Knowing how to prepare for tax season Canada 2024 is important for income earners. Tax season is the time of year when individuals and businesses must submit their income tax returns to the Canada Revenue Agency (CRA).

This process can be complex and overwhelming. But, with proper planning and preparation, you can make it easier and less stressful. Whether you are a first-time tax filer or have been doing it for years, gaining knowledge on how to prepare saves you time and money.

Even if you encounter unforeseen tax payments, be prepared with an express loan from iCash. You can get your instant loan membership started now, and avoid the stress of last-minute tax payments.

If you want to learn more about how to prepare for tax season Canada 2024, read on. Learn practical tips for filing your taxes and get insights on how the Canadian tax system works.

When is Tax Season Canada?

When is tax season Canada? This year, Canada tax season begins on February 24, 2024 and ends on April 30, 2024. During this time, individuals and businesses must file income tax returns for the previous year.

This includes reporting all sources of income, deductions, and credits to determine the amount of tax owed or refunded. For example, Canada tax season 2024 will cover income earned from January 1, 2023 to December 31, 2023. Always keep track of your income and expenses throughout the year so that you are prepared for when tax season arrives.

Tax Season 2024 Canada

In addition to knowing when is tax season Canada 2024, you should know what changes can occur between now and then. Tax laws can change, personal circumstances can change, and even the CRA’s filing procedures can change.

That’s why it’s important to stay informed and educated on tax-related matters. Regularly check the CRA website for updates and changes. There may also be helpful resources online and in your community, such as workshops and other online seminars to help you understand the tax system and its requirements.

The Canadian Tax System

The Canadian tax system operates on a self-assessment basis. This means that individuals are responsible for accurately reporting and paying taxes on their income, assets, and transactions for the previous year.

Of course, you can seek professional help from an accountant or tax preparation service. But, it’s your responsibility to ensure all information is correct and filed on time. Tax brackets and rates may also change from year to year. Stay updated on any changes that may affect you within the Canadian tax system.

How do tax brackets work in Canada?

The Canadian tax system is progressive, meaning that tax rates increase as your income does. The CRA bases Canadian tax adjustments on the previous year’s inflation rate to determine taxes on different income levels for the next year. Raising the limit for each tax bracket means Canadians will pay less tax on the respective part of their income.

Due to inflation hitting a 41-year high in 2022 - and staying elevated all year - there will be changes in tax brackets and deductions for the 2023 tax year. There are five tax brackets that determine the amount of federal tax you owe.

Here’s what the breakdown looks like:

15% on $53,358 of taxable income.

20.5% on taxable income over $53,359 - $106,717.

26% on taxable income over $106,717 - $163,430.

29% on taxable income over $165,430 - $235,675.

33% on taxable income over $235,675.

You should note that these rates only apply to federally collected taxes. Each province and territory has its own tax rates and brackets. This means that your total tax rate will vary depending on where you live.

Understanding T4 Canada

A T4 Canada, or Statement of Remuneration Paid, is a slip provided by your employer and is a crucial document for tracking your income. Your employer is required to provide this to you by the last day of February following the year to which it applies. For the 2024 tax season, you should receive your T4 by the end of February 2024.

This form outlines how much money you’ve earned and how much you’ve already paid in taxes for the previous year. Your T4 slip will break down your income into different categories for gross income, tax deducted, EI premiums, and CPP contributions among others.

Always verify the information on your T4 Canada slip. If you notice any errors, contact your employer right away. If you have multiple employers, you’ll have more than one T4. In this case, ensure that you gather all T4s from every employer you worked for in the year. You will need all of them when filing your tax return.

How do I get my t4 from Service Canada?

You can also access your T4 slip online through the Canada Revenue Agency’s (CRA) My Account service. If you haven’t registered for a CRA account, it’s highly recommended to do so. This will allow you to manage your tax information and benefits easily and securely.

You can also choose to receive electronic versions of important tax documents like your notice of assessment and T4 slips, instead of waiting for them to be mailed. To access these documents, simply log in to your CRA account and navigate to the “tax information slips” section. From there, you can view and download your tax slips for tax season Canada 2024 and previous years.

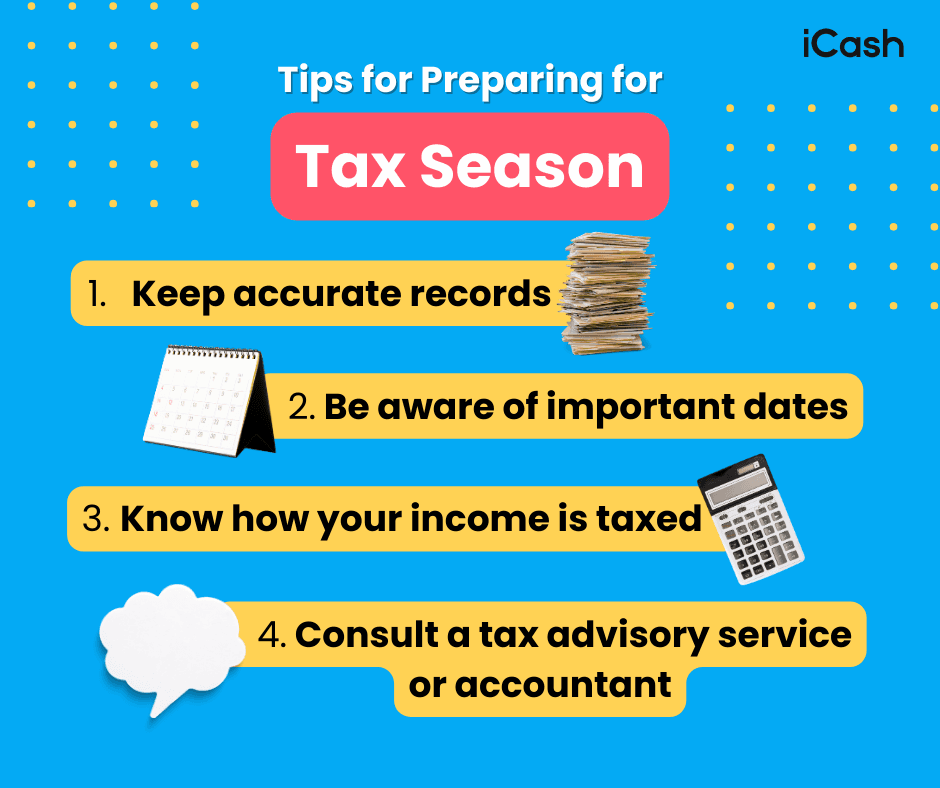

Tips for Preparing for Tax Season Canada 2024

Knowing the best tips for preparing for tax season Canada 2024 will minimize stress and ensure accuracy when filing your tax returns. Don’t wait until the last minute to start getting organized. You can follow these simple steps to make the process smoother.

1. Keep Accurate Records

The first step in preparing for tax season is to keep accurate records of all your income, expenses, and transactions throughout the year. This includes pay stubs, investment statements, receipts for charitable contributions, and any other relevant documents.

Keeping an organized record will not only make filing your taxes easier but also help you identify potential deductions or credits that you may be eligible for. In addition, having accurate records can save you from potential audits and discrepancies in the future.

2. Be Aware of Important Dates

Mark your calendars for all tax deadlines. This is one of the most important tips for preparing for tax season Canada 2024. As mentioned above, the tax deadline for filing your 2024 owed taxes in Canada is April 30, 2024. However, if you know that you won’t owe any taxes or expect a refund, you have until June 15th, 2024 to file without facing penalties.

You should also be aware of the RRSP contribution deadline, which is March 1, 2024 for the 2023 tax year. Contributing to an RRSP gives you a last-minute opportunity to reduce your taxable income and potentially receive a larger refund.

When are self-employed taxes due?

The deadline for self-employed individuals and their spouses or common-law partners is June 15, 2024. However, any tax owing must still be paid by the April 30th deadline. You should file your tax return as early as possible to avoid any potential penalties or interest charges. Plus, the earlier you file, the sooner you can receive any refunds.

3. Know How Your Income is Taxed

Always understand how taxes work on various income types. For example, employment income is taxed differently than investment income. By understanding these differences, you can better plan your finances so that you know how to properly prove your income in Canada.

If you receive income from government benefits or pensions, make sure to accurately report them on your tax return. Some of these income types are also taxable and must be included in your total income for the year.

For example, if you collect employment insurance in Canada (EI), benefits are considered taxable income. This means you may owe taxes on these benefits if they were not already deducted at the source. Moreover, if you have earned income while receiving EI, you may owe even more taxes.

How much tax will I pay on CPP disability?

The Canada Pension Plan (CPP) benefits are considered taxable income and must be reported on your tax return. However, the amount of tax you will pay on these benefits depends on your total income for the year. CPP doesn’t remove income tax from the amount you receive unless you request it.

If your only source of income is CPP disability benefits, you may not have to pay any taxes as long as your total income falls below the basic personal amount (BPA). This amount changes each year, but for 2024, the BPA is $15,705. You can also qualify for short-term funding in the form of a CPP payday loan.

However, if you have additional sources of income, such as investment income, you may owe taxes on a portion of your benefits. Above all, know how your income is taxed and how to accurately report it to the CRA. This will help you avoid any penalties or interest charges.

Are Child Tax Benefits Taxable?

The Canadian Child Benefit (CCB) is a tax-free monthly payment made to eligible families with children under the age of 18. Therefore, this benefit is not taxable and does not need to be reported on your tax return.

Not filing your taxes, however, can affect your CCB payment amount. The CRA uses your tax return information to determine eligibility and the amount of CCB a family receives. Lower household income reported on your tax return can result in a higher CCB amount for your family.

In addition, CCB payments can be considered a source of income for lender’s approval of loans or other financial aid. A child tax payday loan is a common option for parents who need quick cash. These loans use the CCB as proof of income and can be an easier option compared to traditional loans.

4. Consult a Tax Advisory Service or Accountant

Another one of the most important tips for preparing for tax season Canada 2024 is to seek professional help. Consult with a tax advisory service or accountant to ensure you are filing properly. They can also help you take advantage of any changes in tax laws or regulations that may benefit you.

For example, if you’re a student, there may be specific tax credits or deductions for tuition or textbook expenses. If you are a senior, there may be additional credits available for medical expenses. You may also not be unaware of the GST/HST credit in Canada, a tax-free quarterly payment to help individuals and families with low or modest incomes offset the GST/HST they pay.

The climate action incentive program (CAIP) may provide additional tax relief for families living in provinces that have implemented a carbon pricing system (Alberta, Saskatchewan, Manitoba, and Ontario).

Bottom line, a tax professional can help you navigate all of these potential benefits and ensure that you are maximizing your tax savings. You never know what deductions or credits you might be eligible for.

Know How to Prepare for Tax Season Canada 2024 with iCash

Know how to prepare for tax season Canada 2024 with iCash on your side. Organizing your tax documents, exploring potential deductions, and seeking professional advice will ensure a more efficient filing process.

But, it’s not uncommon for tax season to bring on financial surprises even when you’re prepared. You might discover that you owe more taxes than anticipated, or you could face unexpected expenses that strain your budget during this time. In such cases, having a reliable financial backup like iCash can be a game-changer.

Are you in a position where you owe more than you expected? Don’t stress! Visit the iCash easy loans website and get funded in 2 minutes or less.