There’s no denying that in recent years, the economy has faced significant changes, with rising interest rates being one of the most noticeable trends. When they increase, it becomes more expensive to take out loans, whether for a home, car, or even day-to-day expenses through credit cards. It’s the unfortunate reality that many Canadians face today.

Higher interest rates can influence everything from the cost of your mortgage to the amount of interest accumulating on your credit card balances.

For many, these changes can create financial stress and make it harder to manage everyday expenses.

This is why being aware of how interest rates work and managing the impact of higher interest rates can help you protect yourself. This might include adjusting your budget, paying off high-interest debt, etc.

Understanding Interest Rates and Their Impact

How Interest Rates Work

Interest rates are the percentage of money that lenders charge when you borrow money. Financial institutions usually offer them in two main types: fixed and variable.

A fixed interest rate stays the same throughout the life of the loan, meaning your payments won’t change. This is helpful for budgeting since you know exactly what you’ll pay each month.

A variable interest rate, on the other hand, can change over time, depending on the market. When rates rise, your payments could increase, making it harder to manage your loan.

It’s important to know the difference between these two types of loans, especially when interest rates are fluctuating, so you can choose the right one.

When a Rise in Interest Rates May Affect You

Depending on the type of loan or credit you have, a rise in interest rates will impact you differently. If you have a variable-rate loan, such as some mortgages or credit cards, you might see your payments go up as rates rise. This can strain your budget, especially if the increase is sudden or large.

You might think that means that a fixed-rate loan would be the opposite, right? Well, even if you have a fixed-rate loan, you could be affected when it’s time to renew. If rates are higher at that time, your new loan might come with a higher interest rate, which would lead to higher payments.

Trigger Rates and Negative Amortization

Trigger rates and negative amortization are extremely important concepts to understand, especially if you have a variable-rate loan. A trigger rate is the point where your loan payments no longer cover the interest, meaning your loan balance actually starts increasing instead of decreasing.

This is called negative amortization. It can happen when interest rates rise quickly, and your payments don’t keep up with the new, higher interest costs. This can lead to a larger debt over time, which is why it’s important to keep an eye on interest rates and adjust your payments if needed.

Managing Financial Impact

Dealing with a Rise in Interest Rates

Whenever an interest rate increase occurs, it can make things incredibly frustrating, but there are ways to deal with it and remove as much unnecessary stress as possible. The first simple step is to review your budget to see where you can cut back on non-essential spending.

Next, your main focus should be on paying down high-interest debt as quickly as possible. Credit cards and variable-rate loans are often the most expensive when interest rates go up, so it’s smart to tackle these first.

If it’s possible, consider making extra payments or paying more than the minimum required. This will help you reduce your overall debt faster and save money on interest.

It’s also a good idea to keep an eye on your borrowing costs. If you notice that rates are continuing to rise, it might be worth exploring refinancing options. Refinancing can sometimes help you lock in a lower fixed interest rate, making your payments more predictable and easier to manage.

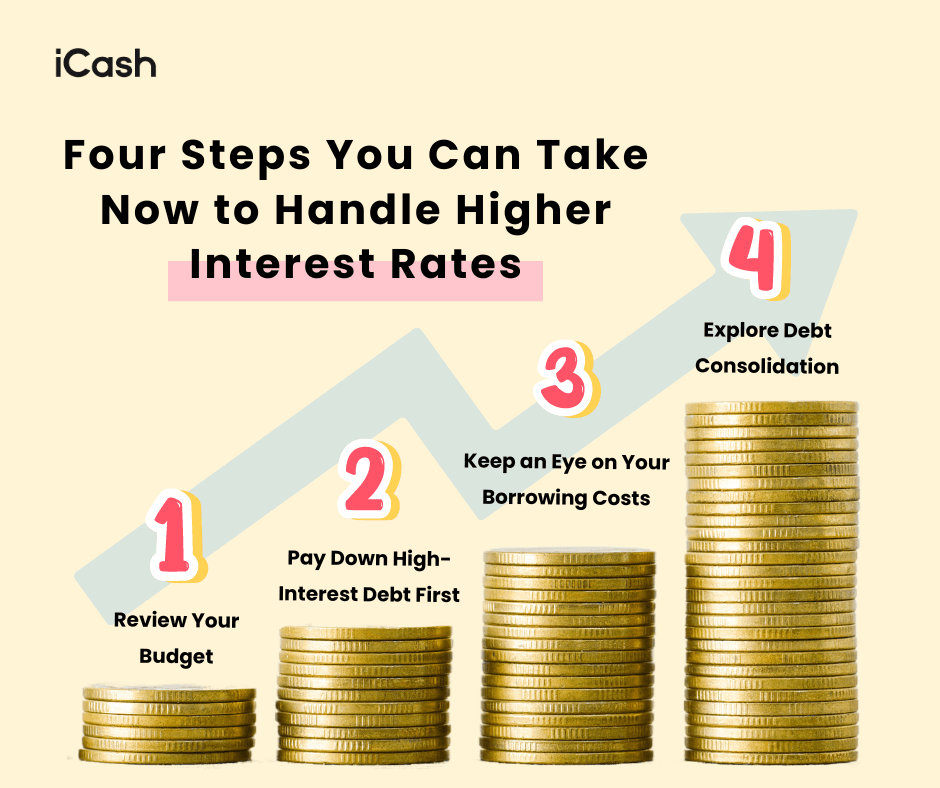

Four Steps You Can Take Now to Handle Higher Interest Rates

Review Your Budget

Start by looking at your current expenses and finding areas where you can cut back. Even if it’s a little bit, it can help. This extra money can then be used to cover higher loan and credit card payments.

Pay Down High-Interest Debt First

Another good idea to handle higher interest rates is to focus on paying down high-interest debt first. Credit cards and variable-rate loans usually have higher interest rates.

By prioritizing these debts, you can reduce the interest you pay over time, save money, and become debt-free faster.

Keep an Eye on Your Borrowing Costs

Keep an eye on the rates of your loans and credit cards, and if you notice rates going up, consider refinancing options. Refinancing can help you secure a lower fixed interest rate, making your payments more predictable and manageable.

Explore Debt Consolidation

If you have multiple debts with varying interest rates, exploring debt consolidation might be a smart move. By consolidating your debts into one loan with a lower interest rate, you can simplify your payments and potentially save money on interest.

Specific Impacts on Loan Payments

Impact on Mortgage Payments

When interest rates rise, your monthly mortgage payments can increase, especially if you have a variable-rate mortgage. This means you’ll need to pay more each month, which can obviously put pressure on your budget.

If you're worried about further rate hikes, consider a fixed-rate mortgage. To reduce the principal balance, try making extra payments when you can. Over time, this can help you pay less on your mortgage payment.

Impact on Personal (Payday) Loan Payments

Payday loan interest rates (also referred to as personal loans) can also be affected. If you have a variable-rate loan, your monthly payments might go up, making it harder to keep up. One way to manage this is by paying off your loan as quickly as possible, which reduces the amount of interest you’ll owe.

Impact on Credit Card Payments

Credit card payments can definitely be impacted by rising rates. Since credit cards often have variable rates, your interest charges can increase, leading to higher monthly payments.

If you can, try making more than the minimum payment each month when your monthly payments come around to reduce your balance faster. You can also explore transferring your balance to a card with a lower interest rate to help save on interest costs.

Stay Ahead of Rising Interest Rates

In the end, it’s quite obvious that rising interest rates can significantly impact your finances, from mortgage and personal loan payments to credit card bills. Managing these changes is possible, but it requires proactive financial planning, such as reviewing your budget, paying down high-interest debts, and adjusting your spending habits.

If you’re unsure about the best steps to take, consider seeking professional financial advice. Now is the time to review your financial situation and make necessary adjustments. For more tips and tools on managing your finances, visit the iCash learn center!