Menu

Date Published: April 13, 2023 (Updated December 5, 2025)

Table of contents :

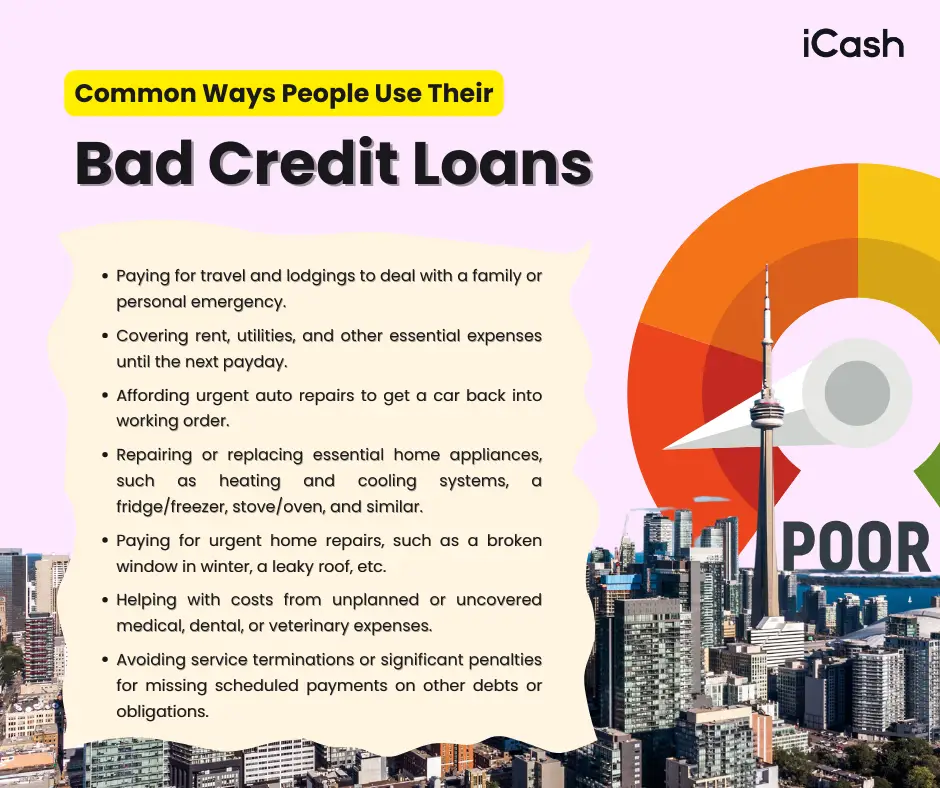

Bad credit loans in Ontario are a specific type of loan made for people with low credit scores, who would normally not qualify for traditional oness from banks. They come in different forms, like small amount loans or payday loans of up to $1,500. The main idea is to help people get loans in Ontario with bad credit.

In Canada, credit score ranges are as follows:

300–559: Poor

560–659: Fair

660–724: Good or acceptable

725–759: Very good

760 and higher: Excellent

Thankfully, fast loans with bad credit are changing everything. They're a big help for people in Canada.

We understand that your credit score doesn't tell your whole story. If you live in a Canadian province and are struggling with bad credit, applying for a quick loan could be a helpful choice for getting the money you need. Apply for a loan right now!

There are many loans for poor credit in Ontario that people can qualify for, such as personal loans, payday loans for people with poor credit, and other that can be paid back in installments. Understanding the features and terms of the types of available loans for bad credit can help you decide which is best for your situation.

Bad credit personal loans in Ontario are created for individuals who may not qualify for traditional options due to their credit history.

They can be used for various purposes like medical bills or even if you need a loan to repair your car. Lenders typically look at factors other than your credit score, like your employment status and income.

Payday loans for people with low credit in Ontario are meant to cover short-term cash needs and are typically repaid on your next payday. The application process is straightforward, with approval and funding happening on the same day - sometimes within an hour or less!

The amount you can borrow is usually a smaller amount of up to $1,500 maximum, and the repayment period is short, often by your next pay period.

Bad credit loans with guaranteed approval are exactly what they sound like - a type of that even people with credit issues can easily get.

While you should always do your research on lenders that offer bad credit loans with guaranteed approval, the truth is that they do make it more likely that you'll get approved than with regular banks.

Bad credit installment loans are made for Canadians needing online instant loans but with a longer repayment period*. These loans allow you to pay back the borrowed amount in smaller, more manageable payments.

For large expenses, like home improvements, poor credit installment loans are particularly helpful. Installment loans are good for big expenses, but you can also use it to pay off other debts that may be harder to manage.

Online loans with bad credit in Ontario offer a more accessible and convenient alternative to traditional banking, where credit scores often determine eligibility. Canadians who might be excluded from conventional loans can turn to online loans for help.

These online lenders are really changing how lending works. They offer different kinds of loans for people whose credit isn't perfect, which means more Canadians can get help when they need it.

Remember, with the right approach and responsible borrowing, you can navigate through financial challenges with ease and peace of mind! So, if you want to know where to get an easy bad credit loan in Ontario, visit the iCash website to learn more about our services and apply for a loan that suits your needs!

Behind each review is an experience that matters

Since 2016, we've helped over 1.6 millions Canadians get instant loans online.

Since 2016, we've helped over 1.6 millions Canadians get instant loans online.

Read more reviews.

Getting an online loan with us is fast and easy. Simply select your loan amount, repayment plan* and provide some personal details.

Our online loan application will tell you if you’re approved instantly. Once approved, all you have to do is electronically sign your contract. It’s that easy!

Once you sign your digital agreement, your cash advance will be sent by e-Transfer within 2 minutes. Fast, convenient and hassle-free. Funds are sent 24/7, no matter what.

Earn money every time you borrow with iCash! Our unique cashback program is designed to reward you for being a loyal customer and can help you save on future loan payments. After successfully paying off your first online loan, you'll receive 4% of the cost of borrowing credited to your account. You can earn up to 12% depending on how many iCash loans you have repaid.

Have more questions? Check out our full FAQ.