How Canadians have adapted their shopping habits due to Inflation in Canada

In Canada, inflation has been on the rise. This is an economic phenomenon where the general price level of goods and services increases over time, resulting in a decrease in purchasing power. This can have significant impacts on consumer spending habits, as people adjust their spending patterns to cope with rising prices and ensure they can afford their basic necessities.

This is particularly true for those with lower incomes, who may struggle to afford basic necessities. As a result, many Canadians are having to cut back on their spending or even need to get an emergency rent loan along with revising their budgets to help keep up with costs that are associated with rising a family.

People have to be resourceful and creative to adapt their shopping habits in response to the current inflation rate in Canada. Here are some of the ways they have done so:

Online shopping

The pandemic has accelerated the shift towards online shopping, and it has also been a popular way to save money. With the ease of online shopping, you can compare prices and find better deals without leaving your home. This enabled you to save money on essential items such as groceries, household supplies, and clothing.

Shift towards generic and store-brand products

Another way Canadians have adapted their shopping habits is by choosing generic and store-brand products. These items are often significantly cheaper than name-brand products, allowing you to maintain your standards of living while keeping costs down. In some cases, these products are comparable or even better in quality than their more expensive counterparts.

Reduction in non-essential purchases

Many people have also reduced their spending on non-essential items. This includes entertainment, travel, and luxury goods. Some have cut back on these purchases to focus on their basic needs and lower their expenses.

Increase in coupon usage

Coupon usage has also increased in Canada as a way for consumers to save money. People are using coupons for essential items such as groceries, household supplies, and personal care products.

Emphasis on buying locally produced goods

Many people prefer buying locally produced goods. By supporting local businesses, you can save money on transportation costs and support their local economy. Additionally, local products may be fresher and of higher quality than imported products.

Despite these adaptations, many people remain concerned about inflation and the increases in pricing for essential items such as food and housing putting a strain on their finances.

Furthermore, there are many people who are worried about the long-term effects such as reduced purchasing power and the erosion of their savings.

In this article, we will explore how Canadians have adapted their shopping habits to higher inflation rates, as well as their concerns about the impact that it is having on their financial well-being.

What Is The Inflation Rate in Canada?

In March 2023, Canada's inflation rate fell to 4.3%, the lowest level since August 2021, as predicted by economists. This deceleration was mainly due to the decline in gasoline prices, which decreased by 13.8% in the year leading up to March. However, food prices rose at a pace of 9.7%, and mortgage interest costs increased by 26.4%, contributing to the overall rise in living costs.

Fresh produce prices have shown signs of deceleration, but food prices have increased at their fastest pace in decades this year, leading to rising concerns for consumers. The prices of fresh fruits and vegetables increased by 7.1% and 10.8%, respectively, in the year up to March, down from 10.5% and 13.4% the previous month. Meanwhile, mortgage interest costs hit a record high, rising by 26.4% over the same period, as Canadians continued to renew and initiate mortgages at higher interest rates.

To help control inflation, the Bank of Canada is forecasting a rate hike to reach 3% in a few months, which could make borrowing more expensive, lower demand, and subsequently reduce prices. In response to the rising cost of living, the co-op model has become increasingly popular among consumers, especially in smaller markets where only one major grocery store exists. Co-ops such as The Grainery Food Cooperative in Halifax, which orders food in bulk from local suppliers and resells it to the public at the lowest price possible, have become an alternative for consumers.

Canadians' Concerns about Inflation

One of the primary concerns for Canadians is the impact of inflation on the cost of living. The price of essential items, such as groceries, homes, and transportation, continues to rise, making it challenging for many households to make ends meet.

Another area of concern is the effect of inflation rate on retirement savings. With the rising cost of living, retirees may find that their savings are not enough to cover their expenses. Inflation can erode the value of investments, making it harder for retirees to maintain their standard of living.

The housing market is also a significant concern. Many are worried if they will be able to afford a home. Higher interest rates could make it harder for Canadians to qualify for mortgages and maintain their current housing payments.

Another significant worry is the potential for a recession. The current inflation rate can raise the risk of a recession if the Bank of Canada needs to raise interest rates. This, in turn, could lead to a slowdown in economic growth and a potential recession.

As a result, many are taking steps to protect their finances, such as investing in assets that are less affected by the current economic environment, as well as reaching out to financial advisors to get ideas on how to manage their money.

Government of Canada Response to Inflation Rates

The Canadian government has implemented several initiatives to address rising inflation rates and provide support to it's citizens during these challenging times. Here are some of the key actions taken by the government to address the current inflationary cycle:

The Bank of Canada aims to keep inflation within a target range of 1-3% and uses interest rates as a tool to achieve this goal. If economic-growth is too high, the Bank of Canada may increase rates once again to slow it down.

On the other hand, if Canada's economic growth is too low, the Bank of Canada may need to lower interest rates to stimulate it. This policy has been effective over the long term and has contributed to Canada's economic strength.

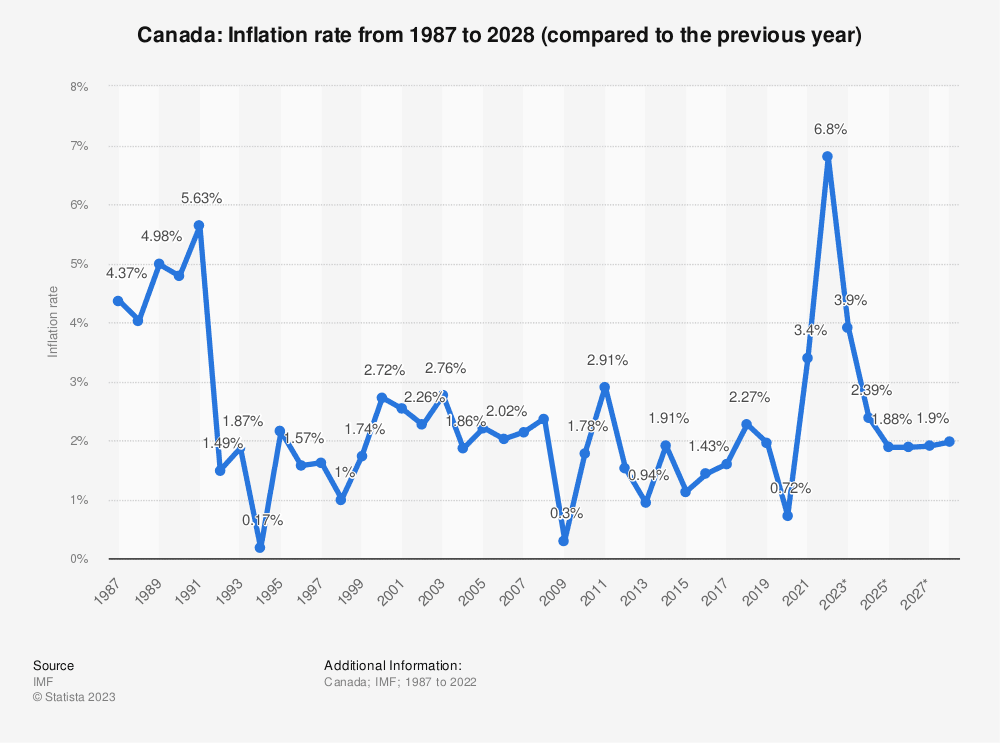

As can be seen from the chart below, long-term inflation rates in Canada have been stable over the years, however, they have a big impact in the short term on people and how they live.

Find more statistics at Statista

The government of Canada has implemented several initiatives to reduce inflationary pressures. For example, they’ve introduced tax credits and incentives for businesses to invest in new technologies and processes that reduce their production costs. They also put more money into infrastructure projects to improve the efficiency of the economy and reduce transportation costs.

The Canadian government has also increased funding for education and training programs to help workers develop new skills and remain competitive in the job market.

Despite these actions, some have expressed concerns about the effectiveness of the government's response to deal with higher costs of living. For example, some argue that these initiatives are not enough to address the root causes of Canada's inflation rate, such as supply chain disruptions and rising global commodity prices.

Others say that the current administration needs to do more to address income inequality and provide support to low-income households, which are most affected by rising prices.

In response to these concerns, the Prime Minister has indicated that his government will continue to monitor the Consumer Price Index and collaborate with the private sector as well as other stakeholders to address inflationary pressures.

Ultimately, it will require a collaborative effort from all stakeholders to address the root causes of price increases and ensure that everyone can continue to afford their basic necessities.

The Global Nature of Inflation Rates and the Need for Collaborative Solutions

It is important to remember that the current inflation rate issue is not unique to Canada but is a worldwide phenomenon. Many countries are experiencing similar issues due to the monetary policies of many governments during the COVID-19 pandemic along with other global factors, such as supply chain disruptions and rising commodity prices.

As a result, the Canadian government's response to higher inflation must be viewed within a global context, and it is essential to collaborate with other countries and stakeholders to address these challenges.

The global nature of higher costs of living means that some factors affecting higher costs in Canada are beyond the control of the Canadian government. For example, global supply chain disruptions have led to shortages of certain goods and increased transportation costs, contributing to higher prices for consumers. Similarly, rising global commodity prices have had a significant impact on the cost of living, making it harder for people to afford basic necessities.

This means that solutions must be sought on a global scale. This includes collaboration between governments, international organizations, and private sector stakeholders to address the root causes of high prices and mitigate its impact on households and economies worldwide.

It is not enough for individual countries to implement short-term solutions; a coordinated global response is needed to address the complex and interconnected nature of the inflation challenge.

Help for Canadians Who Need Extra Cash in Inflationary Times

With the current inflationary environment, many Canadians are finding it increasingly difficult to keep up with the rising cost of living and need extra cash. As the prices of goods and services continue to climb, many people are struggling to pay their bills and make ends meet.

However, there is a solution for those who need immediate financial assistance - iCash. You can apply online for loans of up to $1,500 with instant approval*, providing you with the financial relief to stay afloat during these challenging times.

We understand that higher food and living expenses can create financial stress for many, which is why they offer flexible repayment options and competitive interest rates. Their quick loans are designed to help borrowers bridge the gap between paydays, cover unexpected expenses, or pay off outstanding bills.

You can get the money you need quickly and easily, without having to go through a lengthy application process or provide collateral. Whether you need to pay for groceries, utilities, or medical expenses, they can help you get back on track and alleviate the burden of financial strain.

If you're a Canadian who is struggling to pay your bills due to higher inflation rates, consider applying for a loan from iCash today and get the financial relief you need to stay on top of your finances.