The choice between investing in a registered retirement savings plan (RRSP) vs. a tax-free savings account (TFSA) is among the most common investment decisions Canadians are faced with. Which investment and when to use TFSA vs. RRSP depends on your financial situation and the goals you want to achieve. But before deciding on what’s better, you first need to understand how both the TFSA and RRSP work, and how it can support your personal finances and budgeting goals.

iCash, a Canadian online lender has put together a comprehensive guide to help you understand the difference between a TFSA vs. RRSP, so that you can start investing into your savings account with confidence.

What is a tax free savings account and how does it work?

A TFSA is a registered account through which you can save up money for short or long-term goals. The amount of money that can be contributed to a TFSA each year is limited to an annual maximum, but any unused contribution room from the previous year will automatically rollover. There are no tax advantages on contributions made into a plan - however, a main benefit of a tax-free savings account is that all income earned in the account (for example, interest on savings, dividends from stocks, or capital gains from selling investments) is tax-free.

As long as you don't tap into your TFSA funds for any reason, there are no penalties or taxes to be paid on money leaving your plan. For example, if you invest in a high-interest savings account and it grows quickly, you wouldn't pay any taxes leaving the plan (if your contributions were made with after-tax money).

How to open a TFSA in Canada

You can open a TFSA at any Canadian bank or financial institution. They're generally easy to set up over the phone or online, and most banks will give you your personal plan representative to assist.

To contribute, money can be transferred directly from another account or given to you by cheque. How much you should put in a TFSA will depend on your finances and what you can manage. What’s important to note is that if you over-contribute to your TFSA (i.e., the total amount of contributions exceeds the maximum allowable limit), you’ll be subject to a penalty tax on excess contributions - 1% for each month the excess remains in the account.

What is an RRSP and how does it work?

An RRSP is a registered retirement savings plan that can be used to reduce your tax liabilities in Canada. An RRSP in Canada works by contributing up to 18% of your previous year's earned income. Any contribution exceeding this limit will be subject to heavy penalty taxes.

But unlike a TFSA, any income you earn in your RRSP (i.e., interest from savings or dividends from stocks) is taxable when you withdraw from the plan. You have to pay taxes as normal and only your contributed funds will be deducted from taxes owed. Any income that your investments have earned in addition to your original contribution will be taxed when you withdraw from the plan.

How to open an RRSP in Canada

To open an RRSP investment account, you must purchase a qualifying investment from a registered financial institution or dealer. The cost of the purchase will vary depending on what type of investment you choose. For example, if you're looking to invest in a savings account, it could be as low as $50 per transaction - while investing in stocks may require a much larger initial investment.

You can also choose to convert some of your existing RRSP investments into a different type of plan if you have one or open additional accounts.

Can you have a TFSA and an RRSP?

Absolutely! Because both plans allow tax-sheltered growth, maximizing your permitted RRSP and TFSA contributions – if possible – can help you reach your savings goals sooner.

But, if investing in numerous accounts isn't practical for you, we've outlined a few key differences between the two to help make your investment decision easier. You can read about the differences between a TFSA vs. RRSP in Canada below:

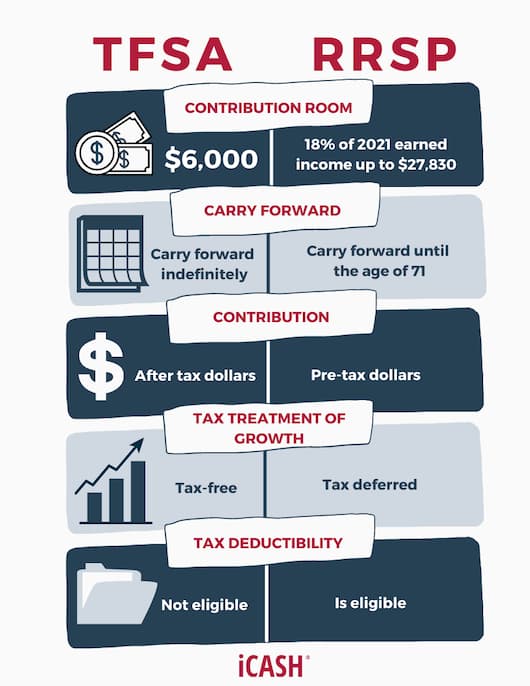

(1) Contribution limit. Since 2009, there has been a yearly maximum contribution limit of $6000 for a TFSA. With an RRSP (in 2021), you can contribute up to 18% of earned income you reported on your tax return in the previous year, up to a maximum of $27,830.

(2) Withdrawal rules. Withdrawals from a TFSA are not penalized, while any withdrawals made from an RRSP before the plan holder reaches retirement age (usually 65 or older) will incur heavy tax penalties. The only exception is that withdrawals may be made without penalty to the plan holder in the case of death, disability or if the funds are used when buying your first home in Canada, and if the amount of withdrawal does not exceed $25,000 in total.

(3) Estate issues. If you die before age 71, any excess funds remaining in your TFSA that have not been transferred to a beneficiary will be added as income to your estate for that year. If you prefer not to leave this money as part of your estate, you can transfer it to your spouse's TFSA - depending on the amount and the year (there are some complicated rules that may apply).

With an RRSP, if you die before age 71 any withdrawals made from your plan will be counted as income to your estate. However, there is no need for any remaining RRSP funds to be transferred to your estate - once you pass away, the RRSPs are automatically closed.

(4) Investment options. You may use TFSA funds to invest in anything you like, including GICs, stocks, mutual funds and ETFs (exchange-traded funds). With an RRSP, your investment options are more limited; typically, your choices will include mutual fund companies or trust companies.

The main distinction between the RRSP and the TFSA is how your income is taxed when you contribute or withdraw funds from each account. The RRSP is a tax-deferred plan in which you contribute with pre-tax money and will be charged income taxes on withdrawals. In contrast, the TFSA is a tax-free account in which you contribute with after-tax money and will not be charged any income taxes on withdrawals.

So, is a TFSA better than an RRSP? To help you understand further, the comparison calculator below shows what happens when you compare putting your earned income in a TFSA versus an RRSP:

TFSA or RRSP - Which is Better?

Try not to sweat your decision too much. Whether you choose the RRSP or TFSA (or both), you’ll likely come out with the same amount of money because of the tax structure. But, if you need a simple breakdown, remember the basics: the TFSA is better suited for short-term savings while an RRSP is better suited for long-term savings that would be used only once you’ve retired.

Since the TFSA permits you to withdraw funds at any time without penalty, it's more useful if your goal is to save a small amount of money and use the funds whenever you need them (for example: if you plan on traveling or paying for some big project with your savings). The RRSP is better suited for long-term saving - since it's the only method of savings that offers you tax-deferred growth on your investment.

Whatever your motive for saving is, ensure you stay on top of your goals. And, if you ever feel stuck or are forced to touch your savings to pay a few bills, private lender loans from iCash may be a good option, as they are quickly accessible and an excellent solution for instant cash infusions.