It's that time of year again. The time when Canadians everywhere search for missing receipts, download tax forms, and wonder if they're doing everything right.

Tax season doesn't have to be scary, though! With a little planning, you can face your taxes with confidence.

This guide will walk you through what you need to know about filing taxes in Canada. We'll cover important dates, ways to file, and tips to get the most money back. Let's turn tax season from a headache into a chance to take control of your finances!

Key Dates and Deadlines You Need to Know

First things first – when are taxes due? For most Canadians, April 30 is the big day. This is when you must file your tax return and pay any money you owe.

If you or your spouse are self-employed, you get until June 15 to file. But unfortunately if you owe money, you still need to pay by April 30 to avoid interest charges.

What happens if you miss these dates? The Canada Revenue Agency (CRA) will charge you a late-filing penalty of 5% of your balance owing, plus 1% for each month you're late, up to a maximum of 12 months.

Remember, even if you can't pay everything you owe right away, still file on time to avoid the late-filing penalty!

Understanding Your Tax Situation

Not all tax situations are the same. Your job, family status, and life events all affect your taxes.

If you work for an employer, they take tax off your paycheque all year. But you might still owe more or get money back when you file. If you're self-employed, you need to be careful and make sure you set aside money for taxes throughout the year since no one is taking tax off for you.

The Canadian tax system uses "marginal tax rates." This means you pay different tax rates on different parts of your income. You don't pay the highest rate on all your money – just the amount that falls into the highest bracket.

Each province also has its own tax rates on top of federal taxes. Where you live affects how much tax you pay.

New for this year: Make sure to check if you qualify for the increased Canada Carbon Rebate or the new multigenerational home renovation tax credit.

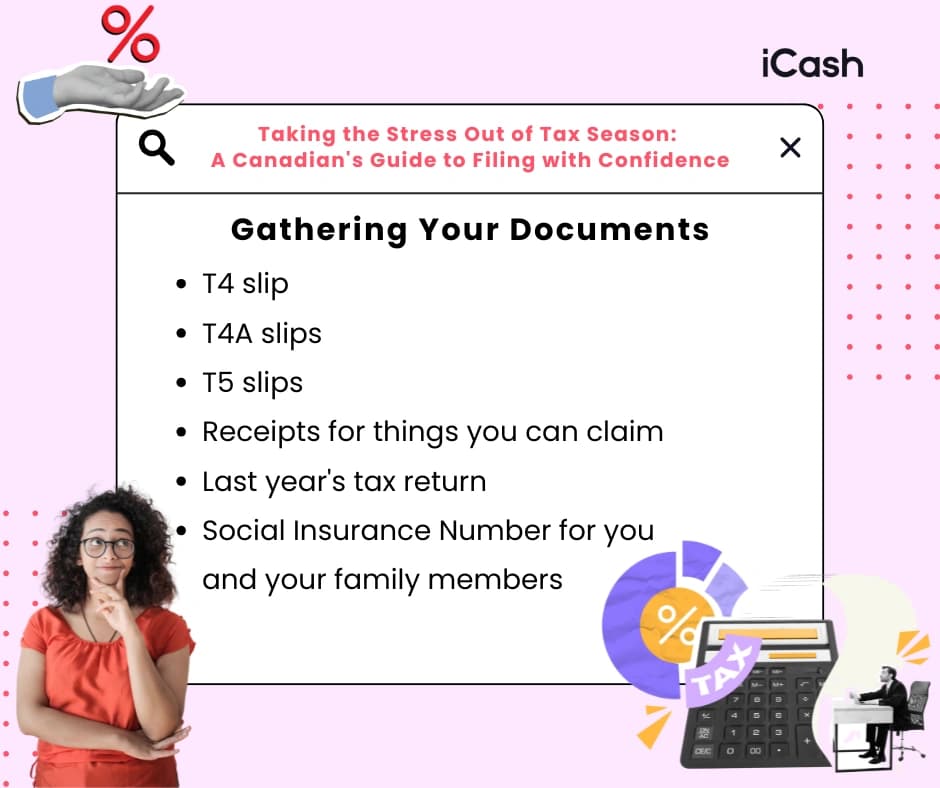

Gathering Your Documents

Before you start filing, gather all your documents in one place. Here's what most people need:

T4 slip (from your employer)

T4A slips (for other income like scholarships)

T5 slips (for investment income)

Receipts for things you can claim (childcare, medical expenses, charity donations)

Last year's tax return

Social Insurance Number for you and your family members

It’s always a good idea to stay as organized as possible with these documents. Create folders on your computer or use a box to keep paper in order. The CRA says you should keep your tax records for at least six years in case they ask questions later.

Filing Methods: What's Right for You?

You have several ways to file your taxes. Each has its pros and cons, and ultimately will depend on your personal preference when it comes to filing your taxes.

Paper filing is the old-school way. You fill out forms by hand and mail them to the CRA. This is free but takes the longest time to process, which isn’t ideal if you’re expecting a refund and intend on using it to pay bills, make specific purchases with it, etc.

Tax software has become very popular. Programs like TurboTax, H&R Block, and WealthSimple Tax make filing easier. Many offer free versions if your tax situation is simple. The software asks questions and fills in the right forms for you. Most let you file directly to the CRA online. This method is definitely the quickest way to get your tax refund (if you’re expecting one).

Hiring an accountant costs money but saves lots of time and stress. This route makes sense if your taxes are complex, you're self-employed, or you own rental property.

Free tax clinics exist for people with low incomes and simple tax situations. Volunteers help you file for free.

The CRA's Auto-fill my return feature can save time by automatically adding information the CRA already has about you. This works with most tax software.

Maximizing Your Return: Get Back What You Deserve

Want to get the biggest tax refund possible? Don't miss these often-overlooked deductions and credits:

Medical expenses: Keep all receipts for medical expenses not covered by insurance.

Work-from-home expenses: If you worked from home, you might qualify for a deduction. Your employer may be able to provide you with the necessary documentation you need to file for this.

Moving expenses: If you moved for work or school, some costs might be deductible.

Student loan interest: You can claim the interest paid on government student loans.

Childcare expenses: Day camps, daycare, and nannies often qualify.

Contributing to your Registered Retirement Savings Plan (RRSP) is one of the best ways to reduce your taxes. Contributions lower your taxable income right away, plus help you save for retirement.

One common mistake is forgetting to claim carry-forward amounts. If you didn't use all your RRSP contribution room or tuition credits in past years, you can use them now.

What to Do If You Can't Pay

Finding out you owe money can be stressful, especially if you don't have enough saved. Remember:

File on time anyway. This avoids the late-filing penalty (which is separate from interest on what you owe).

Pay what you can. Even a partial payment reduces the interest you'll be charged.

Contact the CRA to set up a payment arrangement. They'll often work with you if you reach out first and as soon as possible.

The CRA charges about 10% interest on unpaid taxes. This compounds daily, so paying off your tax debt should be a high priority.

If you're facing serious financial hardship, the CRA's Taxpayer Relief Program might help reduce interest and penalties in some cases.

Helpful Links

CRA My Account: https://www.canada.ca/en/revenue-agency/services/e-services/e-services-individuals/account-individuals.html

Free Tax Clinics: https://www.canada.ca/en/revenue-agency/services/tax/individuals/community-volunteer-income-tax-program.html

Benefits Calculator: https://www.canada.ca/en/revenue-agency/services/child-family-benefits/child-family-benefits-calculator.html

Wrap Up Those Taxes for the Year!

We get it - filing taxes is not fun. But it doesn't have to be something you dread every year.

With some organization, knowledge of key dates, and awareness of the credits and deductions you qualify for, you can approach tax season with confidence.

Remember that filing your taxes isn't just about following the rules—it's about claiming the benefits and refunds you're entitled to as a Canadian. Many people actually get money back!

Start early, take your time, and use the resources available to you. Before you know it, you'll be putting that "File My Taxes" task behind you for another year.