In Canada, everyone has a credit score that can range anywhere between 300 to 900. According to credit bureau Equifax, a good score is between 660 and 725, while a very good score is between 725 and 759. If your score is above 760, you’re generally considered to have excellent credit, and can likely enjoy the advantages of things like better mortgage rates, auto loans etc.

Unfortunately, this means anyone below 660 is considered to have less than ideal credit. And if you fall below 560, you’re officially in “poor credit” territory, which can have a significant impact on your life. Sometimes, bad or poor credit is completely out of your control, and you may be looking for ways to increase your score as quickly as possible. So, is it possible to increase it quickly? Let’s dive in.

Is it Possible to Increase Your Credit Score by 100 Points Overnight in Canada?

Raising your credit score by 100 points in Canada may sound like a pipe dream, but it is indeed possible. However, it’s important to taper your expectations a little. A drastic increase in your credit score overnight simply isn’t possible. This should not discourage you from taking the necessary steps to improve your credit, because if you do, you will absolutely see improvements over time.

It requires dedication and effort on your part, as well as an understanding of the factors, such as making all payments on time that influence your credit score. While you can’t magically raise it overnight, there are some steps you can take to improve your score quickly and effectively.

How Credit Score is Determined in Canada

Before we get into the best tips to increase your credit score (and don’t worry, we will soon enough), it’s important to understand how credit scores are determined in Canada.

In Canada, credit scores are calculated using a combination of factors that reflect an individual's financial behavior. These factors include payment history, amount of debt owed, length of credit history and types of accounts opened. The score is also based on the number and frequency of applications for new lines of credit as well as any available public records related to bankruptcy or other legal matters.

All these components are used to generate a three-digit number between 300 and 900 that lenders use to determine your level of risk when applying for loans or other forms of financing. A higher score indicates lower risk while lower scores indicate higher risk. Typically, anything below 579 is considered bad credit, and anything 800 and higher is considered excellent

How Long Will It Take to Increase Your Credit Score by 100 Points in Canada?

It typically takes several months, and potentially a few years, to increase your credit score by 100 points in Canada. This timespan can vary depending on the individual's current credit score and the amount of effort they take to improve their financial standing.

To begin raising your credit score, you must create a plan for yourself and track your progress along the way. You should start by checking your current credit report from Equifax or Transunion, two of the main credit bureaus in Canada. This will give you an idea of where you stand, helping you to identify which areas need improvement. Shortly, we’ll take a look at more specific tips that will help you increase your score over time.

How Long Does It Take to Repair Your Credit Score?

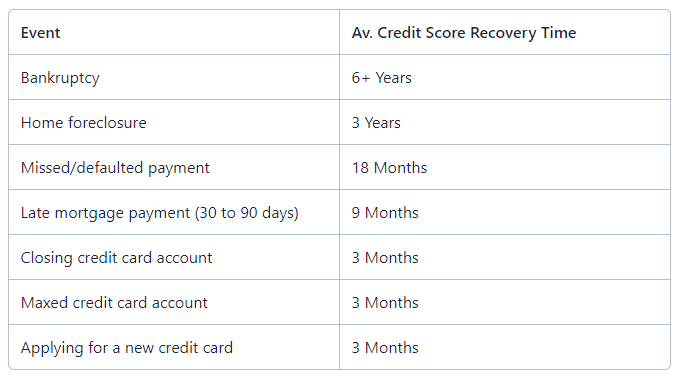

Depending on the severity of damage to your credit report, it could take anywhere from several months up to a few years for you to see a noticeable improvement in your score. Factors such as how much debt you have, what type of debt it is (student loans or consumer debt), and any past delinquencies will all factor into the time frame needed to increase your credit score. Here’s a look at specific events that can damage your score, and how long it may take (approximately) to recover from them.

It's important to stay patient during this process and keep track of your progress since even small improvements can add up over time. With dedication, discipline, and smart financial habits, you will eventually reach the desired level of creditworthiness that will open more doors for further financial opportunities.

*Stats provided by bankrate.com

How Long Do Derogatory Marks Stay on Your Credit Report?

Derogatory credit is any type of negative information on your credit report, such as late payments, collections accounts and bankruptcies. This type of information can stay on your credit report for a long time, in some cases up to 10 years from the date it was reported according to credit bureau TransUnion.

Derogatory marks are one of the most damaging items that can appear on a person’s credit history because they indicate that you have not been responsible with debt repayment or other financial obligations. As a result, derogatory marks will significantly lower your overall score and make it difficult to get approved for new lines of credit or loans at reasonable interest rates.

How to Increase Your Credit Score by 100 Points and Fix Derogatory Credit

Having derogatory credit can be a daunting issue to deal with. It may feel like there is no way out of the situation, but that doesn't have to be true. With discipline and dedication, you can fix your derogatory credit, increase your score and start building a strong financial future for yourself.

Pay off any delinquent accounts

A delinquent account is one that has not been paid by its due date and thus, has gone into default. It’s important to pay off a delinquent account in order to improve your credit score, as late payments can have a significant negative effect on credit scores. Delinquent accounts can be sent to collections, which can cause further damage to a borrower’s credit score and financial reputation.

Lower your credit utilization ratio

Credit utilization, also known as debt-to-credit ratio, is the amount of available revolving credit you are using compared to your total available credit limit. For example, if you have a $3,000 limit on a card and carry a balance of $1,500 then your credit utilization would be 50%.

A lower ratio indicates that you’re not maxing out your cards and can handle more debt responsibly. It also shows lenders that you’re able to manage multiple accounts at once.

Remove any negative items from your credit history

Negative items on your credit score can significantly decrease your credit score and negatively impact your ability to receive loans or other credit. These items could include late payments, collections, foreclosures, charge-offs, bankruptcies, and more. Late payments are the most common negative item on a credit report. So, simply do your best to pay off your bills on time, or at the very least, make minimum payments.

Check for errors in your credit report and dispute them

Unfortunately, this can happen to anyone. Errors can occur on a credit report due to anything like clerical mistakes, incorrect data entry, outdated or inaccurate information, or even fraudulent activity. There are several ways to get your credit report for free, so it’s important to take a look and see if there’s anything that can be disputed. Even a mistake as small as a misspelled name could lead to delinquent payments being attributed to your account!

Don't open too many new accounts at once

Multiple account openings in a short period of time can have an adverse effect on your credit score and could potentially lead to future financial difficulties. Opening too many accounts at once can make lenders wary as this may indicate that you are having difficulty with cash flow, or worse, trying to commit fraud.

Additionally, inquiries from potential creditors will also show up on your report which can cause further damage if done too frequently. These inquiries stay on your report for two years and each one counts against you; the more inquiries there are, the lower the overall score goes.

Ask for help if you cannot manage debt yourself

Finances can be one of the most difficult aspects of life to manage, and it's natural for people to feel overwhelmed by money-related issues. But it’s important to remember that you don’t have to face financial struggles alone. Asking for help is nothing to be ashamed of, and there are many resources available that can provide assistance in times of need. Whether you require assistance with budgeting, debt relief, or other types of financial aid, seeking out professional advice is often the best way forward.

Consider an Instant Payday Loan from iCash

If you’re in a bind and need some extra cash to pay an unexpected bill like a car repair, groceries, etc., you may want to consider an instant payday loan from iCash before racking up your credit card. With iCash, you can get funds send to you via e-Transfer within minutes of applying, and then enjoy the flexibility of paying it back on your own terms!