Tax season isn’t known for being a fun time for most, but certain things can make it a lot more challenging for Canadians. Unfortunately, even a simple tax filing mistake can lead to delays or unexpected fees, and unchecked errors might trigger CRA penalties or audits.

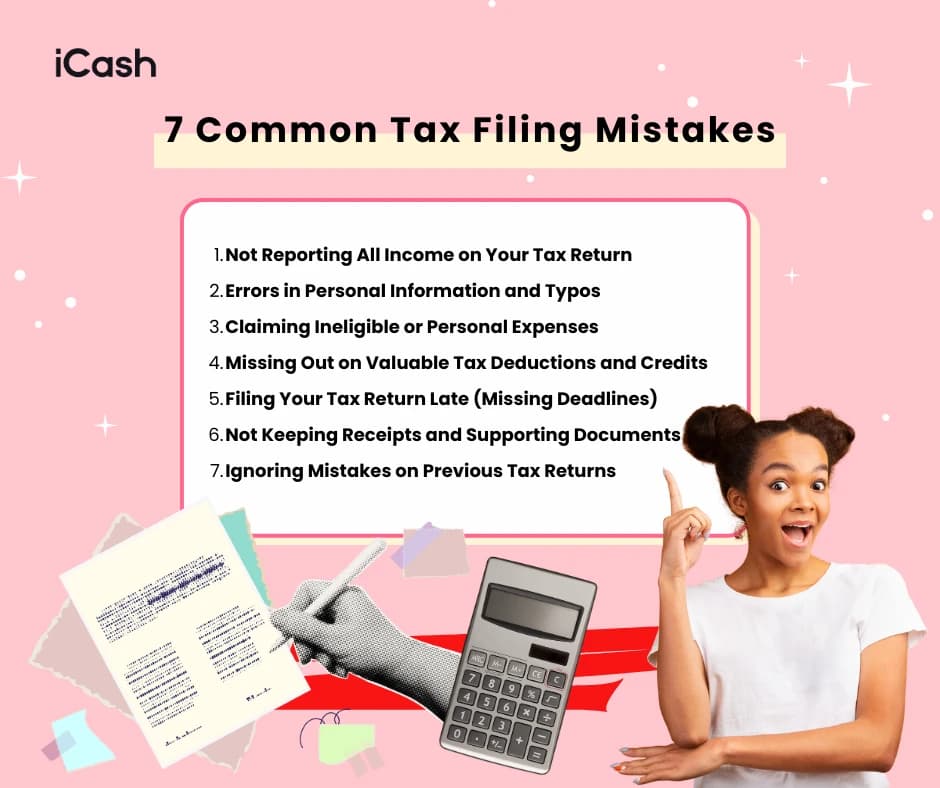

7 Common Tax Filing Mistakes in Canada and How to Avoid Them

Today, we’re highlighting seven of the most frequent tax return errors Canadians make and how to avoid them, so you can file accurately, claim all the credits and deductions you deserve, and steer clear of trouble.

1. Not Reporting All Income on Your Tax Return

Failing to report all of your income is one of the most common tax mistakes people make when filing their return.

It’s easy to overlook “hidden” income sources that don’t come on a T4 slip.

This includes things like:

Cash tips

Side gig earnings

Money from online sales or freelance work

Rental income

Foreign investment income

Each of these is taxable and must be reported. The Government of Canada also offers this resource to help you find out what you need to report as income.

Remember that certain government payments are taxable as well (for example, Employment Insurance benefits) and need to be included in your income.

Leaving out income can have heavy consequences. Unclaimed income can result in considerable penalties if the CRA catches the omission.

To avoid this mistake, begin by keeping thorough records of every income source throughout the year.

Collect all your slips (T4s for employment, T5s for investments, T4As for pensions or gig work, etc.) and double-check that the amounts on those forms match what you report.

Using the CRA’s digital tools can help, too. For instance, the Auto-fill My Return service can import your official tax slips directly into your return to ensure nothing gets missed.

The bottom line: report every dollar you earned!

2. Errors in Personal Information and Typos

Believe it or not, a small typo on your tax return can cause big headaches. Something like a misspelled name, an incorrect Social Insurance Number (SIN), or an outdated address can lead to processing delays and may interfere with your tax credits or refund.

Another common mistake is failing to update your personal information with the CRA after major life changes. If you move or your marital status changes, failing to inform the CRA could lead to incorrect benefit payments or other complications.

For example, misreporting your marital status can affect your eligibility for certain benefits and credits (such as the GST/HST credit or the Canada Child Benefit).

Fortunately, this mistake is easily avoidable.

Double-check all personal details on your return (name, SIN, address, etc.) before filing, and use the CRA’s online My Account portal to promptly update any changes. Making sure your information is accurate and up to date will help you avoid delays or missed correspondence from the CRA.

3. Claiming Ineligible or Personal Expenses

You’ll also want to be careful that you don’t try to claim expenses on your tax return that aren’t actually eligible. Not every dollar you spend is tax-deductible, yet some taxpayers mistakenly attempt to write off personal expenses that the CRA simply won’t allow.

Here are a few examples of expenses you can’t claim:

Private costs like wedding or funeral expenses

Money lent to family members

A loss from selling personal-use property, such as your home or car

Similarly, personal expenses that aren’t related to earning income are not valid tax deductions. Common examples include things like clothing, grooming, or entertainment.

As for what happens if you claim something ineligible? The CRA will likely remove it and adjust your return. But be warned - this can come with interest and penalties added, too.

Stick to claiming only expenses that are truly deductible under the tax rules. If you’re ever in doubt, check the CRA’s official list of allowable deductions and credits or get professional advice.

Hold on to all of your receipts and other documentation for any expenses you do claim, in case the CRA asks for verification.

4. Missing Out on Valuable Tax Deductions and Credits

Although it’s common for people to claim deductions they aren’t actually eligible for, the opposite scenario can also happen. Surprisingly, many Canadians overlook valuable tax deductions and credits, which means they end up paying more taxes than necessary.

While the CRA won’t penalize you for missing a claim, leaving these on the table either means a smaller refund or a higher tax bill for you.

Some commonly overlooked examples include:

Moving expenses

Charitable donations

Childcare costs

Medical expenses

The disability tax credit

Get familiar with the credits and deductions that might apply to your situation so you don’t miss out. The CRA provides a comprehensive list on its website.

Like other expenses, you’ll need to keep all of your receipts for these. Utilize the help of tax software and a tax professional to help pinpoint deductions and credits you might otherwise miss.

There are also tax breaks for students, such as tuition fee credits or the credit for interest paid on student loans. These are commonly overlooked, so be sure to claim those if they apply to you.

5. Filing Your Tax Return Late (Missing Deadlines)

Missing the tax-filing deadline (usually April 30 for individuals and June 15 for the self-employed) is one of the costliest mistakes you can make.

As of 2025, if you file late and owe money, the CRA charges a late-filing penalty of 5% of your balance owing, plus 1% for each full month your return is late (up to 12 months). Interest on the unpaid tax will also accumulate, increasing your bill.

Mark the tax deadline on your calendar and set reminders ahead of time so you’re not racing to file at the last minute. Filing electronically (through NETFILE) is the fastest and you get immediate confirmation of receipt this way.

Even if you can’t pay the full amount you owe by the deadline, you should still file your return on time. This way, you avoid the late-filing penalty, and you can arrange a payment plan with the CRA for the balance afterward.

Expecting a refund? Filing late won’t incur a penalty, but keep in mind that it will delay your refund and any benefit payments that rely on your tax return.

6. Not Keeping Receipts and Supporting Documents

The CRA requires you to keep your tax documents for at least six years after filing. If you can’t produce proof for something you claimed, the CRA can disallow that deduction or credit and you may lose the benefit or face penalties.

Unfortunately, many people toss out or misplace important receipts too soon, which leaves them scrambling if the CRA requests them later.

Keep all of your relevant receipts and slips organized by year. Paper receipts can fade over time, so scan them or take clear photos to store digital copies as a backup.

This way, if the CRA ever audits your return, you’ll have all the necessary proof ready, and the review process will be much smoother.

7. Ignoring Mistakes on Previous Tax Returns

Once a tax return is filed, is it set in stone? No! Fortunately, you can correct past returns if you find an error. The CRA allows taxpayers to request changes to prior returns for up to 10 years after filing.

If you discover that you missed a deduction or reported a figure incorrectly on a previous return, you can (and should) file an adjustment to fix it.

Correcting a past return is fairly straightforward. After you receive your Notice of Assessment, you can request a change through the CRA – either online (using the “Change My Return” option in My Account or the ReFILE service) or by mailing in Form T1-ADJ for a manual adjustment. The CRA will then review your request and send you a notice of reassessment with any approved changes (or a letter if they decide not to make the change).

Make sure to fix any mistakes so you can get any extra refund you’re owed and prevent future problems with the CRA.

Making Tax Season Easier with iCash

We know how stressful tax season can be, but knowing you’ve done your due diligence to avoid common tax mistakes can take a lot of the strain out of it.

Remember to double-check your information, stay organized, and don’t leave any deductions or credits unclaimed. Even simple blunders (like missing a slip or claiming something ineligible) can mean delays, fees, or missed refunds.

Take the time to file carefully, keep your records in order, and reach out for help if you're ever unsure about a deduction or reporting rule. A clean, accurate return now means less stress later, and a better chance at receiving the refund you’re expecting.

And if that refund is delayed or smaller than you hoped, iCash is here to help bridge the gap. You can apply online in minutes for a short-term loan and access the funds you need to stay on track while waiting for the CRA to process your return.

Need a hand managing your finances during tax season and beyond? Apply now with iCash and keep moving forward.