All across Canada, people use payday loans to get through financial emergencies. These loans can be a quick fix when you're in a tight spot, and they’re popular because they’re easy to get, even if you don't have a great credit score.

Understanding the interest rates on payday loans is important because it helps you know how much the loan will really cost you in the end. The last thing you want is to be caught off guard when it’s time to pay back the loan, so it’s good to be informed before you decide if a payday loan is the right choice for you.

In this blog, we'll explore payday loan interest rates in Canada, look at how these rates are calculated, and how they vary across different provinces. By the end, you’ll have a better idea of whether a payday loan is the right choice for you.

What are Payday Loans?

First, let’s start by getting into an obvious question - what exactly are payday loans? Payday loans are short-term loans that are usually due on your next payday. They’re helpful for anyone who needs quick cash to cover unexpected expenses, whether that’s car repairs, grocery bills, vet visits, etc.

Payday loans are way easier to get than loans from traditional banks because they don't require a perfect credit score. Payday loan lenders like iCash look at a person’s income (multiple sources of income accepted too - not just regular employment) rather than basing decisions on a person’s credit history.

When you take out a payday loan from any online payday lenders, you usually borrow a small amount of money, between $100 and $1,500. You’ll then pay back the loan, plus a fee and interest rates, by your next payday. The fees can vary depending on the lender, so it’s important to do your own research and compare payday loan lenders.

So what are the other reasons so many Canadians choose payday loans over traditional bank loans? Well, they’re also incredibly fast and convenient. Not only can you apply online with your laptop or smartphone, but with iCash, if you get approved, the funds are sent to you within 2 minutes by e-Transfer. This is part of what makes them so useful for emergency expenses.

Payday Loan Regulations in Canada

In Canada, online payday lenders are regulated by the federal government and provinces to protect consumers from unfair practices and predatory lending practices. The federal government sets some basic rules that all payday lenders must follow. For example, we must tell you the total cost of the loan before you agree to it. This includes the interest rate and any fees.

iCash will always ensure you know exactly what you’re getting into before you agree to anything. We’ll always make sure you’re fully informed about the costs of an average payday loan before you sign a digital agreement. In Canada, the maximum fee that a lender can charge is $14 for every $100 borrowed.

These regulations are meant to create fairness and clarity before you borrow money from a payday lender. It's important to understand the rules in your province so you can make an informed decision about whether a payday loan is right for you. As always, if you have any questions before signing up, reach out to our customer service team! They’re always happy to help.

How Payday Loan Interest Rates are Calculated

Understanding the cost of payday loans and how payday loan interest rates are calculated can help you know what you are getting into before you borrow money and start thinking about payday loan payments.

When it comes to the cost of borrowing, it is common for payday loans to charge a fee for every $100 borrowed. As an example, if the fee for a $300 loan is $14 per $100 borrowed, then you would have to pay back $342.

You should also know that payday loans often come with additional charges. These can include fees for late payments or for extending the loan. All of these extra costs can make the loan a little more expensive.

Typically, the timeline of payday loans in Canada are short (about two weeks). While the interest rate is modest over this brief term, it's important to understand the Annual Percentage Rate (APR), which represents the cost of the loan over a full year.

Overall, it's important to understand these rates and any additional fees so you know how much the loan will cost you in the end. Any reputable payday lender, like iCash, will always make sure you get a full and clear picture of all the fees and rates before you apply for the loan.

Payday Loan Rates Across Provinces

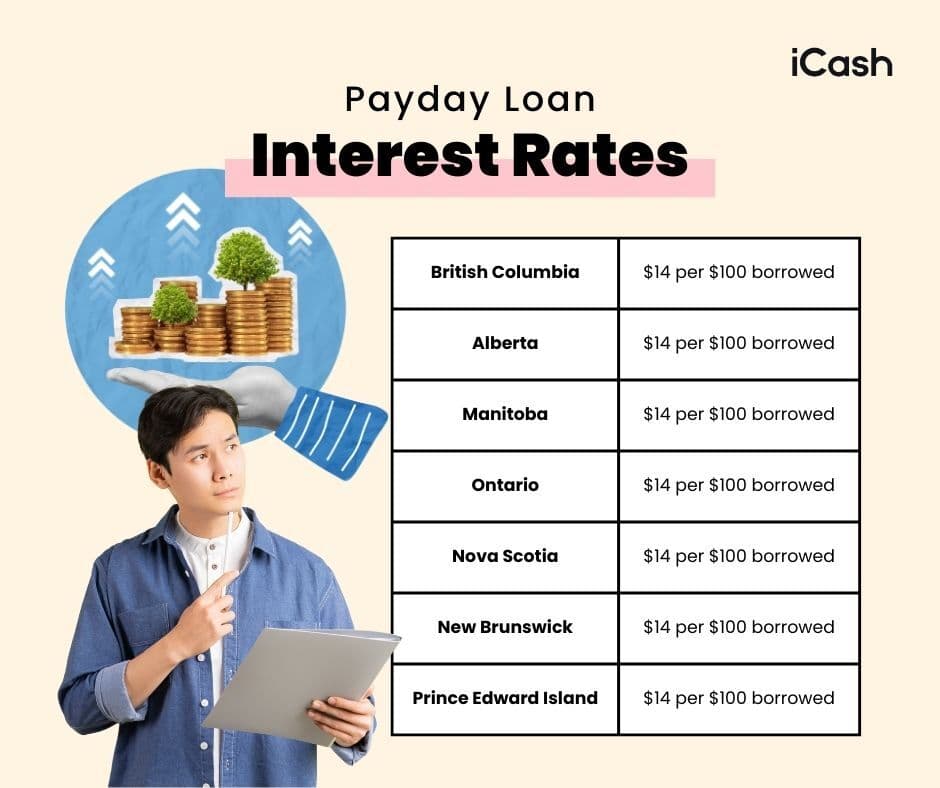

Payday loan interest rates for an iCash payday loan differ depending on your province. Here is the breakdown:

These differences are important because they show how much more you might have to pay depending on where you live. Here are some reasons why payday loan interest rates differ:

Provincial Laws: Each province has the power to set its laws regarding payday loans and payday loan interest rates, which leads to different maximum fees.

Cost of Living: In provinces with a higher cost of living, payday lenders might charge more to cover their expenses.

Market Competition: In some provinces, there might be more payday lenders, which can lead to lower fees as they compete for customers.

Always check the specific rules in your province before taking out a payday loan, so you understand exactly how much it will cost you. And again, it’s always worth repeating - reputable companies will always make sure you know exactly how much your loan will cost before you even fill out an application.

Is a Payday Loan the Right Choice for You?

Payday loans can make a huge difference when dealing with financial emergencies, but it's important to understand the interest rates and overall costs involved.

Different provinces in Canada have different regulations, so the cost of borrowing a payday loan can vary depending on where you live. Before taking out a payday loan, make sure you’re aware of all fees and APRs.

You can always rely on iCash to offer transparent options for payday loans, with honest fees, flexible repayment plans*, and excellent customer service. Plus, with the iCash referral program, you can even get cash back by referring others to us!