Your credit score plays a big role in your financial life, affecting your ability to get loans, credit cards, or even rent an apartment. So, if your score isn’t where you want it to be, you’re understandably nervous about what this means for you.

The good news is that by understanding how credit works and taking a few consistent steps, you can boost your credit score within half a year.

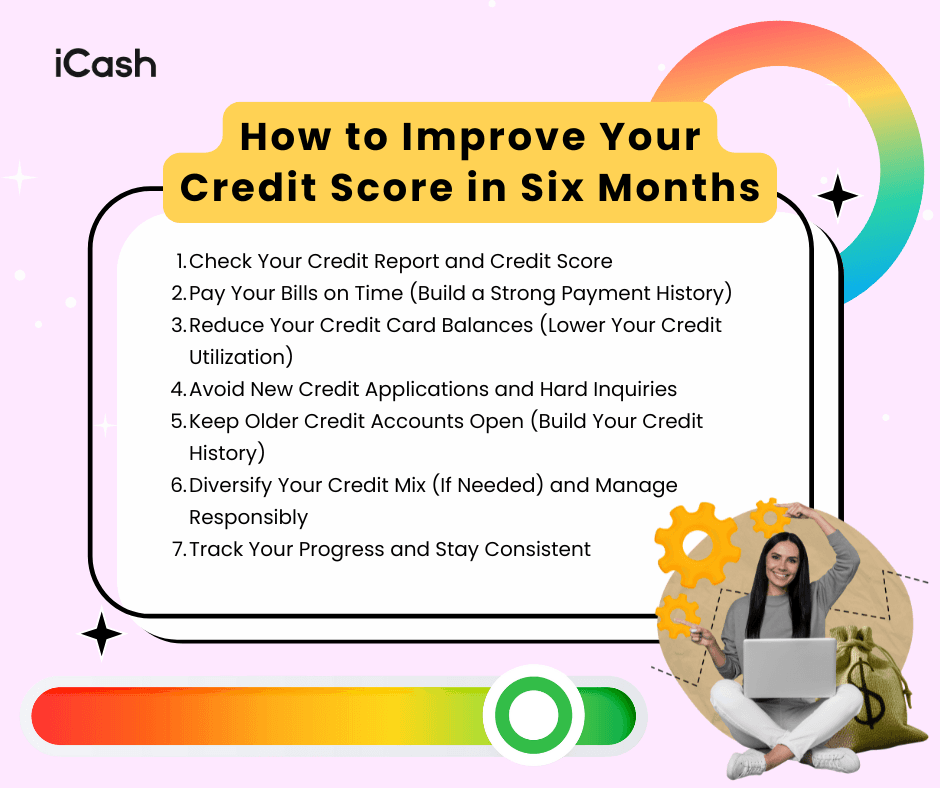

How to Improve Your Credit Score in Six Months: Step-by-Step

In this guide, we’ll explain how to improve your credit score in six months using simple strategies that anyone can follow. We’ll cover checking your credit report, building a positive payment history, reducing your debts, and other smart habits to help raise your score and open up better financial opportunities.

Check Your Credit Report and Credit Score

First things first: to start improving your credit score, review your credit report and current score. Your credit report is a detailed record of your credit history, while your credit score is a three-digit number that summarizes that history.

Here’s what you need to do during this first all-important step:

Request your credit reports from Equifax and TransUnion (credit reporting agencies) for free. This will not affect your score.

Review your reports for errors or unfamiliar accounts. Dispute any mistakes to have them corrected.

Check your starting score using your bank, a financial app, or iCash’s free credit health tool.

Monitor your score regularly to track your progress, checking your own score is a soft inquiry and won’t lower it.

Identify and address negative items such as late payments, collections, or high balances.

Bring past-due accounts current and arrange payment on collections where possible. A zero balance is better than unpaid debt.

By the end of month one, aim to have reviewed your reports, fixed any errors, and outlined what needs improvement.

Pay Your Bills on Time (Build a Strong Payment History)

One of the most important factors in your credit score is your payment history, which is essentially whether you pay your bills on time. In fact, payment history typically makes up about 35% of your credit score calculation, making it the single biggest influence on your score.

Always pay on time. Credit cards, loans, utilities, and cell phone bills all count. Even a short delay can hurt your score. Payments over 30 days late often appear on your credit report and stay there for years.

Set reminders or use auto-pay to avoid missing due dates. If you manage multiple accounts, try aligning due dates or using a bill-tracking app to stay organized.

Catch up on past-due accounts as soon as possible. Contact creditors if needed because they may offer payment plans or extensions. Once current, six months of on-time payments will help rebuild your payment history.

Build strong habits. Each on-time payment adds a positive mark to your credit file. Over time, these outweigh older negatives. Avoid major delinquencies or collections. If you’re at risk of missing a payment, contact your lender early to discuss available options.

Reduce Your Credit Card Balances (Lower Your Credit Utilization)

The second biggest factor in your credit score is how much revolving debt you carry compared to your credit limits. This is called your credit utilization ratio. To improve your score, aim to keep this ratio at 30% or less. Lower balances show lenders that you manage credit responsibly.

Calculate your utilization: Add up your credit card balances and divide by your total credit limits. For example, if you owe $2,500 on a $5,000 limit, your utilization is 50%. Reducing that to below $1,500 brings you under 30%, which is ideal. The lower the better.

Pay strategically: Over the next six months, try to pay more than the minimum, focusing on high-interest or high-balance cards first.

Avoid adding new debt: Try to limit credit card use for now. Use a budget and stick to cash or debit for everyday expenses. If you must use credit, pay off new charges immediately.

Think carefully about credit limit increases: A higher limit can lower your utilization if your balance stays the same, but it may also come with a hard inquiry or tempt you to spend more. If you ask for an increase, do it once, ideally with your oldest card, and avoid using the extra credit.

Avoid New Credit Applications and Hard Inquiries

Applying for new credit during your improvement period can slow your progress. Each application affects your credit in different ways, so it helps to understand the impact and plan carefully.

Know the difference between inquiries. Hard inquiries from credit applications can lower your score, especially if there are several within a short time. They stay on your report for two years, with the most impact in the first year. Soft inquiries, such as checking your own score, have no effect.

Time your loan shopping wisely. If you need a car or a mortgage loan, try to complete all applications within two weeks. Credit models often treat them as one inquiry. If possible, wait until your credit has improved before applying.

Avoid unnecessary credit cards. New cards add hard inquiries and lower your average account age. Instead, give your existing accounts time to help your score. After six months, you may qualify for better offers anyway.

Keep Older Credit Accounts Open (Build Your Credit History)

Another factor that affects your credit score is the length of your credit history, or how long you have been using credit.

Older is better: Scoring models look at both the average age of your accounts and the age of your oldest one. If you have a card you opened years ago, it shows a strong relationship with credit. Closing that account could drop your average age and hurt your score. Unless you have a good reason (such as a high annual fee), keep older accounts open.

Keep old cards active: Some issuers may close accounts due to inactivity. To avoid this, make a small purchase every few months and pay it off. This keeps the account active, helps your utilization ratio, and adds to your credit history. Be sure to pay on time to protect your payment record.

Think before closing or moving accounts: If you transfer a balance to a new card and then close the old one, you reduce your history and increase your average account age. It is better to leave the old account open until your score improves. Similarly, paying off a loan is good, but understand that closed loans will eventually stop contributing to your active history. Your score might dip slightly before recovering.

Diversify Your Credit Mix (If Needed) and Manage Responsibly

Credit mix refers to the types of accounts you use, such as credit cards (revolving) and loans (installment). A varied mix can slightly help your score, but it is a smaller factor, so only open new accounts if they make sense for your finances.

If you have only used credit cards, a secured credit card or a credit-builder loan can help build history. iCash, for example, offers short-term loans that may support your credit-building efforts, as long as you borrow within your means.

You could also become an authorized user on someone else’s well-managed card, but this requires trust and may not always be reported.

If you already have both a card and a loan, focus on managing them well. Positive, consistent use will strengthen your credit mix over time.

Track Your Progress and Stay Consistent

As you work through these steps, checking your report, paying on time, reducing balances, avoiding new inquiries, and maintaining your accounts, track your progress.

Credit scores often improve gradually, so try not to get discouraged if you do not see immediate results. Like a fitness plan, steady effort adds up. With consistency, your score should be higher after six months.

How To Improve Your Credit Score In Six Months: Frequently Asked Questions

Can a credit score improve in six months?

Yes, a credit score can improve in six months. In fact, six months is enough time to see a noticeable difference if you practice good credit habits consistently.

By doing things like paying all your bills on time and reducing your credit card balances, many people can raise their scores within this timeframe.

How can I boost my credit in six months?

To boost your credit in six months, focus on the core actions that influence your score:

Pay all bills on time: This is the single most important factor. Six months of perfect payment history will strengthen your credit profile significantly.

Pay down credit card debt: Aim to bring your balances below 30% of your credit limits (or even to zero if possible). Reducing your credit utilization helps improve your score.

Avoid new credit inquiries: Don’t apply for unnecessary credit cards or loans for now. Give your score time to recover and grow without new hard inquiries.

Keep older accounts open: Don’t close your credit cards, especially your oldest one. Maintaining your credit history length helps your score.

Check your credit report on credit bureaus: Make sure there are no errors holding your score down. If you find any mistakes, dispute them so they can be corrected.

By following these steps diligently, you can expect to see a higher credit score after six months.

For example, if you start with a score of 600, it might increase to, say, 650 or higher (exact results will depend on your individual situation). The important thing is to stick with these good habits even beyond six months for continued improvement.

Can you get a 700 credit score in six months?

You can improve your own credit score in six months by checking your report, paying on time, lowering debt, avoiding new credit, and maintaining your accounts. With consistency, your score should rise.

Good credit brings lower interest rates, better loan options, and more financial stability. Keep the momentum going beyond six months by sticking to these habits.

Start small, stay focused, and your future credit self will thank you.

Six Months to Better Credit

Improving your credit score in six months is possible when you focus on the basics: check your report for errors, pay on time, lower your balances, avoid new credit, and keep your accounts in good standing.

With steady effort, you should see your score rise and your credit report improve.

Better credit can lead to lower interest rates, easier loan approvals, and less financial stress. The habits you build now should continue beyond six months to keep your progress going.

If an unexpected expense puts your momentum at risk, iCash is here to help. We offer free credit score monitoring and short-term loans that can bridge the gap when needed. Just be sure to borrow responsibly.

A stronger credit score starts with small steps. Stick with it, and six months from now, you’ll be glad you did!