Menu

Table of contents :

A short term loan is essentially a loan that is much easier to qualify for compared to traditional banks, because it does not require a perfect credit score to qualify, and the requirements are far less stringent.

Getting a short term loan in Canada can help you face financial challenges that can arise when you least expect it in today's fast-paced digital world. Whether it's a sudden medical expense, an unexpected car issue, or a utility bill that can't wait, quick approval short-term loans can offer a fast and efficient solution to address these immediate financial needs.

When applying for short-term loans in Canada, it’s important to understand their benefits and the application process involved, ensuring you are equipped to make informed decisions during these times.

Having access to a variety of short term loan options is crucial. In Canada, individuals can choose from several short-term loans, including payday loans, installment loans, and no credit check loans. Each type caters to different needs and circumstances, providing flexibility for borrowers.

To qualify for online short term loans in Canada, you simply need to meet the following minimum criteria:

Be at least 18 years old (19 years old for applicants in British Columbia, New Brunswick, Nova Scotia).

Be a resident of any of the provinces in which we operate. (AB, ON, BC, MB, NB, NS, PEI)

Show that you have been receiving the same source of income for the past three months.

Have a total net income of at least $800/month.

Have access to an online bank account.

Have a valid mobile phone number, address, and email address (VoIP numbers are not accepted).

With payday loans, credit score requirements are often less stringent, so they are accessible to those with poor or bad credit history.

An important advantage of payday loans is their expedited approval process. Payday loans are designed to provide a quick solution for urgent financial situations.

Regarding trustworthy payday loans in Canada, iCash is recognized and trusted by over 850,000 Canadians who have come to us because of our commitment to customer satisfaction, smooth application process, and incredibly fast fund disbursement via e-Transfer loan.

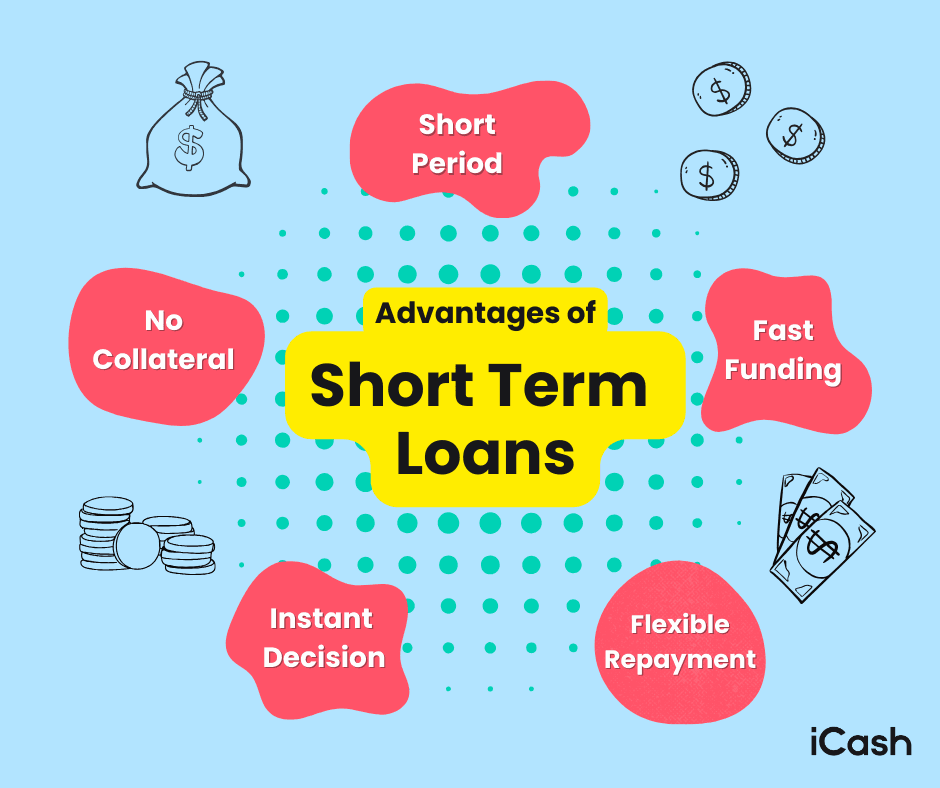

There are several reasons why Canadians turn to short term loans when they need to get cash as quickly as possible. Here are a few of them:

While a low credit score may affect traditional loan approval, short-term loans are designed to consider various factors, including employment status and sources of income, making it easier to get approved.

People with bad credit can take advantage of short-term loans to navigate through financial setbacks.

Short term loans with instant approval* can be a beacon of hope for Canadians during times when financial emergencies pop up unexpectedly. These loans are designed to provide rapid access to funds, allowing borrowers to address their pressing financial needs immediately.

The key advantage of no credit check loans is that they focus on your current financial situation and your ability to repay the loan, rather than your past credit mistakes.

This makes them a great option for people who need quick cash but don’t want their credit score to stand in the way.

Short-term installment loans provide a flexible approach to borrowing money in Canada. These loans are designed for borrowers who prefer a more manageable repayment process*. Installment loans are a form of short-term borrowing where the total loan amount is divided into equal payments over the duration of the actual loan.

This sets them apart from payday loans, which require a lump-sum repayment on the borrower's next payday. The periodic installments make it easier for borrowers to budget and meet their financial obligations. Statistically, the benefits of installment loans are evident.

If you need a same day loan, taking the route of a short term online loan is the way to go. From the digital application to getting your funds via e-Transfer, everything can be done incredibly quickly, meaning any financial emergencies can be dealt with in a flash!

One of the best short term loans in Canada is with iCash. We offer rapid approval, cater to diverse credit histories, provide terms that are easy to understand, and ensure everything can be done online for convenience.

Whether you're facing immediate financial challenges or planning for unforeseen expenses, our efficient services are here to help. We are your trusted source for short-term lending solutions, offering not only quick approval and flexible terms but also a strong commitment to customer satisfaction.

Visit our website today to apply for payday loans and experience the ease of obtaining the financial relief you require. Your financial well-being is just a click away! So apply today and get started with iCash!

*No credit check is required for any second or subsequent loan application. A credit check is only conducted on your first loan application, which means all future loans are exempt from it.

Since 2016, we've helped over half a million Canadians get instant loans online.

Since 2016 we have happily served over half a million customers.

Read more reviews.

Getting an online loan with us is fast and easy. Simply select your loan amount, repayment plan* and provide some personal details.

Our online loan application will tell you if you’re approved instantly. Once approved, all you have to do is electronically sign your contract. It’s that easy!

Once you sign your digital agreement, your cash advance will be sent by e-Transfer within 2 minutes. Fast, convenient and hassle-free. Funds are sent 24/7, no matter what.

Have more questions? Check out our full FAQ.

Discover essential insights on Short Term Loans in Canada: eligibility, process, rates, and more. Get the funds you need quickly. Read now!... Read more

Explore the differences between long-term and short-term loans, their pros and cons, and how to choose the right lender. Check it out now!... Read more

Short term loans can help in emergencies like medical bills, car repairs, rent, home repairs, and unexpected expenses. Learn more in our guide.... Read more