As overwhelming as it can feel to be paying off student loan debt, it can be helpful to know you’re not alone. In fact, according to one recent Canadian survey, nearly half of students graduate with debt, averaging almost $29,000 for those who borrow.

However, there’s hope: you can pay off your student loans efficiently and save money in the long run, and today we’re going to talk about how. Below, we’ll break down practical strategies for paying off student loans efficiently.

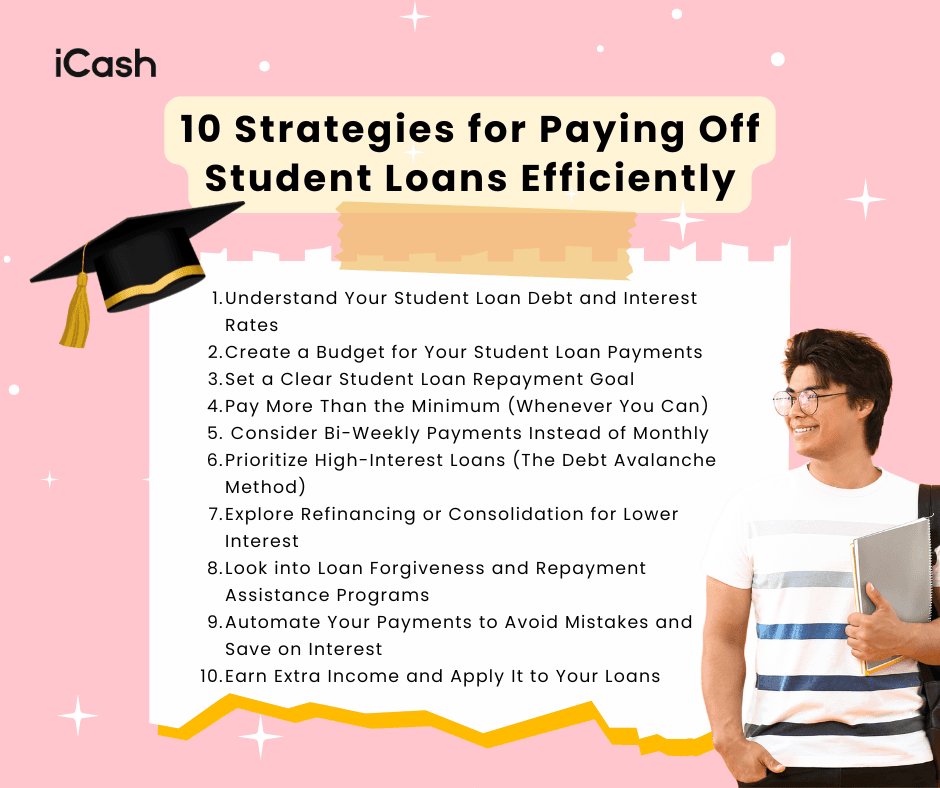

10 Strategies for Paying Off Student Loans Efficiently

From smart budgeting and extra payments to exploring loan forgiveness and assistance programs, use these tips to help you craft a clear plan to become debt-free as quickly (and cost-effectively) as possible.

1. Understand Your Student Loan Debt and Interest Rates

The first step is to get a clear picture of your student loan debt.

List out each loan you have (federal student loans, provincial loans, private loans, lines of credit, etc.), along with their balances, interest rates, and term lengths.

It’s worth noting that in Canada, the federal government eliminated interest on Canada Student Loans as of April 2023.

This move saves graduates about $520 per year on average. Any interest that accrued before 2023 still needs to be paid, but no new interest is accumulating on federal loans. However, if you have provincial loans or older loans, they may still accrue interest, so double-check those details.

Use this time wisely to plan your attack: knowing your interest rates will help you decide which loan payments to target first (more on that in the debt avalanche method below).

Finally, keep all your loan documents and statements organized.

2. Create a Budget for Your Student Loan Payments

A budget is your best friend when tackling student loan payments. Start by tracking your monthly income and all expenses.

Include essentials like rent, groceries, transportation, and utilities, as well as discretionary spending (eating out, entertainment, etc.). This helps you see how much money you can realistically put toward your student loans every month.

Consider using the 50/30/20 budgeting guideline: 50% of income for needs, 30% for wants, and 20% for savings and debt repayment. That 20% (or more) chunk can go straight to your loan payments each month.

3. Set a Clear Student Loan Repayment Goal

Having a target payoff date or timeframe will keep you focused and motivated.

For example, you might aim to pay off all your student debt within five years. Calculate what your monthly payments need to be to achieve that goal. This can be done by using a loan payment calculator or simply dividing the total debt by your desired number of months (adjusting for interest).

Knowing the “debt-free date” you’re working toward can be very motivating on those days when sticking to your student loan plan feels tough.

4. Pay More Than the Minimum (Whenever You Can)

Making only the minimum required payment on your student loans will prolong the debt and rack up interest costs.

To pay off student loans efficiently, try to pay more than the minimum whenever possible. Additional payments go directly toward reducing your principal balance (once any interest for the month is covered). This means lower interest charges going forward and a faster payoff.

It’s okay if you can’t afford to pay extra every single month; even occasional lump-sum payments help.

5. Consider Bi-Weekly Payments Instead of Monthly

A simple trick to pay off student loans faster is to switch from monthly payments to bi-weekly payments.

Here’s how it works: say your monthly payment is $400. If you instead pay $200 every two weeks, you’ll end up making 26 half-payments in a year. This equals 13 full monthly payments instead of 12.

In effect, you get an “extra” payment in without really feeling it, because it’s spread out throughout the year. This can shave several months (or even years) off a long loan term.

Bi-weekly payments also align well if you get paid every two weeks; you can time your loan payment to each paycheck, which helps with budgeting. Many people use this strategy for mortgages and car loans, and it works for student loans too.

6. Prioritize High-Interest Loans (The Debt Avalanche Method)

Not all debt is created equal: some of your student loans might have significantly higher interest rates than others.

To save money and pay off student loans efficiently, attack those high-interest loans first. This approach is often called the debt avalanche method. With the debt avalanche, you continue paying at least the minimum on all loans, but direct any extra payments to the loan with the highest interest rate.

Once that top-interest loan is paid off, you move on to the next highest, and so on. This strategy minimizes the total interest you pay over the life of your loans, making it the fastest and most cost-effective route in mathematical terms.

7. Explore Refinancing or Consolidation for Lower Interest

Another strategy to consider is refinancing or consolidating your student loans, especially if it can substantially reduce your interest rates or simplify your payments.

Refinancing means taking out a new loan (often from a private lender or bank) to pay off one or more of your existing loans.

Ultimately, you want to get a lower interest rate or better terms on the new loan. You might save money over time, but refinancing tends to work best if you already have a good credit score and steady income (better than when you were a student).

For example, if you have a private student loan at 10% interest and you qualify to refinance it at 5%, that could dramatically cut your interest costs.

In terms of student debt, consolidation refers to combining multiple loans into one. Federal student loans can be consolidated through a government program to simplify payments. However, it doesn’t necessarily lower the rate; it sets a new rate based on a weighted average of your current ones.

Before refinancing, be cautious: if you refinance federal student loans into a private loan, you will lose federal benefits like income-driven repayment options, generous deferment/forbearance terms, and potential loan forgiveness programs.

8. Look into Loan Forgiveness and Repayment Assistance Programs

Depending on your situation, you may qualify for programs that forgive a portion of your student loans or help make repayments more manageable. In Canada, there is no universal student loan forgiveness for all borrowers: only certain professionals under specific conditions are eligible for loan forgiveness.

Typically, this applies to some medical professionals (family doctors, nurses, etc.) who work in underserved rural communities; they can have a portion of their Canada Student Loan forgiven as an incentive.

Even if actual forgiveness isn’t in the cards for you, Repayment Assistance Programs can help make your loan burden easier to carry.

In Canada, the federal Repayment Assistance Plan (RAP) is available for anyone who cannot afford their student loan payments. If you qualify based on your income, RAP can reduce or even eliminate your required payment for six-month intervals.

9. Automate Your Payments to Avoid Mistakes and Save on Interest

Setting up automatic payments (autopay) from your bank account is a simple but effective strategy for managing student loan repayment.

When you automate your student loan payments, you accomplish a few things at once:

You ensure you never miss a payment (avoiding late fees and damage to your credit)

You take one task off your monthly to-do list

You might even qualify for an interest rate discount

Many loan servicers offer a small reduction in your interest rate as a reward for enrolling in auto-debit.

In Canada, provincial loans administered through NSLSC also allow pre-authorized debit setup. While the federal portion no longer accrues interest, autopay can help with the timely payment of provincial loans or other debts.

10. Earn Extra Income and Apply It to Your Loans

When you’ve cut expenses as much as reasonably possible, the other side of the equation is increasing your income.

Consider picking up a side hustle or part-time job and dedicating that income solely to your student loans. You could also look into selling unused items or monetizing a hobby.

Every bit of additional money helps. The key is that any extra income goes directly to debt rather than inflating your lifestyle.

Now, let’s say a side job isn’t feasible. Then, turn your attention to your main job: might you be due for a raise or promotion? You might negotiate a raise or seek a higher-paying job, and then commit the difference in pay toward your loans.

Need a small buffer to keep your student loan payment on time? iCash can provide a short-term loan that fits your budget, helping you stay on schedule while working your plan. Review rates and fees first, borrow only what you need, and repay quickly.

Get a loan or learn more here.

Strategies for Paying Off Student Loans Efficiently: Frequently Asked Questions

What is the fastest way to pay off student loan debt?

The fastest way to pay off student loans is to pay more than the minimum whenever possible and direct those extra payments toward your highest-interest loan.

Making extra or larger payments reduces the principal faster, which in turn cuts down the total interest you pay. For example, putting any windfalls (bonuses, tax refunds, etc.) as lump-sum payments on your loans can knock out chunks of debt quickly.

You can also switch to bi-weekly payments, effectively adding one full payment each year (13 instead of 12), which accelerates payoff. Increasing your income through a side hustle and applying that money to your loans will also speed up the process.

Can student loans be forgiven in Canada?

In Canada, there is no broad forgiveness program that cancels student debt for the majority of borrowers, but there are niche programs and assistance plans.

Canada does offer loan forgiveness for specific professions, mainly in the healthcare field: for example, family doctors, nurses, or other medical practitioners working in underserved rural communities might qualify to have a portion of their federal student loans forgiven.

Apart from that, Canada’s focus has been on Repayment Assistance Plan (RAP). This plan doesn’t forgive loans outright but can eliminate payments for a period and will cover interest (and eventually some principal if income remains low over the years).

There is also a “forgiveness” aspect in RAP after 15 years. If you’ve been on RAP and still have a balance after 15 years of leaving school (10 years for persons with disabilities), the remaining debt may be forgiven by the government.

What if I can’t afford my monthly student loan payments?

Contact the National Student Loans Service Centre and apply for the Repayment Assistance Plan. Payments match your income and can be $0; reapply every six months. Check provincial relief for provincial loans, too.

As for private loans, ask for hardship or forbearance, refinance only if the total cost drops, and as a last resort, speak to a Licensed Insolvency Trustee about a consumer proposal or bankruptcy.

Federal student loans are usually dischargeable seven years after you leave school.