An increasing number of Canadians are filing for bankruptcy. Last year, personal bankruptcies increased by 16%, impacting approximately 100,000 Canadians. While bankruptcy can offer essential financial relief, it also raises significant challenges when it comes to rebuilding credit.

These challenges can impact various aspects of life, from securing loans and mortgages to renting apartments and even obtaining certain types of employment. It can also put a strain on personal relationships and cause significant stress for everyone involved.

The good news? Rebuilding your credit is possible with patience, diligence, and a strategic approach. It involves demonstrating responsible credit behaviour through various means, including proper budgeting, timely payments, as well as responsible credit usage and monitoring.

In this guide, we’ll uncover the strategies of how to rebuild credit after a bankruptcy. Learn the actionable steps that can transform your financial health and set you on the path to a brighter future.

The Impact of Bankruptcy on Your Credit

There’s no easy way to say it - bankruptcy greatly lowers credit scores. Filing for insolvency in Canada appears on your credit report and shows lenders you’ve had serious financial struggles. This negative mark makes it very difficult to get new credit or loans because lenders see you as high-risk.

Bankruptcy in Canada is classified as an R9, which is the worst rating on a credit report. This indicates that the debt has been written off, and it will stay on your report for six years from the date of discharge. Declaring bankruptcy more than once can remain on credit reports for up to 14 years – yikes!

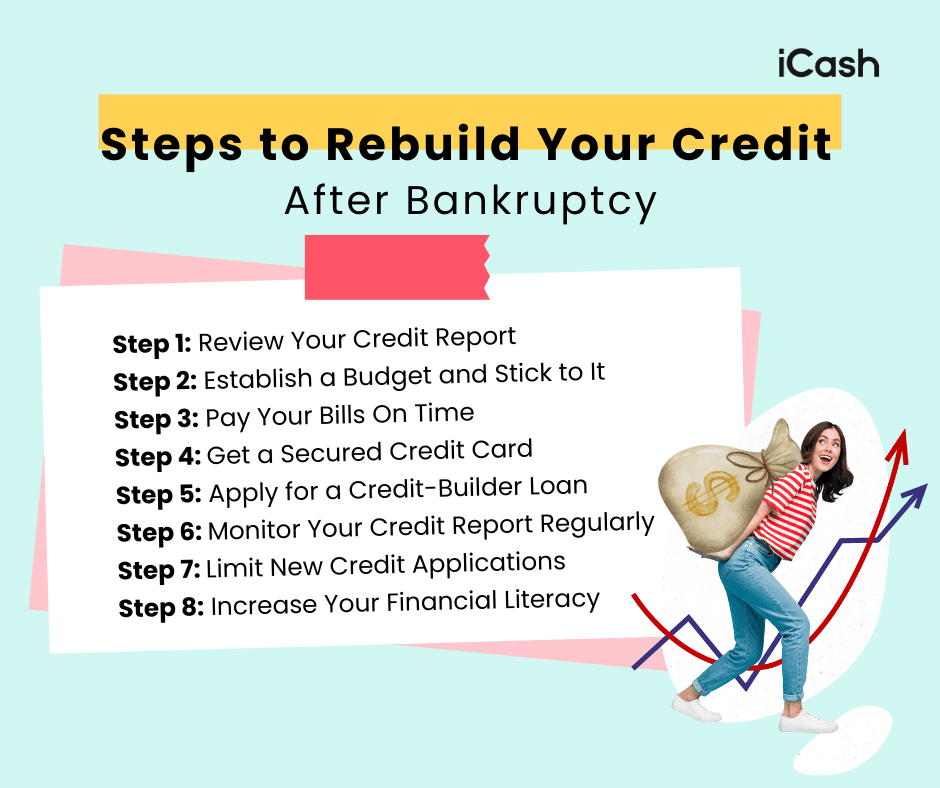

Steps to Rebuild Your Credit After Bankruptcy

Adopting responsible financial habits to rebuild your credit after bankruptcy is crucial. Regularly monitoring your credit, making timely payments, and avoiding excessive debt are all necessary steps in the process. For more clarity, let’s take a look at these steps in more detail.

Step 1: Review Your Credit Report

Start by obtaining your credit report from the two major credit bureaus in Canada: Equifax and TransUnion. You’re entitled to one free report per year from each credit bureau. You can request these reports online, by mail, or in person, depending on the availability of the location.

Once you have your copy, take the time to review it for any inaccuracies that may be negatively impacting your credit rating. If you find any errors, dispute them right away. An example is an incorrectly reported late payment that you actually made on time.

To dispute the error, write a detailed explanation, include the credit bureau's dispute form if available, and attach supporting documents like your bill payment confirmation. Be sure to keep records of everything you send. You never know when you might need to reference them during the dispute process.

Step 2: Establish a Budget and Stick to It

Setting a budget post-bankruptcy helps you regain financial stability faster. Begin by calculating your monthly income, considering all revenue streams. Then, list your necessary expenses such as housing, utilities, groceries, and transportation.

Next, distinguish between needs and wants (this is key). Prioritize paying off high-interest debts, cut back on discretionary spending, and consistently contribute to your savings account. You can also use budgeting tools or mobile apps to track your budget. These will help you oversee your spending habits and identify areas where you can cut costs.

Step 3: Pay Your Bills On Time

Paying your bills on time is crucial, regardless of your financial situation. Late payments can severely damage your credit score. To avoid this, establish a reliable system to pay bills on time, every time.

Creating reminders on your phone or calendar can keep you on track. You can also set up automatic payments through your bank’s online bill pay service. If you know you have a monthly car payment, set up an automatic transfer from your bank account to the lender on the same day each month. Over time, consistent payments will reflect positively on your credit profile and contribute to your recovery.

Step 4: Get a Secured Credit Card

Secured credit cards require a cash deposit as collateral, which usually matches your credit limit. This deposit minimizes the risk for the lender, making it easier for individuals with poor or no credit history to qualify. As you make regular, on-time payments, it's sent to credit reporting agencies, helping you rebuild your credit over time.

Choosing the right secured credit card starts with some research. Consider the amount of the deposit required, annual fees, and interest rates. Make sure the issuer reports to the major credit bureaus so that your on-time payments are positively recorded. Finally, read the terms and conditions carefully to avoid hidden fees and understand your responsibilities as a cardholder.

Step 5: Apply for a Credit-Builder Loan

Credit-builder loans are ideal for students, newcomers with limited or no credit history, and those looking to rebuild credit after bankruptcy. With this type of loan, you borrow a small amount of money and make regular payments over a set period. The lender will report these payments to the credit bureaus to demonstrate a consistent payment history.

There are also small loan options available to people with less-than-perfect credit. They can help you manage unexpected expenses or bridge financial gaps in your budget. The best loan for you depends on your financial situation, so it's essential to research and compare different lenders, interest rates, and terms before applying for any of these loan options.

Once you've secured the loan that best fits your needs, use it wisely and ensure timely repayments. And remember, keep an eye on your credit report to ensure all the information is accurate and up-to-date.

Step 6: Monitor Your Credit Report Regularly

Monitoring your report regularly can help you catch errors, identify fraudulent activity, and spot areas for improvement in your credit habits. Using a credit monitoring service, like Credit Karma, allows you to track your profile and receive alerts for any changes.

These tools help you understand key factors affecting your score, such as payment history, credit utilization, and length of credit history. For example, Credit Karma’s credit score simulator shows how actions like paying off debt or opening a new card can impact credit scores. It gives you the knowledge to make informed financial decisions and actively work towards improving your credit.

Step 7: Limit New Credit Applications

If you ask a lender about the biggest red flags for credit, they'll likely say it's multiple new credit applications in a short time. Each time you apply for new credit or a new credit card, a hard inquiry is made on your report. Multiple hard inquiries in a short period indicate financial instability.

Be selective with new credit card applications and only apply if you genuinely need it. A good rule of thumb is to keep new credit applications to a minimum, ideally no more than one or two per year.

Step 8: Increase Your Financial Literacy

By following these steps, you'll gain a better understanding of your credit and how to rebuild it after bankruptcy. You can also explore other methods to enhance your financial literacy, which include:

Attending workshops or seminars

Reading books or articles on personal finance

Enrolling in online courses

Professional advice from a financial advisor

Knowing more about your financial situation and the strategies available to improve it can boost your confidence and ability to restore your credit post-bankruptcy.

Get Tips on Rebuilding Credit After Bankruptcy with iCash

Rebuilding your credit after bankruptcy is possible with patience and determination. The key is to create a plan, stick to it, and make responsible financial decisions. Start by reviewing your credit profile, paying down outstanding debts, and avoiding new credit applications.

Set up payment reminders and continue making on-time payments. Then, gradually increase your financial literacy by reading, attending workshops, or taking courses. Rebuilding your credit takes time, so stay committed to your recovery journey.

If you need some extra encouragement, check out the financial literacy resources offered by iCash. We offer personalized credit-building tips, budgeting tools, and educational articles to help you achieve your financial goals with confidence. Start today and take the first step toward a brighter financial future with iCash.