If you’re reading this article, then, statistically speaking, you’ve probably struggled with credit card debt at one time or another and you’re looking for ways to reduce credit card debt as well as save money. You’re not alone, though – it’s something that affects millions of people around the world.

Cash use has declined, and plastic has gained the top spot as our preferred way to pay for things, it’s only natural that it’s become easier for people to fall into debt. With that debt comes stress plus worry, increasing interest expenses, and the debt piles on even further. It’s what’s called a debt trap, or cycle of debt by experts.

Even those with the best financial management skills, and the best of intentions, can get caught in this debt cycle. Sudden expenses that you didn’t plan for, or a purchase you have to make can throw your personal finances into havoc. Loss of a job, cutbacks in work hours, and other strains on your finances can also lead to increasing debt.

The latest information from various financial research firms indicate that the average credit card debt represents a greater percentage of total scheduled monthly payments than of total outstanding debt. That all adds up to a tremendous amount of interest expense. The bottom line is by carrying credit card debt, we’re all paying far more for our purchases than we think.

Getting out of debt, or reducing credit card debt, is not easy. In fact, that’s the reason why some Canadians may need to apply for loans from direct lenders. That’s especially true if the circumstances of your income and expenses that got you into debt in the first place haven’t changed. But it’s vitally important in order to save money, reduce anxiety, and even improve your credit score as well as your finances in the long term.

Fortunately, there are lots of strategies that can help you to reduce your credit card debt. We’ll look at the top 10 ways to reduce credit card debt and save money in more detail in this article.

While not every strategy will work for every person, there’s sure to be at least a few options on our list that you can adopt in your own life. With a little work, a little planning, and a little commitment, you CAN reduce your credit card debt or eliminate it entirely.

But before we get into our debt reduction strategies, let’s be sure we’re all on the same page about debt. Specifically, let’s look at the reasons we fall into debt in the first place. We’ll explain how and why making minimum payments only on credit cards can cost you thousands of dollars, keeping you in debt. Of course, we’ll extol the benefits that stem from reducing your personal debt.

How much debt does the average Canadian have?

Two trillion dollars of debt is a big number. Let us try to put some context around it. A common way to measure household debt is to compare it with the amount of disposable income people have. In Canada’s case, Household debt rises to 171% of disposable income. In other words, the average Canadian owes about $1.70 for every dollar of income he or she earns per year, after taxes.

The reasons we fall into debt

First, it’s important to understand how credit cards work. While it may seem simple and remedial, understanding the mechanics of interest on purchases is essential to understanding how debt accumulates. When you charge a purchase on a credit card, you’re essentially taking out a mini-loan for that purchase. The credit card issuer is paying the bill to the merchant, and you’re agreeing to repay the issuer with interest.

Most credit card companies give you some kind of grace period on your purchase, where if you pay off the balance in full within that grace period, you don’t get hit with interest charges. The grace period and associated terms along with the conditions vary from one credit card company to another.

How is interest charged on a credit card?

For most people, though, balances are rarely paid off in full before the grace period expires. Most of us carry some kind of revolving credit card balance each month. At the end of our billing cycle, Canadians are forced to pay a minimum payment – often 5% or less of the outstanding balance. Therefore, even with the best-laid plans, it’s easy to not pay off your balance each month. Other bills, like utility bills, mortgage payments, rent, etc.., don’t let you only pay a little bit and carry a balance. But credit cards do. So, paying off the balance in full ends up near the bottom of most people’s priority lists.

Credit card companies count on this, as the interest charged on the balances is how they primarily make money. If everyone paid off their balance in full each month, they’d either have to charge enormous fees, or they’d go out of business. The interest rates on credit cards, compared to most other types of loans are extremely high.

These rates vary from company to company, and even from cardholder to cardholder within the same company. However, rates of 16% to 30% are common, with the average Canadian credit card having a rate just shy of 20%.

What is a credit card interest rate? What does APR mean?

Those interest rates are expressed as APR, or annual percentage rates. A 20% APR would mean you’re paying 1.67% on your outstanding balance each month (20/12 months).

Carrying a balance of roughly $4,000, that means close to $70 per month in interest payments. It only gets worse if you simply make minimum payments and keep using the card, as we’ll discuss in more detail below.

Life Events

Life events can also be one of the key drivers of credit card debt. When our finances are tight, payday loans provide a quick, no-paperwork, no-hassle way to make purchases and pay later. It’s convenient. But it comes at a cost. Too often, when you get a loan to pay for a costly repair, pay a handyman or repairman to fix something, replace an appliance, or have other unexpected bills, we need to think about how we will pay for them from our ordinary income. Charging it, and paying later, is pretty much the standard option for most working people who aren’t independently wealthy.

Of course, we can then pay off that balance over time, a little bit here, a little bit there from our next few paychecks. But that can take several months for large purchases or expenses. All that time, you’re being charged interest. Absent meaningful savings for “rainy days” and emergencies, though, it may be the only option that a lot of us have to pay for things that aren’t luxuries which cannot be avoided. More often, people aren’t able to save as much as they used to so credit cards become the default choice for payment.

At the same time, when our income takes a hit, such as due to reduced work schedules, unemployment, injury or illness, etc., we naturally turn to the options that are open to us to pay our bills, feed ourselves and our families which keeping a roof over our heads.

For many people, this means leaning on credit card credit limits, up to and including maxing them out. While it might help in the short run, it’s setting yourself up for serious financial disaster later on.

Is it better to get a loan or line of credit?

Whether you use a credit card or take out a loan from online lenders, these options allow you to get funds you need to pay for a purchase and / or service.

A loan is a fixed amount of money that you will need to repay the financial institution over a specific time frame. A line of credit allows Canadians to take out the amount they need at any one time and pay it back. Once a line of credit is paid back, it is available once again without having to reapply for it.

Another key reason why people fall into credit card debt is due to a lack of credit or loan availability. This can be the result of a poor credit score, limited income, and other factors that make it hard for people to qualify for loans as well as other forms of credit.

Many types of loans offer interest rates that are far lower than credit card companies charge. Some people may not qualify for loans, financing, or line of credit options, especially from traditional banks and lenders. On the other hand, credit card companies practically beg you to sign up for credit cards. It’s an easy trap to fall into when you need help paying for things.

What happens if you only make the minimum payment on your credit card?

Whatever the particular reasons may be that brought you into credit card debt, once you’re there, it’s hard to get out. The minimum monthly payments on credit card balances can be a lifesaver for a lot of people – deferring the lion’s share of the cost of a purchase for a later date. But that’s not a free service. The interest rates guarantee that the longer you put off paying for that purchase, the more it will ultimately cost you.

Let’s take a look at a hypothetical example to more plainly illustrate how minimum payments trap you forever under debt. Imagine John typically charges $2,000 in purchases to his credit card each month.

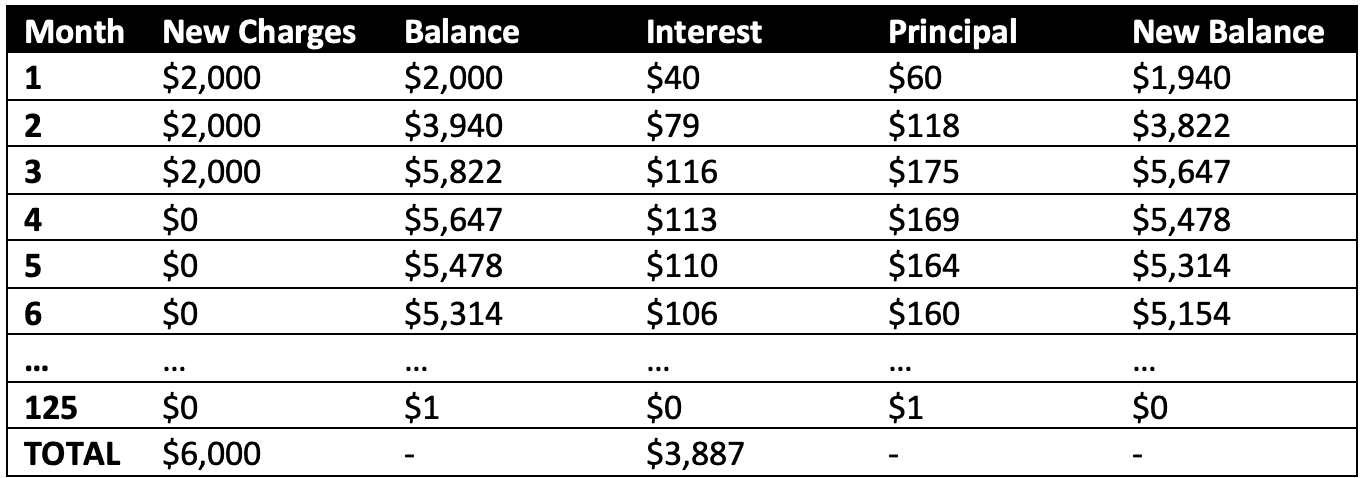

In the first scenario below, let’s see what it would cost John if he did this for 3 months, then stopped charging purchases to the card. He’ll continue to make the minimum payments only but won’t add to the outstanding balance with new charges. His rate is 24%, and minimum payment is 5% or $15, whichever is more. How long would it take him to pay that balance off, and how much interest would be charged?

So, on $6,000 of original purchases, by paying off only the minimums and never charging anything new to the card, it will take over 10 years to pay off the balance. In the process, John would have spent $3,887 in interest payments, a whopping 64% premium over the original purchases he made. That’s in this amazing scenario where John stops charging anything to his credit card. For many people, that’s not realistic, either so you can imagine how much longer you’d be in debt, or how much faster you’d max out the card.

How can I get rid of credit card debt without hurting my credit?

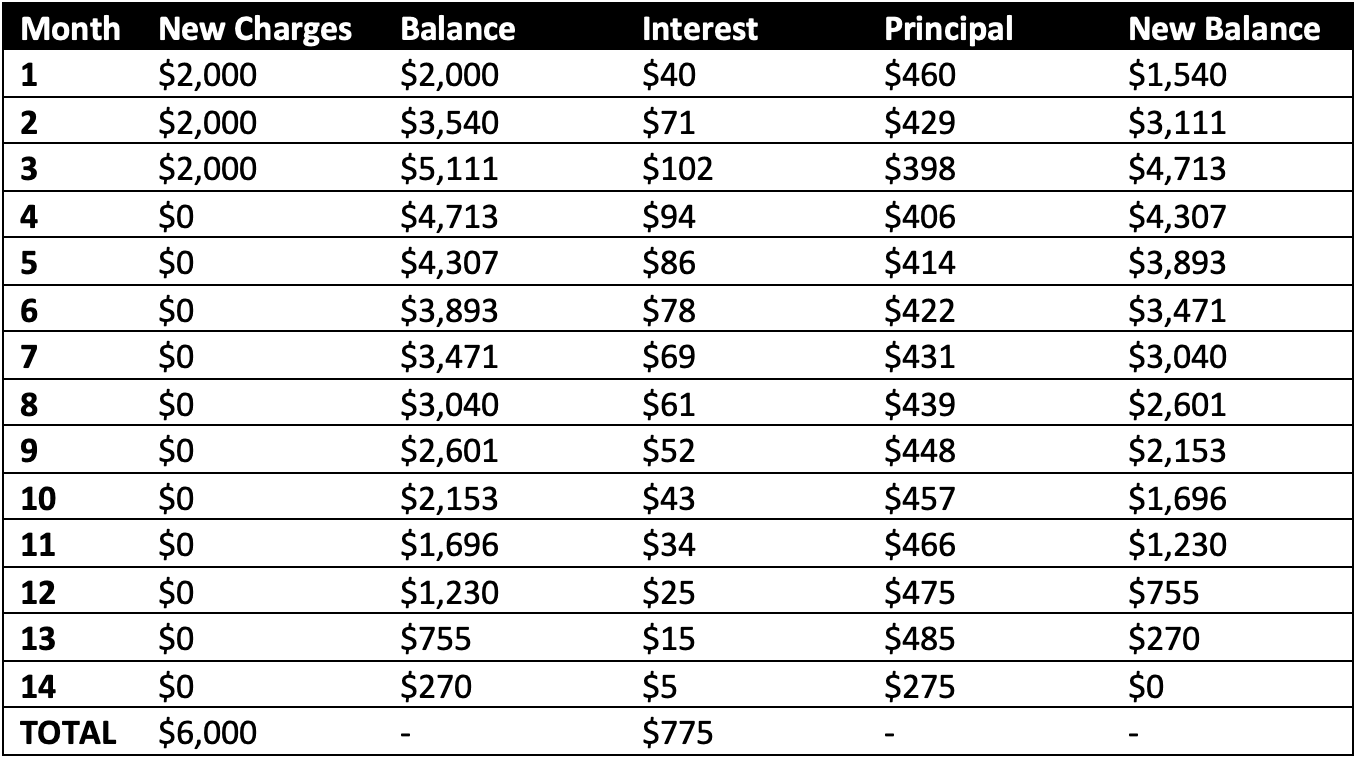

Obviously, reducing debt has an immediate financial benefit, saving you money in interest payments. In our example above, if John had made payments of $500 a month instead of the minimum 5%, he would have paid off the balance much faster and spent less on interest charges.

In this case, John paid off the balance in just over a year instead of just over 10. He paid $775 in interest (a 12.9% premium) compared to $3,887, a savings of $3,112! But saving money on interest charges isn’t the only benefit of reducing credit card debt. There are two other key benefits.

First, getting out of debt removes an enormous psychological burden. Many people stress the most when it comes to debt. It is also the source of a lot of friction in relationships. Removing a large outstanding credit card debt can do wonders for people’s mental health and relationships as well as your overall well-being.

Second, reducing or eliminating debt can actually make it easier to obtain other loans and credit products. One of the key factors in determining your credit score is the ratio of your outstanding debt to your total available debt limit.

If you’re carrying a large debt load on your credit card – more than say 30% of your total credit limit – that can drastically reduce your credit score. By removing that debt, your credit rating will go up and you’ll be able to qualify for loans from direct online lenders.

10 Ways to Reduce Credit Card Debt and Save Money

Now that we’ve demonstrated the value in reducing credit card debt and saving you money, let’s look at 10 different ways to accomplish that.

Other than winning the lottery or inheriting a large sum of money, most people aren’t going to be able to make a single debt repayment to end up with a $0 balance.

There are however many different things you can do to tackle your credit card debt and make a real dent in your outstanding balance no matter how large or small that balance might be. Use as many of these methods as is practicable for you and you’ll find your credit card debt shrinking over time.

1 – Pay more than the minimum payment on a credit card

As we’ve illustrated above, the biggest force keeping you in perpetual credit card debt is only making the minimum payment each month. Try to pay more on a credit card even if it’s only $10 or $25 more, whatever you can afford. Most of us can’t suddenly find or set aside hundreds of dollars more per month. But $10, $25, $50 – that’s reasonably doable for the average person and that small increase in payment adds up to big savings over time.

Payments made above the minimum will go entirely toward decreasing your principal balance, which means less interest charges and more principal repayment the next month. In no time, you’ll be realizing meaningful savings in interest charges and can save hundreds, thousands, or even tens of thousands of dollars over the long term.

2 – Learn how to create a personal budget

If you don’t already have a personal or household budget, then you should create one and stick to it. A simple Excel file or something jotted down on paper is a perfect place to start. There are also many budgeting apps available for iOS and Android phones. There are also budgeting programs for Windows and MacOS computers, too.

Depending on your preferences and comfort levels with technology, you can choose an option that makes the most sense for you as long as you start budgeting today.

Knowing where your money is coming from and where it’s going can be the key to holding on to more of it. It’s a great way to hold yourself accountable and avoid making unnecessary impulse purchases.

It also can help you identify areas where you can trim back on your expenses and put that savings toward paying down your credit card debt. Maybe that $5 coffee every work day morning can turn into every other day instead. That’s $40 per month saved right there. You’ll find many examples like this when you put things down on paper or in a program. It’s sobering to see it in black and white so you can deal with it rationally. Ultimately, you can find more money to set aside in your savings account, so that you don’t need to borrow money in the future.

3 – Get a home equity loan to pay off credit card debt

If you own your own home outright, or have paid off some portion of your mortgage, you might be able to qualify for a home equity line of credit or HELOC. Essentially, this kind of credit product lets you borrow against the accumulated asset value in your home. Regulations and availability will vary significantly by jurisdiction, of course but the more home equity that you have, the more likely you can access a HELOC.

While this is essentially like a credit card, there are some key differences. First, it’s a credit line – you don’t use it to make purchases, but rather get cash proceeds from it. A home equity line of credit is not a loan, either, you don’t get the money all upfront as a lump sum. Rather, you draw against it in the amounts you need, and then repay it over time. You pay interest on the outstanding balance, much like a credit card but the interest rates are usually much lower. Where a credit card averages around 20% APR in Canada, HELOCs typically average around 6-7%, with 10% being the high-end – a good 1/3 of the interest cost on a credit card.

4 – Transfer Debt to another card with interest free card promotion

Many banks and credit card companies offer promotional, 0% APR interest rates for new card members, usually for the first year or 18 months. It’s a way of enticing you to switch to their card, or open an account there, in the hopes that you’ll stick with them and they’ll make money off interest charges on your account later on. You are however usually under no obligation to stick with that card for the long-term. You can transfer your outstanding balance to their card, pay it off during the interest-free period, and then close the account.

There might be a balance transfer fee associated with this, but it’s minimal in most cases. A one-time charge of 3 - 5% is far less than paying 1.6% - 2% in interest on the balance every month for 12 or 18 months.

This is especially useful if you know your financial situation is going to improve in that time, and you just need some breathing room to pay down your balance and get things back on track. Just be sure to read the terms and conditions of the promotion before you sign on the dotted line.

5 – Consolidate your debt from multiple credit cards into a single low interest card

A similar method as the one described above can be accomplished even without finding an interest-free promotional rate. If you have one or more credit cards with fairly high-interest rates, you can try to qualify for a lower rate card and transfer your balance(s) to that card. Even if you only have one credit card with a balance, transferring that to a new card with a significantly lower interest rate can be well worth it.

Imagine you have a $10,000 outstanding balance on a card at 24% APR. That’s $200 per month in interest payments you’re making, or 2%. But if you could get approved for a 16% APR card and pay a one-time 3% balance transfer fee of $300, you’d be paying only $133 per month. Over the life of that balance, that single up-front payment of $300 to move to the lower interest rate card, even only paying the minimums, would save you $2,974 in interest, a net gain of $2,674 in your pocket or bank account.

The effect can be even greater if you consolidate multiple cards into one, if your existing cards charge service fees or account maintenance fees. Even if your new card does (you should be able to find one that doesn’t), having 1 service fee of $15 a month instead of 3 saves you $30 right there, that you can then put towards your payments every month.

6 – Prioritize to pay off debt

If you have multiple debts, whether that’s various loans and credit card debt, or just several credit cards, it’s important to prioritize which debt you will pay off first. You should always pay down your debt.

If you only make the minimum payments but are not sure which to put some extra money towards, go for the highest interest rate one. That will save you the most amount of money in the long term.

7 – Adjust Terms or Rates on Existing Loans

One trick to get some extra cash that you can use to pay down your debt is to adjust the loan term or interest rates. For example, if you have a mortgage, you can often refinance or restructure the loan, either at a lower interest rate, over a longer term, or both. This can save you hundreds of dollars per month in many cases.

While you do pay more in interest over the life of the mortgage, most people aren’t planning to live in their current home for the 30 years of a typical mortgage anyway.

There are also options if you have poor credit or other types of loans that you may already have.

8 – Consolidate credit card debt

There are numerous debt settlement and consolidation help companies out there. These companies variously negotiate with credit card companies and other lenders to pay off your debt for less than you owe.

Consolidation loans involves moving multiple debts into a single loan or debt instrument, saving you on service fees and lowing the interest rate on your existing debts.

Consolidating high-interest credit card debt with a debt consolidation loan, for example, can save you anywhere from a few percentage points of interest to 10% or more and as we’ve shown throughout this article, a few percentage points can translate to a lot of savings in the long term.

9 – Apply for a Personal Loan

Personal loans or lines of credit typically have much lower interest rates than a credit card. If you are able to qualify for one of these loans, you can use the proceeds to pay off your credit card balance.

You’ll still need to repay the loan and the interest on the loan is part of that repayment. The amount of your debt will be the same but the interest charges on the loan will be far less which means that over the life of the loan you can save hundreds, or thousands of dollars then if you kept the same balance on your credit card.

Many Canadians can qualify for a personal loan or a secured loan. This is especially true with traditional banks and lenders. However they often have fairly high credit score requirements that you have to meet in order to qualify.

10 – Get a Short Term Loan

short term loans from alternative lenders can be a perfect solution. Online lenders offer loans that you can repay over several pay periods. This can get you the cash you need today.

We offer loans where approval process takes less than an hour from the start of the application to getting your funds. There are no document requirements, no office visits and the services are available any day of the year 24 / 7 because we never close.

This can be a great solution when you’re stuck and do not wish to take on more credit card debt.

Online lendering can really help you make meaningful improvements in your personal finances, saving you money, eliminating stress and helping you improve your credit score for the future.

To learn more about iCash loans, visit https://www.icash.ca.