Whether you’re just beginning to build your credit or have been doing so for years, understanding your credit score and credit report is more important than ever. Both play huge roles in determining your financial health, but they serve different purposes and contain different information.

Knowing the difference between them and why they are important can help you make better financial decisions, secure loans with better terms, and in general maintain overall financial well-being.

Are Credit Scores and Credit Reports the Same?

While credit scores and reports have similarities, the simple answer is no - they are not the same. It’s not uncommon for people to confuse credit scores with credit reports, thinking they’re the same thing. However, they’re quite different, and understanding this difference is key to managing your finances effectively.

A credit score is a numerical representation of your creditworthiness, while a credit report is a detailed credit history record. It may seem like a small distinction, but it’s important because each provides different insights into your financial health.

What is a Credit Score?

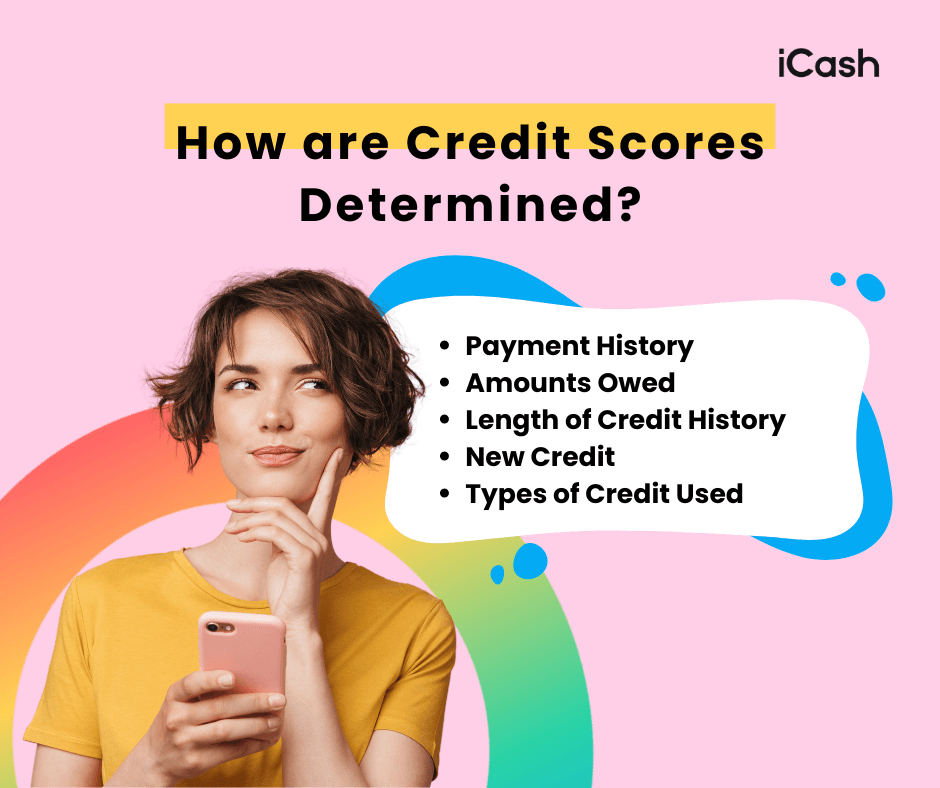

Credit scores are three-digit numbers that reflect your creditworthiness. Lenders use this score to determine how likely you are to repay your debts, and therefore if you’re someone they can trust to lend money to. Your credit score is calculated based on:

Payment History: Whether you've paid past credit accounts on time. This is a huge one and accounts for about 35% of your credit score.

Amounts Owed: This is the amount of credit and how much of your available credit you are using. High balances can negatively affect your score.

Length of Credit History: This measures how long your credit accounts have been established. A longer credit history may have a positive impact on your score.

New Credit: The number of new accounts you've opened can also have an impact on your score. Opening many new accounts in a short period can be seen as risky behavior by lenders.

Types of Credit Used: This is the mix of credit cards, retail accounts, installment loans, finance company accounts, and mortgage loans (among other things) that you may have. A diverse credit mix can positively impact your score.

What is a Credit Report?

A credit report, however, is different because rather than being represented by a number, this is a detailed document that outlines your credit history. It includes:

Personal Information: Such as your name, address, Social Security number (SSN), and date of birth. This helps identify you accurately.

Credit Accounts: Information on current and past credit accounts, including the type of account, the credit limit, the account balance, and your payment history.

Credit Inquiries: A list of entities that have accessed your credit report. There are two types of inquiries: hard inquiries (which can affect your credit score) and soft inquiries.

Public Records: Information on bankruptcies, foreclosures, and other public records related to your creditworthiness.

Credit reports are issued by credit bureaus, such as Equifax, Experian, and TransUnion.

Comparing Credit Scores and Credit Reports

Together, credit scores and credit reports provide a comprehensive picture of your financial health. While your credit report gives detailed information about your credit history, your credit score gives a quick snapshot of your creditworthiness. Lenders will use both to assess a person's risk.

Your credit score can indicate if you need to look deeper into your credit report for potential issues, such as late payments or higher-than-normal credit utilization. Similarly, your credit report can help explain your low or high credit score.

For example, if your credit score suddenly drops, reviewing your credit report can reveal if there are any negative entries, like late payments.

Importance of Monitoring Both

You should always keep a close eye on your credit score and report to maintain good financial health. They can impact your ability to qualify for loans, get favorable interest rates, and in some cases, even affect employment opportunities:

Loan Approvals and Interest Rates: Lenders use your credit score and credit report to decide whether to approve your loan application and what interest rates to offer. A high credit score and a clean credit report can lead to better loan terms.

Detecting Fraud: Regularly monitoring your credit report can help you detect and address identity theft or fraudulent accounts. If you notice accounts or inquiries you didn't authorize, you can take immediate steps to dispute them and protect yourself.

Financial Planning: Understanding your credit score and credit report helps you make informed decisions about borrowing and managing debt. It allows you to identify areas for improvement and create a strategy to improve your credit.

How to Improve Your Credit Score and Clean Up Your Credit Report

Improving your credit score and making sure your credit report is accurate takes effort and time. Here are some quick and helpful tips:

Pay Your Bills on Time: Consistent, on-time payments are the most important factor in boosting your credit score. If needed, set up reminders or automatic payments to avoid missing due dates.

Reduce Debt: Lowering your credit card balances can positively impact your credit score. Aim to keep your credit utilization ratio below 30%.

Avoid Opening (or Closing) Too Many New Accounts: Each new account results in a hard inquiry, which can lower your credit score. Be selective about applying for new credit. The same can be said about closing too many accounts.

Check Your Credit Report Regularly: Always look for errors or outdated information and dispute any inaccuracies with the credit bureaus. You can check your credit report for free at least once a year.

Diversify Your Credit Mix: A mix of credit types (credit cards, loans, etc.) can positively affect your credit score. However, you should only open new credit accounts if it’s absolutely necessary and manageable.

iCash Can Help You Out

While credit scores and credit reports are different from each other, they are both essential for understanding and managing your financial health.

A credit score is a snapshot of your creditworthiness, while a credit report is a more detailed look at your credit history. By regularly monitoring both, you can make informed financial decisions, secure loans with better terms, and protect yourself from identity theft.

Being aware of your credit status lets you take steps to improve your overall financial standing. Remember, achieving good credit is a process that requires regular attention and responsible financial behavior.

At iCash, we believe monitoring your credit and taking steps to improve it is important. If you need a financial boost to help handle bills (and avoid late payments), you can apply for a payday loan with iCash today.