When you own a home with a mortgage, failing to make the required payments can lead to what’s known as mortgage foreclosure. According to the most recent data from Bank of Canada, 99% of Canadian mortgage holders are in good standing. However, this still means over 11,000 Canadian mortgages are in arrears, meaning they are overdue by at least three months.

Foreclosure is a legal process where the lender takes steps to recover the money owed by seizing and selling the property. In Canada, mortgage lenders view foreclosure as a last resort. The process and options can vary by province, but the outcome is serious: you could lose your home.

Today, we’re going to cover all the basics of mortgage foreclosure in Canada. Our discussion will include the many reasons foreclosures happen, the consequences of foreclosure, how to avoid them, and much more.

What Does Mortgage Foreclosure Mean?

Foreclosure happens when a homeowner defaults on their mortgage, usually by missing several mortgage payments in a row. Because the home is collateral for the loan, the lender can eventually seize and sell the property to recover the money owed.

Importantly, foreclosure procedures differ across Canada.

In some provinces (such as British Columbia and Alberta), lenders must go through the courts. In others, like Ontario, lenders commonly use a power of sale clause instead of a court foreclosure.

Both processes result in the home being sold, but as we’ll explain below, they work in different ways.

Why Do Foreclosures Happen?

Most simply, foreclosures happen when homeowners cannot keep up with their mortgage payments. No one buys a home planning to go into foreclosure one day, but all kinds of circumstances can arise that make this a reality for many Canadians.

Some of the most common reasons include:

Illness

Rising expenses/inflation

Any other financial hardships that make it difficult to pay the mortgage

It usually takes more than a single missed payment for most lenders to initiate foreclosure.

Typically, you need to miss two or three payments (about 90 days without payment) before a lender considers taking action. Just keep in mind that every mortgage contract is different, so the exact number of missed payments that trigger foreclosure can vary.

The Foreclosure Process in Canada

Fortunately, before initiating a foreclosure, you’ll usually get a warning via a formal notice of default. This notice is a warning that you are behind on payments, and it gives you a chance to catch up. Lenders don’t want to go through the expensive foreclosure process either, so this grace period is beneficial to mortgage holders as well as lenders.

Don’t ignore these notices or fail to make arrangements. If you do, it will likely lead to the lender moving forward with foreclosure proceedings.

In provinces that require judicial foreclosure, the lender files a claim in court. A judge may give the homeowner a fixed time (sometimes a few months) to pay the arrears or the full mortgage balance. If the debt remains unpaid, the court can issue an order to sell the property or transfer it to the lender.

In the end, the home will be sold and the borrower will be evicted if foreclosure is completed.

The entire process can take several months or more, which gives the homeowner some time to try to resolve the situation. But if no resolution is reached? The property will be sold to pay off the loan.

Foreclosure vs. Power of Sale

In some provinces, lenders use a power of sale instead of the court foreclosure process. A power of sale allows the lender to sell the property after a default, often much faster and without a court order.

The lender must still give notice and a waiting period (for example, 35 days in Ontario) for the homeowner to pay the arrears. This is also known as the redemption period. After that, the lender can proceed to sell the home.

There are considerable differences between foreclosure and power of sale. For example, with a power of sale, the homeowner keeps any surplus money if the house sells for more than the debt (and the lender can sue for any shortfall).

Conversely, with foreclosure, the lender takes ownership of the property and keeps all proceeds (but generally cannot pursue the borrower for a shortfall).

In summary, power of sale tends to be faster and less expensive, while foreclosure involves more legal steps and can strip the owner of any equity in the home.

Consequences of Foreclosure

Going through a foreclosure has weighty financial effects.

First, you will lose your home and have to move out. Your credit history will also suffer a major blow – a foreclosure record can remain on your credit report for about seven years. This can make it tough to get a new loan for a while.

You could also lose any equity you had in the property. If the sale of the home does not cover the full mortgage balance you owe, you might still be responsible for the remaining mortgage debt depending on the province and process.

In short, foreclosure can affect your finances and credit for years to come.

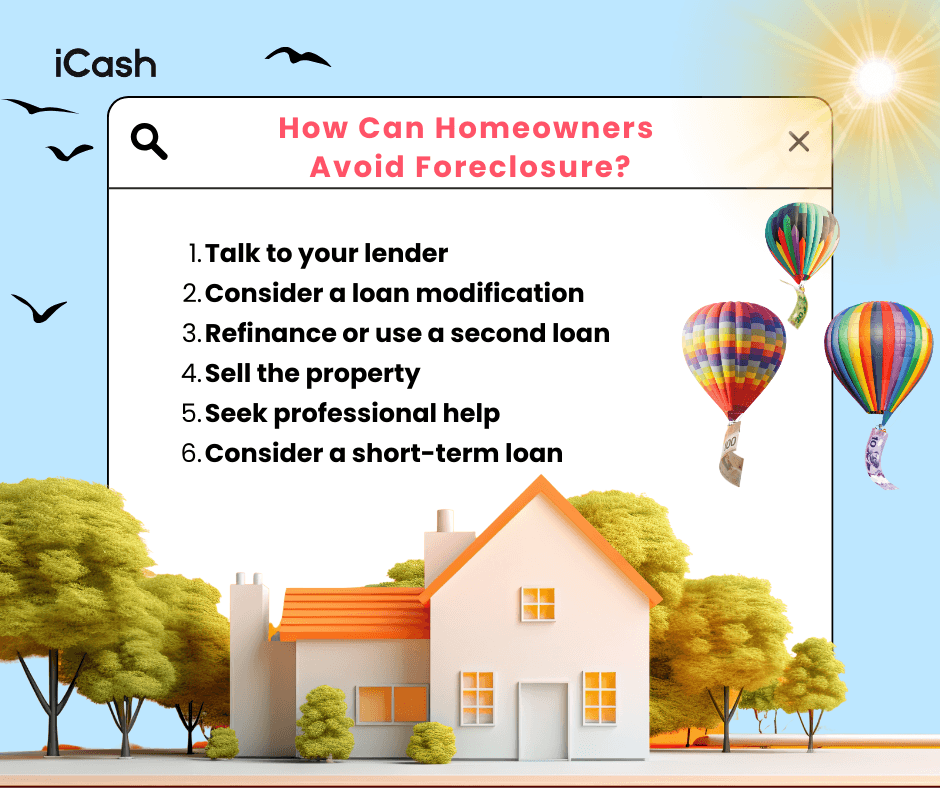

How Can Homeowners Avoid Foreclosure?

If you are facing potential foreclosure, the most important thing is to take action early.

Here are some steps that might help you avoid foreclosure:

Talk to your lender

Contact your lender immediately and explain your situation. They may offer options like a revised payment plan or a temporary deferral of payments. Lenders often prefer to work with you rather than move forward with foreclosure, since foreclosure is expensive and time-consuming for them as well.

Being upfront about your financial challenges shows goodwill and opens the door to potential solutions before the situation gets even worse.

Consider a loan modification

Ask if your lender can adjust the terms of your loan (for example, extending the amortization period or lowering the interest rate) to reduce your monthly payment. A loan modification can make your mortgage more affordable and help you catch up on overdue payments without having to refinance.

While approval depends on your financial situation and the lender’s policies, this option can provide long-term relief if your income has changed. Some lenders even have hardship programs specifically designed for borrowers facing temporary financial struggles.

Refinance or use a second loan

If possible, refinance your mortgage to get a lower rate or longer term. Alternatively, a second mortgage or home equity loan could provide funds to catch up on missed payments (though this means taking on new debt).

Refinancing works best if your credit is still in relatively good standing and your home has maintained or increased in value. A second loan can be riskier since it adds another layer of debt. That said, it may buy you time to stabilize your finances and avoid foreclosure proceedings.

Carefully review the costs and interest rates to make sure this option makes sense for your circumstances.

Sell the property

If keeping the home is not feasible, selling it on your own terms might be better than waiting for the bank to foreclose.

You can use the sale proceeds to pay off the mortgage, and you might preserve any remaining equity. Selling early also avoids the damage that foreclosure can do to your credit report.

While this is a difficult decision, it gives you more control over the outcome and allows you to move forward with fewer financial and legal consequences. In a strong housing market, you may even walk away with extra funds after paying off your mortgage balance.

Seek professional help

Talk to a credit counselor or financial advisor for guidance. In extreme cases, speaking with a licensed insolvency trustee or a lawyer can help you consider options like a consumer proposal or other legal strategies to manage your debts.

These professionals can negotiate with lenders on your behalf and explain the long-term effects of each option. Having an experienced advisor can also mitigate your stress since they understand the legal and financial steps involved.

Professional support is especially important if you have multiple debts beyond your mortgage and need a clear plan to regain financial stability.

Don’t ignore the problem. Staying proactive and communicating with your lender improves your chances of finding a solution and keeping your home.

Consider a short-term loan

If you’re struggling with overdue bills or other financial pressures, short-term relief can help you stay on track. At iCash, we provide quick and responsible payday loan options to help Canadians manage urgent expenses.

Applying online is simple, and approved funds can arrive in your account within hours—giving you room to focus on the bigger financial decisions that matter most.

Frequently Asked Questions

How many mortgage payments can I miss before foreclosure begins?

Most lenders will consider foreclosure after about two or three missed mortgage payments in a row (roughly 60 to 90 days of non-payment).

However, it can depend on your lender and mortgage agreement. You will usually receive a notice of default before any legal action starts.

How long does the foreclosure process take in Canada?

It varies. In provinces using power of sale like Ontario, the process from the first missed payment to the property’s sale can be as quick as six to 12 months. In provinces with judicial foreclosure, it often takes longer (sometimes nine months to over a year), since court proceedings add extra steps.

Every case is different, but foreclosure is not instantaneous; the procedure gives some time for the homeowner to try to remedy the situation.

Do I still owe money if my house is sold and it doesn’t cover the mortgage?

Possibly. If your home is sold and the sale price is not enough to pay off the outstanding mortgage, the remaining amount is called a deficiency. In a power of sale scenario, the lender can require you to pay that deficiency.

In a full foreclosure (where the lender took ownership), you typically would not owe the shortfall. However, in that case, you also wouldn’t receive anything if the house sold for more than what was owed.

Can I stop a foreclosure once it’s in progress?

Yes, up until a certain point. Paying off the overdue amounts (plus any fees) will usually halt the foreclosure. You can also work out an agreement with your lender (such as a payment plan or a loan modification) to stop the process.

Once the home is sold or the court grants a final foreclosure order, it’s too late. But prior to that, the homeowner has opportunities to save the home.

How will a foreclosure impact my credit?

A mortgage foreclosure is one of the worst marks on a credit report. It will significantly lower your credit score, and the record of the foreclosure can remain on your report for about seven years. We talk about how to increase your credit score in six months in this article.

During that time, getting approved for new credit (especially another mortgage) will be very difficult, and you’ll likely face higher interest rates. The good news is that as more time passes after the foreclosure, its impact on your score will lessen, and you can work on rebuilding your credit.