Guide To: Debt Management Plan

This guide will tell you exactly what a debt management plan (DMP) is, how much they cost, who can apply for one and more! Let's get started by defining what this plan is first.

A DMP is a program for getting out of debt by paying off the loans and credit accounts you have at lower interest rates. Ideally, everything will be consolidated into one repayment plan with a fixed rate of interest to prevent compounding.

You can free up some of your monthly cash flow by cutting down the number of payments you need to make each month. It's not too late to get started on this process and put yourself back on the road to financial stability.

Our experts at iCash, an online Canadian quick loan specialist, have put together an easy-to-follow guide to a signing up for a debt management plan.

• Advantages to Debt Management Plan

• How does a Debt Management Plan Work?

• Prioritize and Organize Your Debt

• Figure Out Your Monthly Expenses

• Do I Qualify for a Debt Management Plan?

• How Do You Avoid Being Refused from a Debt Management Plan?

• Disadvantages of a Debt Management Plan

• How Can a Debt Management Plan Affect my Credit Score?

• Debt Management Plan vs. Consumer Proposal

• Debt Management Plan Fees

• Debt Management Plan vs Debt Settlement Plan

• Who Offers Debt Management Plans?

• How Do You Sign Up?

• Will a Debt Management Plan Affect my Mortgage?

• Is a Debt Management Plan Legally Binding?

• Is a Debt Management Plan Right for You?

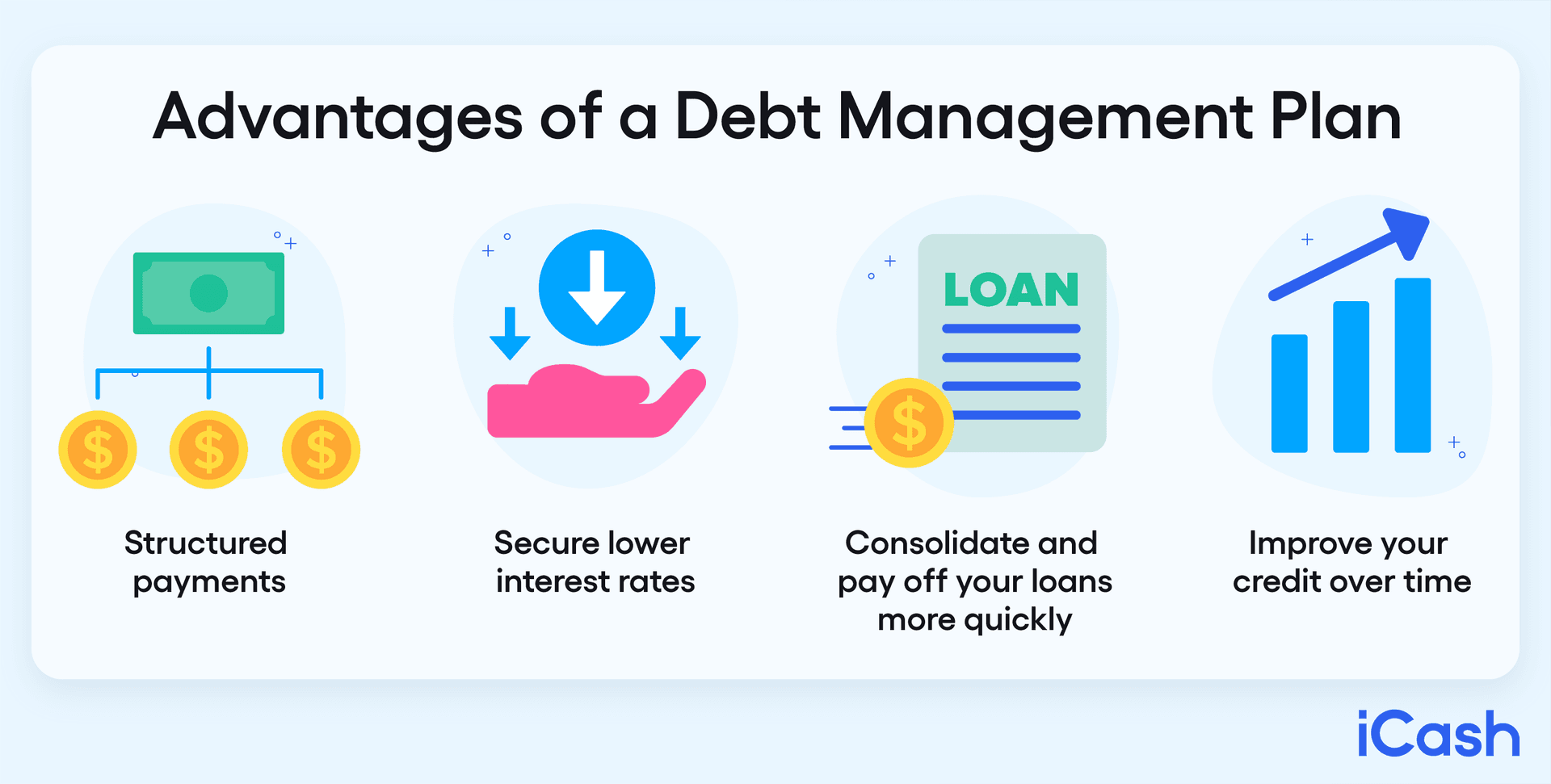

Advantages to Debt Management Plan

One of the main advantages to a DMP is that you can consolidate and pay off your loans more quickly. Debt consolidation is defined as: combining several loans into one payment to reduce the total number of payments each month.

Another advantage of a DMP is that competition among creditors can result in lower overall costs for you. Your interest rates are likely to be reduced as a result of the plan's negotiated terms with other creditors, which could work in your favour.

How does a Debt Management Plan Work?

The DMP commonly uses a debt consolidation company for the implementation of this type of liability relief plan. This firm works with creditors in order to create a monthly payment schedule to suit all your loan and monthly income requirements. Debt Consolidation organizations offer consolidation loans which are used by people who file for bankruptcy protection or those individuals who need money to pay off their credit card bills on time.

By enrolling in a DMP, it will help you manage all your bills in an organized fashion, by providing less financial stress.

Furthermore, with a DMP, you could be offered reduced interest rates in the future because credit card companies view those who enroll in debt negotiation as a lower risk than other forms of liability relief such as filing for bankruptcy, a hard money loan or credit counselling.

In fact, debt consolidation is a legal way to reduce interest rates and help you pay off your liabilities more quickly.

As mentioned above, the main advantage of this debt relief choice is the fact that it will save you time and effort, since all payments can be merged into one master cheque which is then handled by the consolidation third party to pay down the accrued loans.

There are a few steps you can follow yourself to really help make that DMP work for you:

Prioritize and Organize Your Debt

Organize your debts and loans, from lowest to highest. You'll want to pay off the small amounts first and save larger ones for last. This will increase the amount of money you have each month.

For example: If you owe $2,000 on one credit card with a 15% interest rate, that means you'll pay $130 in interest, or just over $3 per day. Assuming you pay off one debt a month, you'll save more than $900 in interest alone by the end of the year – and double that if you can pay two debts off each month!

To make sure nothing slips through the cracks, put together a list of everything you currently owe and when the monthly payments are due (both when the bill is due and when it's paid).

Include all your accounts, including debts, credit cards, student loans, car loans and mortgages. Ideally this would be a spreadsheet you can access anywhere (make sure to back up the data in case your computer crashes).

A debt management plan is like a monthly budget – if you map it all out and stick to it, there's no reason you can't pay off debt quickly.

According to the consumer protection agency, most people in Saskatchewan with a credit card debt are paying more than 10% of their total income on just one card each month. That means that even if they have other balances or loans, they're forking out more than $900 to pay down just one loan every month.

With a DMP, you pay each creditor in full every month. This means that you'll be paying more interest, but everything will be paid off sooner. It's generally much better to pay down credit card as quickly as possible rather than trying to spread it out.

Figure Out Your Monthly Expenses

Write down your monthly expenses. The best way to do this is in a spreadsheet where you list each expense and how much it is on average every month.

Include all main expenses:

- rent/mortgage

- food

- transportation

- entertainment

- debt payments

- utilities (including Internet network usage, and phone).

You should also add how much you want to spend each month for charity, donations, or gifts. You may even want to set a target such as, "I'm going to donate $20 a month" or whatever you think is appropriate.

How much money you should save per month depends on your income.

If you want to create an effective DMP, you need to set up automatic withdrawals for debt repayment, so you make sure you start with those that have the highest interest rate.

Do I Qualify for a Debt Management Plan?

Anyone with multiple liabilities can potentially qualify for a DMP. Especially if those debts are piling up and unmanageable to pay down on your own.

A common question among people considering enrolling in a debt management plan is: What can disqualify me from signing up? There are many requirements to meet before you can start repaying your debts through a DMP but knowing what will get you disqualified is a good way to avoid doing just that.

How do you avoid being refused a Debt Management Plan?

Don't lie. This is the number one reason that people are denied a DMP, because they lied on their application. If you have bad credit, don't pretend it's good or worse, if you stretch the truth and are caught lying on your application you'll be automatically disqualified for fraud.

A debt management plan requires complete honesty and transparency. If you have a bad credit score, take responsibility for that and don't lie about it either. This will only make the creditors distrust you more because they'll think you're covering up other debts.

Other common reasons for DMP rejection are bankruptcy, you’ve been unemployed for over a year and foreclosure. Try to pay off debt with consolidation loans or a budgeting strategy (the old-fashioned way).

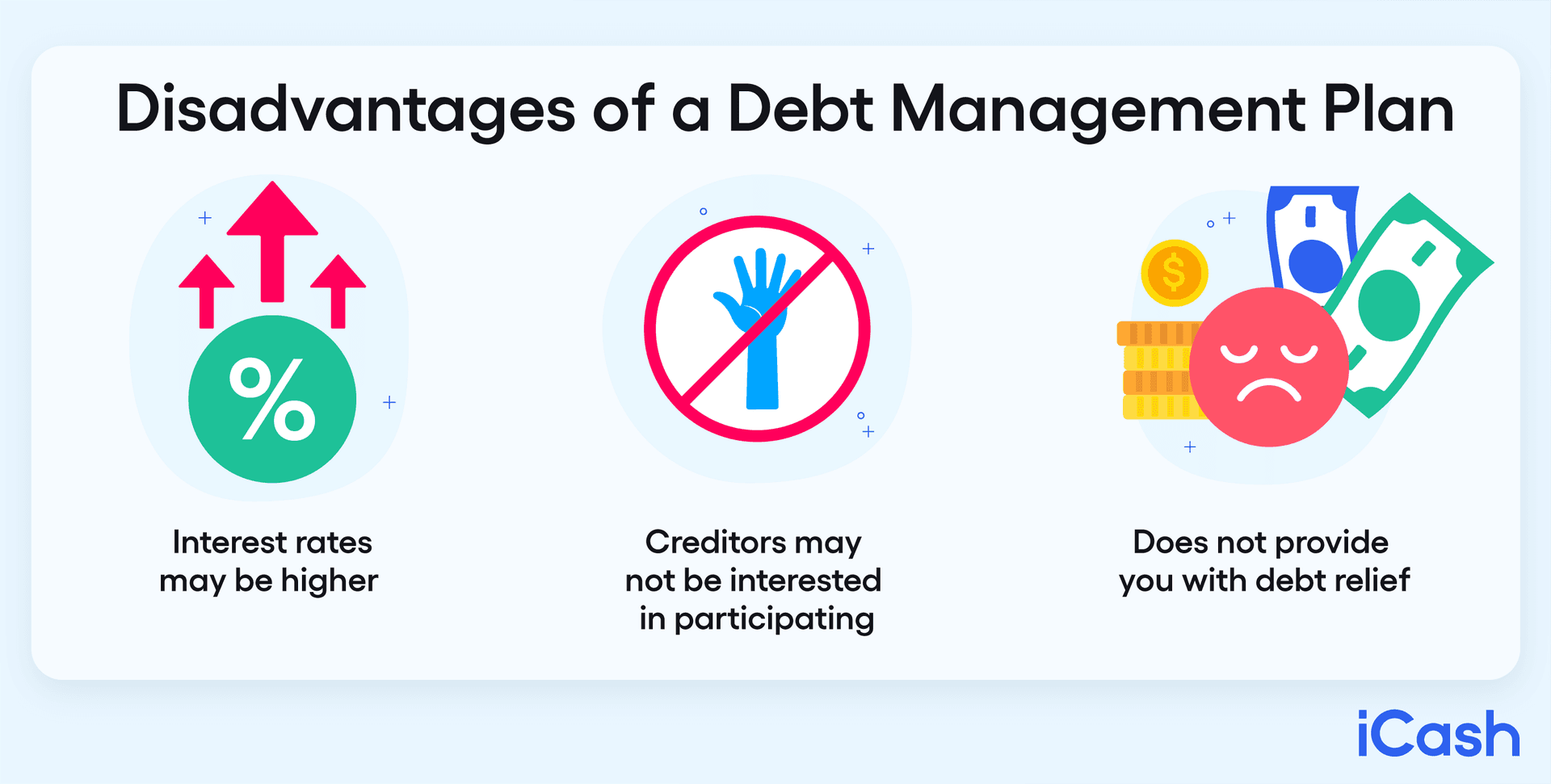

Disadvantages of a Debt Management Plan

There are disadvantages and problems to a DMP: being trapped in a constant debt cycle (as your payment plans drag out), or defaulting on a loan payment plan.

For example, if you owe $1,000 when interest is 10%, it would take 100 months or over 8 years for your loan/debt to double. If your creditor reduces its rate of interest from 10% to 9.9%, it would now only take 97 months or 7 years and 3 months for your loan or debt level to double.

Before you commit to a solid DMP, you should look at your current financial status and avoid over stretching yourself financially. Pay per month; compare this with the required monthly payment for your debts. Then, try to find out what happens if your surplus cash is not enough.

You may have no choice but stop paying some of your outstanding balances. Make sure they are not higher priority liabilities such as mortgage or car loans. And if you realize you are going to miss a payment on something important, you can always turn to an express loan from a direct lender.

How can a Debt Management Plan Affect my Credit Score?

The existence of a DMP on your file will be noted in your credit record, as well as your public records and it will also appear on your credit score. Each individual debt is listed with its current balance, minimum payments due, and any defaults on payments made.

This all remains for up to six years on your credit history report. Even with a debt management plan in place, it is still important to make sure you have an emergency fund of up to three months' expenses that can be used if anything comes up which may cause defaulting on your monthly payments.

For the best results, try not agreeing to a debt management plan where interest rates are increased or capitalized. Before deciding, try to find out what will happen if you default on your monthly payments.

Remember that funding for the DMP comes from an account set up in your name, which may require a credit check. It will not be possible to see this line of credit on a credit report unless it is used for something else, or payments have been missed.

Debt Management Plan vs Consumer Proposal

The difference between a debt management plan and a consumer proposal is that a DMP can be done yourself. The consumer proposal is an alternative that requires a credit counselling company.

A debt management plan keeps your accounts open so they will still report to your credit status, making it easier for you if you decide to refinance down the road or apply for a short-term loan in the future. Keeping them open helps you add to your credit score.

A consumer proposal is a good way to consolidate your debt into one lump sum. Then with the help of a credit counsellor you can come up with a payment plan that works for you. In Canada, you also have legal rights that differ depending on where you live. Make sure you check your unique rights are when it comes to a consumer proposal.

Although the consumer proposal is a good debt repayment solution it does have some drawbacks. The first is that you will not be able to legally discharge your liabilities through bankruptcy for 7 years after enrolling in this plan.

Another issue with both plans is that they are not very beneficial unless there is an existing relationship between you and your lenders. You also must have more debt than you can manage yourself. If you do not have any outstanding loans then these solutions would not be helpful, and you are better off researching budgeting tips that will work best for you to help pay down your liability.

One of the advantages of a consumer proposal is that it allows individuals to retain an asset for them to rebuild their credit score if it is included in the repayment plan. Another benefit of a consumer proposal is that they can be paid off over a set period, while debt management plans are ongoing.

So, if you have extra money during their repayment plan, they can continue to make payments on their consumer proposal. Your lender will provide you with copies of your monthly statement and a notice of assessment that can be used for tax purposes.

The consumer proposal is designed to give you more flexible payment options than debt management plans. If your budget gets a little tight in the middle of the month you can pay less towards your consumer proposal or even stop paying on it completely, and then make up for it at the end of the month.

On the other hand, if you default on a payment under a DMP you will be hard pressed to get out of it because your credit rating is already tarnished and getting the lender to agree to more lenient repayment terms may not be an option.

The main benefit of consumer proposals over debt management plans is in the interest rate. Consumer proposals are based on the fair market value of your liabilities, while the DPM is based on your credit score.

Debt Management Plan Fees

It is important to note that each DMP may have different fees and costs associated with it. Therefore, it's crucial to understand the full terms of your agreement before signing up for a debt management plan.

There are two primary fees associated with a DMP: an application and a monthly administrative fee. You should contact your repayment plan provider to learn about any additional costs they may have. For example, some companies charge an annual amount in addition to the application and administrative.

The monthly administrative fee covers the costs of maintaining your individualized debt repayment plan. It can differ from one company to another since it depends on their other expenses such as technology offered, or communication channels used.

There are also upfront charges to enroll in a debt management program. This may include application fees and the cost of an initial financial review to assess your ability to repay debts, as well as ongoing consultations with you throughout the duration of your plan.

The good news is that DMP fees are tax deductible to individuals who itemize their taxes.

Debt Management Plan vs. Debt Settlement Plan

Debt settlement is currently a very popular program for households to manage their liabilities. In some countries it is touted as an alternative to bankruptcy. Although debt settlement programs and debt management plans both seek to help people reduce their loans, there are some significant differences between the two:

• A debt management plan involves you paying your creditors on schedule but spending more up front for a portion of that payment. The amount you pay over and above what you would normally pay is held in an account and used to reduce your principal if payments are missed or reduced.

• A debt settlement program involves negotiating with your creditors for a reduction in the amount owed. This reduction is often based on one source of disposable income (usually the family member with the highest). The settlement tends to be a lump sum to be paid over time.

Who Offers Debt Management Plans?

DPMs can be offered by either individual creditors or specialist third-party companies that act as debt managers. Most major financial institutions, including banks and other credit issuers can offer DPMs as part of their product range. Private companies such as Credit Counselling Canada can also provide DMP services to customers for a fee.

How do you sign up?

Contact the company or bank you're trying to sign up with to find out what documentation you need to provide. This will vary from company to company and will be dependent on the type of debt you possess. It is best to do your research before approaching them.

However, if you plan on signing up for a debt management plan with a credit card issuer or loan provider, you should be able to find information on their website about what you need to do, and how long it takes.

In some cases, an application form must be completed and sent back with certain documents attached for approval before the plan is confirmed.

Will a Debt Management Plan Affect my Mortgage?

The good thing about a DMP is that if you are already a homeowner it will not influence any mortgages you currently have. As long as you can continue to pay monthly, it has no affect on your application for a new mortgage.

Of course, if you are defaulting on your repayments for the DMP then your credit score will drop and your ability to receive a mortgage will be affected, but it will not completely stop you from applying for one.

Is a Debt Management Plan Legally Binding?

Fortunately, DPMs are not legally binding and are entirely voluntary. You can also cancel at any time if you feel like you have a better solution to pay down your debts.

It’s important to note that consumer proposals are legally binding. In terms of how long a DMP can last, typically none stretch longer than a maximum of 60 payments (so roughly 5 years), but most are paid off within 36.

Is a Debt Management Plan Right for You?

A DMP is the best solution for people with multiple loans, but it’s not always enough if you have other financial issues such as an overspending habit or high-interest rates on credit cards.

If that sounds like you, then consider iCash to help manage these debts and take control of your finances in one go. We can offer up instant loans online of up to $1,500 so that you don't find yourself stuck without funds when something unexpected occurs.

About the author