TL; DR

Combatting grocery inflation requires a mix of planning and waste reduction. To lower your monthly bill immediately, focus on strategies such as:

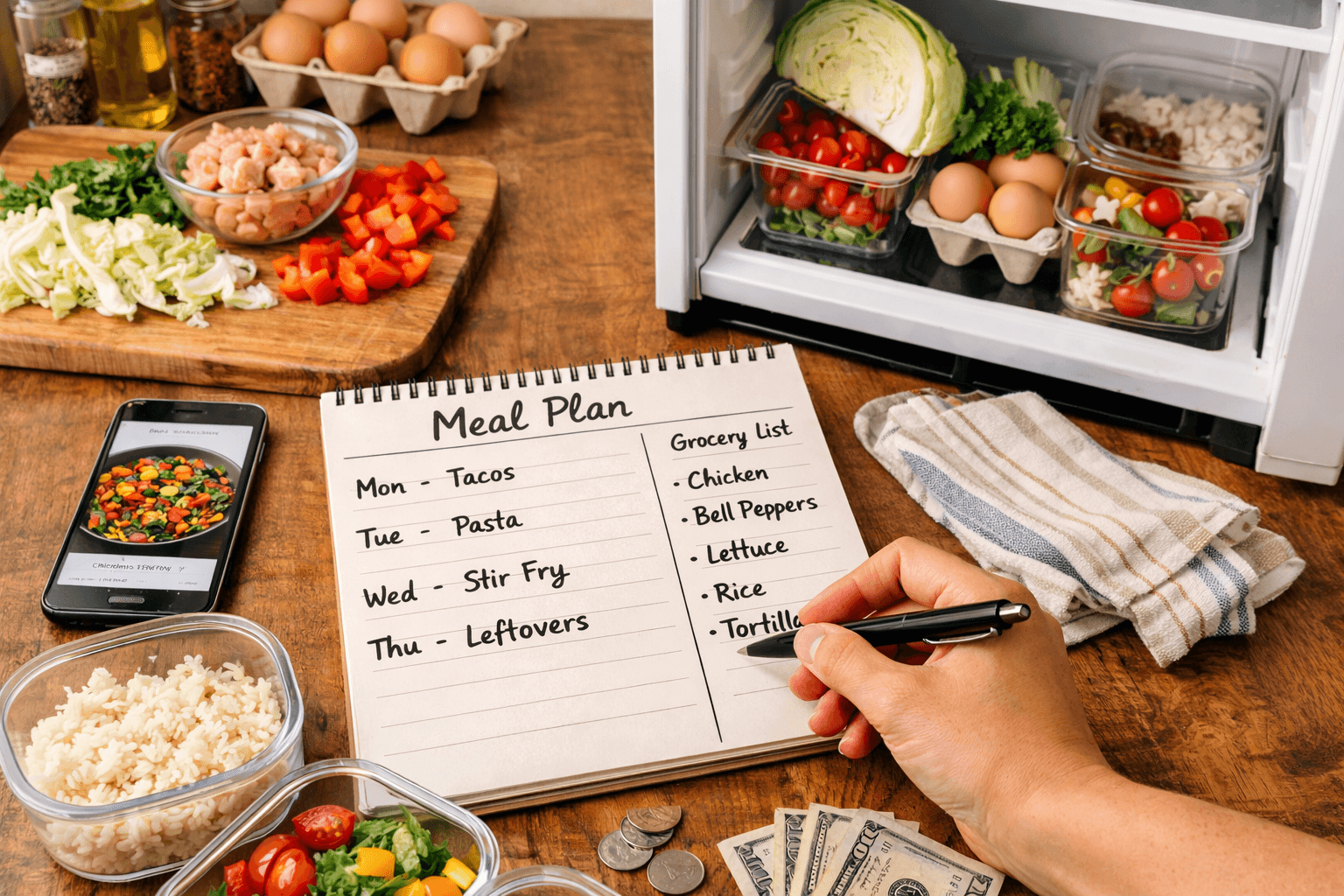

Meal planning: Plan meals around shared ingredients before shopping

Store brands: Switch to store brands that are made in the same facilities

Freezer strategy: Shop your freezer first and freeze more to avoid $1,300 waste

Cash budgeting: Use cash instead of cards to stay within budget

If you've felt sticker shock at checkout recently, you're not alone. Statistics Canada reports grocery prices have increased over 20% since 2021, with December 2025 showing a 6% spike in a single month. For a family spending $800 monthly on groceries, that's an extra $160, nearly $2,000 annually.

Thankfully, it’s not all doom and gloom. There are ways to cut costs without sacrificing nutrition or variety. These aren’t perfect strategies, and ideally, we can look forward to a day where grocery shopping doesn’t feel like you need to win the lottery to afford. But until then, let’s explore 10 realistic and honest ways to fight back against grocery inflation.

1. Master Meal Planning

Estimated savings: $100-150/month

Meal planning might sound boring (and honestly, it kind of is), but it's one of the most powerful tools against grocery inflation. When you plan meals before shopping, you buy only what you need and avoid impulse purchases that drain your budget.

Start simple. Pick three to four recipes for the week that share common ingredients. If you're using half a head of cabbage for tacos on Tuesday, plan a stir-fry for Thursday that uses the rest. Also, check your fridge before planning. You might already have half-used ingredients hiding in there.

2. Switch to Store Brands for 30-50% Savings

Estimated savings: $25-40/month

Store brands are frequently manufactured in identical facilities as name brands, offering 30-50% savings with comparable or identical quality. You're often paying $2-5 extra for marketing and packaging, not superior ingredients.

High-impact switches you can easily make:

Pasta: President's Choice vs. Barilla (saves $1.50 per box)

Canned tomatoes: No Name vs. Hunts (saves $0.80 per can)

Frozen vegetables: Great Value vs. Green Giant (saves $1.20 per bag)

Switching five regular purchases to store brands saves $25-40 monthly without changing what you eat.

3. Time Your Shopping Around Sales Cycles

Estimated savings: $50-80/month

Canadian grocery stores run 6-8 week sales cycles, and stocking non-perishables during sale periods can cut per-unit costs by 50%. Understanding these patterns means never paying full price for pantry staples.

Download your grocery store's app for digital flyers and loyalty deals. When you see 40%+ discounts on non-perishables you use regularly, buy 4-6 units. Most stores repeat cycles predictably.

If you buy pasta at $0.99 instead of $2.49 and use 10 boxes monthly, that's $15 saved on pasta alone. Extend this to canned goods, rice, and oils for $50-80 monthly savings.

Important: Only buy what you'll actually use. Five jars of artichoke hearts on sale isn't saving if you throw out 60%.

4. Reduce Meat Costs (Going Vegetarian is Optional)

Estimated savings: $60-100/month

Meat and protein products have, sadly, seen some of the steepest price increases during Canada's grocery inflation crisis. But you don't have to become a vegetarian to save money (unless you want to, of course).

Consider these methods to save a bit of money on your protein purchases:

Use less meat per meal by bulking up dishes with beans, lentils, or mushrooms

Buy whole chickens instead of pre-cut pieces

Choose cheaper cuts of meat and use a slow cooker (if you have one) to make them tender

Try "Meatless Mondays" or occasional vegetarian meals during the week

Buy reduced-for-quick-sale meat and freeze it immediately

Eggs remain one of the most affordable protein sources in Canada. A dozen eggs can provide protein for multiple meals at a fraction of the cost of most meats.

5. Shop Your Freezer First

Estimated savings: $40-60/month

Conducting a freezer inventory before shopping and building at least two meals around existing Before making your next shopping trip, do a freezer inventory and see if you might be able to build at least two meals around what you already have.

Frozen vegetables are nutritionally comparable to fresh ones and often cost less. They don't spoil, so you can buy them in bulk when they're on sale. The same goes for frozen fruits, which are perfect for smoothies, baking, or even just thawing for a snack.

Label everything with dates when you freeze it, and try to rotate through your frozen items regularly.

6. Buy Seasonal and "Ugly" Produce

Estimated savings: $25-30/month

Fresh produce can be tricky during inflationary times. Prices fluctuate wildly based on season and supply chain issues.

Shop seasonally whenever possible. Strawberries in January? Expensive. Strawberries in June? Much more reasonable. Root vegetables like carrots, potatoes, and onions are affordable year-round and they’re all things you can use to cook some great dishes.

Check out the "ugly produce" sections many Canadian grocers now offer. These slightly imperfect fruits and vegetables are significantly discounted but perfectly fine for eating. A wonky-looking carrot tastes the same as a perfect one.

Consider shopping at discount grocery stores like FreshCo, Food Basics, or No Frills, where produce prices can be 15-20% lower than premium grocery chains for some items.

7. Compare Price-Per-Unit, Not Package Size

Estimated savings: $30-50/month

Comparing price-per-unit (displayed per 100g or 100ml on shelf labels) prevents packaging manipulation and saves $30-50 monthly. Bigger packaging doesn't always mean better value.

Check the shelf label's price-per-unit number ($/100g or $/100ml). Compare this across all sizes and brands. Sometimes medium packages cost more per unit than large or small. This becomes automatic after 2-3 shopping trips.

8. Cut Food Waste to Recover $650+ Annually

Estimated savings: $50-75/month

According to the NZWC (National Zero Waste Council), the average Canadian household wastes about $1,300 worth of food every year. During a time of grocery inflation, that number probably hurts to read.

Combat food waste with these strategies:

Store herbs in water, lettuce in paper towels, mushrooms in paper bags (extends life by days/weeks)

Freeze bread, overripe bananas, fresh herbs in oil, and leftover portions immediately

"Best Before" dates are quality indicators, not safety, use your senses

Make stock from vegetable scraps and chicken bones (free stock worth $5-8 per batch)

Implementing just proper storage and aggressive freezing can cut waste by 50-60%, that's $650-780 recovered annually.

9. Slash Your Beverage Budget

Estimated savings: $45-80/month

Canadians spend hundreds of dollars annually on beverages that offer little nutritional value. Juice, pop, specialty coffee drinks, and bottled water add up quickly.

Switching to tap water and making coffee at home can save your household $100-200 per month. If plain water feels boring, add sliced fruit, cucumber, or mint for natural flavoring.

It’s also worth noting that you don’t necessarily need to permanently cut those drinks out of your life. Even cutting down a little and maybe only making those purchases every second shopping trip can save you some cash.

10. Use Cash-Only Budgeting

Estimated savings: $96-144/month

Paying with physical cash instead of cards can potentially reduce unplanned purchases by 15-20%. The act of handing over bills makes spending feel "real" in a way that tapping cards doesn't.

Withdraw your weekly grocery budget in cash. Leave your debit card at home. When you reach your cash limit, that’s it, you're done. If you get to the cash register and don’t have enough cash to pay for all your items, then some stuff must be left behind. This forces real-time prioritization of needs versus wants.

11. Consider a Warehouse Membership

Estimated savings: $400-600/year (beyond membership cost)

If you have a larger household, a warehouse membership like Costco can pay for itself quickly. A basic membership costs around $65 annually (plus tax), while the Executive membership costs $130 (plus tax) and offers 2% cash back on purchases.

Best warehouse buys (vs. regular stores):

Non-perishables: 30-50% savings (rice, pasta, canned goods)

Paper products: 40-60% savings

Frozen proteins: 20-30% savings per pound

Medications: 50-70% savings

For a family of four spending $300 monthly at a warehouse (with 25% average savings), that's $900 annual savings minus $65 membership = $835 net benefit.

Split-buying strategy: Smaller households can team up with friends to split the membership cost and divide bulk purchases.

The Bottom Line on Beating Grocery Inflation

The unfortunate reality is that grocery inflation in Canada isn't disappearing anytime soon. But you're not powerless against it. These strategies can help reduce your food costs without requiring major lifestyle sacrifices.

You don’t need to go all out and implement all 10 tips in one shot, either. Start with two or three of them. Maybe it's meal planning combined with buying store brands, or doing a freezer inventory and cutting beverage spending. Small changes add up over time.