If you’ve just started a new job and need a loan, you may be wondering if it’s even possible. After all, lenders typically look for stable employment and income as their primary point when considering loan applications. Thankfully, there are some lending options available for Canadians who have recently started a new position. In this blog, we’ll discuss how to get a loan if you’ve just started a new job in Canada.

First, it’s important to understand that lenders will typically look at a number of factors when considering a loan application, including credit score, income, employment history, and debt-to-income ratio. These factors help lenders determine whether you are a reliable borrower and can afford to repay your debts.

When you’ve just started a new job, lenders may be more cautious about approving your loan application. This is because they may view your employment as less stable than someone who has been with the same employer for several years. However, there are steps you can take to improve your chances of getting approved.

Loan Approval Tips for New Employees

There were 348,000 more employed Canadians in February 2023 vs August 2022. That means lots of new jobs. And getting a new job often means living off savings or credit to bridge the gap between paycheques. Here are some helpful tips you can use to get approved for a loan, even after you’ve just changed careers:

Start With a Small Request

As a new employee, you may want to consider starting small when it comes to borrowing. Of course, this may not be ideal if you need to borrow thousands of dollars. However, applying for a smaller loan may increase your chances of approval, especially if you have a limited credit history or income. Additionally, taking out a smaller loan and making timely payments can help build your credit score and establish a positive relationship with the lender.

Check Your Credit Score

Before applying for a loan, it’s important to check your credit score. Your credit score is a numerical representation of your creditworthiness and helps lenders determine whether you are a reliable borrower. In Canada, credit scores range from 300 to 900, with a score of 650 or higher generally considered good. In 2020, the average credit score in Canada was 672, according to a survey by Borrowell.

If you have a good credit score, you are more likely to be approved by lenders, even if you’ve just started a new job. However, if your credit score is low, you may need to take steps to improve it before applying for your typical loan. There are several ways to increase your credit score, thankfully.

Avoid Bad Credit Habits

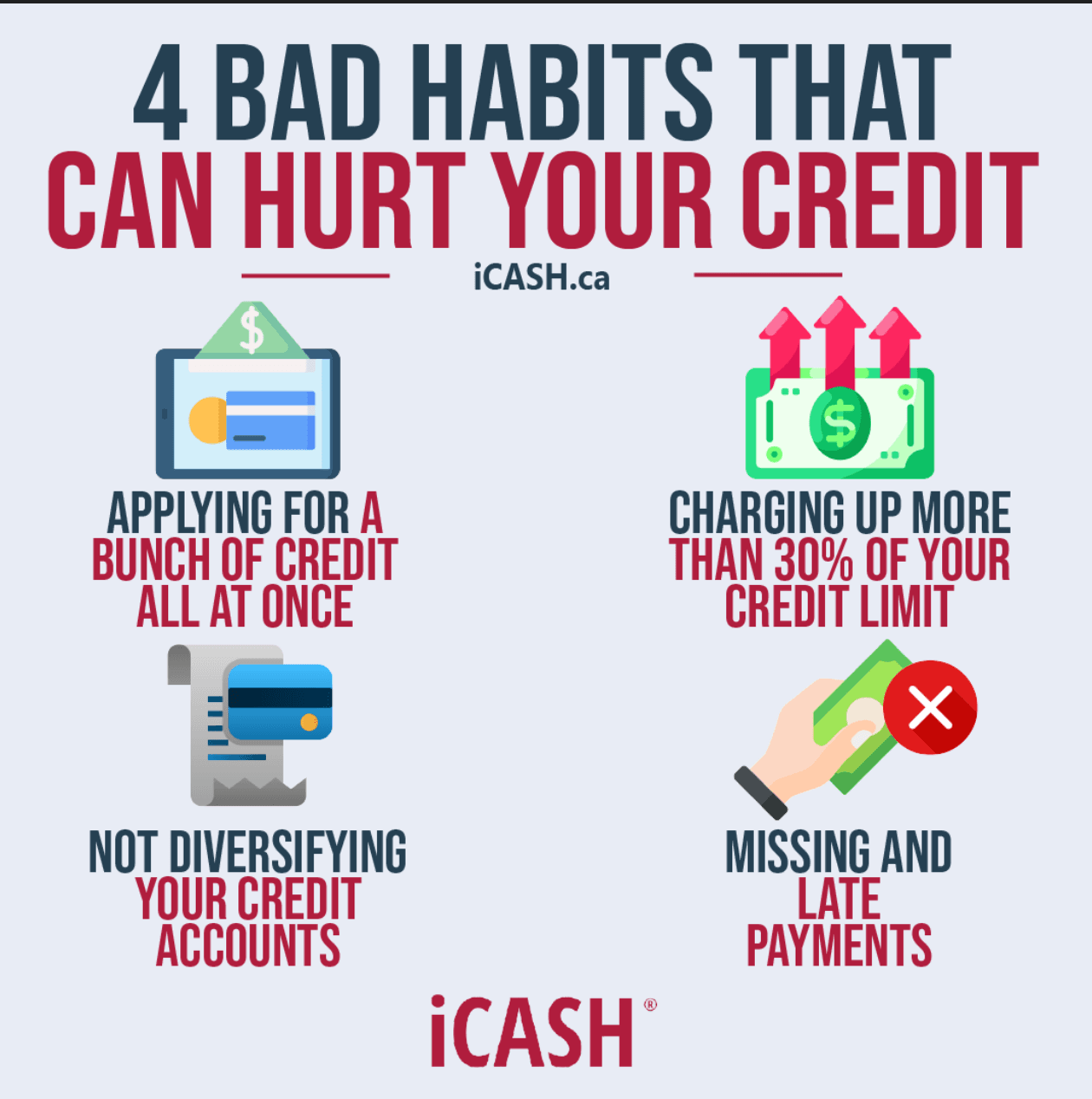

While a good credit score won’t necessarily guarantee your approval, it’s still important to practice healthy credit habits to ensure that your score remains in good standing. Avoiding bad credit habits can help someone get approved for a loan by keeping their credit score high and showing lenders they are reliable borrowers.

Building strong financial habits such as paying bills on time, being mindful of spending and keeping balances low will make it easier for potential lenders to see that the borrower is responsible with money and can be trusted with repayment of the loan.

Here are 4 bad credit habits you should avoid as much as possible:

Look for Alternative Lenders

Unfortunately, having good credit does not automatically mean you’ll get approved for a loan. They may still require proof of a steady income, and if you’ve just started a new job, that can be hard to provide.

However, the good news is that alternative lenders may be more willing to work with individuals who have recently started a new job, as they take a more open-minded approach to evaluating borrowers. According to a 2020 survey by the Financial Consumer Agency of Canada, about 20% of Canadians have used an alternative lender for credit at some point in their lives. That’s where iCash comes in!

With iCash, we can offer most people flexible installment loan terms and repayment options, which can be beneficial if you’re still getting established in your new job and need some flexibility in your budget.

Provide Proof of Income

Regardless of how long you have been at your new role, you can still provide proof of income to lenders. This can include pay stubs, bank statements, or a letter from your employer confirming your employment and income. This may be a little more difficult if you get paid in cash, but there are several ways one can prove their cash income.

If you have a steady income and can demonstrate that you’re able to make loan payments on time, lenders may be more willing to approve your application.

Demonstrate Financial Stability

Lenders also evaluate your financial stability when determining your eligibility for a loan. Your income and expenses, including your debt-to-income ratio, are essential factors in this evaluation.

As a new employee, you may not have a long employment history, but you can demonstrate financial stability in other ways. For instance, if you've been living at the same address for a few years, it may indicate that you have stable living conditions. In fact, according to a study by Equifax, having a stable residential address for several years is considered a positive factor in credit scoring models used by lenders, and those that lived at the same address for five or more years were 15% less likely to have a delinquent account.

Request a Letter From Your Employer

This option may not be for everyone, as it would essentially require you to tell your employer the reason you’re requesting a letter. That being said, requesting a letter from your employer that confirms your employment status and income can be a great way to help you secure a loan. Ideally, the letter should include your job title, your salary or hourly wage, and any other income you receive, such as bonuses or commissions. You should also make sure to give your employer enough notice to provide the documentation you need.

Consider a Co-Signer

If you’re having difficulty getting approved for a new job loan on your own, you may want to consider applying with a co-signer. A co-signer is someone who agrees to take responsibility for the loan if you are unable to make payments.

Having a co-signer can help you get approved, especially if you’ve just changed jobs. However, it’s important to remember that they will be equally responsible for the loan, so it’s important to choose someone you trust and who has a good credit history.

Can I Get a Loan if You’re Unemployed?

So, we’ve answered the question on how to get a loan if you just got a new job. But what if you’re currently unemployed? Can you still be approved? The short answer is that it can be challenging to get a loan without a steady source of income. However, it's not impossible.

Like we discussed in the tips above, some lenders like iCash, consider other sources of income when approving borrowers, not just employment income, so it’s entirely possible to get approved for loans for the unemployed. Another option is to apply with a co-signer who has a steady income and good credit history. This can increase your chances of getting approved for a loan, but again, it's important to remember that your co-signer will be equally responsible for repaying the loan.

Can I Get a Loan if I'm Self Employed?

Yes, you can, but you'll likely need to provide documentation such as tax returns, bank statements, and profit and loss statements to prove your income and cash flow. It's important to keep accurate records and have a solid business plan to show lenders that you have a reliable source of income.

Can I get a Loan for a new job if I'm Temporarily Employed?

Traditional lenders, such as banks, typically prefer borrowers with steady income and a long employment history, which can be difficult to demonstrate if you're in a temporary position. However, if you have a good credit score and a healthy debt-to-income ratio, you may be able to qualify for a loan. Additionally, some lenders may consider your education and overall work experience when evaluating your application.

iCash is Here to Help

Whether you just got a new job, or you need extra funds to help pay any unexpected bills, or deal with emergencies, iCash can help. You can apply for a loan, get approved, and receive your funds via e-Transfer all within an hour. Just create your account today.