Picture this: You're rushing to work when your car starts making a sound like your engine is about to fall out. Or maybe you come home to find your basement flooded because your washing machine decided to throw a tantrum. The feeling in the pit of your stomach when things like this happen is….. Not fun.

Those were just some basic examples of why it’s so important to have insurance. Think of it as having a financial safety net that catches you when life throws these unpleasant things at you.

Here’s the simple truth - every Canadian needs some kind of insurance protection, and understanding what you have helps avoid nasty surprises when you need help most.

Sometimes, even with good insurance, unexpected costs can still squeeze your budget. But let's start with the basics so you know what you're dealing with.

What Is Insurance Really?

Think of insurance as making a sort of “deal” with a large group of people. Everyone contributes small amounts of money regularly, so that when someone faces a huge unexpected cost, the group covers it. It's like a community support system with legal agreements.

Here's how it works: Instead of risking a massive $15,000 bill if you crash your car, you pay something like $100 - $200 a month for auto insurance. If that accident happens, your insurance company covers most of the big bill. Ideally, you’ll never have to worry about an accident, but realistically, things aren’t always in your control, and insurance can give you some peace of mind knowing you're protected.

The same idea works for your home. Rather than facing a $50,000 flood repair bill all by yourself, you might pay something like $150 a month for home insurance. It's like trading a small, predictable cost for protection against huge, unpredictable ones.

Insurance is different from warranties or service contracts. Those usually cover specific items for specific problems. Insurance covers you for a whole range of "what if" situations that could seriously mess up your finances.

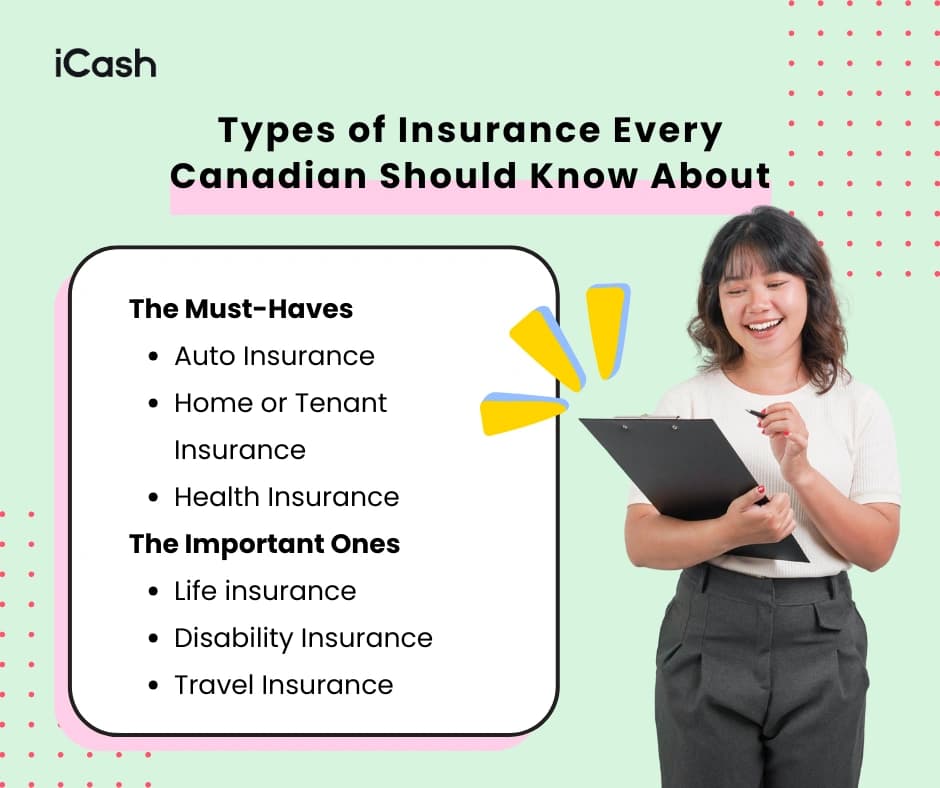

Types of Insurance Every Canadian Should Know About

Let's break down the insurance world into some bite-sized bits of info!

The Must-Haves

Auto Insurance is required by law in most provinces. So, if you own a vehicle in Canada, you must have car insurance.

Depending on the type of coverage you decide to go with, most auto insurance covers damage to your car, other people's cars, and medical costs if someone gets hurt in an accident. In Canada, basic coverage usually runs between $100 to $300 per month, depending on where you live and what you drive. Remember, going without it isn't just risky – it's illegal and can cost you way more in fines and penalties if you’re caught driving without it.

Next, you need to have Home or Tenant Insurance. This protects your biggest investment, or your belongings, if you rent. Home insurance usually covers your house and belongings against fire, theft, and other disasters. Tenant insurance covers your belongings and protects you if someone gets hurt in your apartment. Home insurance might cost $100-200 monthly, while tenant insurance is usually $15-30 per month. Going without this coverage leaves you vulnerable to significant financial losses.

Health Insurance in Canada includes your provincial coverage plus any extra benefits through work or private plans. The provincial part is free, but supplemental insurance for things like dental, prescriptions, and vision can cost $50-200 monthly. Without it, a root canal could cost more than a vacation.

The Important Ones

While life insurance may not be a “must,” it’s still extremely important to consider getting some. Life Insurance helps your family pay bills and stay in their home if something happens to you. It's especially important if people depend on your income. Basic coverage might cost $20-50 monthly for young, healthy people.

Then there’s disability Insurance, which replaces some of your income if you can't work due to illness or injury. Many people overlook this, but statistics (unfortunately) show you're more likely to become disabled than to die during your working years.

Travel Insurance covers medical emergencies and trip cancellations when you're away from home. Why is it a good idea to get travel insurance? Because a broken leg in the U.S. could cost up to $50,000 without coverage. For a week-long trip, travel insurance might cost $50-100.

Important Insurance Terms to Understand

Insurance policies use technical terms that can make simple concepts sound complicated. But they’re fairly straightforward. Let's break down the most important ones:

Premium is what you pay for your insurance – monthly, quarterly, or yearly. It’s kind of like your membership fee for insurance coverage.

A deductible is what you pay out of pocket before insurance kicks in. If you have a $500 deductible and $2,000 in damage, you pay $500 and insurance covers the remaining $1,500. Higher deductibles usually mean lower premiums. There are usually deductibles for dentist visits, prescriptions, and whatever else your policy may cover.

Coverage Limit is the maximum amount your insurance will pay. If your limit is $50,000 and damages are $60,000, you're responsible for that extra $10,000.

Exclusions are things your insurance won't cover. Every policy has them, and they're usually listed in the policy details. This is arguably one of the most important things to check in advance. Imagine paying upwards of $500 for something like an eye exam and new glasses, only to find out later that your insurance isn’t going to cover it.

When you get a policy, ask your agent or broker to explain it in plain English. Good questions include: "What exactly does this cover?" "What are the main things it doesn't cover?" and "How do I actually make a claim if I need to?"

Here's a small money-saving tip: Bundling different types of insurance with the same company often gets you discounts. Also, raising your deductible can lower your premium – just make sure you can actually afford that higher deductible if you need it.

Making Insurance Work for Your Budget

Insurance should be treated like rent or groceries – a necessary expense, not an optional one. But that doesn't mean it has to break your budget.

Start by figuring out what coverage you absolutely need versus what would be nice to have. Auto and basic health coverage? Essential. Extra travel insurance for that dream vacation? Important, but maybe not if money's super tight.

If it’s possible and realistic, try to build a small emergency fund specifically for insurance deductibles. Even $500 set aside can make dealing with a claim much less stressful.

If you find yourself in a position where money gets tight, you might feel the urge to cancel insurance to free up cash. This is not recommended because gaps in coverage can actually cost you more later through higher premiums or denied claims. If you're facing a situation where you can't make a premium payment, call your insurance company first – they may have options to help.

Sometimes life throws multiple financial challenges at you all at once. Maybe your insurance premium is due the same week your car needs unexpected repairs. In these situations, short-term loans from iCash can help you keep your coverage continuous, which protects you from bigger problems down the road.

Making Smart Insurance Choices Matters

We get it, insurance isn't the most exciting topic, but it's one of the most important financial tools you have. It protects you from surprise expenses that could seriously impact your finances for months or even years.

The key is understanding what you have, making sure it fits your needs, and keeping it current. Review your coverage once a year or whenever your life changes significantly. Got married? Had a baby? Bought a house? Time to check and potentially update your insurance.

Don't let insurance jargon intimidate you either. Ask questions until you understand what you're buying. A good insurance professional will happily be able to explain everything in terms that make sense.

Remember, you don’t have to own the most expensive coverage possible – always prioritize the right coverage for your situation and budget. Sometimes that means making tough choices, but going without essential protection isn't really saving money if it leaves you vulnerable to financial disaster.