Menu

Table of contents :

Searching for alternatives to iCash? We get it, you want to make sure you're getting the best deal. That's smart. Taking the time to compare your options matters. Over the years, more than a million Canadians have chosen to trust iCash, and we’re grateful to keep earning that trust every day.

We stand out among fast-loan providers with instant decisions, transparent fees, and 24/7 funding. Whether you're comparing apps or exploring your options, we'll here to help Canadians with their emergency cash needs.

1,000,000+ Canadians have trusted iCash for their emergency loan needs. Here's why they choose us:

When it's a true financial emergency, every second counts. When it comes to fast payday loan providers in Canada, nobody does it quicker than us. With instant decisions and funding via e-Transfer in 2 minutes, it doesn’t get much faster! No waiting days for banks or dealing with slow processing times.

Unlike others who slip in surprise charges, we show you the full cost upfront before you even agree to a loan. No hidden fees, no shocks later. Our pricing follows government regulations at $14 per $100 borrowed. We believe financial stress is hard enough without worrying about unexpected costs appearing on your statement. What you see is what you pay, every single time.

Apply 100% online. No store visits required. Our mobile-optimized platform works 24/7, even on weekends and holidays, with modern bank-level 256-bit SSL encryption to keep your data safe. Whether you're at home, at work, or on the go, you can complete your entire application from your phone or laptop in just a few minutes.

iCash maintains an exceptional reputation across the country. We've earned:

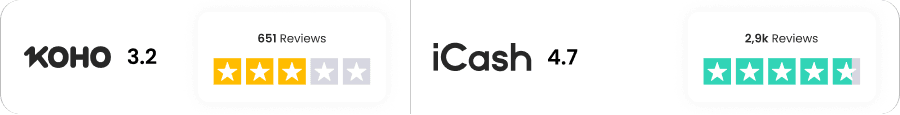

4.7 out of 5 rating on Trustpilot from over 2,800 reviews

4.5 out of 5 on Google from 6,000+ reviews

4.8 out of 5 on the Apple Store with 21,000+ reviews

4.7 out of 5 on Google Play from 12,000 reviews

Our customer support team is available 24/7, 365 days a year to answer questions and help resolve any concerns.

With over 1 million Canadians helped, iCash is a fully licensed and regulated lender operating in Alberta, British Columbia, New Brunswick, Ontario, Manitoba, Nova Scotia, and Prince Edward Island. We're proud members of the Canadian Consumer Finance Association.

We offer up to 12% cashback on the cost of borrowing for returning members. This exclusive membership perk helps reduce your overall borrowing costs and rewards your loyalty. Repeat customers also enjoy an even faster re-loan process with no credit verification required, plus access to increased borrowing amounts (up to $1,500)*.

Provider | Loan Type | Loan Amount | Cost | Approval Time | Funding Speed | Application | Key Feature | Cashback Offer | App Rating (Apple/Google) |

iCash | Cash advance, short-term loans, payday loans | $100-$1,500 | $14 per $100 borrowed | Instant decision | 2 minutes via secure e-Transfer | Online first | Fastest approval & funding in Canada | Up to 12%* | 4.8/5 |

PAY2DAY | Payday loans | $100-$1,500 | $14 per $100 borrowed | Up to 3 hours | Same day | 100% online | Simple online process | None | 3.6/5 |

GoDay | Payday loans | $100-$1,500 | $14 per $100 borrowed | Instant pre-approval decision | Timeframe varies | 100% online | Straightforward approval | None | - |

Cash4You | Payday loans | $100-$1,500 | $14 per $100 borrowed | Same day | Same day | Online and instore | Established brand with physical locations | None | - |

Cashco Financial | Payday loans | $100-$1,500 | $14 per $100 borrowed | Same day | 1-2 days | Online and limited stores in SK and ON | No credit check required | None | - |

Mr. Payday | Payday loans | $100-$1,500 | $14 per $100 borrowed | 30 minutes (only during business hours) | Additional 30 minutes after approval | Mostly online (one store in BC) | Straightforward approval | None | - |

Focus Cash Loans | Payday loans | Up to $1,500 | $14 per $100 borrowed | Varies | Same day | 100% online | Fast approval | None | 4.2/5 |

Loan Express | Payday loans | Up to $1,500 | $14 per $100 borrowed | 5 minutes | Within 1 to 2 minutes | 100% online | Quick application | None | - |

MyCanadaPayday | Payday loans | Up to $1,500 | $14 per $100 borrowed | 4 to 24 hours | Same day | 100% online | Available across Canada | None | - |

Moneymart | Payday loans | $1,000-$25,000 | Varies | Same day | Same day | Online and in-store | Nationwide store locations | None | 4.7/5 |

24Cash.ca | Payday loans | $500-$850 | $14 per $100 borrowed | Advertises quick approval, but no specifics | Up to 24 hours after approval | 100% online | Flexible repayment | None | - |

Speedycash | Payday loans, Personal loans | Up to $1,500 | $14 per $100 borrowed | 1 to 4 hours | Same day | Online and in-store | Fast online process | None | - |

Cash Money | Payday loans, Personal loans | $100-$1,500 | $14 per $100 borrowed | Same day | Same day | Online and in-store | Established brand with physical locations | None | 2.2/5 |

Fairstone | Payday loans, personal loans | $500-$60,000 | 19.99%-34.99% APR | Same day | Roughly one business day | Online and 250+ branches | Nearly 100 years in business | None | - |

Easy Financial | Installment loans, Personal loans | $15,000-$150,000 | 9.99%-35% APR | 10 minutes | 24 to 48 hours | Online and 400+ branches | Rebuild credit with every payment | None | - |

Blue Copper Capital | Payday loans, personal loans, line of credit, business loans | $100-$100,000 | 16%-35% APR ($14 per $100 for payday loans) | 20 minutes | Same day (time varies) | Online and in-person (AB, BC only) | Blue Copper Club membership with discounted rates | None | - |

Spring Financial | Installment loans, Personal loans, Mortgage loans | $500-$35,000 | 9.99%-46.96% APR | Within hours | 1-2 business days (24 hours via e-Transfer) | 100% online | Credit building program | None | - |

Magical Credit | Installment loans, Personal loans, Payday loans | $100-$20,000 | 19.99%-46.8% APR | Next business day | Within 24 hours | 100% online | Accepts government subsidies and non-traditional income | $200 referral bonus (conditions apply) | - |

While several instant loan apps operate in Canada, we deliver the fastest combination of approval and funding. Our instant approval decision and 2-minute e-Transfer funding speed means you get your money when you need it most, not hours or days later.

To ensure this comparison is fair and accurate, we evaluated each lender based on:

Speed Metrics: We tested application-to-funding times during both business hours and weekends to measure real-world performance.

Cost Analysis: We verified all fees against provincial regulations and official lender websites to ensure accuracy.

Customer Reviews: We analyzed over 50,000 reviews across Trustpilot, Google, Apple Store, and Google Play to assess customer satisfaction.

Licensing Verification: We confirmed provincial licensing status with regulatory bodies to ensure compliance and legitimacy.

Feature Testing: We reviewed application processes and platform features to verify ease of use and accessibility.

KOHO is a name that may sound familiar to you. They aren’t a traditional payday lender. They’re more of a banking app with a cash advance feature. Here’s the key difference between KOHO and iCash:

KOHO Cash Advance | iCash Payday Loan |

✓ Up to $250 interest-free | ✓ Up to $1,500 available |

⚠️ Annual fee: $144 - $177 | ✓ Annual fee: $0 |

⚠️ Functions as a pre-paid card, not a banking product | ✓ No subscription required |

⚠️ Possible delays, depending on day | ✓ 2-minute e-Transfer funding 24/7 (even on weekends and holidays) |

⚠️ May have strict eligibility requirements | ✓ One-time cost ($14 per $100) |

⚠️ Limited to small amounts | Fees apply to borrowed amount |

Best for: Small emergency needs if you already use KOHO | Best for: Larger emergency expenses when you need cash quickly |

Reading Trustpilot reviews for both iCash and KOHO gives you insights into actual customer experiences with each service.

Getting a payday loan with us is simple and fast. Here's how it works:

Step 1: Apply Online

Select your loan amount and repayment plan, then provide some basic personal details through our secure online application. The entire process takes just a few minutes and can be completed from any laptop or smartphone by downloading our iOS app or Android app.

Step 2: Instant Decision

Our system provides an instant approval decision. Once approved, all you need to do is electronically sign your contract.

Step 3: Get Funds

Once your contract is signed, your funds will be sent by e-Transfer within minutes. Fast, convenient, and easy. We send funds 24/7, even on weekends and holidays.

To qualify for an iCash loan, you need to meet these basic requirements:

Be at least 18 years old (19 years old for applicants in British Columbia, New Brunswick, Nova Scotia)

Be a resident of any of the provinces in which we operate (AB, ON, BC, MB, NB, NS, PEI).

Show that you have been receiving the same source of income for the past three months.

Have a total net income of at least $800/month.

Have access to an online bank account, in which pre-authorized debits can be performed.*

Have a valid Canadian mobile phone number, address, and email address (VoIP numbers are not accepted)

*Please note that KOHO accounts do not qualify as they do not support pre-authorized debits.

We accept all types of income as acceptable forms of repayment too, including:

Regular employment income - Wages or salary from your full-time or part-time job

Child tax credit benefits - Monthly government payments to help with the cost of raising children

CPP and private pension - Retirement income from Canada Pension Plan or workplace pensions

Employment insurance - Temporary financial support while you search for new employment

Workers' compensation - Benefits received after a workplace injury or illness

Disability income - Government or private support for those unable to work due to disability

Province-specific programs like ODSP and AISH - Provincial assistance programs for individuals with disabilities

Welfare support - Government financial assistance for those experiencing financial hardship

Self-employed income - Earnings from your own business, freelancing, or contract work

Whether you choose us as your loan provider or someone else, we want anyone reading this to be as informed as possible before applying for a payday loan.

It's important to borrow only what you know you can pay back and keep track of your repayment date. Responsible borrowing means understanding your financial obligations fully before accepting a loan. Do not take on more than one loan at a time, and remember that legitimate lenders will never give you more than one loan at a time.

And while there are no restrictions on how you use your loan funds, sometimes it’s best to consider using it for emergency costs like car repairs, medical bills, home repairs, etc. Consider alternatives if you want to use it for vacations or entertainment.

Make sure you think about the repayment terms carefully. We make sure to spell out all terms and fees clearly before you sign anything. All lenders should do the same. If there is any vagueness or inconsistency in what they charge, see that as a major red flag.

Before applying for any payday loan, compare your options. Look at approval times, funding speeds, fees, and customer reviews. Make sure you understand the total cost of borrowing and confirm that the lender is licensed and regulated in your province.

If you’re ready to get some financial assistance, we’re here to help. Start your application today!

Up to 7 flexible repayment options available, from 42 to 62 days | |

Age requirement: 19 years or older | |

Term up to 62 days | |

Age requirement: 19 years or older | |

Age requirement: 19 years or older | |

Repayment period up to 62 days | |

Fast approvals with 93% acceptance rate |

Since 2016, we've helped over 1.6 millions Canadians get instant loans online.

Since 2016, we've helped over 1.6 millions Canadians get instant loans online.

Read more reviews.

Getting an online loan with us is fast and easy. Simply select your loan amount, repayment plan* and provide some personal details.

Our online loan application will tell you if you’re approved instantly. Once approved, all you have to do is electronically sign your contract. It’s that easy!

Once you sign your digital agreement, your cash advance will be sent by e-Transfer within 2 minutes. Fast, convenient and hassle-free. Funds are sent 24/7, no matter what.

Have more questions? Check out our full FAQ.