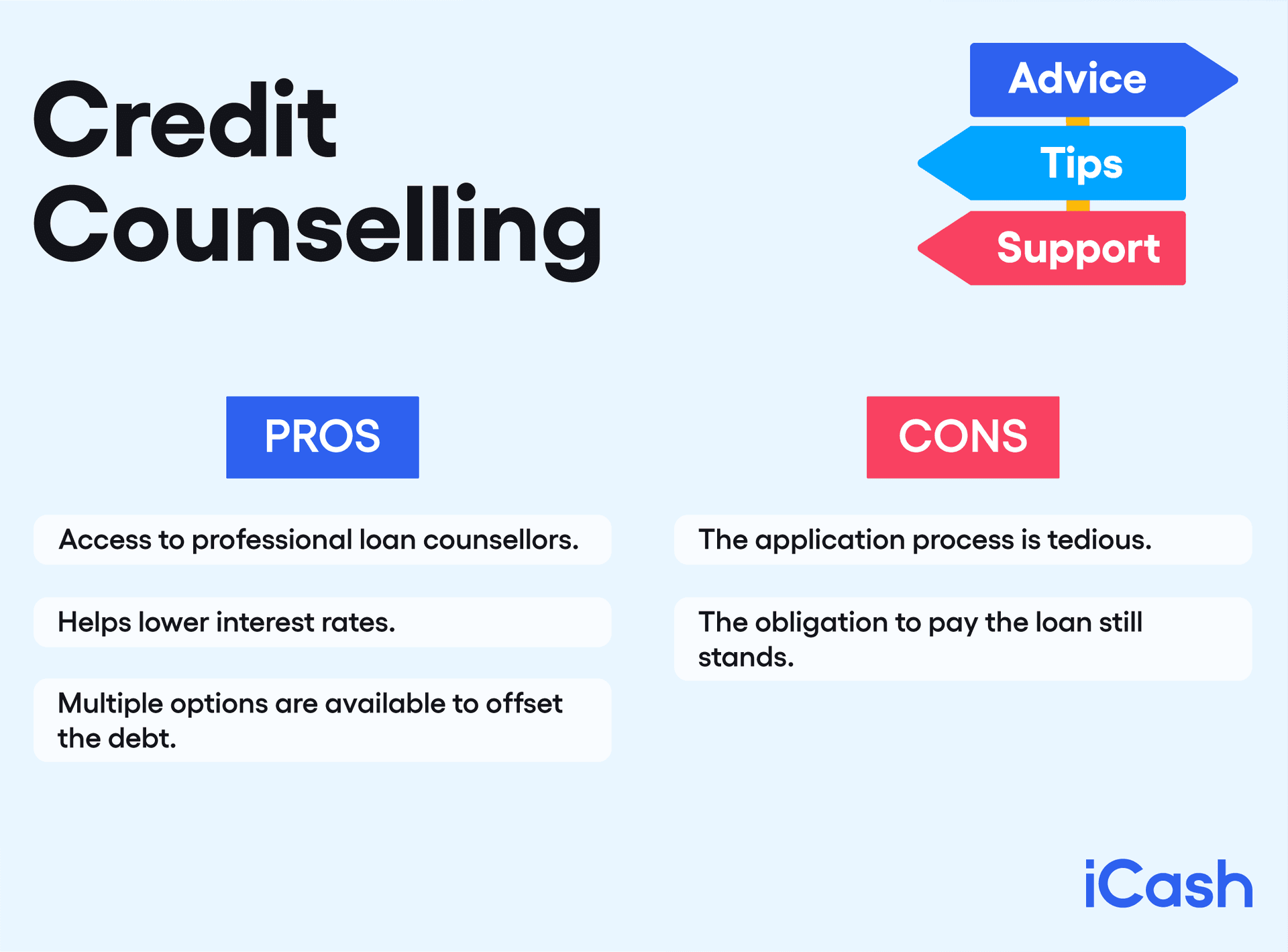

• Access to professional loan counsellors.

• Helps lower interest rates.

• Multiple options are available to offset the debt.

• The application process is tedious.

• The obligation to pay the loan still stands.

Debt Settlement

Debt settlement is an incredible way to handle extremely high debts that you can't clear by yourself. This debt payoff program can come to your rescue when you feel all is lost. So, what does settling your debt mean? You could be wondering.

When you opt for debt settlement, you agree to pay the debt much lower than you owe the creditor. The best part is, you have two ways to do this. You can go solo and talk to your creditor or creditors. Alternatively, you can have a debt counsellor negotiate a better settlement term on your behalf.

The main drawback to this approach is it can ruin your credit score, reducing chances of securing credit in the future. Once a bad debt is settled, it's noted on your credit score.

This can scare away most future lenders because nobody wants to give money to a defaulter with multiple debt settlements. So, you may want to evaluate other debt payoff programs before settling on debt settlement.

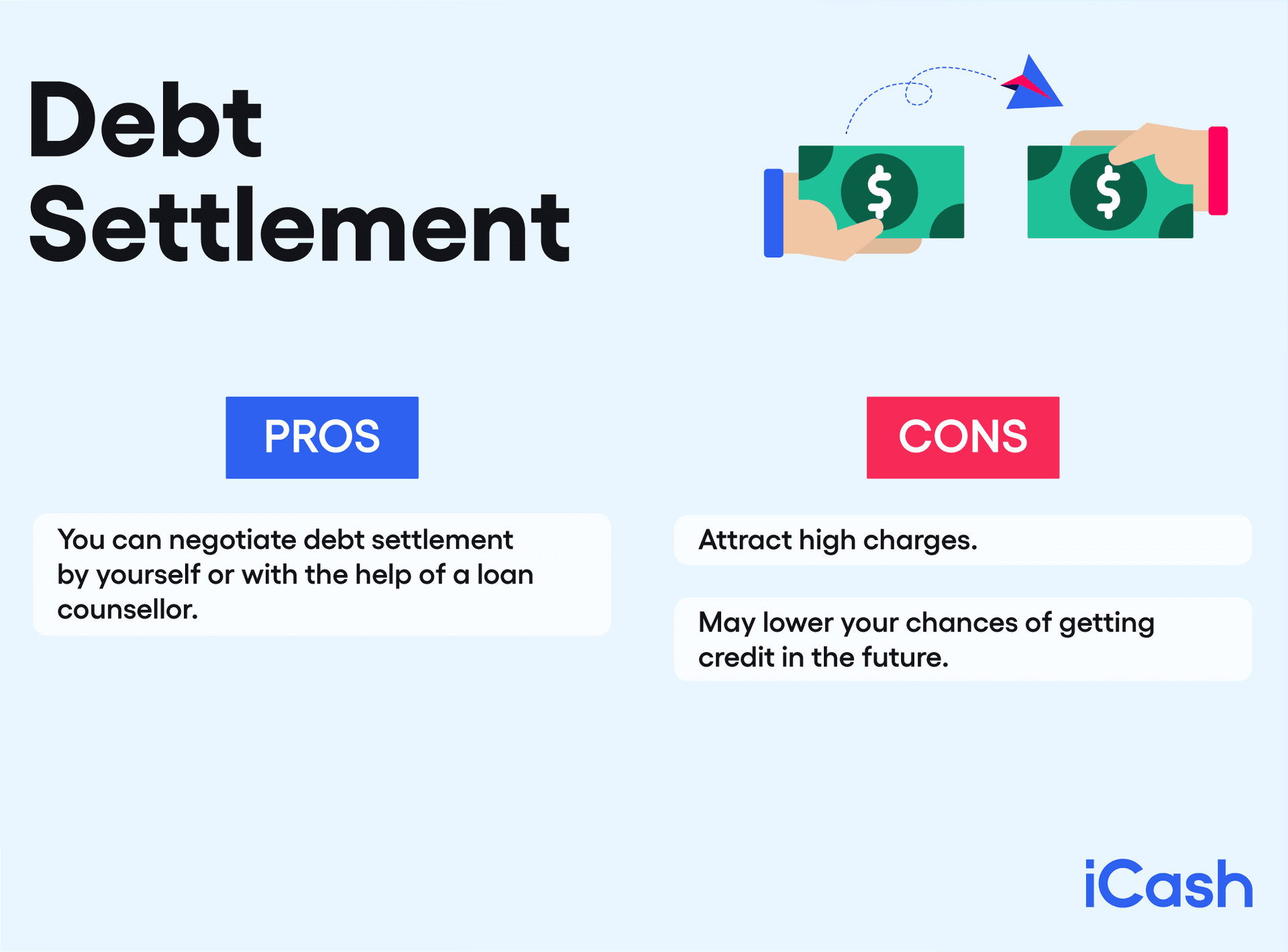

Pros & Cons of Debt Settlement

• You can negotiate debt settlement by yourself or with the help of a loan counsellor.

• Attract high charges.

• May lower your chances of getting credit in the future.

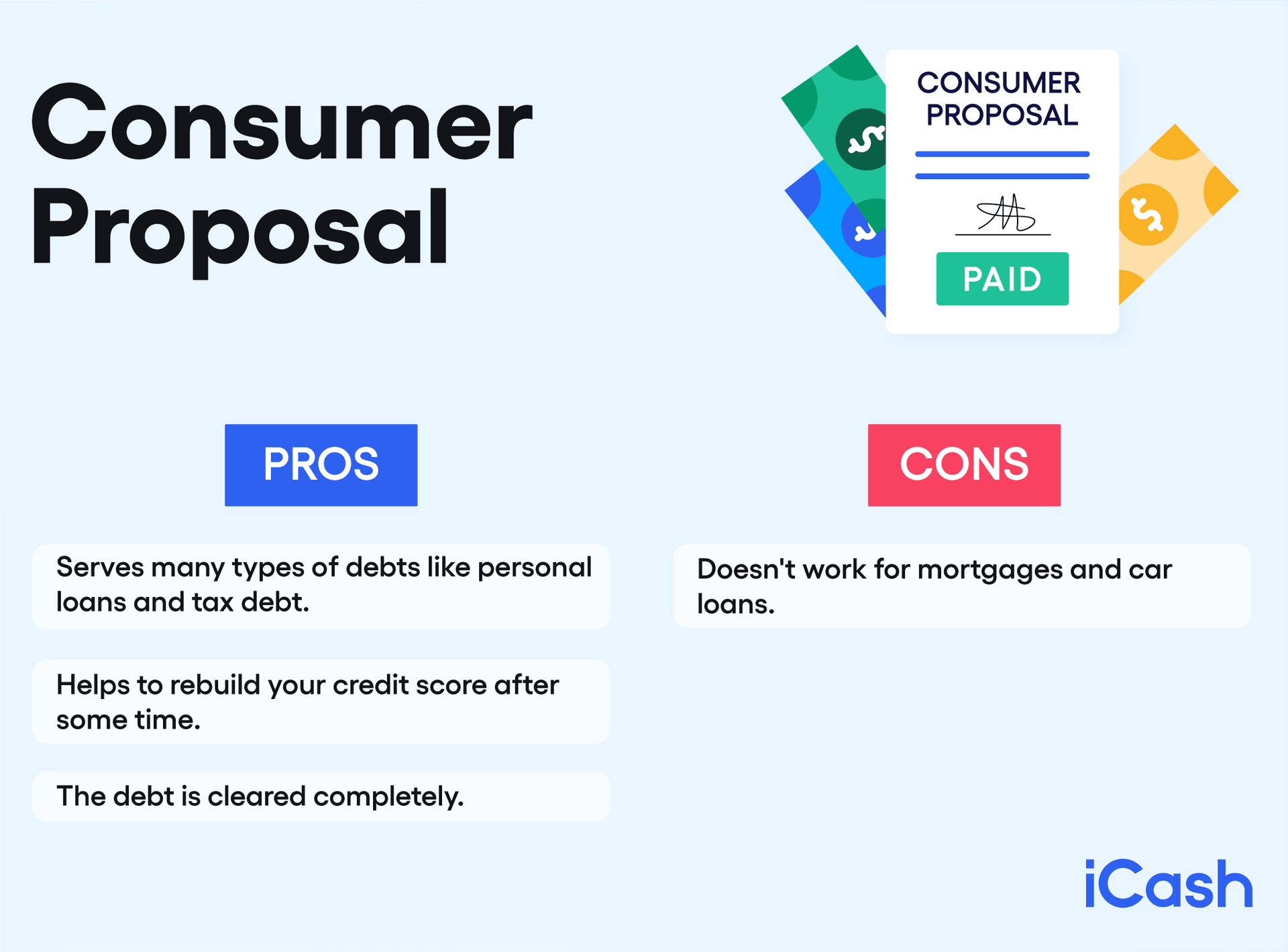

Consumer Proposal

A consumer proposal is a great way to pay back part of what you owe your lender. However, the agreement between you and the lender is legally binding and is closed in the presence of an insolvency trustee.

The best part is consumer proposal works for many types of debts such as credit cards, personal loans, student loans, and tax debts. Whatever the type of loan you have, know that you're covered in the consumer proposal.

Consumer proposal only works when you're a permanent resident of Canada or legally here for work. Also, your total unsecured debt shouldn't exceed $2500.

Pros & Cons of a Consumer Proposal

• Serves many types of debts like personal loans and tax debt.

• Helps to rebuild your credit score after some time.

• The debt is cleared completely.

• Doesn't work for mortgages and car loans.

• Has many restrictions.

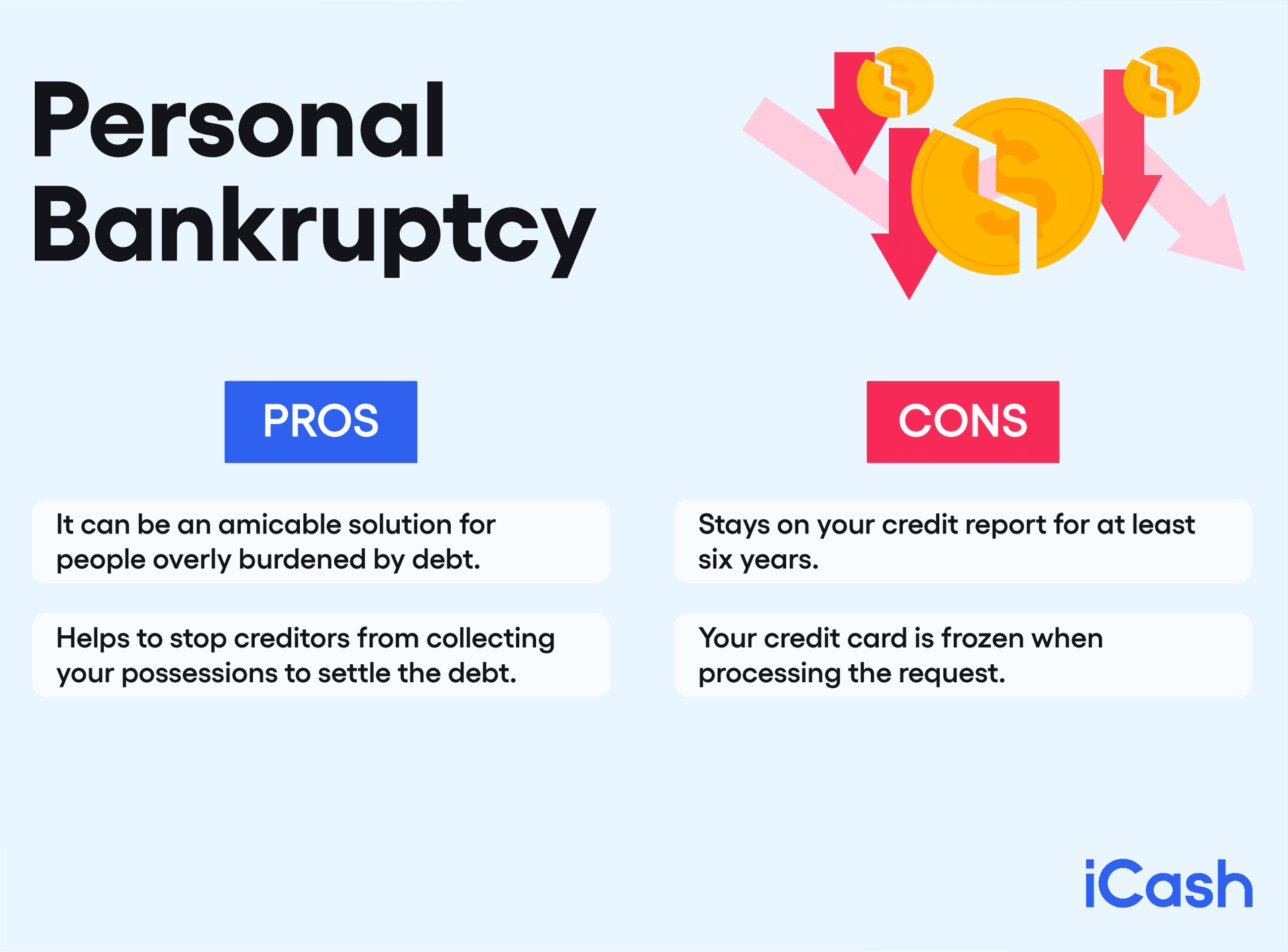

Personal Bankruptcy

Filing for bankruptcy isn't an excellent way to get out of debt. It would help if you only went for this option after evaluating the other alternatives. When you file for bankruptcy, a judge reviews your assets and debts to ascertain you can't pay your debt for real.

Before anything, you need a bankruptcy trustee to help you consolidate your financial information before going to the judge. The judge assesses your assets versus your debt to determine the greater one.

If you're fortunate, the judge can help write off the debt when the debt outweighs your assets. But before this happens, you may be obligated to use your current assets to pay part of the debt.

Pros & Cons of Debt Consolidation

• It can be an amicable solution for people overly burdened by debt.

• Helps to stop creditors from collecting your possessions to settle the debt.

• Stays on your credit report for at least six years.

• Your credit card is frozen when processing the request.

Wrapping UP

Getting out of debt can be a hassle for many people! Nonetheless, one can use debt payoff programs to break free from the bondage of debt. Unfortunately, these solutions have shortcomings, making them unsuitable for some situations.

You'll have to choose the most ideal program that works for you. If you're not sure, talk to a loan counsellor or bounce your thoughts with friends and family members who may have witnessed better options than these. Remember, you're not alone in this debt battle!

About the author