Menu

Products

Why iCash

Help

Customize your instant loan

Receive your money by 5:29 pmMinimum

$100

$750

Maximum

$1,500

1

2

3

Elite

New customer

Prestige

VIP

Cost summary

Apply now and receive your money by e-Transfer at no extra cost.

Table of contents :

Today in Canada, new payday loan companies are making it easier and faster than ever before to take out a short term loan. This is helping more, and more Canadians access quick cash when they need it most, without the hassles and stress associated with traditional loans.

New payday lenders have changed the game by using technology and a focus on customer service, to deliver a purely customer-centric lending experience. Until recently, the only source of small money loans in Canada was the conventional brick-and-mortar payday loan provider. These stores were typically only located in major population centers like large cities. They often would have limited hours of operation and limited options for borrowers.

All of that has changed; however, with new payday loan companies that operate online, Canadians can borrow up to $1,500 with a quick loan without ever leaving their home!

Not to mention, there was minimal support or customer service, where there would often be long waits to get approved for a loan. On top of all that, they were usually located in dodgy areas of town, which wouldn't exactly give customers a sense of security and safety.

Every aspect of obtaining payday loans from direct lenders online is designed to leverage digital technology to make life easier. In many ways, these new payday lenders are trying to make obtaining a loan as on-demand and straightforward as the rest of our digital lives – no more complicated or time-consuming than purchasing on an e-commerce retailer's site.

The core features of the loans available from brand new payday loan lenders are similar to those of their brick-and-mortar loan store counterparts, of course. Quick loans don't require collateral and provide cash funds to borrowers.

The loan is outstanding for a set time, the loan term, which can range from a few weeks to 62 days, all depends on the borrower's income schedule. After this loan term is up, the loan must be repaid, along with an interest or finance charge.

When someone is approved for a payday advance loan in Canada, the funds they receive are unrestricted in terms of how they can be used. Unlike home loans or auto loans, private loans are not contingent upon the purchase of a particular asset, nor linked to that purchase in any way. This allows borrowers to use emergency loans from new payday loan companies in Canada the way they see fit.

The most common uses for these loans focus on an emergency or unplanned expenses, such as home or auto repairs, medical/dental/veterinary expenses, family emergencies, appliance repair or replacement, rent/utilities/food supplementation, or otherwise helping to make ends meet between pay periods. New payday loan companies leave consumers in control, with both the freedom and responsibility to improve their personal financial situation.

The best rated online payday loan companies set themselves apart from their traditional loan store counterparts in almost every aspect of the lending experience. This is even more apparent when comparing online lenders to banks, which provides the starkest difference in the areas of ease of access, speed, availability, and customer service.

It is these areas that primarily differentiate online lenders and make them the preferred choice of many Canadians for easy loans today. At their core, online loans retain the same features as traditional loans and loan store loans. The lending process itself and all that surrounds it is where the biggest differences can be seen. That's where many of the benefits and advantages of new online payday loans shine.

To start, conventional loans often require a trip to a loan place. They may need an appointment, a good deal of travel and lots of waiting around once you arrive. That's the exact opposite of how things work at the best rated online payday loan companies.

Customers can apply online at any time, day or night, 24/7/365. All it takes is a smartphone, tablet, or computer and a working internet connection. There's no travel required, no appointments, no lines – everything can be done from the comfort of a customer's home or office, on a schedule or time table that makes the most sense for their busy lives.

Next, because everything is online and digital, there's no paperwork required to get a loan. Long gone are the carbon copy forms, pages of tedious paperwork with too-small boxes or lines to write out all the requested information. With new online payday loan lenders, the entire application and approval process takes place online, with online forms – there's nothing to fax, mail, or scan and nothing to fill out by hand, either.

Online payday loans also have a clear advantage in the speed department. The best online lenders have short online applications that take just minutes to complete. They also offer instant approval decisions in about a minute – eliminating the long, stressful waiting game typical of traditional lenders. If approved for an express loan, most customers receive same day funding, too. In some cases, online lenders provide funding in just minutes after completing the lending process!

At the same time, online lenders don't skimp on safety and security. By using industry-standard encryption technology, robust data protection policies, and best practices for security, all of the application information remains confidential and secure. Funding and repayment take place using established electronic transfer technology in use by all of the major banks and financial institutions, too.

Last but certainly not least, when customers get new payday loans online in Canada today, they also gain access to top-notch customer service. Most lenders have self-service knowledge bases to help answer basic questions, as well as a fully-staffed customer service team, available via phone, email, live chat, or all of the above. They can help answer questions, resolve issues, and make the application, approval, funding, and loan management process as smooth as possible for borrowers.

For customers in need of a new payday loan in Canada, it's as simple as choosing an online lender and logging on to their site or using their money lending app. The qualification requirements and other aspects of the lending process are typically outlined there, which should be reviewed before applying.

Then, just follow the application process, which varies from lender to lender. Most online loans and lenders today will have an application process that looks something like what is described below.

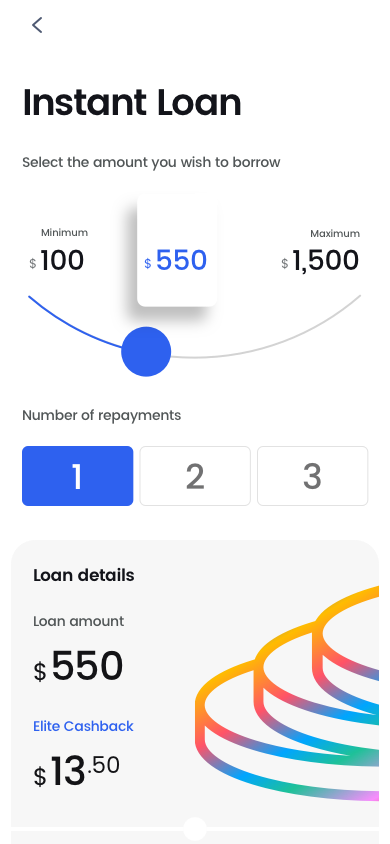

First, customers will need to choose their desired loan amount. In some cases, they may also be able to select repayment installments*, as some lenders offer multiple installment repayments in addition to the standard lump-sum repayment at the end of the loan term.

This is a valuable feature for new payday loans in Canada, which can make it easier for borrowers to repay the loan without straining their finances even further.

Next, customers need to complete the application itself. This usually consists of a few pages of digital forms. Basic information such as identity and residence is required, along with income and related information.

This forms the basis of the profile that the online lender will use to determine eligibility, risk, and approval for a new payday loan. It's worth mentioning that many of the top lenders offering these loans have very low or no minimum credit score requirements to qualify and instead rely on the information in the loan application – though still may conduct a credit check to verify that information.

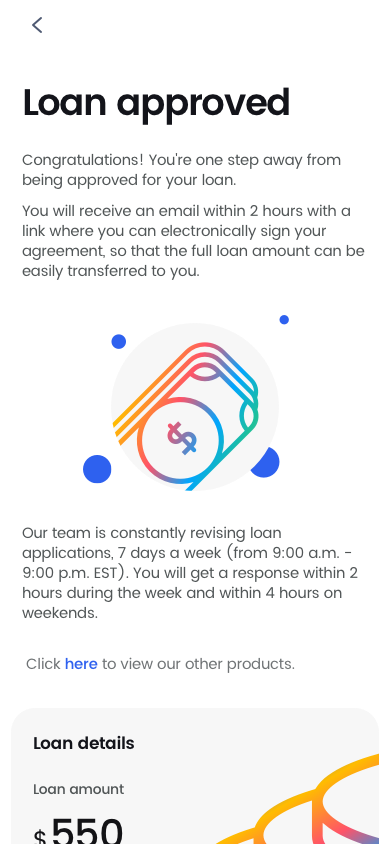

Then, customers hit submit on the application, and it is processed by the lender. While some lenders still use a manual review process, the top online lenders offering new payday loans in Canada today have automated, technology-driven approval systems. These can provide an approval decision in about a minute, no matter what time of day or day of the week it may be.

Once approved, borrowers receive a digital loan agreement to review. This specifies the details associated with the loan, such as the interest rate, repayment date and amount, and so on. It can often be signed digitally with just a few clicks and then is automatically returned to the lender. This typically triggers the funds' release process at most lenders.

In terms of funding, most lenders offer funds in about one business day. Some provide same-day funding or even faster methods. Utilizing email money transfer (e-transfer) technology, some of the top lenders offer new personal loans with funding available just minutes after the payday loan agreement is returned.

When it comes time to repay the loan, there's no stress or worry about that, either. Repayment is made automatically by debiting the bank account a customer provided during the application process. In the interim, borrowers can manage their loan online or through the lender's app. New payday loans in Canada today are finally bringing lending into the 21st century!

A payday loan organization is a private company that offers short term loans for up to $1,500 with flexible repayments*.

Many payday loan organizations in Canada offer loans to people in need of urgent funds. They are an alternative to traditional lenders, which usually have more complicated requirements.

The advantage is that when you get a payday loan, you have high chances to qualify even with bad credit or an unconventional income source.

You have many options for private lenders; you will probably find many available in your region. Still, scrutiny is essential to ensure you are dealing with a serious and legit company, as it happens with any business. So before choosing a payday loan organization, do a bit of research and see if they meet a few essential conditions.

The first thing you need to check is whether the lender is licensed and has the necessary certifications, including the license to operate in your region. Particular regulations are set for every province, and lenders must obey the law and be recognized by the government as legit operators. Reputable lenders can provide all these licenses, so you can see they are trustworthy and serious.

Privacy and safety are crucial, especially when you are conducting your business online. In Canada, respectable payday loan organizations invest in ensuring the safest communication channels and safeguarding the clients' personal information. It's essential to check that your information and banking details are not shared with any third party.

Apart from making sure the lender is legit, you must also inquire about the lending terms. Look for a payday loan organization that offers flexible reimbursement terms. This is one of the essential aspects, especially for loans that are meant to cover financial emergencies. Still, keep in mind that the repayment period and the number of installments also depend on local regulations.

Overall, it's best to find a lender that offers full transparency and gives you all the details you need before making a decision. The relevant information, both on the lender's licenses and the loan terms must be easy to access on their website and by direct inquiries.

The customer support is excellent proof of the company's transparency and seriousness. All reputable loan organizations in Canada make sure their customer services are efficient and available to sort any issue that may appear.

People turn to payday loan organizations in Canada when they need a rapid solution for their temporary financial crisis. It's usually an unexpected cost that causes a severe hit to the budget, and the next paycheck is still quite far. When you cannot postpone those expenses, a payday loan can be the support you need. Apart from that, there are a few situations when a payday lender is your best option.

Bad credit is one of the most frequent problems for people trying to get a loan, even a short-term one. But that is no longer an issue when you deal with reputable private lenders. Even if they check your credit score and history, they don't use it as a criterion. So, applying for a loan with a bad credit score has never been easier!

Instant approval is one of the main advantages when you apply with a payday loan organization online. Not only will you benefit from a speedy process, but you will know immediately if your loan is approved. And we all know how important that is when time and financial emergencies are pressing you.

Apart from the possibility of being instantly approved, you can also access the funds quicker than you may expect. A respectable loan company offers services 24/7, and that includes funding. You will have the money ready for electronic transfer in no time, even during weekends or holidays.

Finally, flexible requirements are one of the primary advantages of borrowing money from a payday loan organization online. They have no minimum credit score level, and their loans are meant to be as accessible as possible.

That means you can get a emergency loan even if your income doesn't come from a salary but benefits. On top of that, you won't have to submit any paperwork, so that the entire process will be quick and straightforward.

Therefore, the time to start looking for payday loan organizations in Canada is when urgent costs are waiting to be covered immediately.

Most Canadians will need a loan at some point during their life. Whether it's a mortgage, a car loan, or a short term loan to cover an emergency, borrowing money is part of everyone's life.

Depending on the type of loan you need, various loan companies are available, each specialized in particular lending products. Based on your circumstances and the amount and repayment terms* you need, you can choose one of the following:

• Banks are the traditional option for borrowing money, mostly for certain types of loans. They usually handle mortgages, car loans, and other long-term loans that give your more considerable sums, like student loans, debt consolidation loans, or business-related loans.

The application process is usually long, and it usually involves deeper inquiring into your credit history and providing various documents to be approved.

• Credit Unions are another frequent choice for Canadians looking for larger loans that expand over many years. They are similar to banks when it comes to the requirements and application process.

• Pawn Shops can also be an option, usually when you need a smaller amount and want to avoid stuffy paperwork. They offer a type of short-term loan, generally for 30 days, and you will be borrowing money against your assets. People typically pawn jewelry, electronics, pieces of equipment, or other objects with a value that can cover the amount they want to borrow.

• Credit Card Companies are another option when you need urgent funding for unanticipated expenses that you cannot postpone.

• Dealers and real estate developers can also offer you a loan. When you want to buy a car or a house in a new residential area, they can provide you with a loan directly since they are interested in helping you make the purchase.

• Online lenders are an easy and fast way of accessing short term loans in Canada. By doing it all online, the whole process is simple. But the main advantage is that the requirements are flexible, and you don't have to provide any collateral.

What our customers are saying

Since 2016, we've helped over half a million Canadians get instant loans online.

Since 2016 we have happily served over half a million customers.

Read more reviews.

How to get a loan with iCash

Getting an online loan with us is fast and easy. Simply select your loan amount, repayment plan* and provide some personal details.

Our online loan application will tell you if you’re approved instantly. Once approved, all you have to do is electronically sign your contract. It’s that easy!

Once you sign your digital agreement, your cash advance will be sent by e-Transfer within 2 minutes. Fast, convenient and hassle-free. Funds are sent 24/7, no matter what.

We help our members get their finances back on track

Frequently asked questions

Have more questions? Check out our full FAQ.