Your credit score plays a crucial role in your financial life, but this is especially true when securing loans and credit. Lenders will use your credit score to assess your creditworthiness (essentially a measure of how likely you are to repay your debts responsibly).

Credit scores are like golden tickets that open doors to attractive loan offers, lower interest rates, and more favorable loan terms. However, a poor credit score can result in higher interest rates, fewer loan options, or even rejection of a loan application.

Whether you're building credit or repairing it, iCash will help you explore strategies such as establishing a solid payment history, reducing credit card debt and being cautious with new credit applications. Our goal is to help set you on the path to a healthier credit score and better loan terms!

Understanding Credit Scores

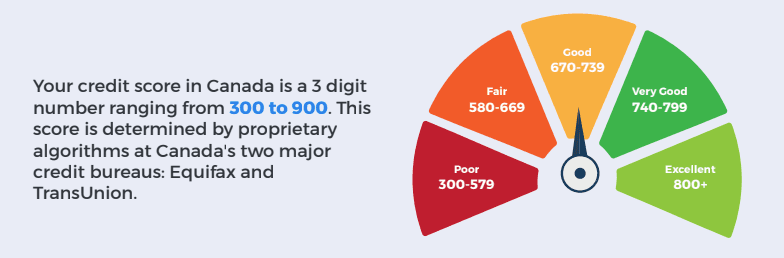

So what exactly is a credit score? A credit score is basically a numerical representation of your creditworthiness. This info gives lenders a quick snapshot of your ability to manage debt responsibly. It serves as a vital tool in the lending process, allowing lenders to assess the risk of extending credit to you. Lower credit scores indicate a higher risk of default, while higher credit scores indicate a lower risk.

For example, when you apply for a loan or credit card, lenders will review your credit score to determine whether to approve your application and what terms to offer. A good credit score can lead to lower interest rates, higher credit limits, and more attractive loan options. But a poor credit score can result in higher interest rates, stricter borrowing terms, or even outright loan rejections.

Factors Influencing Credit Scores

Before you can improve your credit score, it’s important to understand the key factors that lenders consider when evaluating your creditworthiness:

Payment History

A credit score is heavily influenced by your payment history. Credit card companies, loan companies, and utility companies want to see that you consistently pay your debts on time. Defaults, delinquencies, and late payments can negatively affect your credit score.

Credit Utilization

Utilization of credit is the percentage of available credit you are currently using. Maintaining a healthy credit score means keeping your credit utilization below 30%. Higher credit utilization may signal financial strain and negatively affect your score.

Length of Credit History

Having a long credit history is another crucial factor. A longer credit history works in your favor because it provides more data for lenders to assess your credit behavior. That’s why it's not advisable to close old credit accounts, as they contribute positively to your credit score.

Types of Credit Used

Having a variety of credit is a good idea because lenders like to see that you can manage different types of credit responsibly. This includes revolving credit (e.g., credit cards) and short-term installment loans (e.g., car loans, mortgages). A diverse credit mix can have a positive impact on your credit score.

Recent Credit Inquiries

Each time you apply for new credit, a hard inquiry is generated on your credit report. Too many within a short period can raise concerns for lenders, as it might indicate you’re taking on significant debt or facing financial difficulties. Try to space out credit applications to minimize their impact on your credit score.

Tips for Improving Your Credit Score

So, is it possible to improve your credit score in order to secure better loan terms? Absolutely! Here are a few tips to help you achieve a better credit score!

Build a Solid Payment History

One of the most significant factors in establishing a strong credit score is maintaining a flawless payment history. Making payments on time shows your responsibility as a borrower. Whether it's credit card bills, loan installments, etc. consistently paying on time positively impacts your credit score. Unfortunately, even a single late payment can cause a dent in your creditworthiness which is why it's crucial to prioritize making payments by or before the due date.

In today's fast-paced world, it's easy to overlook due dates and miss payments. To prevent this from happening, consider setting up payment reminders. You can use your smartphone's calendar app or task manager to create alerts a few days before each due date. Also, many banks and credit card issuers offer automatic payment options. Enabling automatic payments ensures your bills will be paid from your designated account on the scheduled date, eliminating the risk of late payments.

If missing a payment is unavoidable (after all, life happens), communicate with your creditors ASAP. Many lenders are willing to work with borrowers facing temporary financial setbacks. You can contact them and explain the situation honestly. Some creditors may offer temporary forbearance, a payment plan, or an extension.

Reduce Credit Card Debt

Do you carry balances on multiple credit cards? If so, then it's essential to prioritize your repayment strategy. Begin by focusing on the credit card with the highest interest rate. By targeting high-interest cards first, you can reduce the interest you pay over time, ultimately saving you money.

Continue making the minimum payments on all your cards while directing any additional funds toward the highest interest card. Once the high-interest card is paid, move on to the next one, and repeat the process until you've eliminated all credit card debt.

Here are some strategies to help you efficiently lower your credit card debt:

Create a Budget: Look at your monthly income and expenses to create a comprehensive budget. Find areas where you can cut back, and allocate more funds toward debt repayment.

Snowball Method: With this approach, you focus on paying off the smallest credit card balance first. For any others, you’ll be making minimum payments. Once the smallest balance is paid off, roll the amount you were paying on that card into the next smallest balance, accelerating your debt payoff momentum and hence why they call this the snowball method.

Debt Consolidation: Making multiple credit card payments can be overwhelming. Consolidating your debts with a personal loan or balance transfer credit card may be a good idea. Debt consolidation can simplify your repayment process and may offer a lower interest rate, making it easier to tackle your debt.

Negotiate with Creditors: It never hurts to reach out to your credit card issuers to explore the possibility of negotiating for better terms or even a reduced settlement amount. A more manageable repayment plan may be possible with some creditors.

Avoid New Credit Card Charges: While this may be difficult for some, try to refrain from making new charges While paying off existing credit card debt. Adding more debt to your existing balance can hinder your progress and prolong your debt repayment journey.

Keep Your Old Accounts Open

The length of your credit history is an important factor in calculating your credit score. It measures how long you've been using credit and how well you've managed it over time. A longer history provides more data for credit scoring models to assess your creditworthiness. Longer credit histories are generally associated with higher credit scores. Those with a relatively short credit history may have a more limited score, which could affect their ability to get more favorable loan terms.

Even if you have no use for an account, closing an old account can shorten your credit history, negatively impacting your credit score. It can also reduce the total amount of credit available to you, which can result in a higher credit utilization ratio if you have outstanding balances on other cards.

Diversify Your Credit

Having a diverse credit mix refers to having a variety of credit accounts. Different types of credit, such as credit cards, installment loans, and lines of credit, are preferred by lenders. Your credit score can be positively impacted by a diverse credit mix that demonstrates your ability to manage various financial obligations.

Lenders view diverse credit as a sign of creditworthiness and financial stability. It shows that you can handle different credit types responsibly, which may make you a more attractive borrower. However, when considering different types of credit, you should focus on those that align with your financial goals and needs. For example, if you need a credit card for everyday expenses, use it responsibly, pay off balances, and avoid carrying high balances.

Seek Professional Help

Sometimes, the best thing to do is simply ask for help. An expert credit counselor or financial advisor can help you improve your credit score and overall financial health. Counselors help you build a plan to address credit issues, negotiate with creditors, and improve your credit score. Financial advisors, on the other hand, provide comprehensive financial planning services, assisting with budgeting, retirement planning, investments, and more.

These experts will take into account your specific goals, income, expenses, and debts to develop a plan that aligns with your needs. By receiving personalized help, you can make informed decisions to overcome credit challenges and achieve financial stability.

Building a Strong Credit Foundation for a Bright Financial Future

By understanding the factors that influence credit scores and implementing the tips provided in this blog, you can start to take control of your credit destiny. Building a solid payment history, reducing credit card debt, and keeping old accounts open are all small steps toward achieving a healthier credit profile. Also diversifying your credit mix and seeking professional help from credit counselors or financial advisors can further strengthen your credit foundation.