How to Check Credit Score in Canada

Date Published: April 19, 2023 (Updated February 12, 2026)•11 min read

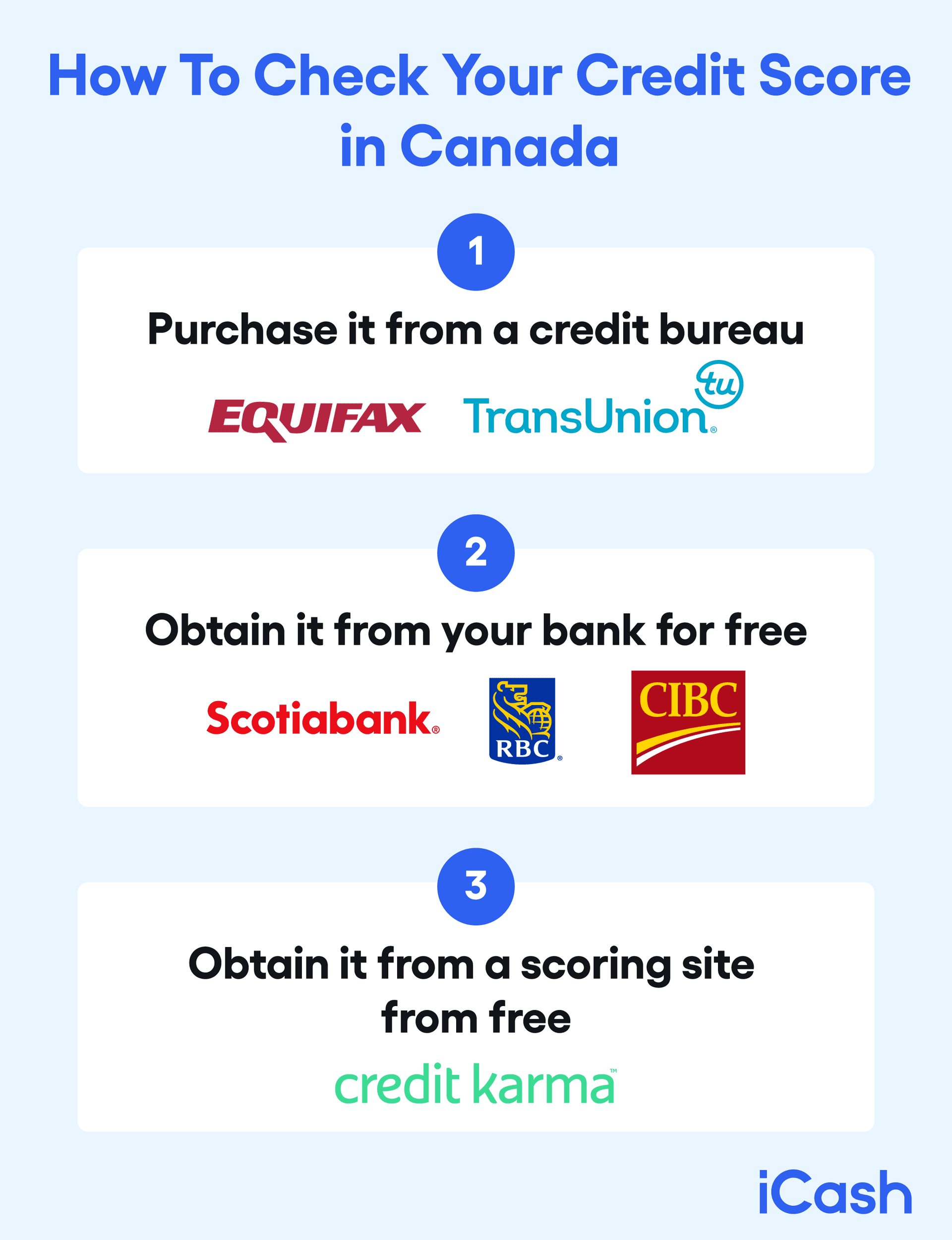

To check your credit score in Canada, you can purchase the results from credit bureaus such as Equifax and TransUnion. You can also get your credit information for free from your bank or online organizations, such as Credit Karma.

Despite these options, 52% of Canadians have never asked for a credit report, according to a 2018 survey by Equifax Canada.

While this number may have improved, it still shows that many Canadians are not money-savvy, especially considering approximately half of the population is in debt.

Whether or not you have debt, one of the best ways to understand your financial position is by checking your credit history and score at least once a year, and definitely before a major purchase or request for credit.

Below, you will find a detailed guide on credit scores and how to check them in Canada:

• Overview of Credit Score

• How to Check Your Credit Score in Canada Using Credit Bureaus

• Get Your Credit Score from Your Bank in Canada for Free

• Other Sources for Your Free Credit Score

• How Often Should You Check Your Credit Score?

• Will Checking Your Credit Score Hurt Your Score?

• Do You Know Your Credit Score? Apply for a Loan Today!

Overview of Credit Score

Your credit score is a numerical expression (between 300 and 900) that tells lenders whether you are likely to default on a loan: your creditworthiness. A high score shows that you would be a low-risk borrower and ideal for a low-interest rate offer.

Your score is generated from your credit report, which is a health summary of your financial history.

Keep in mind that credit bureaus use different types of scoring models to calculate your score. This means that you may have different results from other bureaus.

There is no specific number that guarantees you better loan terms and interest rates. Nonetheless, credit scores from 740 to 799 are above average, while those 800 and above are considered excellent.

These numbers mean the individual has demonstrated responsible credit behaviour, making potential lenders and creditors confident to process their request for quick cash.

Scores from 670 to 739 are considered good, and those from 580 to 669 are fair. Generally, lenders see people with 670 and above as lower-risk borrowers and those from 580 to 669 as subprime borrowers.

These individuals may find it difficult to qualify for favourable loan terms. People with a score of below 580 may find it even more difficult to be eligible for a loan or to get credit.

Note that direct lenders have different criteria when assessing loan applications. Some factors they consider include employment status, source of income and location. Therefore, they may accept varying scores depending on the criteria.

How to Check Your Credit Score in Canada with iCash

Getting your credit score with iCash is quick and completely free. Our credit health service, powered by Equifax, gives you real-time access to your credit score whenever you need it. As an iCash member, you can check your score as often as you'd like without impacting your credit rating.

Here's how to get started:

Create your free iCash account

Access the credit health service through your dashboard

View your Equifax credit score instantly

Monitor your score regularly to track your financial health

Our credit health service breaks down the different factors affecting your rating, including payment history, credit utilization, and length of credit history. This helps you understand exactly where you stand and identify areas for improvement.

iCash members can access their scores anytime. Just remember that inactive users will be unsubscribed after three months, but you can easily reactivate the service through your member dashboard.

How to Check Your Credit Score in Canada Using Credit Bureaus

You can get your credit score from the two main credit bureaus in Canada: Equifax and TransUnion.

Credit bureaus are agencies that collect and compile individuals' credit information from banks and other financial institutions. These are then sold to lenders so they can make the appropriate decision when granting loans.

The process for checking your score from both bureaus is similar.

How to Check Your Credit Score with TransUnion

To check your financial score with TransUnion, you will need to purchase it. Here are the steps to follow:

Step 1: Create a TransUnion Account

Visit the TransUnion credit report portal and sign up for an account with them.

Step 2: Request Your Credit Report and Score

From your account, request your credit report and score, choose how you want to receive it (online or by mail), and then pay.

Note that TransUnion offers a subscription credit monitoring service. You can use this to check your TransUnion credit score online for a monthly fee of $19.95.

How to Get a Free TransUnion Credit Report

Once a year, you are eligible for a free copy of your credit report via mail from TransUnion. If you want to receive your credit report faster online, you will have to pay for it. That said, the TransUnion free credit report doesn't contain your score.

How to Check Your Credit Score with Equifax

To check your score on Equifax, you'll also have to purchase it using the following steps:

Step 1: Create myEquifax Account

Visit the TransUnion credit check portal and sign up for an account with them.

Step 2: Request Your Credit Report and Score

From your account, request your report and score, choose how you want to receive it (online or by mail), and then pay the fee.

Note that TransUnion offers a subscription credit monitoring service. You can use this to check your TransUnion credit score online for $4.95 (for the first month, and following the monthly fee is $19.95.

How to Get a Free TransUnion Credit Report

Once a year, you are eligible for a free copy of your financial credit history via mail from TransUnion. If you want to receive your report faster online, you will have to pay for it. That said, the TransUnion free credit report doesn't contain your score.

How to Check Your Credit Score with Equifax

To check your credit history on Equifax, you'll also have to purchase it using the following steps:

Step 1: Create a myEquifax Account

Visit the myEquifax portal and sign up to create an account. Step 2: Request Your Credit Score

From your dashboard, request your Equifax score and credit report. Equifax gives consumers online access to their financial history and scores through their monthly subscription service, which gives you 2 options ranging from $4.95/month to $9.95/month. (starting at $16.95).

You should typically get online access to your score immediately. However, if you request it by mail, it will be processed and mailed to your address within 15 days.

If you prefer one-time access to your score and report, Equifax offers it at $23.95 for 30 days.

Get a Free Equifax Credit Report

Just like TransUnion, Equifax offers a free copy of your credit report once every year via the mail. This report will contain your personal information, credit account information, hard inquiries (discussed below), bankruptcies, and collection accounts. However, the report does not include your score.

To get a free Equifax credit score online, subscribe to the 30-day trial of Equifax Complete™ Premier.

TransUnion vs. Equifax Credit Score: What is the Difference?

Sometimes, you may find that your TransUnion credit history differs from your Equifax result, even with a similar overall report. The reason for this is these credit bureaus use different metrics to calculate your score. For instance, TransUnion looks at your credit data for the past 24 months, while Equifax uses your 81-month credit history.

Credit report errors may also lead to different scores from the two bureaus. So, while TransUnion may have correct information on your report, Equifax may not – and vice versa.

Get Your Credit Score from Your Bank in Canada for Free

Some banks offer free credit checks to access your overall score for their customers through their online banking platforms. They derive these scores from reputable credit bureaus and will typically indicate which bureau provided the score.

Not all banks offer free credit score assessments, so make sure you call your institution first. But, some popular banks in Canada that offer free scores include Scotiabank, CIBC, and RBC.

Depending on which bank you use, the process for obtaining your free credit report may vary. However, they will typically ask you to register for an online account or use their mobile banking app (if the bank has one).

These days, most banks already get you set up with your online account upon opening your profile with them. However, if they don't, setup is as simple as following their online prompts and providing the necessary identifying information to link your physical account to your online one. If you have any issues, you can always visit the bank, and they will help you get set up.

Once your online account is set up, you simply follow their virtual prompts and go to their "Free Credit Score Service," and you can request your free report.

Other Sources for Your Free Credit Score

You can access your score for free from several online sources, including Credit Karma and other third-party financial institutions.

Get Your Free Credit Score from Credit Karma

This is as simple as signing up for a free account on Credit Karma and pulling your free credit report and score. Note, though, that Credit Karma does not calculate your score by itself. Instead, it pulls your score and reports information from TransUnion and Equifax.

One common question is whether checking your financial report through Credit Karma will negatively affect your credit score. Since Credit Karma generates your TransUnion and Equifax scores through a soft inquiry, it does not negatively impact your overall score.

Soft inquiries are used as a reference, not for attempting to open a new line of credit, such as a hard inquiry is. That means you can check your scores as often as you would like without negatively affecting your score in the long run.

Other Third-Party Sources to Access Your Credit Score

Aside from banking institutions and the official credit bureaus, many third-party financial institutions can help you obtain your free credit report. Typically, each institution will require that you set up an account.

During this process, you will be asked for personal identification information that can be considered sensitive, which is why you must research the institution beforehand to avoid online scams. Once you have supplied the institution with the necessary identifying information, which they will check against the information at the credit bureaus to ensure accuracy, you'll be able to follow their required steps to request your free report.

How Often Should You Check Your Credit Score?

A good rule of thumb is to check your score every three months -- or monthly if you conduct many transactions and want to make sure your finances are in order and there is no fraudulent activity on your account.

Your score may take months to change, so you shouldn't check it daily or weekly. Only checking it once every year is not the best practice, as you may find significant changes to your credit report over this period, but it is the bare minimum.

Benefits of Checking Your Credit Score Regularly

The benefit of checking your credit scare regularly is that you need to know your score if you plan on buying a house, a car or even applying for a credit card or a short term loan.

A regular score check affords a lot of benefits, including:

Ensure Your Credit Information is Accurate

Your score reflects the information on your credit report. Check your score regularly to ensure your financial record is current and accurate. If the score is lower than expected, there could be errors in your file. In this case, dispute the issue with the relevant credit bureau.

Rebuild and/or Maintain a Good Credit

Credit history doesn't change in just a few days. It takes months and sometimes years to build up a good one. Monitoring your score keeps you in control of your credit and makes you accountable for achieving your financial goals.

Know Your Financial Health

Ignoring your score is just as detrimental as ignoring your physical health. Whether good or bad, it's important to know where you stand financially. This will push you to take steps to improve your financial position and get out of debt.

Respond to Crucial Issues Quickly

Checking your score frequently informs you of changes to your credit report as soon as possible. For example, if your score falls suddenly, you can easily trace the cause and quickly take the necessary actions to recover your lost points. If you take too long to check your score, you may not be able to narrow down the cause and may have a difficult time recovering.

Will Checking Your Credit Score Hurt Your Score?

Checking your credit score yourself does not impact the final number.

Here's how it works: Anytime your credit is checked, an inquiry is registered on your report. Depending on who is reviewing it and why it is being checked, this inquiry is classified as either soft or hard.

How to Check Your Credit Score Without Penalty

A soft inquiry is the only sure way to check your score with zero penalties. That said, you can moderate the effects of a hard inquiry on your credit. For instance, you can apply only for loans you are most likely to get approval for in order to reduce the number of hard inquiries on your file.

What is a Soft Inquiry?

A soft inquiry is a type of credit check that either you or a third party completes for non-lending purposes.

For example, a soft inquiry is triggered when you check your report via a credit bureau or free database for your personal reference. It can also be triggered when you submit a rental, insurance or job application. These third parties would likely complete a soft inquiry credit check to assess your financial health.

This kind of credit check does not lower or negatively impact your score. On the contrary, it is a healthy credit monitoring practice.

What is a Hard Inquiry?

A hard inquiry is a type of credit check a third party completes for lending purposes.

For example, you can trigger a hard inquiry when you seek a loan to purchase a home or a car. The lender will complete a hard inquiry check of your credit history to assess whether you would be a financial risk.

Hard inquiries can have a short-term negative impact on your credit score. Too many hard inquiries in a short time can drop your score by 7-10 points. This could also mean you are seeking different loans and credit cards that you probably can't repay. Hard inquiries stay on your credit report for two years but will only impact your score for a few months.

Sometimes, hard inquiries are unavoidable: For example, when applying for an auto loan or mortgage. In such cases, credit bureaus may recognize that you are submitting applications to multiple lenders to compare rates for one type of loan. Generally, you won't be penalized for this.

How to Check Your Credit Score Without Penalty?

A soft inquiry is the only sure way to check your score with zero penalties. That said, you can moderate the effects of a hard inquiry on your credit. For instance, you can apply only for loans you are most likely to get approval to reduce the number of hard inquiries on your report.

Do You Know Your Credit Score?

The next time you want to apply for a loan, you may want to check your score first and note the factors that may influence the lender's decision about your application. Fortunately, at iCash.ca, you do not need a good credit score to be approved. We offer fast, secure, and easy loans available every day of the week, 24-hours a day.

About the author