Budgeting is an important part of managing your finances effectively. It involves creating a plan for allocating your income towards expenses, savings, and repaying debt. By setting a budget, you can learn to live within your means, avoid excessive spending, and work towards your financial goals such as saving for retirement, buying your first home, or funding education.

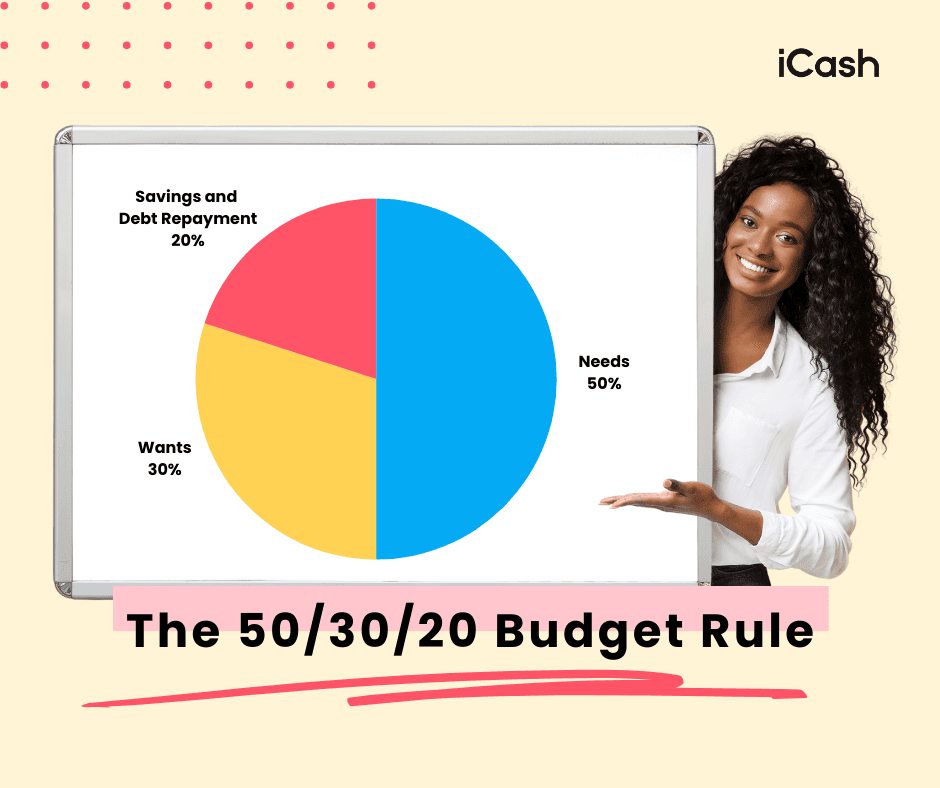

One popular method for keeping your finances in line is the 50/30/20 budget rule. This rule suggests dividing after tax income into three categories: 50% for needs, such as housing and groceries, 30% for wants, such as dining out, streaming services and other forms of entertainment, and 20% for savings and debt repayment. This structured approach helps you maintain a balanced spending plan, ensuring that essential needs are met, leisure spending is controlled, and savings goals are prioritized.

If you want to learn more about the 50/30/20 rule and how it can benefit your goals, continue reading. Plus, you’ll discover tips and strategies for balancing your spending while prioritizing savings and repaying debt.

Understanding the 50/30/20 Rule

The 50/30/20 rule is a simple and effective budgeting guideline that, as mentioned, allocates 50% of your take home pay to needs, 30% to wants, and 20% to savings and repaying debt.

The origin of the 50/30/20 rule is traced back to Senator Elizabeth Warren and her daughter Amelia Warren Tyagi. It was popularized in their book “All Your Worth: The Ultimate Lifetime Money Plan,” published in 2005.

In the book, Warren and Tyagi provide a straightforward and practical framework to manage your finances. It offers a balanced budget that supports both current needs and future financial health. The 50/30/20 rule has since gained popularity due to its simplicity and overall effectiveness – it works for many people!

50% — Needs

Needs refer to expenses essential for daily living and maintaining a basic functionality in society. Costs that support your necessities, such as housing, utilities, groceries, transportation, healthcare, health insurance, etc. These are non-negotiable expenses that must be met to ensure survival and an appropriate standard of living.

For example, housing costs like rent or mortgage payments need to be paid for you to have a safe and stable place to live. Utilities such as electricity, water, and heating are required to create a liveable environment. Food expenses are necessary to sustain good health and energy levels.

Even health-related costs, including health insurance premiums, medical care, medication, or other assistive devices are also categorized under needs, as they are essential for maintaining your overall well-being.

You can see why setting aside 50% of your income for these expenses is so important. Of course, if your income doesn’t cover all of your needs, you may need to make adjustments or look for additional financial assistance. In this situation, an easy-to-access emergency loan or government aid can provide temporary relief while you work towards increasing your income or reducing expenses in other areas.

30% — Wants

Wants are expenses that enhance your quality of life but are not essential for survival. These expenses are often related to personal enjoyment, leisure, and non-essential services. For example, dining out at a restaurant, going to the movies or other forms of entertainment like taking a vacation or indulging in hobbies are all considered wants.

Following this 30% rule limit requires mindful spending habits and often making tough choices. It might mean opting for a less expensive dining option or choosing local recreational activities over costly vacations. By consciously managing discretionary spending, you’ll become more disciplined in your financial decisions and develop healthier budgeting habits along the way.

So the next time you’re tempted to splurge on something outside of your budget, think about the bigger picture and the impact it could have on your financial stability. With discipline and conscious decision making, you’ll strike the right balance between wants and needs. Never let short-term desires overshadow your long-term goals – prioritize wisely and watch your financial health thrive!

20% — Savings and Debt Repayment

Savings and debt repayment are critical components of a solid financial plan, accounting for 20% of your budget. This serves multiple purposes, including building an emergency fund, retirement contributions, and making extra debt payments.

An emergency fund acts as a financial safety net, providing immediate cash for unexpected expenses such as medical emergencies, car payments or repairs, or sudden job loss. Aim to save three to six months’ worth of living expenses to cover these unforeseen costs without derailing your financial stability.

Retirement contributions are equally important, ensuring financial security in your later years. Investing in Registered Retirement Savings Plans (RRSPs) or Tax-Free Savings Accounts (TFSAs) offers Canadians tax-advantaged ways to build a retirement nest. Starting early and contributing consistently can greatly build your wealth over time.

Extra debt payments focus on reducing existing liabilities, like student loans, credit card debt, or mortgages. By paying down debt faster, you not only lower interest expenses but also free up future income for investments or personal goals. Prioritizing high interest debt can help you reach financial freedom faster.

Benefits of the 50/30/20 Budget Rule

The 50/30/20 budgeting rule is praised by many because it works. While various budgeting methods are available, this rule offers several unique benefits, including:

Easy to follow: One of the main advantages of the 50/30/20 rule is how easy it is to follow. It provides a clear guideline on how much money you should put toward each category without getting tied down by complicated calculations or budgeting software.

Flexibility: Unlike other tedious methods, this budgeting rule allows for flexibility in spending. As long as you stay within your designated percentages, you can prioritize your spending based on your personal needs and goals.

Encourages saving: By setting aside 20% of your income towards savings and debt repayment, the 50/30/20 rule promotes a healthy savings habit. This can help you save for whatever you need, whether it’s saving for a down payment on a home, building an emergency fund, or investing in your future.

Reduces financial stress: Following this rule and having a solid financial plan can alleviate stress and anxiety. By ensuring that your necessary expenses are covered while also leaving room for your non-essential spending and savings, you can feel more in control of your finances.

How to Adopt the 50/30/20 Budget Rule

Adopting the 50/30/20 rule for budgeting is straightforward, no matter the financial situation you are in. Here’s how to get started:

Calculate Your Monthly Income: Start by determining your month-to-month income after tax. This includes your paycheck, freelance earnings, and other other regular sources of income.

Divide Your Income: As the rule suggests, allocate 50% of your earnings towards necessities, 30% for leisure spending, and 20% towards savings and repaying debts.

Use Budgeting Tools: Popular budgeting apps like Mint, YNAB (You Need a Budget), or Pocketguard for automatic categorization and tracking of your expenses. Alternatively, you can create a detailed spreadsheet in Excel or Google Sheets to manually track spending.

Track Your Expenses: Regularly record your expenses to ensure they align with the three categories. Review your spending weekly or monthly to catch any deviations early.

Adjust as Necessary: Life circumstances and financial situations can change. In these cases, it’s perfectly okay to adjust your budget. For example, if you receive a raise or have a large unexpected expense, revisit your budget distribution to make sure it still fits your needs.

How To Use the 50/30/20 Rule to Your Advantage

To use this rule to your advantage, maintain discipline and regularly review the way you spend your money. Ensure you’re honest with your categorization and clearly differentiate between needs and wants. Use the insights from budgeting apps to identify trends and potential saving opportunities.

Adjusting to 60/20/30

In some cases, the 50/30/20 rule may not be suitable for your current situation. For instance, if your necessities take up more than 50% of your income, consider transitioning to a 60/20/20 distribution. Allocate 60% of your after tax income to cover essentials, reduce leisure spending, and continue saving 20%. This ensures you’re still maintaining a balance between your immediate needs and future financial security without sacrificing your savings plans.

Regular Reviews and Adjustments

Regularly reviewing and adjusting your budget keeps your financial plans on track. Set a monthly (or weekly) schedule to review your financial performance. Use this time to see whether the current allocations are still practical and beneficial.

Life events such as job changes, relocations, or unplanned expenses might necessitate a temporary or permanent shift in your budget percentages. By staying flexible and proactive, you can ensure the 50/30/20 budgeting rule or its adjusted versions serve you best at every stage in your journey.

Why the 50/30/20 Rule is Easy to Follow

The 50/30/20 rule simplifies budgeting for everyone. This designated structure minimizes the complexity of managing finances, making it easier for you to track your spending and maintain control.

For example, if you earn a monthly take home pay of $3000, the rule directs you to set aside $1,500 to essentials like rent or mortgage payments and groceries, $900 to leisure activities, and $600 to savings or debt obligations. Having this clarity helps you reduce the mental burden, meaning you spend less time worrying about financial decisions.

Where the 50/30/20 Rule Doesn't Work

While this budget rule offers a simple framework, it may not be feasible for everyone, particularly low-income households, single parents, or those with high debt. For low-earning families, putting 50% of their income might be unrealistic due to the high costs of rent, utilities, and groceries. This could leave insufficient funds for discretionary spending and savings.

High debt situations also pose challenges, as 20% of the income might not be enough to cover minimum debt repayments and build a savings cushion. In such cases, alternatives like the 70/20/10 rule, which prioritizes essentials and paying off debt over non-essential spending, might be more appropriate.

Other budgeting methods such as zero-based budgeting, where every dollar is assigned a job, can help individuals gain better control over their finances. Seeking assistance and financial support from community resources is also beneficial to navigate these financial hurdles.

Mastering Your Finances With the 50/30/20 Rule

There’s no other way around it – budgeting is essential for achieving financial stability. This rule offers a simple yet effective financial planning framework to help you stay on top of your finances without feeling overwhelmed or deprived.

However, if you find yourself struggling despite following this guideline, simple short-term loans from alternative lenders, like iCash, can provide you with much-needed relief.

These loans can help cover unexpected costs or tide you over until your next paycheck. They offer temporary financial relief while you continue working toward long-term stability. Set up your loan membership today and start taking control of your finances.