For a secure retirement, you need reliable income. Many people turn to annuities as a way to convert savings into guaranteed payments that last a lifetime. However, choosing the right annuity for your retirement planning requires understanding the different types of annuities and how each one works.

Here, we're going to cover what annuities are, how they provide ongoing income, the differences between fixed and variable annuities, the benefits and key factors to consider when selecting an annuity, and much more.

The Role of Annuities in Retirement Planning

An annuity is a financial contract with a provider (usually a life insurance company) that you purchase with a lump sum or series of contributions in exchange for a guaranteed stream of income. In simpler terms, an annuity lets you turn a portion of your retirement savings into regular pension-like payments.

Typically used in retirement, life insurance companies sell annuities and can provide income monthly, quarterly, or annually for a specified period or for the rest of your life. You can choose to begin receiving payments immediately or at a later date if you buy a deferred annuity.

Many retirees purchase an annuity around their retirement date to secure a steady paycheck from their savings without having to worry about managing investments.

Fixed vs Variable Annuities

When you’re choosing the right annuity, you need to understand the distinction between fixed and variable annuities, as they offer very different structures and risk profiles.

Keep in mind, however, that you aren’t limited to one or the other. Some people allocate a portion of their funds to a fixed annuity for security and another portion to a variable annuity for growth potential, depending on their comfort level.

Fixed Annuities

A fixed annuity provides a guaranteed rate and steady payments, appealing to those who want predictable, stable income. While returns are lower than market-based options, it offers security, simplicity, and low fees, ideal for conservative investors.

Variable Annuities

A variable annuity links your returns to market performance, so payments rise or fall with investment results. It doesn’t guarantee income but may suit those with higher risk tolerance, long timelines, and other income sources who want growth potential and tax-deferred earnings.

Immediate vs. Deferred Annuities

Another way annuities differ is in when they begin to pay income. You will need to decide between an immediate annuity that starts paying right away, versus a deferred annuity that begins at a future date.

Immediate Annuities

An immediate annuity begins paying income within a year, making it ideal for those near retirement who want to convert a lump sum into steady, guaranteed income. Payments are fixed and can help bridge the gap while delaying CPP or other withdrawals.

Deferred Annuities

A deferred annuity delays income, giving your money time to grow. It’s a good option if you want guaranteed income later in retirement. These annuities can be fixed or variable, funded with a lump sum or ongoing payments.

Longer deferrals mean higher payouts, but early withdrawals often trigger penalties.

Lifetime Income: Life Annuities vs Term Annuities

You still have more decisions to make about your retirement income. One of these decisions is whether you want payments for life or just for a specific period.

Annuities generally come in two flavors on that front: life annuities, which pay out as long as you live, and term-certain annuities, which pay out for a fixed number of years.

Life (Lifetime) Annuities

A life annuity provides guaranteed income for as long as you live, whether that’s to age 75 or 105.

The trade-off is that if you pass away early, the insurer keeps any remaining value unless you’ve added features like joint-and-survivor, guaranteed period, or cashback options.

These features reduce your monthly payments but offer protection for spouses or beneficiaries. Life annuities are best for those who prioritize steady lifetime income over leaving a large inheritance.

Term-Certain Annuities

A term-certain annuity pays income for a fixed number of years (such as 10 or 20) rather than for life. If you pass away during the term, remaining payments go to your beneficiary or estate.

It’s a good option if you need income for a specific period, like bridging the gap between early retirement and pension benefits, or if you want to leave unused funds to your heirs.

In this case, the trade-off is that payments stop once the term ends, so it doesn’t protect against outliving your money. Longer terms mean smaller monthly payments since the funds are spread over more years.

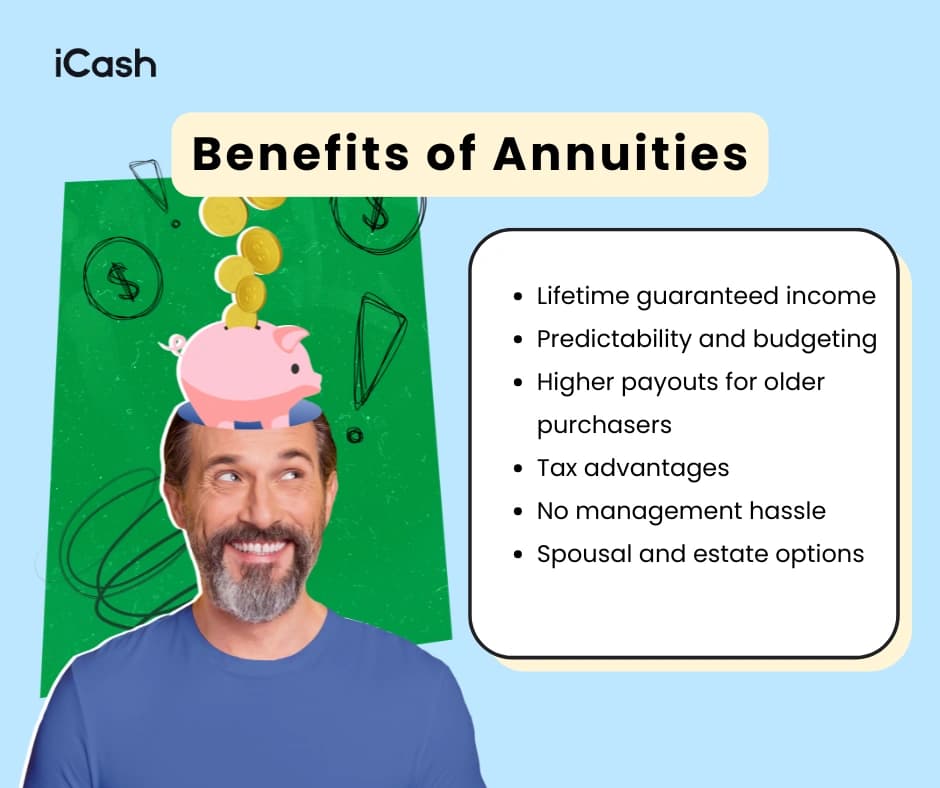

Guaranteed Lifetime Income: Benefits of Annuities

Annuities play a unique role in retirement planning by offering something no other investment can promise: guaranteed lifetime income. This feature can provide significant peace of mind.

Here are some of the most enticing benefits of including an annuity in your retirement strategy:

Lifetime guaranteed income: A life annuity pays you for as long as you live, removing the risk of outliving your savings.

Predictability and budgeting: Fixed and term-certain annuities offer set payments, making it easier to cover monthly bills. Some variable annuities also offer minimum income guarantees.

Higher payouts for older purchasers: The older you are at purchase, the higher the monthly income, especially beneficial for healthy retirees or those with limited savings.

Tax advantages: Non-registered annuities may be partially tax-free. Deferred annuities grow tax-deferred, and registered annuities are fully taxable only once payments begin.

No management hassle: The insurance company handles everything, making annuities a low-maintenance income solution for retirement.

Spousal and estate options: Add-ons (like joint-life or guaranteed periods) can protect a spouse or heirs, though they reduce monthly payments.

What are the Risks and Drawbacks of Annuities?

Along with these benefits, the drawbacks and risks associated with annuities need to be considered, too:

Loss of liquidity: Annuity funds are locked in. You can’t access the lump sum outside scheduled payments without penalties, so it’s not ideal for emergencies.

Irrevocable decision: Once purchased, annuities are usually final. Some allow limited withdrawals, but with trade-offs.

Inflation risk: Fixed annuities don’t rise with inflation, which can erode value over time. Inflation protection is available, but lowers initial payments.

Cost and fees: Annuities often require a large upfront investment. Variable and indexed options carry higher, layered fees that can reduce returns.

Risk of dying early: Without added protections, life annuities may pay out less than you contributed if you die early. Unused funds stay with the insurance company.

Complexity and misunderstanding: Contracts vary and can be hard to compare. Misunderstanding terms may lead to poor choices, especially with variable annuities.

Credit risk of the insurer: Your income depends on the insurer’s stability. In Canada, Assuris offers protection up to $5,000/month, but choosing a reputable provider is still key.

Whether an annuity is “worth it” depends on your individual circumstances and priorities. In the next section, we’ll look at how to evaluate those factors to make the right choice.

Choosing the Right Annuity: Factors to Consider

Every retiree’s situation is unique. The best annuity option for one person might not be make sense for the next.

Here are some of the most important factors and questions to consider as part of your decision-making process:

Time Horizon (When You Need Income): Think about when you’ll need the income. If you’re retiring soon, an immediate or short-deferred annuity may fit. If retirement is still years away, a deferred annuity gives your investment time to grow, potentially leading to higher future payouts.

Risk Tolerance: Ask yourself how much risk you can accept. If you prefer steady income, a fixed annuity or guarantees on a variable annuity may be better. If you’re open to market fluctuations and have backup resources, a variable or indexed annuity might suit you.

Other Retirement Income Sources: Consider your existing income streams, including government benefits, pensions, and investments. If those cover your essentials, you may not need much annuity income.

Health and Life Expectancy: If you're in good health and expect a long life, a life annuity may provide substantial value. If your health is limited, term-certain annuities or those with refund options may make more sense.

Legacy Goals (Beneficiaries): How important is leaving money to heirs? A pure life annuity maximizes your income but typically leaves nothing behind. If a legacy matters, look for contracts with guaranteed periods, refund features, or annuitize only part of your savings.

Product Features and Flexibility: Which features matter most to you? Options might include limited withdrawals, inflation increases, or death benefits.

Costs and Fees: Review all costs and fees so there are no surprises. Fixed annuities build fees into the payout, while variable ones list charges separately. These can add up quickly. Check surrender terms, too, in case you need early access.

Make Informed Retirement Choices with Confidence

Annuities can offer stable, predictable income in retirement, but only if you choose the right structure for your needs. Whether you're looking for growth, guaranteed payments, or future security, the right choice begins with understanding your options.

Choosing the right annuity can provide future security, but what about right now? If you're managing expenses while planning your long-term retirement income, iCash offers fast, simple access to short-term funds when you need them most.

Whether you're between payouts, covering unexpected costs, or just need breathing room in your budget, iCash helps bridge the gap with quick online loans for Canadians.

Learn more at iCash.ca and keep your financial plan on track.