Guide To: 15 Financial Signs You Have a Debt Problem

In a 2018 survey, three-quarters (74%) of Canadians admitted they lived in debt—Ipsos reports. While this may be alarming for you, it's safe to assume the participants in the survey were aware they had a debt problem.

Debt plays a big part in our lives. Most of us have used debt to buy a home, a car, or to pay college tuition. So, there's no condemnation here, only that debt can also be very destructive. The problem is not that you have debt, but it becomes one if it spirals out of control.

Maybe you've reached your credit limit after paying your bills, and now you have to deal with a poor credit score. Even so, you can still access a bad credit loan even if you have bad credit. With this type of loan, you can pay it back with your next paycheck. However, if you fail to get a handle on your debt, it will take away everything you own and add more stress for you and your family.

The emphasis here is to increase your awareness of your debt situation before it's too late. We are committed to ensuring you act smart with debt, such as optimizing it to increase your income and improve your standard of living.

As a result, we have compiled a comprehensive list of 15 debt warning signs, so you can achieve a good financial life.

• 15 Financial Signs That You Have a Debt Problem

• Overcoming Your Debt problems

15 Financial Signs That You Have a Debt Problem

You Don't Know Your Total Debt

The first step is asking yourself how much debt you have and what you need to do to eliminate it. Do you have a credit card or two which you use to pay your bills or groceries? Have you ever checked your bank statement for any outstanding loan? Do you have a student loan and how much interest do you pay? If you can't answer these questions clearly, then you have a debt problem. Knowing how much you owe will give you a reality check and push you to find a solution.

Too High Debt-to-Income Ratio

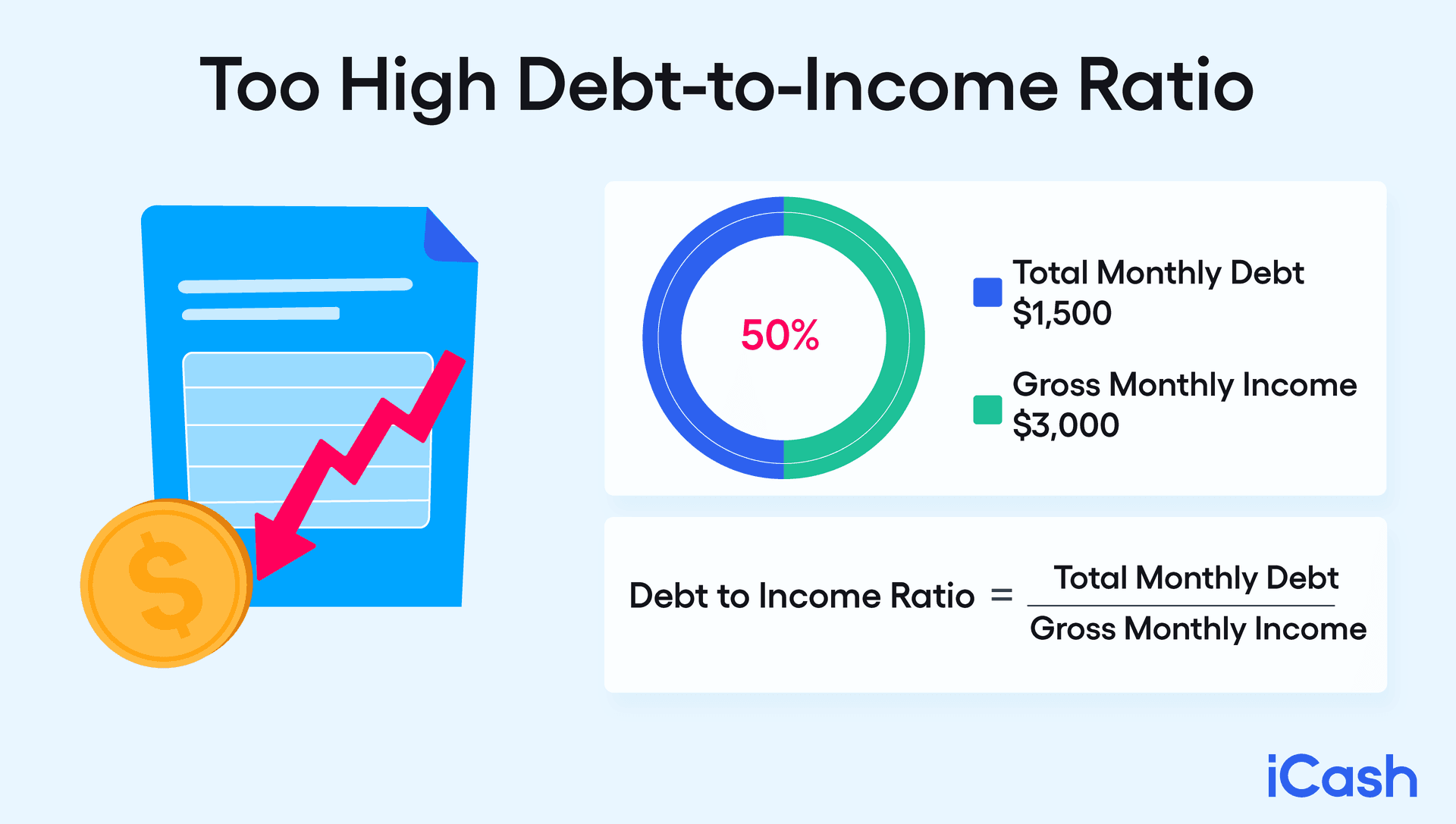

The debt-to-income ratio (DTI) is a percentage of your gross monthly income (pretax) used to pay off your total monthly debts. It's also a measure that lenders use to determine if they should lend to you.

The formula for calculating the ratio is adding up all your monthly debts and dividing it by your total monthly income and multiplying them by 100. To get your total monthly debt payments, you have to add up all debts in the month including insurance, credit cards, mortgage, and rent.

Let's say you earn $3,000 and the total debt per month is $1,500. Your DTI will be ($1,500/$3,000x 100) 50%. This is considered a high debt-to-income ratio, making it difficult to secure a line of credit. You should instead focus more on paying off any balances on your credit card, living below your means, and getting a side hustle.

If your DTI falls towards the lower percentages, such as less than 36%, you can confidently borrow a loan as you can afford it. If you want to calculate your debt-to-income ratio, use this debt-to-income ratio calculator.

Too High Interest-to-Income Ratio

The interest-to-income ratio also reveals your financial position. Companies use it to gauge if they can pay interest on their outstanding debt. It gives you an idea if you can afford to pay your debt interest while paying your bills for the month.

It is determined by dividing earnings before interest and taxes by the interest expense for the period. A high interest-to-income ratio is over 20% of your monthly income. If you have to borrow a loan, first research favourable rates and terms. You can find credit cards for 0% APR.

Minimum Payments on Cards

If you are always making the minimum payments on your credit card, it's a revelation you are struggling to pay off your credit card debt every month. Minimum payments offer temporary relief of not paying late fees and protecting your credit score. However, due to the high-interest charge, you will have a huge balance every month.

To illustrate, let's assume you have a $7,000 credit card balance and your annual percentage rate is 24%. If you're required to pay 3% of your balance, then the monthly minimum payment is $280. This means you will fully pay the balance, including the spread out interest charges, in a little over 25 years. If you decide to pay $350 (5% minimum payment) every month, you will shorten the repayment period and pay less interest in at least 10 years.

Maxed Out Credit Cards

You know you've maxed out your credit card when you can no longer pay for your purchases. Reaching this point endangers your financial stability and is a sign of a debt problem.

This usually happens when you constantly use your credit card without making full payments, leading to the accumulation of interest. You face additional fees for spending beyond your credit limit, and you are also destroying your credit score as a maxed-out card leads to a higher credit utilization ratio.

The general rule of thumb is to get your credit utilization ratio under 30%. The credit score range in Canada is 300-900 with 660 and below being bad. It could be time to cut back on your spending and first pay off any balance you have on your card.

Failure to Pay Bills on Time

We all have bills we need to pay every month, such as gas, water, or rent. Being unable to pay your bills on time or not at all can be stressful. If it happens every month, this piles up your debts because now you have to deal with late payments and interest charges. One solution is to negotiate a payment plan with your creditors. Although it could take time to pay everyone you owe, it goes a long way to reduce your debts.

Borrowing to Pay Bills

If you rely on credit cards to pay for your groceries or electric bills, it means your income is too inadequate. If this becomes a habit where you need debt to survive, you'll be stuck in a vicious cycle. Try to live below your means, so you're not tied to your creditors.

Overdrawn Bank Account

Having frequent negative balances in your account and bounced checks, implies an underlying debt problem. You will keep having more debt as you will be charged with expensive overdrafts and non-sufficient funds fees by the bank. You can start by creating a budget to track your spending and leverage your money to pay off debts. Check out these budgeting tips to get started.

No Savings

Most financial experts recommend having at least 3-6months of savings for living expenses. If you have zero savings, you could be forced to borrow in case of an emergency. Even if you have assets, always ensure you have ready cash, so you don't have to dispose of them. Begin to save towards your emergency fund to avoid trouble whether you have debt or not.

Sleep Problems Because of Financial Stress

Do you find yourself tossing and turning at night because you can't get around your debts? It's time to take stock of your finances, or else you will put your health and productivity at risk. Start practising sound financial habits, such as reducing expenses.

You Can't Get New Credit

When a credit card company refuses to advance your credit limit, you may have high debt or a poor credit score. This should be a wake-up call to get your debt in order. You can consider getting a payday loan which perfectly acts as fast cash for emergencies. It's possible to borrow as little as $100, pay for what you need, and repay easily without being in debt.

Lying About Your Finances

You need to admit to yourself, you're in a bad place financially, if you're hiding your debt or credit situation from family and friends. Don't let debt take over your life if you can do something about it. If you're too embarrassed, find a neutral person such as a financial advisor to create a repayment plan.

Receiving Debt Collection Calls or Letters

Getting calls or letters from creditors can be unpleasant. It's a symptom that your debts have become delinquent and may take you time to pay back everything. Avoiding your creditors will only subject you to a lawsuit, a frozen bank account, or garnished wages.

Wage Garnishment

Wage garnishment is a strategy creditors use to collect payments on debt defaults. Since it's a legal proceeding, it's hard to reverse it unless you go through another legal process. If the creditor succeeds, you will have to accept a cut from your paycheck every month. When you lose control over your wages, then you have a big debt problem.

You Have Multiple Payday Loans

A payday loan is a short-term loan that doesn't require security and has high interest. You can access instant payday loans in Canada that can save the day since they are a quick and easy means to finance your needs. But they come at a price with high-interest charges (as high as 400% APR) and unclear terms which can lock you in a serious debt trap. Even worse, if you have multiple loans, you'll keep struggling to pay them back as you've likely borrowed for an emergency. Always choose a payday loan lender who is trustworthy and reliable.

Overcoming Your Debt Problems

If you can relate to most of these warning signs, you have the chance to turn around your finances. Understanding the difference between good and bad debt is key before committing to a loan. We can help you work towards a debt-free life, by availing affordable and flexible loans to help you achieve your financial goals. Please get in touch with us today.

About the author