Menu

Table of contents :

When you need more money Quickly , you might find yourself asking, "how do I make quick cash?" Fortunately, it's now easier than ever - you just need to know where to look.

Digital platforms revolutionize our approach to earning money. From selling items you no longer need on websites like eBay or Facebook Marketplace, to taking on freelance projects, there are a wealth of opportunities at your fingertips.

The gig economy also opens doors for quick cash through apps like Uber, DoorDash, or TaskRabbit. It allows you to earn funds on your own terms, turning your free time into profit.

No matter your age or income status, you can easily make quick cash. Finding what works for you may take time, however, exploring these opportunities can lead to rewarding monetary outcomes.

Earning money quickly is straightforward when you're open to various options and utilizing what you already have at your disposal. There are many paths to quick earnings, from side hustles in Canada. Success lies in making the most of your abilities and interests.

The quicker you earn, the faster you can meet your financial goals or handle any unexpected expenses that come your way. With dedication and the right approach, you'll see that earning fast funds can significantly ease pressures and open up new possibilities for your budget.

Online Marketplaces: Platforms like eBay and Facebook Marketplace are ideal for quickly selling personal items. From gently used electronics to clothing, these platforms connect sellers with buyers, turning unwanted items into dollars.

Gig Economy: Apps like Uber, DoorDash, and TaskRabbit are suitable for those looking to make income according to their schedule. Whether it’s driving, delivery, or performing tasks, these platforms offer a practical route to fast money.

Freelance Services: Websites such as Upwork and Fiverr offer independent contractors a platform to market their abilities, from writing and graphic design to web development and digital marketing.

Specialized Skills: Utilizing your unique talents or hobbies can also lead to a quick income. Teaching virtual courses, creating and selling handmade goods at craft shows, or offering tutoring sessions are a few examples.

Fast loans: If you need funds in minutes, consider a fast loan online. This option is perfect for urgent monetary needs, especially when traditional methods may not be fast enough.

All of these options are diverse and cater to a wide range of skills, interests, and immediate financial needs. Of course, if you need to find the quickest solutions available right now, sign up to get an instant loan in 2 minutes or less!

Need to know how to make money online? Numerous reliable websites and apps help you earn income based on your talents or hobbies, from any location you choose. The key to success lies in choosing the platforms that best match your interests.

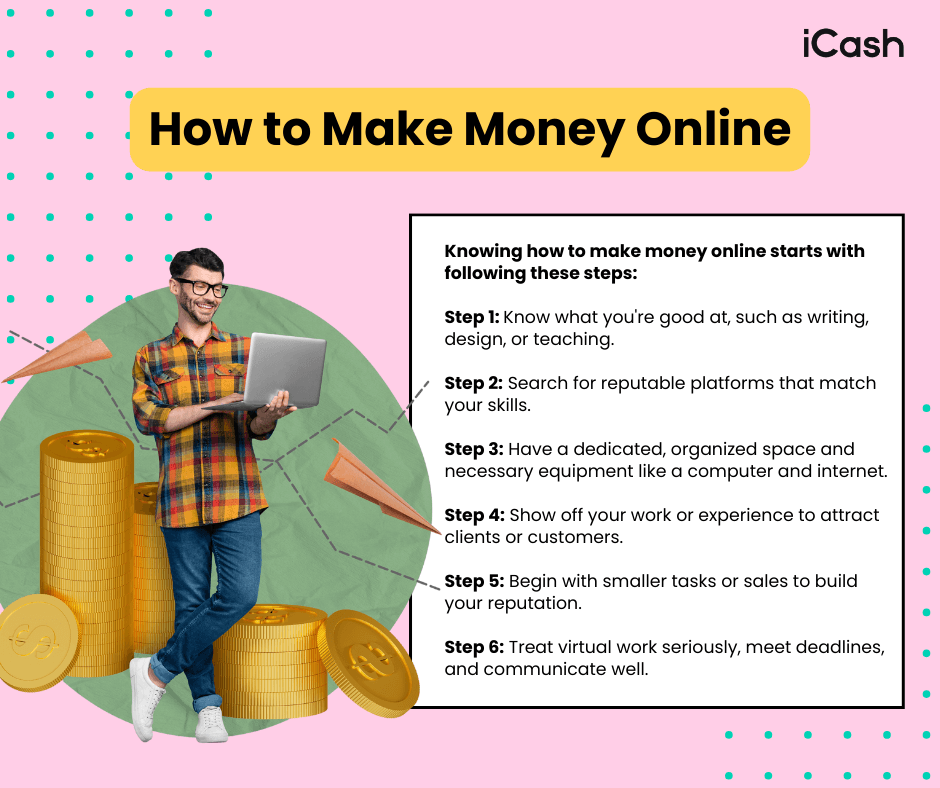

Knowing how to make money online starts with following these steps:

Step 1: Know what you're good at, such as writing, design, or teaching.

Step 2: Search for reputable platforms that match your skills.

Step 3: Have a dedicated, organized space and necessary equipment like a computer and internet.

Step 4: Show off your work or experience to attract clients or customers.

Step 5: Begin with smaller tasks or sales to build your reputation.

Step 6: Treat virtual work seriously, meet deadlines, and communicate well.

By following this approach, you’ll know how to make money online the right way. Starting with these foundational steps sets the stage for continued success.

If you want to make money online in Canada, there are plenty of opportunities. From freelancing in various fields to selling products virtually, Canadians have access to many platforms.

Some of the popular platforms to make money online in Canada include:

Shopify: Ideal for those looking to start their own e-commerce business. This Canadian company offers tools to create an web-based store, sell products, and manage inventory.

Upwork and Fiverr: Perfect for freelancers in areas like writing, graphic design, programming, and digital marketing. These platforms connect you with clients around the world, allowing you to work on projects that interest you.

Instacart: For those who enjoy grocery shopping or want to help others by delivering groceries, Instacart is a valuable platform. It connects shoppers with customers in their area, allowing you to earn dollars by picking out and delivering groceries.

Doordash: Ideal for those who have a vehicle and enjoy driving, this platform offers a flexible way to earn income by delivering food from local restaurants to customers' doors. Work on your own schedule and choose when and where you want to make deliveries.

Looking for the best way to make money online? Do your research to find the right opportunity. Not all avenues are the same. The best ones will align your interests while providing a reliable income stream.

Think about it this way - if you're great at writing, platforms like Medium or freelance websites such as Upwork and Fiverr can connect you with clients who value your talents.

If you collect sports cards, websites like eBay offer a marketplace where you can sell to enthusiasts and collectors worldwide. It provides an excellent opportunity to turn your hobby into a profitable venture by reaching buyers willing to pay for rare or sought-after cards.

By using your passions and picking the right place to show your skills, making money online becomes more fun. Some reliable websites and apps that offer excellent opportunities for earning dollars virtually include:

1. Upwork: Connects freelancers with jobs in writing, design, tech, and more.

2. Etsy: A marketplace for selling handmade or vintage items and craft supplies.

3. eBay: An ideal marketplace for selling sports cards and collectibles.

4. Survey Junkie: Pays you for taking surveys on various topics.

5. YouTube: Earn through ads, sponsorships, and memberships by creating engaging videos.

6. Amazon Mechanical Turk (MTurk): Offers a wide range of micro-tasks, from data entry to survey participation, allowing you to earn money in your spare time.

These networks offer many of the best ways to make money online, whether you're into freelancing, crafting, giving opinions, or making videos.

Now that you have a list of reputable platforms for easy ways to make money online, let's provide an example of how to utilize these platforms effectively. If you’re starting, creating content for YouTube or selling an item on Etsy may be cumbersome.

Instead, you may want to consider an easier way. Some immediate earning methods are more complex than others. Some offer simpler ways to start earning without needing a large initial investment of time or resources.

For example, if this is your first time trying to make income on the internet, consider an easy option like taking surveys. Platforms like Survey Junkie are user-friendly and allow you to earn by simply sharing your opinions. This can be a great way to dip your toes into the virtual earning world without the pressure of creating products or content.

Another beginner-friendly option is completing micro-tasks on Amazon Mechanical Turk (MTurk). These tasks can range from simple data entry to quick research assignments and don't require specialized skills, making it an accessible way to start earning extra funds.

These easy ways to make money online provide a low-stress introduction, perfect for those just beginning their journey or looking for a simplified process altogether.

For those in immediate need of funds, alternative lending companies offer quick cash online in the form of payday loans. You can apply for a loan and receive up to $1,500 within minutes. Fast approval processes paired with easy eligibility criteria make digital loans for payday accessible to a wide range of people.

One example is iCash, a trusted digital lending service that offers instant funds to qualified borrowers. It’s a lifesaver when you're in a pinch and need funds to cover urgent expenses, such as medical bills, car repairs, or sudden cash shortfalls.

Knowing how to make money from home is valuable for anyone looking to supplement their income or transition to a remote work lifestyle. With the rise of the digital economy, there are more opportunities than ever to earn without stepping out your front door.

Whether you're a parent needing flexible working hours or simply looking to diversify your income streams, earning income from home provides the versatility and potential for financial growth that traditional jobs may not offer.

With so many ways to work from home, how do you pick the best one? Start by knowing what you want and find a role you feel comfortable with.

Ways To Make Money From Home

There are many ways to make money from home. Of course, you can leverage the web-based platforms mentioned above. But, if you’re looking for something more permanent, work from home opportunities may be a better option.

Some easy ways to make money from home include the following remote work opportunities:

Virtual Assistant Jobs: Many businesses and entrepreneurs are looking for remote support. As a virtual assistant, you could manage emails, schedules, social media accounts, and other administrative tasks. Websites like Remote.co and FlexJobs list virtual assistant roles across various industries.

Online Teaching & Tutoring: If you have expertise in a particular subject or skill, you can teach or tutor students online. Platforms like VIPKid, Teachable, and Udemy allow you to connect with students worldwide. You can create your course content or tutor students in real time.

Become a Remote Employee: Many companies are now offering fully remote positions that allow you to work from anywhere. Look for job listings on sites like Indeed, LinkedIn, or We Work Remotely for roles ranging from customer service and tech support to software development and project management.

There are also ways to make extra funds from home that don’t involve remote work. For example, investing in the stock market or cryptocurrency can be a lucrative way to grow your savings, provided you do your research and invest wisely.

Another option is to utilize cashback and rewards apps like Rakuten, which offer you free money back for purchases you were already planning to make online. This can add up to significant savings and extra funds over time without much extra effort.

You could even look for government grants or subsidies that you might be eligible for. For example, if you’re a low-income earner, the Canadian GST/HST credit

might be something to consider. This is a quarterly payment that helps individuals and families with low and modest incomes offset the GST or HST they pay.

Whatever route you take, can effectively supplement your income from the comfort of your home. Doing some quick research can help you uncover opportunities for extra money, especially if you need rapid financial assistance.

Knowing how to make money fast is essential in today’s economy. Whether it's through online platforms, leveraging personal skills, or engaging in short-term gigs, various strategies can help you generate income efficiently.

The key is to focus on methods that match your talents and availability, ensuring that you can start earning without significant delays. By exploring a mix of digital and local opportunities, you can find quick paths to income that fit your lifestyle.

Finding how to make money quickly may seem challenging, but several effective methods can help you generate dollars on the spot. This means you won’t have to wait weeks or months to see earnings.

There are a variety of online and offline options available - find what works best for you!

Some ideas on how to make quick funds on the spot include:

1. Digital Products and Courses

If you're knowledgeable in a certain area, consider creating and selling digital products or online courses through platforms like Teachable or Gumroad.

The instant funds transaction from selling digital products or online courses can be particularly appealing. Once you set up your product or course, customers can purchase it at any time, leading to a potentially continuous stream of income.

2. Affiliate Marketing

Use affiliate links to earn commissions by promoting products or services on your blog, social media, or website. Platforms like Amazon Associates or ClickBank offer a variety of products to promote, allowing you to earn money for referrals. You’ll get recurring commissions from each sale made through your links.

3. Pet Sitting or Dog Walking

With apps like Rover, you can quickly find pet sitting or dog walking gigs in your area. It’s a fast and enjoyable way to earn money if you love animals. Plus, it gives you the flexibility to choose your schedule and rates.

4. Rideshare Driving

Rideshare driving is a flexible way to earn funds by transporting passengers within your city. Through platforms such as Uber, you can turn your car into a source of income. The signup process is straightforward, and you can begin driving shortly after applying.

This opportunity not only offers the convenience of choosing your working hours but also the potential to earn based on how much you decide to drive. It's an ideal option for those looking how to make money fast while meeting new people along the way.

5. Delivery Services

Join a delivery service like DoorDash or Instacart. You can start making deliveries as soon as you're approved. You can work as much or as little as you want, choosing hours that work best for your schedule.

6. House Cleaning

House cleaning is a practical and in-demand service that generates fast income. Many people are looking for reliable individuals to clean their homes, making it a lucrative opportunity for those willing to put in the work.

You can start by offering your services to friends, and family, or through local online community boards. As your reputation for thoroughness and reliability grows, so can your client base through word-of-mouth and online reviews.

7. Hosting Yard Sales

Hosting yard sales is a classic and effective way to earn dollars on the spot. By selling items you no longer need or use, you can declutter your home and make dollars simultaneously. It's a direct and community-friendly approach to generate income, allowing you to set up shop right in your front yard.

8. Room Sharing

Room sharing is an excellent way to offset housing expenses and generate additional income. Consider renting out a spare room on platforms like Airbnb or Roomies.ca that can provide a steady stream of income. This option not only utilizes existing space but also taps into the market of short-term rentals.

Discovering how to earn quick cash outside of gigs, freelancing, and local jobs can lead to more ways to grow your funds. Diving into investment options, including the stock market, real estate, or cryptocurrencies, can be a lucrative way to do it.

With investment opportunities comes the need for a clear strategy. The stock market can offer quick returns through day trading or swing trading, but it requires an understanding of market trends and the ability to act fast on trading opportunities.

Real estate investments, whether through buying to rent or flipping properties, require market knowledge, upfront capital, and sometimes, a willingness to undertake renovations. Cryptocurrencies can yield substantial gains but also pose risks; successful crypto investing needs thorough research.

To navigate these investment landscapes successfully, educating yourself on each market is crucial. Utilizing financial news and online courses can enhance your decision-making process.

Stock Market: Use trading platforms to invest in stocks that have the potential for quick returns. Look for volatile stocks or those on the verge of breaking news that could lead to short-term gains.

Cryptocurrency: The crypto market has rapid fluctuations. With a strategic approach, you can buy low and sell high in a short period, capitalizing on the volatility of cryptocurrencies.

Real Estate: Investing in real estate can also offer opportunities for quick ways to earn cash. This could involve purchasing properties to flip for a profit or investing in rental properties for a steady income stream. With the right property and market conditions, real estate can provide significant returns on investment.

Finding ways to earn quick cash is essential for anyone looking to boost their income. Whether it's through digital platforms or local gigs, fast funding solutions are well within reach for those who need money now!

Rapid funds may look different for everyone, depending on their income status and lifestyle. For those living paycheck to paycheck, finding immediate sources of income can be a game-changer. It provides not just a financial cushion but also peace of mind.

Engaging in online surveys, independent projects, or even selling unwanted items can be a practical way to supplement your income. It gives you extra dollars in times of need, reducing the stress of living paycheck to paycheck.

Earning quick cash in Canada has become increasingly accessible thanks to digital platforms. Canadians looking for fast monetary solutions can turn to a variety of web-based avenues, such as completing surveys, contract work, or selling goods on marketplaces. The digital era opens the realm of possibilities for those needing extra income.

Additionally, digital lending platforms have revolutionized how Canadians obtain fast funds. These platforms offer a streamlined, user-friendly application process, making it possible to secure loans with same day cash disbursement.

This is especially beneficial if you need funds to cover unexpected expenses or bridge the gap until your next paycheck. With an easy application process, flexible repayment options, and minimal eligibility criteria, same day quick loans services provide a reliable way to access money today.

To avoid quick cash scams and risks, it's crucial to stay informed. Knowing the red flags can protect you from falling victim to fraudulent schemes.

For example, be cautious of any scheme that requires you to pay upfront to start earning. Legitimate jobs and investment opportunities usually do not ask for payment to participate.

Fraudulent activity often involves pressuring you to invest money or commit to jobs immediately. Take your time to research and think over any offer that requires a quick decision.

Need some tips to keep your earnings safe? Follow these simple guidelines:

Research Thoroughly: Before diving into any opportunity, do your homework. Look for reviews, testimonials, and any red flags about the company or platform. A lack of transparency or too-good-to-be-true promises are often signs of a scam.

Never Pay Upfront: Legitimate job offers or investment opportunities won't require you to pay upfront. Be wary of any request for payment as a condition for engagement.

Protect Personal Information: Avoid sharing sensitive information like your SIN or bank details until you're certain the opportunity is legitimate.

Trust Your Instincts: If something feels off, it probably is. Trusting your gut feeling can save you from falling into a scam.

Following these strategies can help you find safe ways to earn cash and protect yourself from falling victim to scams. Always prioritize safety and legitimacy in your quest for fast income.

Get quick cash from iCash, your trusted partner in overcoming financial hurdles. With a focus on convenience, speed, and accessibility, we simplify the process of obtaining the funds you need. Whether you're looking for ways to make quick cash online or dealing with unexpected expenses, there’s a reliable solution.

Need to know how to make quick cash online? Our streamlined application ensures convenience and speed. Plus, competitive rates and exceptional customer service make our loans a top choice among Canadian borrowers.

Even if your credit history isn't perfect, our bad credit loans give you the support you need. We provide loans for low credit scores 24/7, including evenings, weekends, and holidays. Get financial relief whenever you need it.

Don’t wait! Grab the iCash app today and discover a reliable, efficient way to manage your quick cash needs.

*No credit check is required for any second or subsequent loan application. A credit check is only conducted on your first loan application, which means all future loans are exempt from it.

Since 2016, we've helped over 1.6 millions Canadians get instant loans online.

Since 2016, we've helped over 1.6 millions Canadians get instant loans online.

Read more reviews.

Remember when getting a loan meant waiting in a long bank line for over an hour? Those days are over. Download the iCash app from the Apple App Store or Google Play, then fill out the digital application. It only takes about 3-5 minutes.

You'll get an approval decision immediately. No waiting around for days or weeks. Once approved, review exactly how much you're approved for, what it costs, and when you'll pay it back. Then just sign electronically!

Money hits your bank account within 2 minutes via e-Transfer after you’ve been approved and have signed your digital agreement. Fast, convenient and hassle-free. Funds are sent 24/7, no matter what, even on weekends and holidays.

Have more questions? Check out our full FAQ.