You can say goodbye to stress with a payday loan app, especially in today's economy where the cost of living in Canada continues to rise. In these expensive times, having access to quick financial assistance is key.

Payday loan apps offer a lifeline by providing immediate access to cash for those caught off-guard by escalating costs or unexpected expenses. Whether it's for groceries, utilities, or unexpected bills, these apps help with managing finances.

We’ll explore what payday loan apps are, how they work, and the benefits they offer, such as speed, accessibility, and privacy. We'll also learn how iCash, a leading payday loan company in Canada, distinguishes itself through user-friendly processes, quick approvals, and secure transactions.

Facing financial stress doesn't have to be overwhelming! With the iCash instant loan app, rapid financial relief is a few clicks away. Apply for quick monetary solutions and find your pathway to financial peace of mind.

Payday Loan Apps Canada: What Are They?

Payday loan apps in Canada provide 24-hour digital funding up to $1,500. They provide solutions to unexpected expenses like medical bills, car repairs, or sudden utility payments. These loans are accessible anytime and anywhere - an added benefit for those who need money outside of traditional business hours.

The application process is straightforward. You can complete it in minutes. Once you receive approval, you’ll get funds via e-Transfer for easy deposit into your bank account. Use the funds as soon as you receive them - and for whatever expense comes your way!

This speed and efficiency make payday loan apps a popular choice among Canadians. There’s never been an easier way to receive funds online. Sign up, choose your loan amount, and receive your funds.

Stuck in a remote area? Or, maybe it’s late, and in-store lenders are unavailable. Instant payday loan apps provide the flexibility and convenience that traditional lending institutions can't match.

Even individuals with lower credit scores may find themselves eligible for a loan. Alternative lenders pride themselves on providing accessible credit to Canadians who may not qualify for traditional forms of financing. This inclusivity ensures that more people have access to reliable emergency funds when they need them the most.

Are payday loan apps legit?

Are payday loan apps legit? It’s a common question among first-time borrowers. The answer? Absolutely!

Mobile lending apps in Canada operate under strict regulations designed to protect consumers from unfair lending practices. Each province has regulations that loan companies must follow.

In Ontario, for example, the Payday Loans Act, 2008, ensures that borrowing apps are licensed to operate. This act sets limits on the cost of borrowing, prohibits certain fees and practices, and provides borrowers with a cooling-off period to cancel the agreement without penalty.

Reputable lending companies also put consumer security at the forefront. They use advanced encryption to protect personal and financial information. It also allows for a more private borrowing experience.

Never worry about someone knowing your financial business. With lending apps, everything remains confidential - as it should!

Best Payday Loan Apps

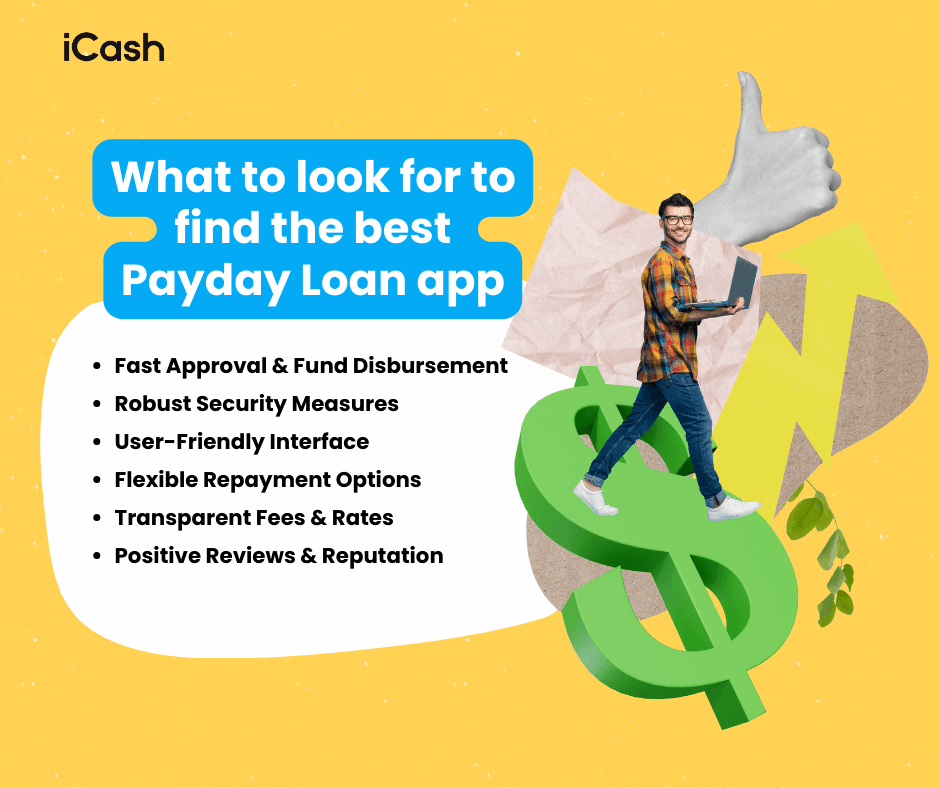

When searching for the best payday loan apps, evaluate your needs. The ideal app for you depends on several factors, including the speed of loan disbursement, ease of use, security measures, and the flexibility of repayment options.

Here’s what to look for to find the best option for you:

Fast Approval & Fund Disbursement

Look for apps that promise fast approval and fund disbursement. This rapid response is crucial in emergencies. Imagine needing money right now and having nowhere to turn.

Finding an instant payday loan app that provides rapid cash can make all the difference. When time is of the essence, you don't have the luxury to wait for days. An app that can process your application and disburse funds within minutes can be a lifeline.

Robust Security Measures

Ensure the app you choose prioritizes security. Look for apps that use strong encryption for data transmission and storage. The app should also clearly outline in its privacy policy how it uses and protects your information.

Borrowing money online doesn’t have to feel intimidating. With the right security measures in place, you can trust that your personal and financial details are safe.

User-Friendly Interface

The best payday loan apps have smart interfaces that simplify the borrowing process. You shouldn’t have to navigate through complicated menus or deal with glitchy dashboards, especially if you’re already stressed about finances.

A few clicks should provide you with the funds you need. Whether you’re on the go, or looking for the easiest way to get money right now, you’ll appreciate a user-friendly platform.

Flexible Repayment Options

Having flexible repayment options makes managing your loan easier. Some apps offer customizable repayment plans, allowing you to choose payment dates that align with your pay schedule. This flexibility prevents financial strain during the repayment period.

Depending on your location, you may be eligible for multiple installment payments. Instead of paying off the loan in one lump sum, you can divide the payback amount into several smaller payments.

Transparent Fees & Rates

The best payday loan apps have transparent fees and interest rates. Transparency is key when it comes to the costs associated with your loan. Lenders should always disclose all fees, interest rates, and any additional costs upfront. This transparency ensures there are no surprises, allowing you to make an informed borrowing decision.

Positive Reviews & Reputation

Having a proven track record of happy customers in the form of positive online reviews shows credibility. You’d feel more comfortable working with a lender with high ratings than one that doesn’t meet customer expectations.

You can search for reviews on the iOS or Android app store, Google reviews, TrustPilot, etc. Having a good variety of reviews from different platforms can help you make an informed decision. Ultimately, you’ll want to choose the app that aligns best with your needs.

Introducing iCash: A Trusted Payday Loan App in Canada

With over 950K happy customers and counting, iCash stands among the most trusted payday loan apps in Canada. The quick and easy loans provide funding 24 hours a day, 7 days a week. It’s the most convenient way to access cash when you need it most.

The app also streamlines the signup process. You won’t need ID documents, paperwork, bank statements, or in-person visits. Approvals are available around the clock, 24/7 - getting a loan on the weekend is possible, too!

Other key features include:

Easy integration with banking systems.

256-bit SSL encoded bank level security.

Fast e-Signature process.

Funds 24/7 via e-Transfer.

Flexible repayment options and zero hidden fees.

Exclusive access to financial education resources.

Real-time notifications and loan status updates.

In-app customer support whenever you need it.

Facing an unexpected expense or need extra cash before your next paycheck? Get up to $1,500 using the iCash instant loan app. It’s like having an ATM in the palm of your hand!

Getting Started With the iCash App

Getting started with iCash is a straightforward process. If you’re ready to access safe and reliable funds, you can do so in a few simple steps. Here’s how to get up to $1,500 using nothing but your smartphone or mobile device:

1. Get the iCash app: Download the instant payday loan app from your smartphone's app store. It's available on both iOS and Android devices.

2. Set Up Account: Open the app and create a new account. You'll need to provide some basic personal and financial information to get started. It’s really simple!

3. Complete Application: Fill out the loan application. Include details such as your income level, and the amount you wish to borrow. You can borrow up to $1,500 in funds.

4. Quick Approval: The approval process takes just minutes. Smart technology analyzes your application quickly, ensuring you get a response without unnecessary delays.

4. Review Loan Terms: Review the loan terms carefully. This includes the interest rate, repayment schedule, and any associated fees. If everything looks good, sign and submit.

5. Receive Your Funds: Now, for the fun part! Loan funds are sent via e-Transfer 24/7. This means you can have access to the cash almost immediately, no matter the time of day or night. Borrowing on a weekend or holiday? No problem! Cash is available whenever you need it.

By following these simple steps, you can get the financial assistance you need, without any hassle or extra waiting. Use your funds for whatever smaller purchase you need to make.

Stuck with a hefty car repair bill? Need to book a last-minute flight to visit family? There are no restrictions on how to use the money. Plus, with easy repayment options, managing your loan is effortless!

Choose the iCash App for Your Payday Loan Needs

When you choose the iCash app, you’ll experience numerous benefits. Access a fast registration process, around-the-clock approvals, and seamless e-Transfers. Getting the financial support you need doesn’t have to be difficult.

The app's bank-level security gives you added peace of mind. Knowing that 256-bit SSL encryption protects your information allows you to focus on managing your financial needs without worrying about data security.

You’ll also enjoy transparent terms and access to financial education resources. This ensures you're well-informed and prepared to make smart financial decisions. Feel confident using a payday loan app that prioritizes your financial well-being above all else.

Don't let financial stress weigh you down! Download the best payday loan app today and take the first step towards managing expenses with ease.