How to Improve Your Credit Score

There are a multitude of ways Canadians can improve their credit score, such as ensuring monthly bills are paid on time, maintaining a low debt / income ratio, and ensuring any debt owed is paid in a timely fashion, just to name a few.

In this guide, we’ll look at different ways to bring up your financial standing while improving your credit score, and all within a reasonable time, regardless of your financial past.

What is a Credit Score?

A credit score in Canada is a number between 300 and 900 that will display your creditworthiness. This score, issued by credit bureaus such as Equifax and TransUnion, will give lenders an understanding of the risks involved when providing you with loans. The higher your score, the better.

A higher credit rating means you are financially savvy and follow the steps outlined in this guide to maintain a healthy financial past and future.

What is considered a good credit score? A great score ranges between 741 and 900, while anything above 670 is generally seen as low-risk. Let’s take a look at some key points to remember about your financial history and resulting score.

• Why It is Important to Improve Your Credit Score

• How to Improve Your Credit Score in Canada

• How Long Does It Takes to Increase Your Credit Score

• When to Improve Your Creditworthiness

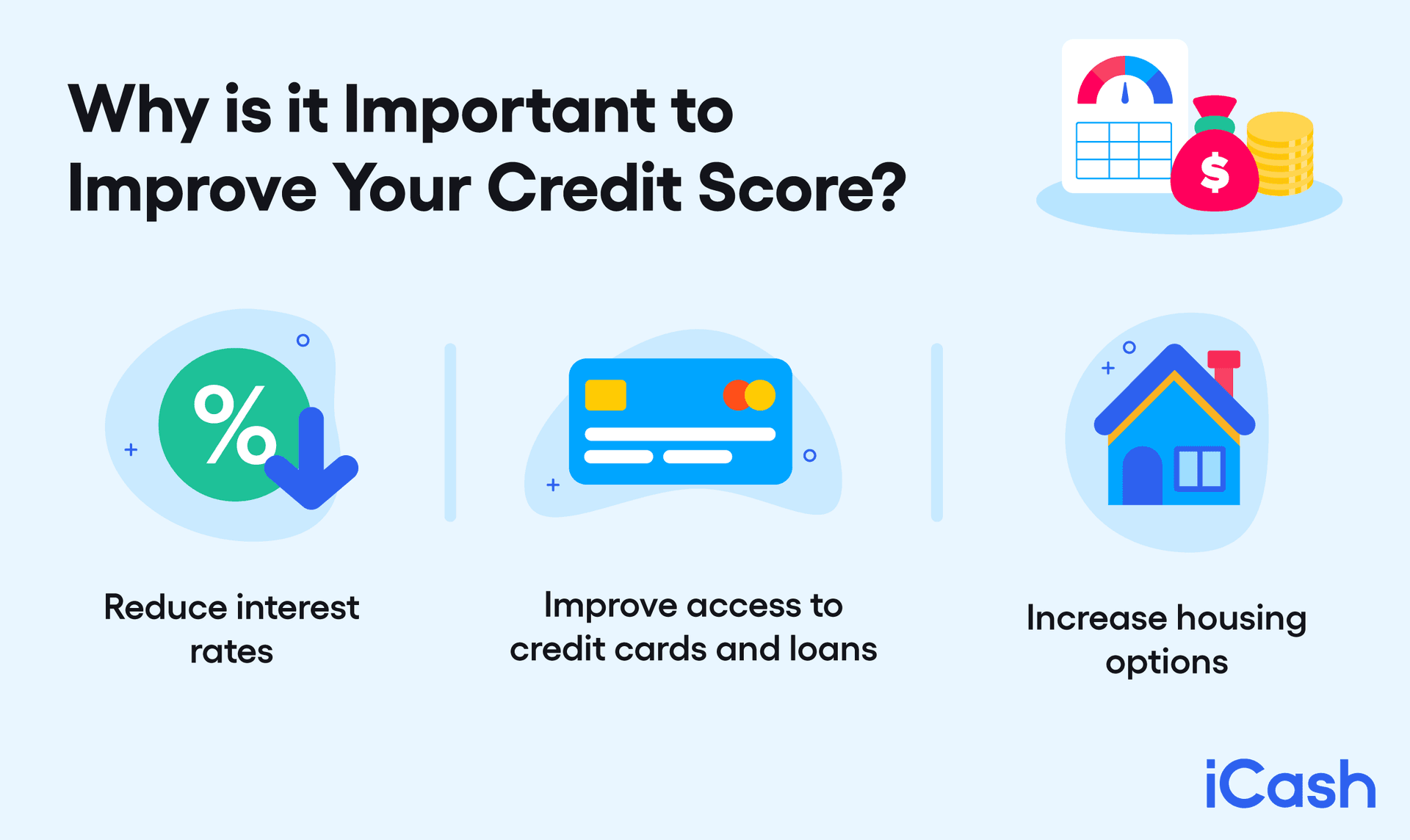

Why It is Important to Improve Your Credit Score

Current and potential lenders will access your credit history which will reveal your score to evaluate the risk involved in providing loans. Your employer or landlord may also request credit checks to assess your financial stability.

Increasing your credit score will have the following benefits:

Reduces Interest Rates

The higher the credit score, the lower the interest rates. Lenders will assign interest rates based on perceived risk, so being in a position of good credit will dissuade their worries. The impact of interest rates is accumulative as you repay your loan over time, so even a small difference will benefit you greatly

Improves Access to Credit Cards and Loans

Your score determines whether a credit card issuer or lender will approve your application. A high score exhibits your money management ability, so creditors are more likely to trust you. They see that you are able to repay your debt on time and are financially healthy enough to take on the loan given.

Increases Housing Options

Good credit will show your landlord that you can pay back your rent. A high credit rating also improves the probability of securing good mortgage loans with low security deposit requirements.

How To Improve Your Credit Score in Canada

No matter how healthy (or unhealthy, as the case may be) your financial history is, there are always ways to make it healthier and improve your credit score. Below, you’ll find specific steps you can take at any time to help enhance that final score and put you in better financial standing.

There are numerous scoring systems out there, but credit reporting agencies tend to follow the same evaluation pattern when looking at your overall score:

- Payment history

- Credit utilization (amounts owed)

- Length of credit history

- New credit

- Types of credit

Here’s how to achieve a good credit score in Canada:

1. Access and Evaluate Your Credit Report and Financial History

A credit report is a detailed summary of your credit score history, including accounts you’ve opened or closed and unsecured personal loans. Your lenders send this information to the credit bureaus, who will compile them into a report. These reports are then converted into scores.

The first step to improving your creditworthiness is to know how well you are currently doing. Checking your credit report gives you an understanding of the areas where you can improve. For example, if you notice that your bill payments have been dragging your credit score down, you can choose to spend more time fixing this.

• How to access your credit report

To access your credit report, request a free copy from your credit bureau. For TransUnion, you can request a free consumer disclosure instead of a report, which comes at a fee. A credit report is accessible to lenders and represents an abbreviated version of the consumer disclosure. However, the consumer disclosure doesn’t include your overall financial score. You can request your free credit report from Equifax in person, over the phone or by mail.

2. Improve Credit Score by Paying Bills on Time

Your payment history takes up 35% of your credit score, so pay your bills on time to secure a good credit position. Your payment history shows all your debt payments, including credit card loans and installment loans. It includes information about whether you’ve repaid the debts on time and if you have any delinquent payments.

If your credit history shows you in good standing with on-time payments, this shows credit bureaus that you are reliable, thus raising your creditworthiness.

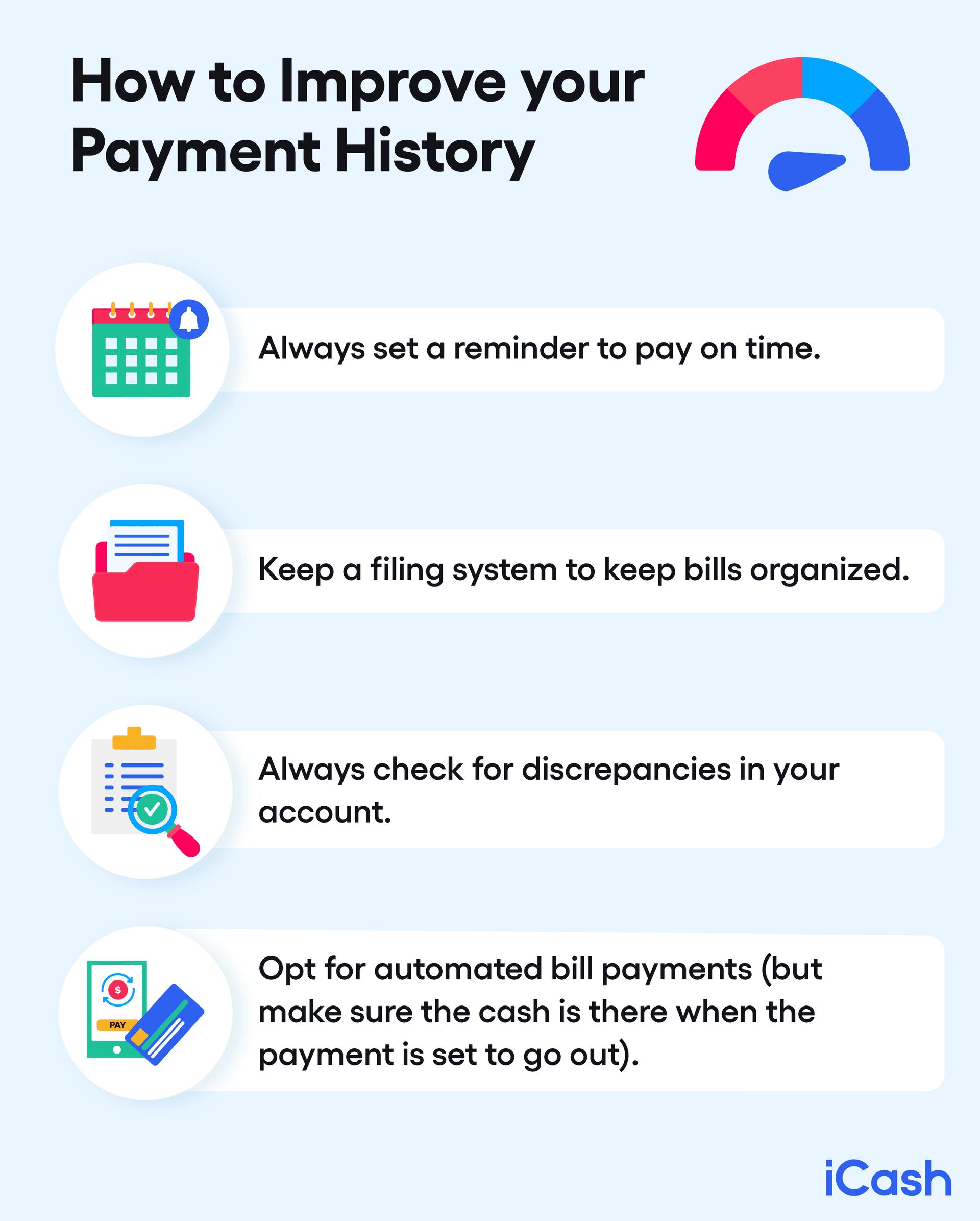

• How to Improve your Payment History

- Always set a reminder to pay on time;

- Keep a filing system to keep bills organized;

- Always check for discrepancies in your account;

- Opt for automated bill payments (but make sure the cash is there when the payment is set to go out).

To raise your credit score, keep monitoring your payment history. If there is a debt that you haven’t repaid, you can contact your lender and negotiate your repayment period.

Repaying revolving debts from credit cards, for instance, will boost your credit rating.

It’s important to note that closing your line of credit accounts may cause your credit score to drop temporarily. For example, repaying your installment loan (typically used for mortgages and car loans) will reduce your credit mix because you will have fewer types of credit listed on your financial record.

Don’t feel dissuaded by this. You can keep your accounts open even after repaying your loans. This will help maintain your credit history and credit mix scores, although you may have to continue paying interest rates.

3. Reduce Your Credit Utilization

Another way improve your overall score is to use credit utilization.

Credit utilization describes how much credit you’re currently using compared to your overall limit. This can be known as “amounts owed” and is worth 30% of your credit score. The lower your credit utilization, the better. This shows potential lenders that you’re not overspending.

The rule of thumb is to keep your credit utilization below 30%. Anything above this will seriously impact your credit health. As much as possible, aim for a credit utilization of 5% - 7%.

4. Increase the Length of Your Credit History

The length of your credit history shows how long your credit accounts have remained open. Longer accounts are well received by credit reporting agencies because they show that you have a history of managing credit and are more likely to be reliable.

If you have bad credit or next to no credit, you can improve your credit history by applying for an instant loan online which may help you build creditworthiness. Otherwise, you can apply for a secured credit card.

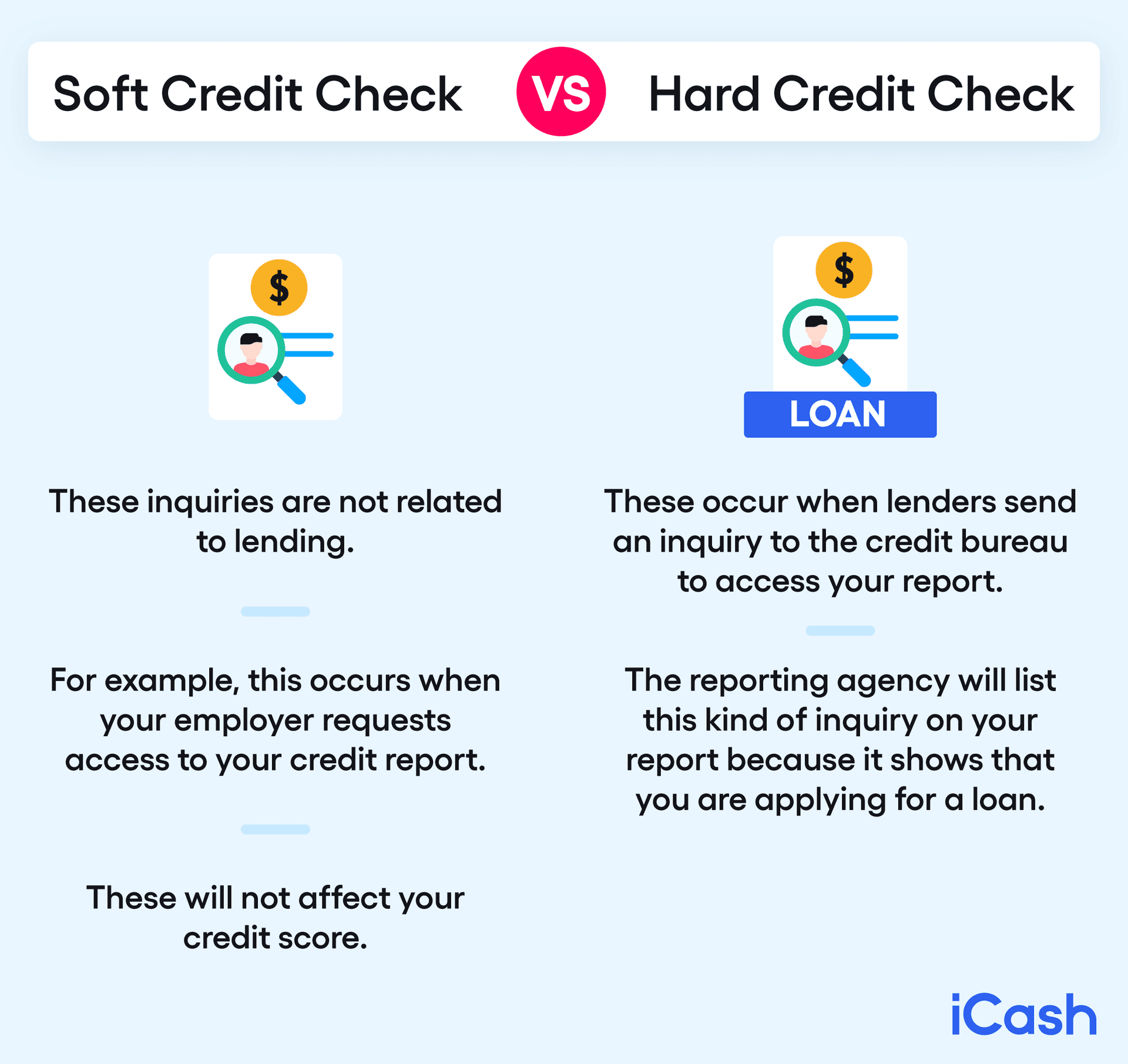

5. Improve Your Credit Score by Keeping Inquiries to a Minimum

Credit inquiries are worth 10% of your overall credit score. Credit inquiries are divided into soft checks and hard checks.

Soft credit checks: These inquiries are not related to lending. For example, this occurs when your employer requests access to your credit report. These will not affect your credit score.

Hard credit checks: These occur when lenders send an inquiry to the credit bureau to access your report. The reporting agency will list this kind of inquiry on your report because it shows that you are applying for a loan.

Higher credit inquiries mean a higher number of loan applications, which may concern prospective lenders and damage your financial standing. If you need to borrow more money, don’t apply to several accounts at once because this will raise the number of reported credit inquiries.

6. Include Different Types of Credit Lines

Using different types of credit lines shows that you can effectively manage a range of accounts, increasing your creditworthiness.

At the same time, don’t apply for quick loans for the sake of showing diversity. Types of credit are only worth 10% of the total credit score. This means that its effects on improving your credit rating are quite minimal and opening more accounts can instead hurt more important aspects of your score, such as your credit history.

7. Request Higher Credit Limits

To prevent a high credit utilization ratio, you can not only reduce your credit usage but also request higher credit limits. This will automatically lower the proportion of credit you currently use, which will reflect favourably in the credit report.

For example, if you are using $1,000 and have a credit limit of $2,000, this will seem less concerning when your credit limit increases to $3,000. At the same time, make sure to keep your credit balance low to ensure that this move is effective.

8. Use Credit Monitoring to Track Your Progress

A credit monitoring service assists you in tracking changes in your credit report and credit score. Equifax offers credit monitoring and access to credit scores for $19.95 per month, while TransUnion offers them for $24.95 per month. There are also other monitoring services to consider.

Once you have access to your credit review, go through it and verify the information. If there is anything that doesn’t seem accurate, you can dispute it. This will benefit you because it prevents your score from being pulled down by arbitrary inaccuracies.

9. Use a Secured Credit Card

A secured credit card involves a cash security deposit, which provides collateral for the card issuer if you fail to repay your debt. Using this type of credit card will show the credit bureaus that you can manage your loans and are paying them back on time. This enhances your trustworthiness.

To improve your credit with a secured card, use it sparingly, keeping in mind your credit utilization ratio.

How Long Does It Takes to Increase Your Credit Score

You can improve your score in the span of one to two months. Achieving good credit within 30 days may seem tough, but it’s possible. The best way to do this is by being aware of your financial history regularly and disputing any inconsistencies.

If you are rebuilding your credit score after a bankruptcy, the process will take longer. Both Equifax and TransUnion include first-time bankruptcies in credit reports for 6 years. Don’t get discouraged when your credit score takes a while to improve. The most important step is to find employment, increase your savings, and process your payments diligently.

When to Improve Your Creditworthiness

It’s always a good time to build your credit score to access better interest rates and loan terms. Don’t wait until your score reaches a concerning level to start doing something about it. Maintaining great credit will show your lenders that you are always reliable, especially when applying for a loan.

Keeping a constant eye on your credit allows you to identify any changes and whether these changes are a result of your activities or if there is any possibility of credit fraud or identity theft. Staying in the loop of how well your credit score is doing will show you how much more you can improve, and where you can improve your creditworthiness.

Your overall score is an important marker of your current financial situation. A good credit rating becomes the key consideration for financial institutions and lenders when providing you with access to certain services. Monitor your credit more closely to stay on the right track.

Keep an Eye on your Credit Score and Financial Standing

Don’t forget, if you need money for rent, home improvements or auto repair bills? Apply now for an instant approval loan* in 2 minutes with iCash, a Canadian payday lender. You can apply for a loan in 3 easy steps.

One of the things that sets iCash apart is that our loans are available online, day or night, 24/7. That means that you can get the money you need when you need it.

As a legitimate online lender, we are licensed to provide loans in Alberta, British Columbia, New Brunswick, Ontario, Manitoba, Nova Scotia, and Prince Edward Island.

About the author