If you've ever sent a cheque that bounced, you know how frustrating it is. It can happen to anyone, whether you're paying bills, rent, or making a purchase. Maybe you didn't realize that there were insufficient funds in your account to cover the payment, or maybe there was an error in the amount or the recipient's name.

Whatever the reason, receiving a notification that your cheque has bounced can be a nerve-wracking experience, especially if you're unsure of what to do next. In this blog, we'll provide you with helpful tips on what to do if a cheque you sent bounces, including steps you can take to rectify the situation and minimize the impact on your finances and credit score.

What is a Bounced Cheque?

A bounced cheque is one that is returned unpaid by the bank because there are insufficient funds in the account to cover the payment. When you write one, you're essentially instructing your bank to transfer a specified amount of money from your account to the recipient's account. The recipient can then deposit the funds into their bank account, and their bank will send it to your bank for payment.

What Happens When Your Cheque Bounces?

By understanding the consequences, you can take steps to prevent it from happening and avoid the financial and legal fallout that can result. Here’s a look at the likeliest occurrences you may experience.

Your bank notifies you

When your cheque bounces, your bank will notify you that the payment was not honoured due to insufficient funds. Your bank will charge you an NSF (non-sufficient funds) fee, which can range from $25 to $50 or more, depending on your bank's policies.

The recipient's bank notifies them

The recipient's bank will also notify them that the cheque was returned unpaid due to insufficient funds. Unfortunately, the recipient's bank may charge them a fee as well, which can range from $4 to $20 or more, depending on their bank's policies.

After receiving a notification, the recipient will likely contact you to request payment. It's important to respond to their request promptly and try to resolve the situation as soon as possible.

Legal action may be taken

If you don't make arrangements to pay the recipient or resolve the situation, they may take legal action against you. This can include taking you to small claims court, sending you to collections or reporting you to a credit bureau, which can negatively impact your credit score.

Additional fees and penalties may be charged

In addition to the fees charged by your bank and the recipient's bank, there may be additional fees and penalties, such as interest charges, late fees, or collection fees, that can further increase the amount you owe.

Your account may be frozen or closed

While this certainly won’t be the first course of action a bank takes, if you have a bad financial history, they may freeze or close your account. This can make it incredibly difficult for you to access your funds or obtain credit in the future.

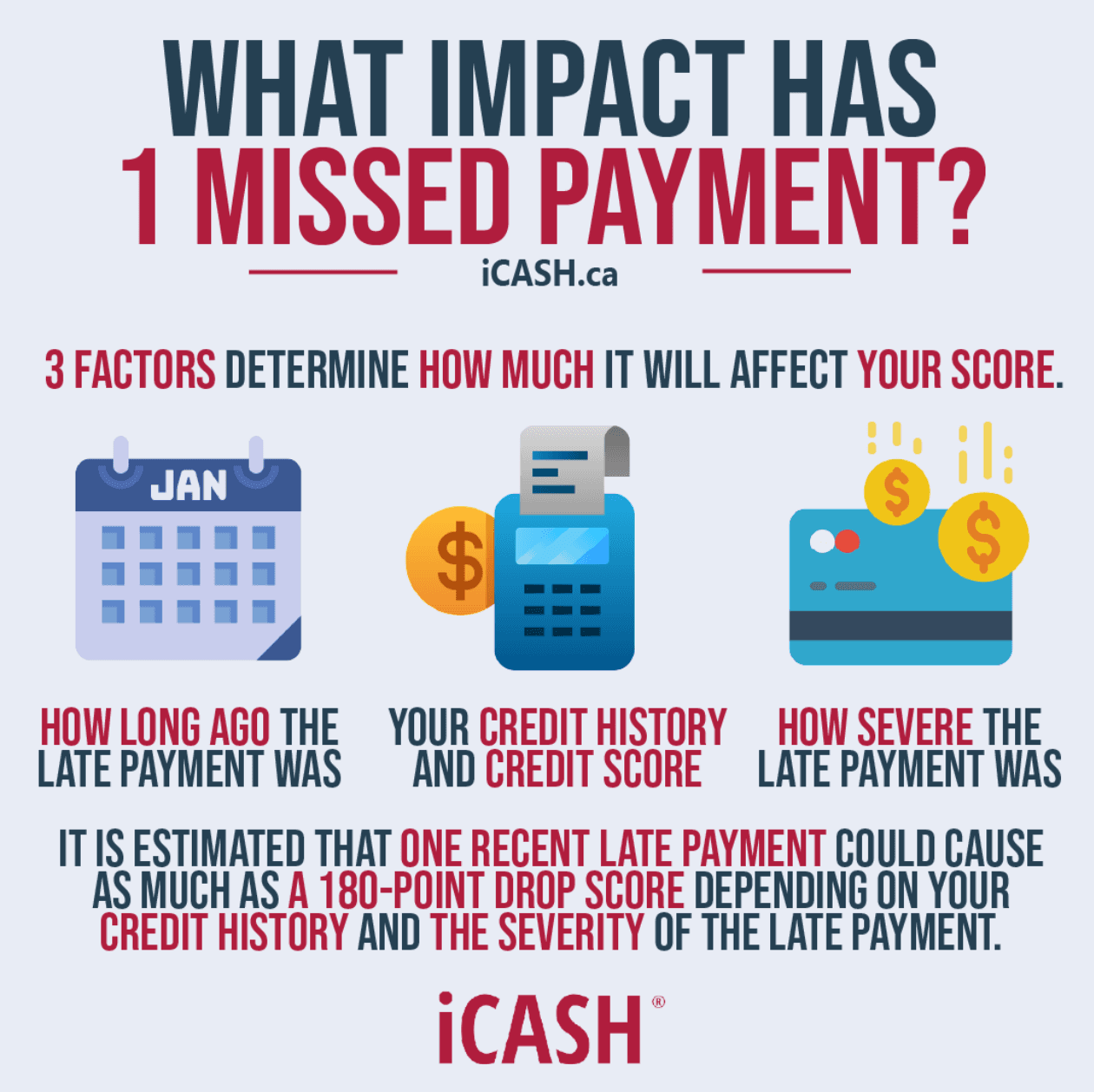

Your credit score may be affected

If the recipient or your bank reports the bounced cheque to a credit bureau, it can negatively impact your credit score. While there are ways to repair and raise your credit score, it can still make it harder for you to obtain credit or loans in the future.

What to Do If Your Cheque Bounces

The first thing to remember is that it’s important not to immediately panic. Yes, it can be a stressful experience, but the good news is that there are several steps you can take to address the issue and minimize the impact on your finances and credit score.

Contact your bank

If your cheque bounces, the first thing you should do is contact your bank to find out why. Your bank can provide you with information about the reason for the bounce and any fees that have been charged. They can also help you set up a payment plan to pay the amount owed and prevent further fees and penalties.

Contact the recipient

Once you have spoken to your bank, you should contact the recipient to apologize for the inconvenience and discuss payment options as soon as possible. You may be able to arrange a new payment method, such as an e-Transfer or cash payment, to settle the debt.

Make a payment plan

If you're unable to pay the full amount owed immediately, you may be able to work with the recipient to set up a payment plan. This can help you avoid further fees and penalties and demonstrate your commitment to resolving the situation.

Negotiate with the recipient

If the recipient is willing to negotiate, you may be able to reach an agreement to settle the debt for a reduced amount or over a longer period of time. Be honest and transparent about your financial situation and try to find a solution that works for both parties.

Check your credit report

If the recipient reports it to a credit bureau, it can negatively impact your credit score. Check your credit report to make sure that the information is accurate, and dispute any errors or inaccuracies that you find.

Learn from the experience

It’s not a bad idea to see this as a learning opportunity. Make sure to keep track of your account balance and cheque details in the future, and take steps to prevent a similar situation from happening again.

Tips on Avoiding a Bounced Cheque

While this may seem obvious, the best way to avoid any financial issues is to simply avoid writing a cheque that will bounce. That being said, here are some steps you can take to ensure that you don't write one that has the risk of bouncing.

Keep track of your account balance and monthly expenses

It's essential to keep track of your account balance and ensure that you have sufficient funds to cover any cheques you write. Make a habit of checking your account balance regularly and recording any transactions to avoid overspending.

Use electronic payments

These days, almost everything can be paid electronically, such as through online transfers and e-Transfers. This can be a more reliable and efficient way to send money. They are also instant, so you can be sure that the recipient receives the funds quickly.

Keep track of outstanding cheques

Make a list of any cheques you’ve written that have not yet cleared and deduct them from your account balance. This will help you avoid overspending and ensure that you have enough funds to cover any upcoming expenses.

Set up overdraft protection

Overdraft protection can help you avoid bouncing a cheque by allowing you to withdraw more money from your account than you have available. However, it's important to be aware of the fees and interest charged for using this service and to use it sparingly. In some instances, you may be able to get your overdraft fees refunded.

Don't write post-dated cheques

A post-dated cheque is one with a future date written on it. While it can be useful for scheduling payments, it can also be risky if you're not sure that you'll have enough funds to cover it on the date specified. Avoid writing post-dated cheques unless you're certain that you'll have sufficient funds.

Prevent Your Cheque From Bouncing

If you want to be absolutely sure that prevent your cheque from bouncing, a short-term loan from iCash could be a solution worth considering. With our loans, you can get the funds you need quickly and easily In fact, our fees are likely less than what you'd pay for a bounced cheque, making it a cost-effective option for managing your finances. Get started by downloading our smartphone app or creating your account on our website.