Why Did My Credit Score Drop?

Date Published: April 19, 2023 (Updated February 27, 2025)•9 min read

If you are someone who regularly checks on their credit score, it may surprise you to see it fluctuate for seemingly no reason at all. Your score represents the risks involved when lenders approve your loan applications, including online payday loans, so the score will change according to how you address your current credit accounts.

An Equifax Canada survey has shown that most Canadians still fail when it comes to basic financial knowledge, which includes the ability to check their credit report and subsequent score regularly.

According to research, only 29% of Canadians actually check their credit file regularly, like they should. And one in four Canadians have never checked their credit report. This means they are not aware of any inaccuracies in their file, and can experience drops in their score that they do not notice or understand.

Let’s take a closer look at why your credit score drops, and what you can do to try and get it back up and get yourself back into better financial standings.

• Reasons Your Credit Score is Dropping

• You Have Late or Missed Payments

• You Have High Credit Utilization

• Your Credit Limit Has Dropped

• You Closed A Credit Card

• You Recently Applied for More Credit

• You Filed for Foreclosure or Bankruptcy

• Your Credit Report Contains Incorrect Information

• You Made an Expensive Purchase Using Your Credit Card

• You Paid Off A Loan

• You Were a Victim of Identity Theft

• What to Do When Your Credit Score Drops

Reasons Your Credit Score is Dropping

Seeing your credit scores drop is never a good feeling. However, being able to quickly identify the cause can help you take the right steps to get it back on track.

These are some reasons why you would experience a drop in your score. Here are a few of the main culprits:

You Have Late or Missed Payments

Your payment history is the most important aspect of your credit score, making up 35% of the final number. This section records how you pay your bills and whether you have any delinquent payments. If you see your credit score drop after missing a payment or not being able to repay your bills in the past 30 days, this is likely the reason why.

After those 30+ days of late payment, your lenders may report the payments due to the credit bureaus, causing your credit rating to decrease. To prevent your score from dropping, make sure to keep a schedule or a reminder system to pay your bills on time. You can also set up a budgeting plan to ensure you have enough funds when the deadlines come around.

You Have High Credit Utilization

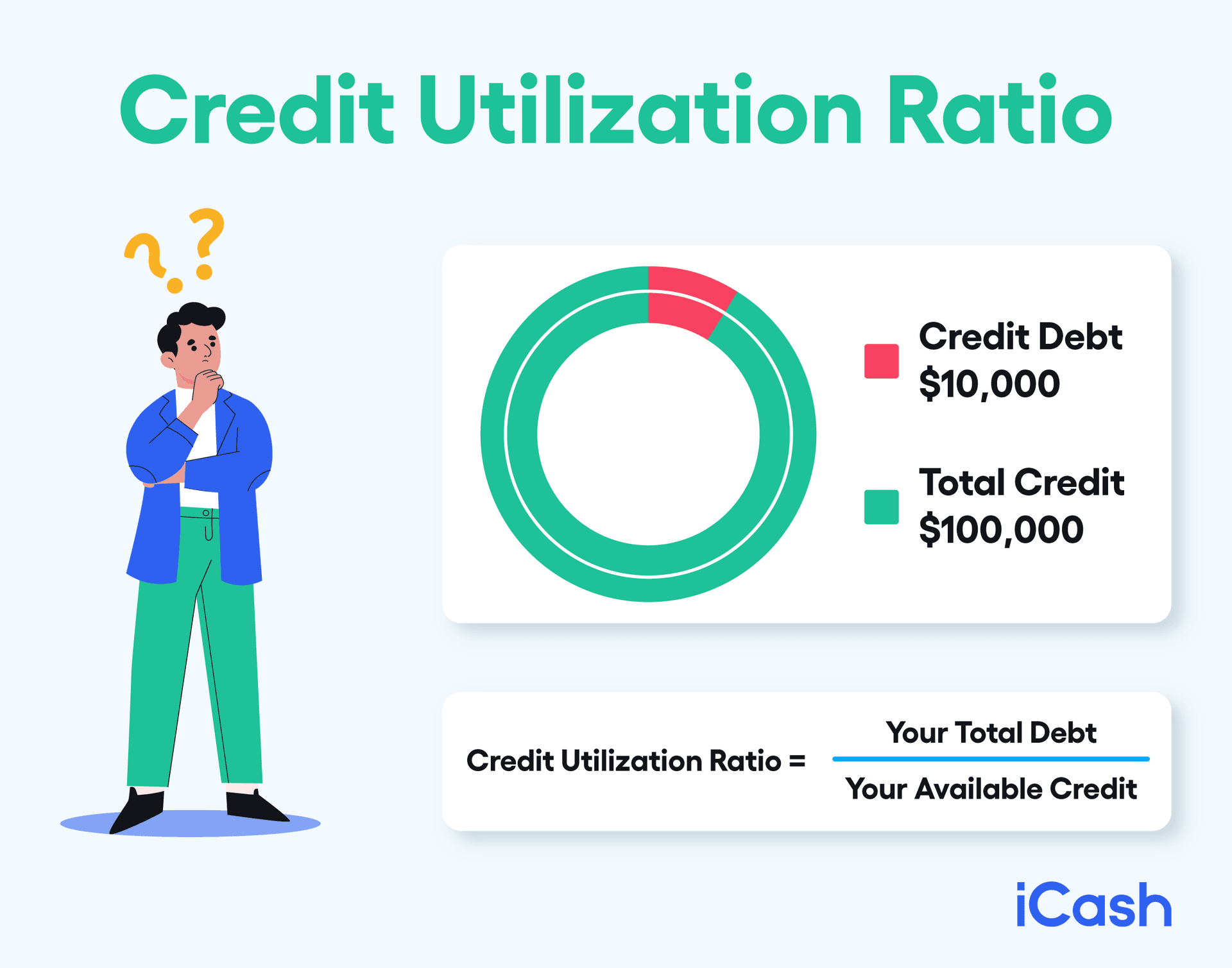

Your credit utilization ratio shows how much credit you use in respect to your credit limit. The higher this amount is, the more it seems you are live beyond your means and are not as well-positioned to take on new debt.

Your credit utilization ratio can be calculated by finding how much credit you are using as a proportion of the total limits of your different credit card balances. For instance, if you have a $100,000 credit limit and you use $10,000, your credit limit is 10%.

To keep your credit utilization ratio from hurting your overall score, aim for a ratio of 10% or less. If you don’t have the option of reducing your spending, you can open another credit account so that your limit increases.

Your Credit Limit Has Dropped

If there is a sudden decrease in your credit limit, this makes your credit usage suddenly higher in terms of proportion. For instance, if the $100,000 drops to $70,000, spending $10,000 results in a credit utilization ratio of around 14%.

Financial institutions that issue your credit cards can set credit limits according to factors such as your income, credit history, credit score, and the amount of debt you have. Sudden decreases in credit limits can be caused by consistently missing payments or when you have amounting debt.

If you want to raise your credit limit, you can call your card issuer or make a request online. In cases where they decline your request, you can apply for a new credit card. In case of emergency, consider applying for an unsecured loan, as they often offer instant decision making on your loan application.

You Closed A Credit Card

Closing your credit card means losing the amount of credit that that card can offer, which leads to a drop in your loan limit.

When you are no longer using a credit card and decide to close it, you may not expect this to impact your credit score negatively. After all, you have fewer accounts which means fewer possible debts.

However, closing a credit card you are no longer using can cause your credit score to drop. If you don’t have to pay a high annual fee to keep your card open, this is something you can potentially do to maintain your score. This will also show that you have a longer credit history.

Namely, you have credit accounts that have been opened for a long time and therefore show credit reporting agencies that you have more experience navigating payments.

You Recently Applied for More Credit

If you have recently made more applications for mortgages, loans or new credit cards, this will likely cause your credit score to drop. When you apply for new credit, the financial institutions or lenders will undergo a credit check by requesting your report from the credit bureaus.

This will be recorded by the agency as a hard inquiry, which displays how often you have applied for credit accounts recently. If you request a credit line increase for an existing card, it will also show on your report.

These scenarios can cause a slight drop in your credit score. To prevent this from happening, you can refrain from applying to multiple credit accounts at the same time. You can also check the preapproval or prequalification offers from creditors.

You Filed for Foreclosure or Bankruptcy

Bankruptcy involves a legal process where borrowers can opt for relief from their debts, while foreclosure involves your lender seizing control of your property after months of missed payments. Bankruptcy and foreclosure both harm your credit score because of the accumulation of late or missed payments.

Your credit score will likely drop significantly if you’ve gone through either of these events. Both Equifax and TransUnion include bankruptcies in your credit report for the following six years after being discharged. This may, however, depend on your province.

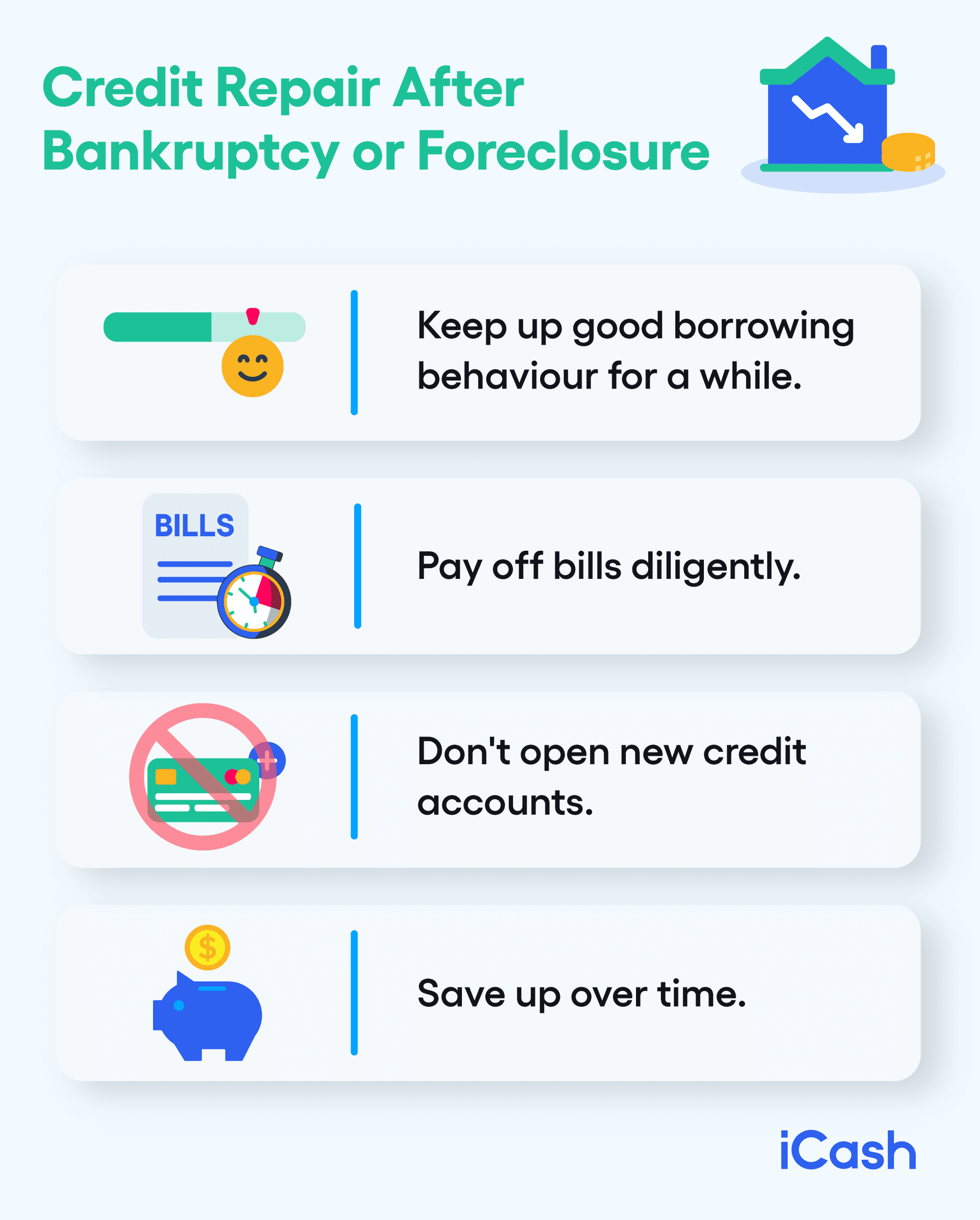

If you have just gone through this scenario, you can expect to see your score drop dramatically. What you can do is keep up good borrowing behavior for a while. This means paying off bills diligently, not opening new credit accounts, and saving up over time.

While waiting for your credit score to improve, emergencies may always arise and you may need money fast. Getting approved for a loan with a low credit score can be hard, but we're here to help. We offer loans for bad credit derived from financial setbacks in the past.

Your Credit Report Contains Incorrect Information

While it may not be common for credit report agencies to include incorrect information in your file, a misunderstanding with the people who report information to them can result in a drop in your credit score.

For instance, if your lender lets them know that you have not caught up with payments for the past 5 months, they will likely show a credit score drop. However, if you paid immediately after but your lender doesn’t inform the agencies, this can negatively impact your score. Regularly checking your credit report is one of the best ways to ensure no inaccurate information shows up in your file.

Incorrect personal details or payment history information can harm your score unfairly. One of the best ways to prevent your credit report from showcasing incorrect information is to regularly check your report. If you see something you think is inaccurate, you can dispute this with the reporting agencies.

You Made an Expensive Purchase Using Your Credit Card

Maybe, even though you’ve been using the 50/30/20 rule to budget, you’ve been eyeing a high-priced luxury item for a long time, and you finally decide to buy it with your credit card instead of available cash in your account. Once you do, however, you notice that your credit score drops. This is because your credit utilization ratio has increased, hinting to lenders that you have used up a higher capacity of your credit limit.

Before you charge a hefty expense onto your credit card, make sure you can pay it off in full before the billing cycle ends. Carrying a high balance on your credit card is not only bad for your utilization rate, but it will also incur a whole lot of interest.

You Paid Off A Loan

It might sound weird that your credit score can drop after you pay off a loan, but when a significant change occurs to your credit history, your score gets affected temporarily. When you pay off a loan, especially ahead of time, it will mean you are closing some of your credit accounts. This will reduce the variety of credit accounts you have, and lowers your credit mix, which affects your score.

It is important to note that this will only result in a temporary change and that it will be a positive factor in the long run.

You Were a Victim of Identity Theft

Identity theft occurs when your personal information is compromised and is used by someone else acting as you. This includes your name, driver’s license, Social Insurance Number (SIN), and credit card information. An imposter may use this knowledge to make transactions, use up more of your credit, and raise higher amounts of debt under your name.

Stolen identities can result in criminal records, significant amounts of debt, and various other consequences that will cause huge problems for you personally and financially.

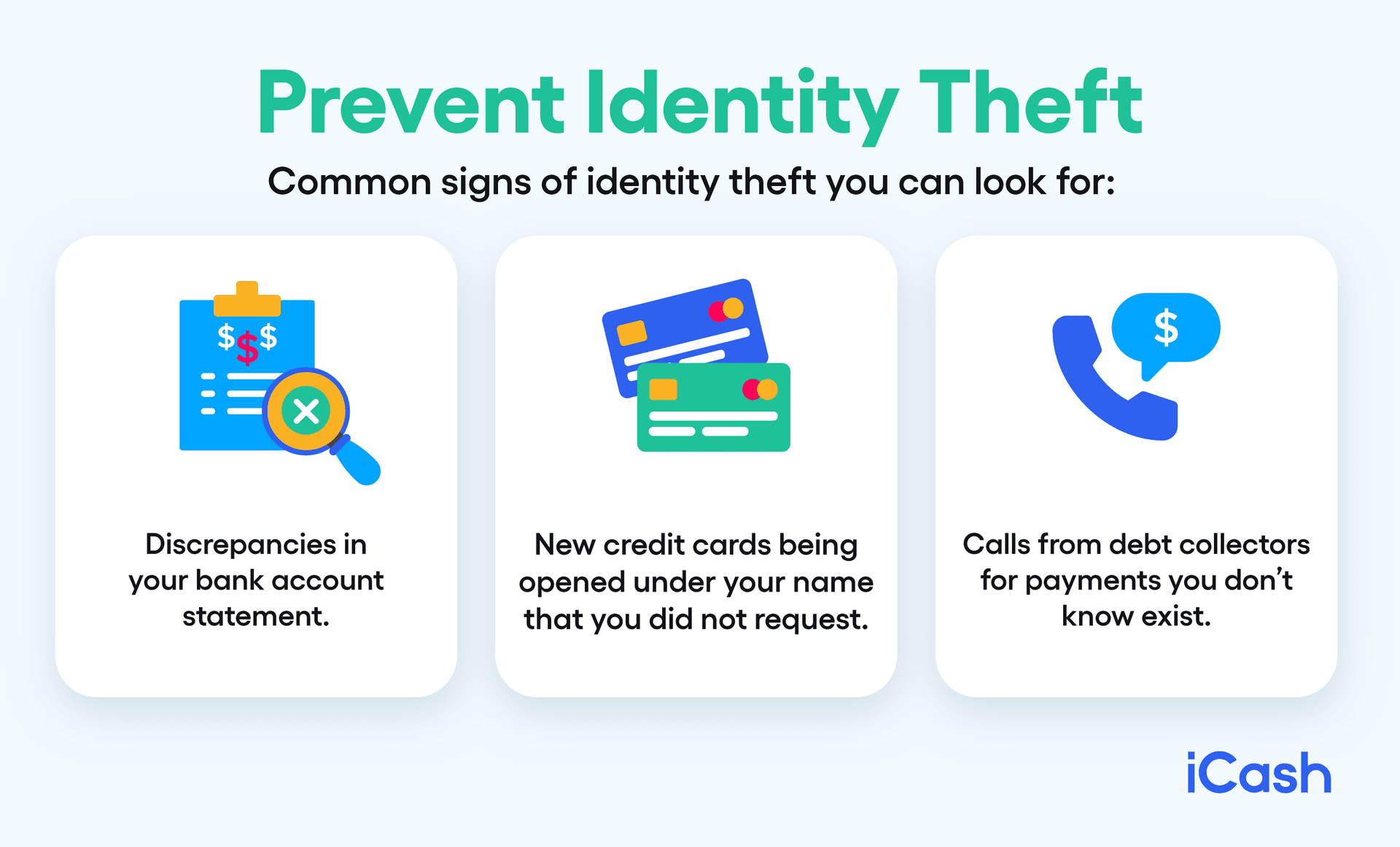

There are some common signs of identity theft you can look for:

• Discrepancies in your bank account statement (transactions you don’t recognize)

• New credit cards being opened under your name that you did not request

• Calls from debt collectors for payments you don’t know exist

Keep tabs on your personal bank account and check your statements often to ensure there are no rogue transactions. Most banks are aware of your daily and monthyl activities and if they detect something out of the ordinary they will often contact YOU about it to make sure it was you who accessed fees from the account.

If you become aware of a new credit card being opened under your name and know it wasn’t you, contact your credit card issuer and ask them to block or close the accounts. You will also have to contact the credit reporting agencies to let them know to exclude that information from your report and possibly initiate a credit freeze.

If you receive calls from debt collectors for reasons you can’t determine, someone may be using your information to accumulate debt. You can check your credit report to confirm this before disputing that information with the credit reporting agencies.

This also applies if you receive unfamiliar bills or discover some are missing. Some criminals will change your mailing address so they can receive more sensitive information. Make sure you keep a record of all your accounts and that you know why you’re paying what you’re paying.

There are steps you can take to reduce your risk of experiencing identity theft, thus causing your credit score to drop. You can regularly check your bank statement, credit report, and credit card statements for any unfamiliar transactions. You should keep your important documents – credit cards, SIN, birth certificate, passport – in a safe place. Don’t give out this information to anyone unless they can prove that they come from a legitimate institution.

If you have moved houses, let creditors and billers know immediately when you change your mailing address. This prevents confusion and reduces the risk that someone else can gain access to your information. Always do your research when embarking on a new financial offer or loan, make sure you choose a trusted and licensed institution when it comes to your money and credit history.

What to Do When Your Credit Score Drops

There are steps you can take to improve your credit score if you notice it has dropped, including paying your bills on time, regularly checking your credit report, and using your credit accounts sparingly.

iCash provides loans for everyone, whether or not you have a good credit score. We offer a variety of quick online loans, such as bad credit loans and payday loans. We want to ensure that you receive the type of financial support you need without facing hidden charges or setbacks from a credit score drop. iCash is the only direct lender in Canada that provides instant approval* at all hours of the day, every day of the week.

About the author